STORE INTELLIGENCE · RUIKA LIN · APRIL 2017

Top Mobile Games of Q1 2017: Revenue Grew 53% YoY as Asian Titles Expanded Their Dominance

Year-over-year Q1 revenue growth for mobile games reached 53% in 2017, according to Sensor Tower Store Intelligence data.

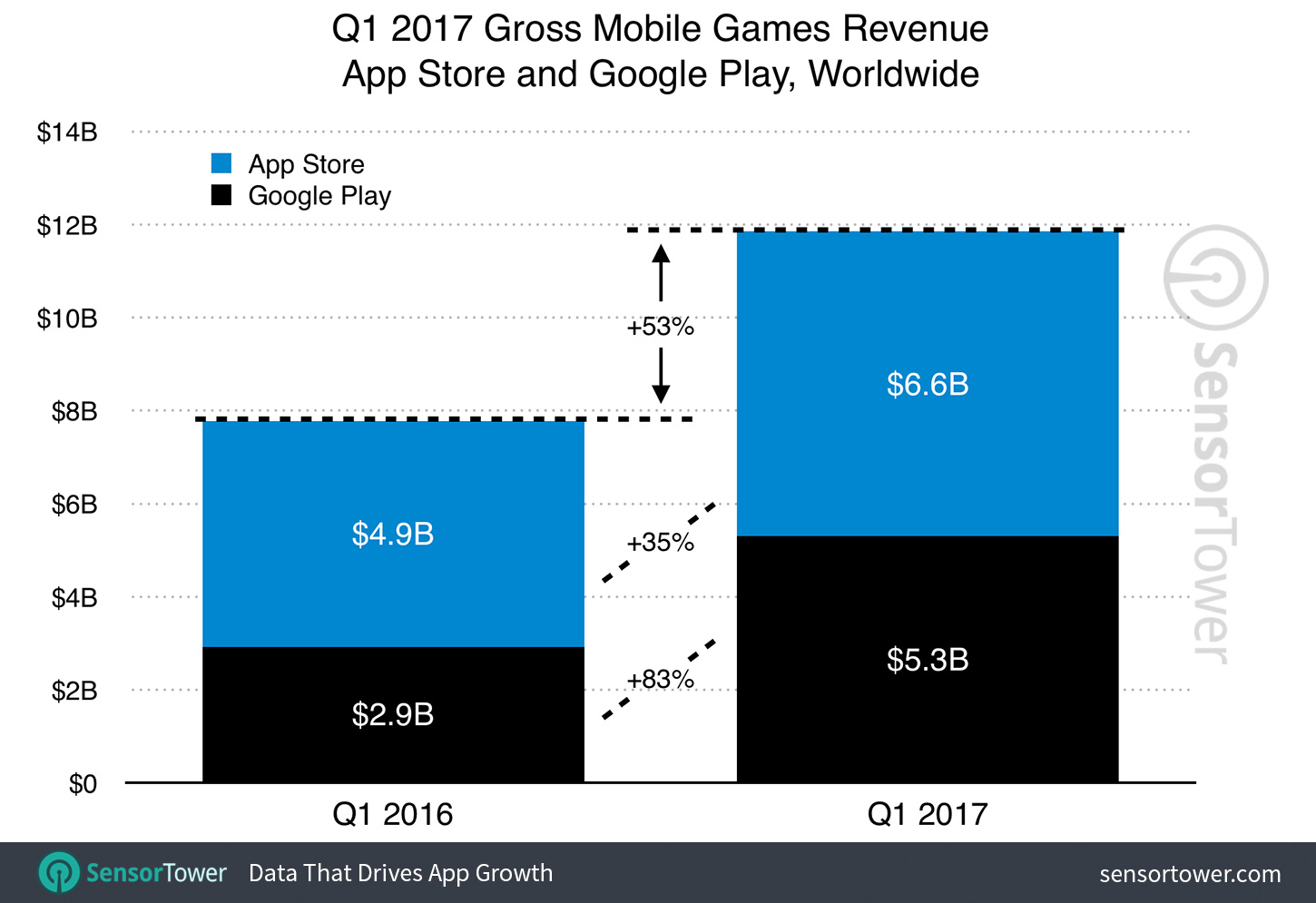

Last quarter, worldwide gross revenue from mobile games on the App Store and Google Play grew approximately 53 percent year-over-year to about $11.9 billion, up from about $7.8 billion in Q1 2016, according to Sensor Tower Store Intelligence. Following up on our analysis on the top mobile games of Q4 2016, this report will look at the Games category's revenue growth in Q1 on both stores, as well as the quarter's leading titles in terms of downloads and revenue.

Games Category Revenue Growth - Q1 2017

Mobile games continued to be the dominant category in the worldwide app ecosystem in terms of monetization, accounting for close to 80 percent of the gross revenue generated by Apple's App Store in Q1, and more than 91 percent through Google Play.

