STORE INTELLIGENCE · RANDY NELSON · JANUARY 2021

Watch On Demand: Sensor Tower's 2020 App Market Recap Presentation

Sensor Tower data reveals the key app market trends of 2020 and 2021 in an on demand video presentation.

The unprecedented trends that emerged in early 2020 due to COVID-19 continued to affect the global mobile app market throughout the year and will no doubt have a lasting impact into 2021. Having studied the pivotal industry events of last year, we created an on-demand video presentation for the Facebook App Summit last month that looks at 2020's key mobile trends along with a preview of where the mobile app market is headed in 2021. Here are three major findings from the presentation around how user behavior has shifted and will continue to evolve this year, based on Sensor Tower Store Intelligence data.

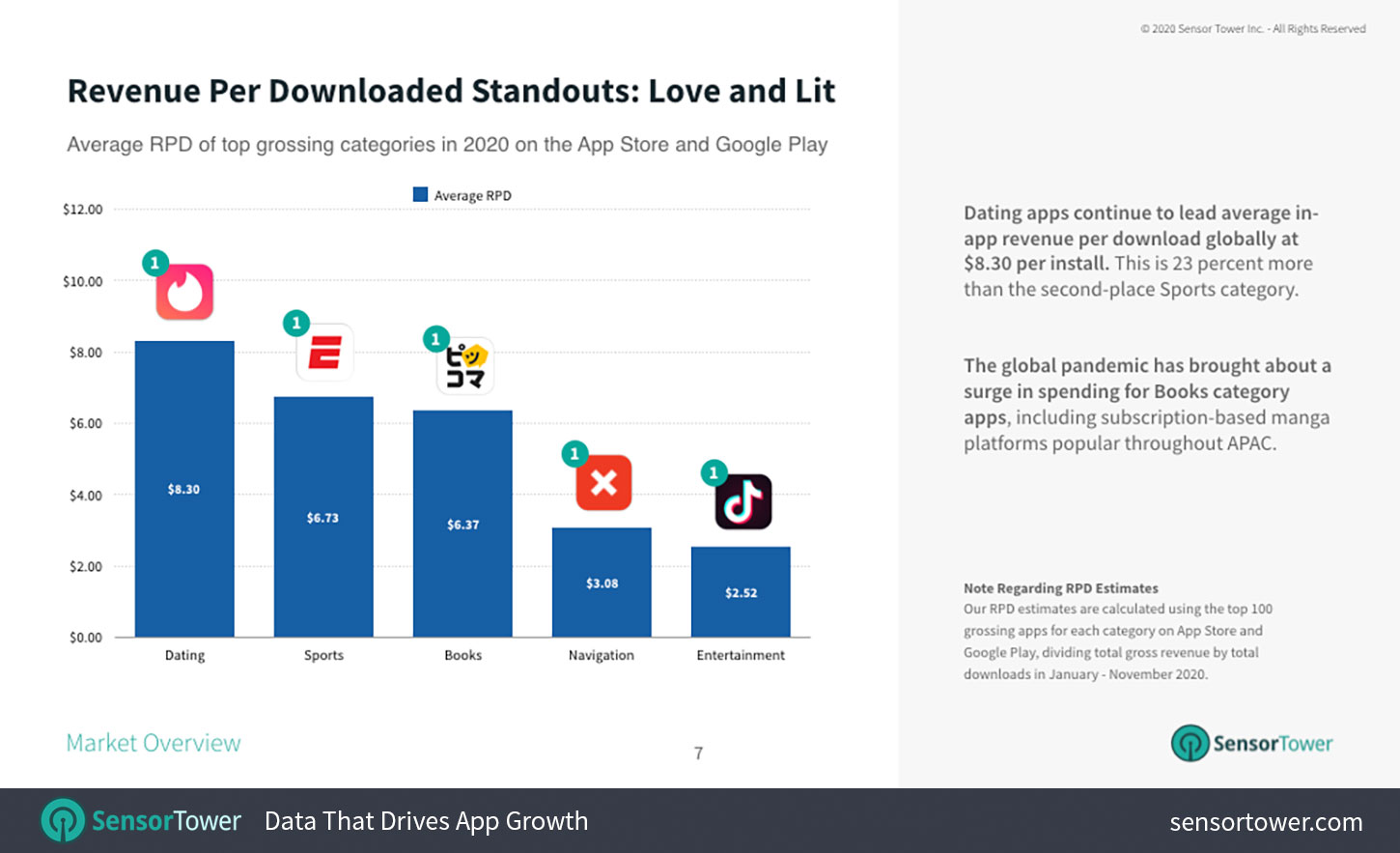

Dating Apps Led in Big Spending

Though 2020 heralded widespread social distancing practices, this didn't stop users from flocking to dating apps, which saw a huge boost last year in spending. Among the top 100 apps by revenue in each category, dating apps saw the most revenue per download. They generated $8.30 per install on average, 23 percent more than sports apps, which came in second at $6.73.

Dating apps also saw the largest spending-to-adoption ratio among non-game apps. Although the category accounted for only 1 percent of global non-game app installs, it represented a 10 percent share of spending.

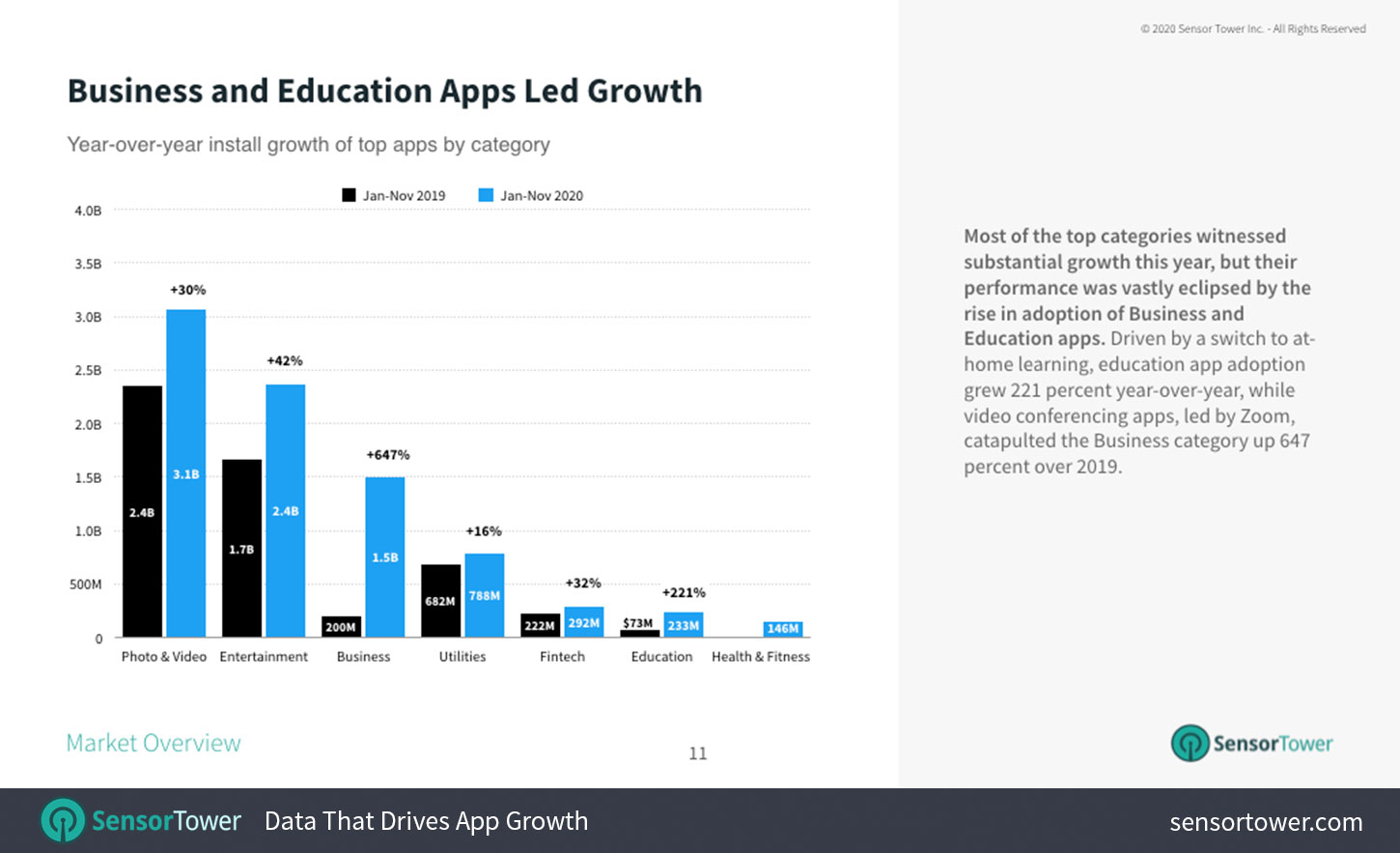

Business and Education Apps Were Growth Leaders

As many schools and workplaces went virtual last year, the app stores' Business and Education categories saw a surge of first-time installs globally. Led by breakout apps such as Zoom, the top apps in the Business category saw their installs climb 647 percent year-over-year to 1.5 billion installs from January to November 2020.

In the first 11 months of last year, installs of the top education apps grew 221 percent Y/Y to 233 million installs globally as classrooms became remote. During this period, the category also saw the second highest growth in spending, jumping 74 percent Y/Y from $154 million to $267 million. This growth was exceeded only by the Books category, which grew 95 percent Y/Y from $480 million to $952 million.

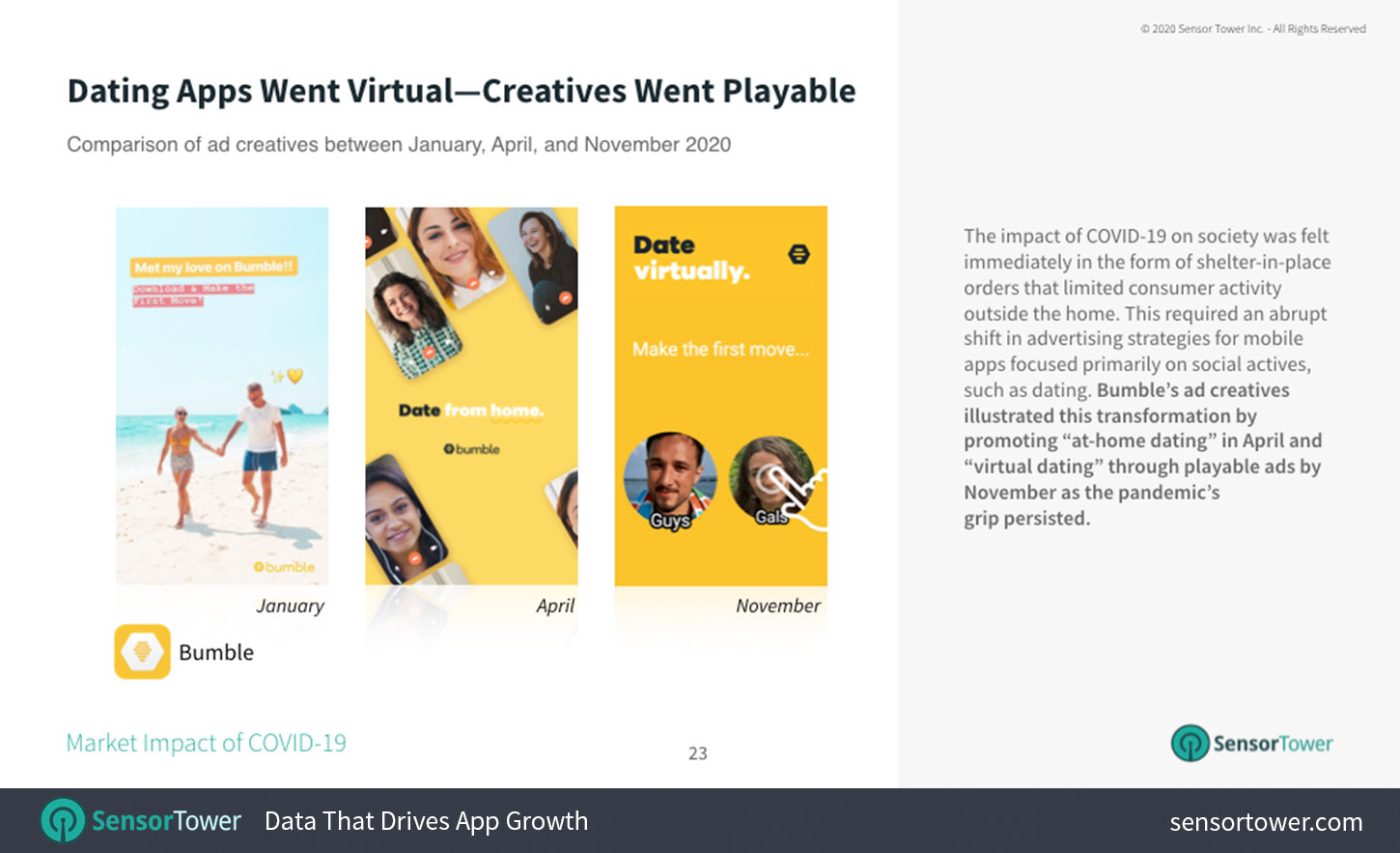

Mobile Advertising Leans Into Interactive

Gaming publishers have often pioneered innovation in their marketing creatives. When consumers found themselves spending an unprecedented amount of time on their mobile devices in 2020, non-game apps began experimenting with campaigns that have long been staples in the Games category.

A notable example of this was how dating apps began embracing playable ads, a change spurred by shelter-in-place orders. Since users weren't able to meet in person, dating apps began using interactive ads to promote "at-home dating." This trend may very well continue into 2021 as consumers' lifestyles continue to be impacted by the ongoing COVID-19 crisis.

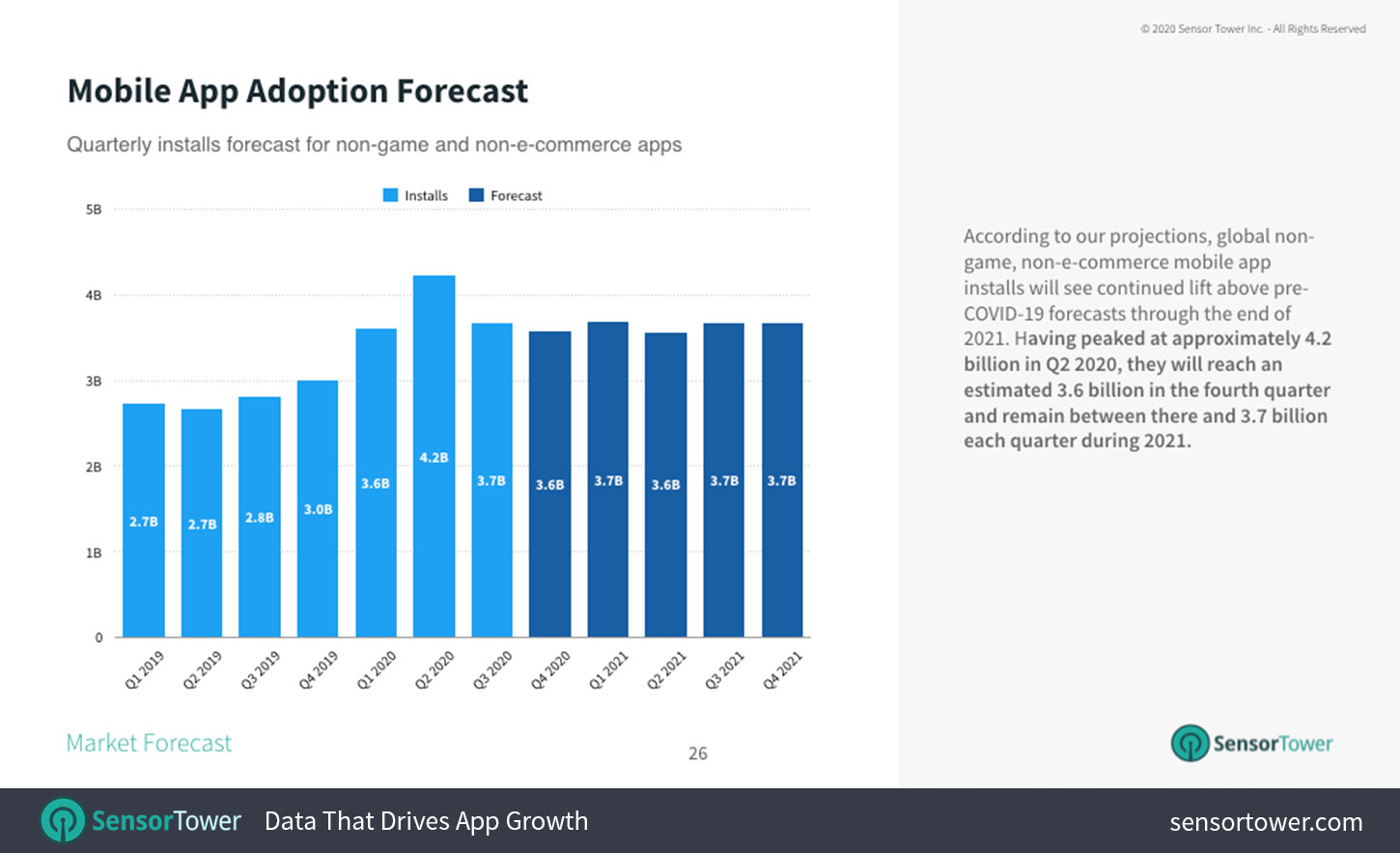

A Continued Boost

Although worldwide installs of non-game and non-e-commerce apps peaked in Q2 of last year, categories across the board will continue to see a lift beyond last year's forecasts. Sensor Tower projects that apps, excluding mobile games and e-commerce, will continue to see around 3.6 to 3.7 billion installs per quarter in 2021 as consumers continue turning to their mobile devices for entertainment as well as social connection.

For a full view of last year's trends and Sensor Tower's predictions for this year, our complete presentation is available to watch on demand by clicking below.