The chart above illustrates that mobile games revenue generated on the App Store grew 35 percent year-over-year, from approximately $4.9 billion in Q1 2016 to about $6.6 billion last quarter. Google Play games revenue grew approximately 83 percent for the same period, from about $2.9 billion to approximately $5.3 billion.

In terms of downloads, worldwide mobile game installs on both stores totaled close to 8.8 billion last quarter, an increase of approximately 15 percent from about 7.6 billion in Q1 2016.

Top Mobile Games by Downloads and Revenue - Q1 2017

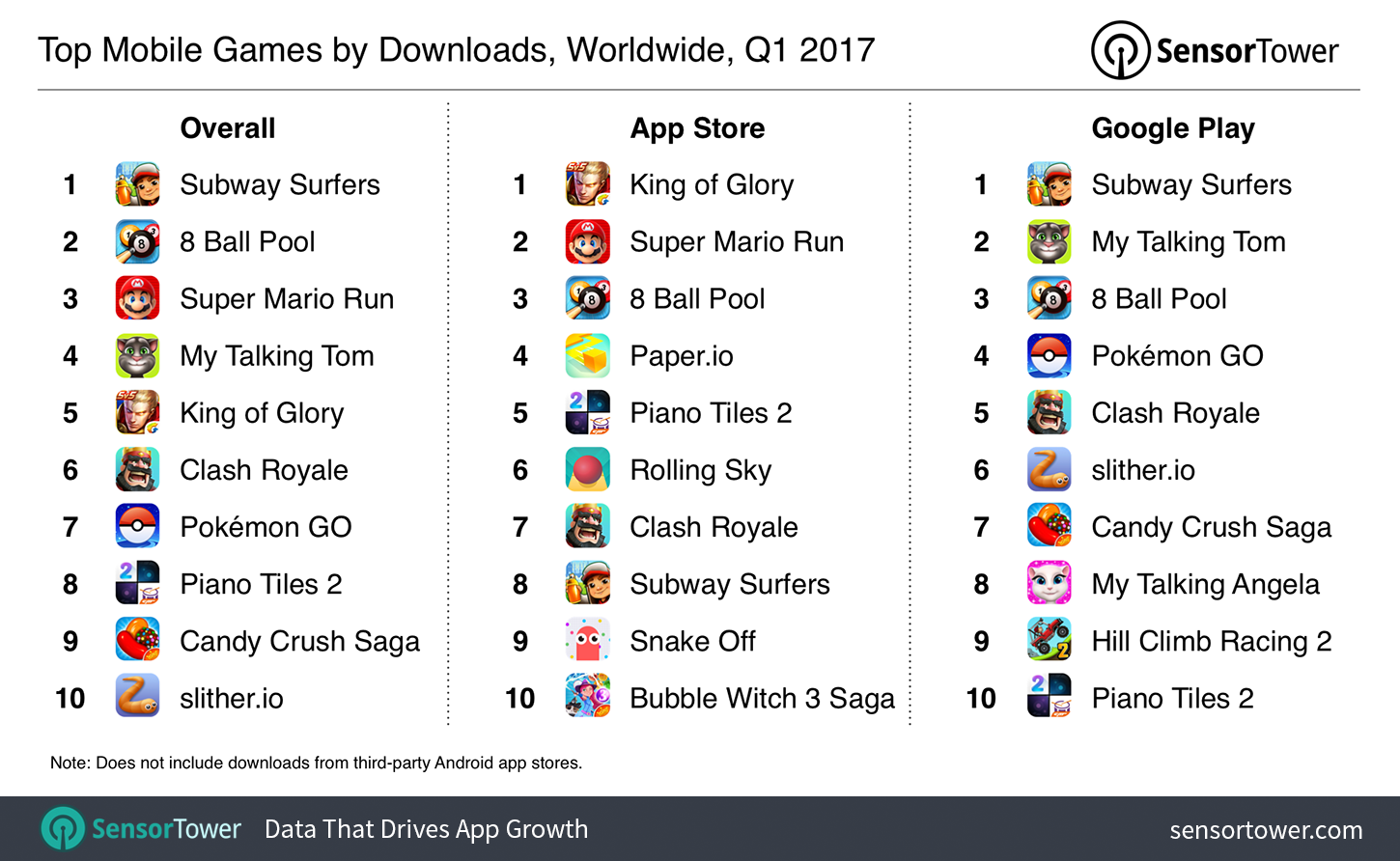

Kiloo's Subway Surfers topped the overall downloads chart, as Super Mario Run's momentum decreased in the new year. Despite the slowdown, Nintendo's first mobile game still remained competitive as the runner-up on the App Store, the only platform it was available on for the majority of Q1. Given its recent release on Google Play, a more definitive story about its performance across the board will start to unfold throughout the rest of 2017.

Tencent's King of Glory became the world's most downloaded mobile game on the App Store last quarter, and landed a spot in the top 10 overall ranking thanks to an increased number of new installs during Q1, mainly from China. It's worth noting that King of Glory was the only top 10 game last quarter that was absent from the list in Q4 2016. In fact, it was only ranked No. 31 for overall downloads that quarter.

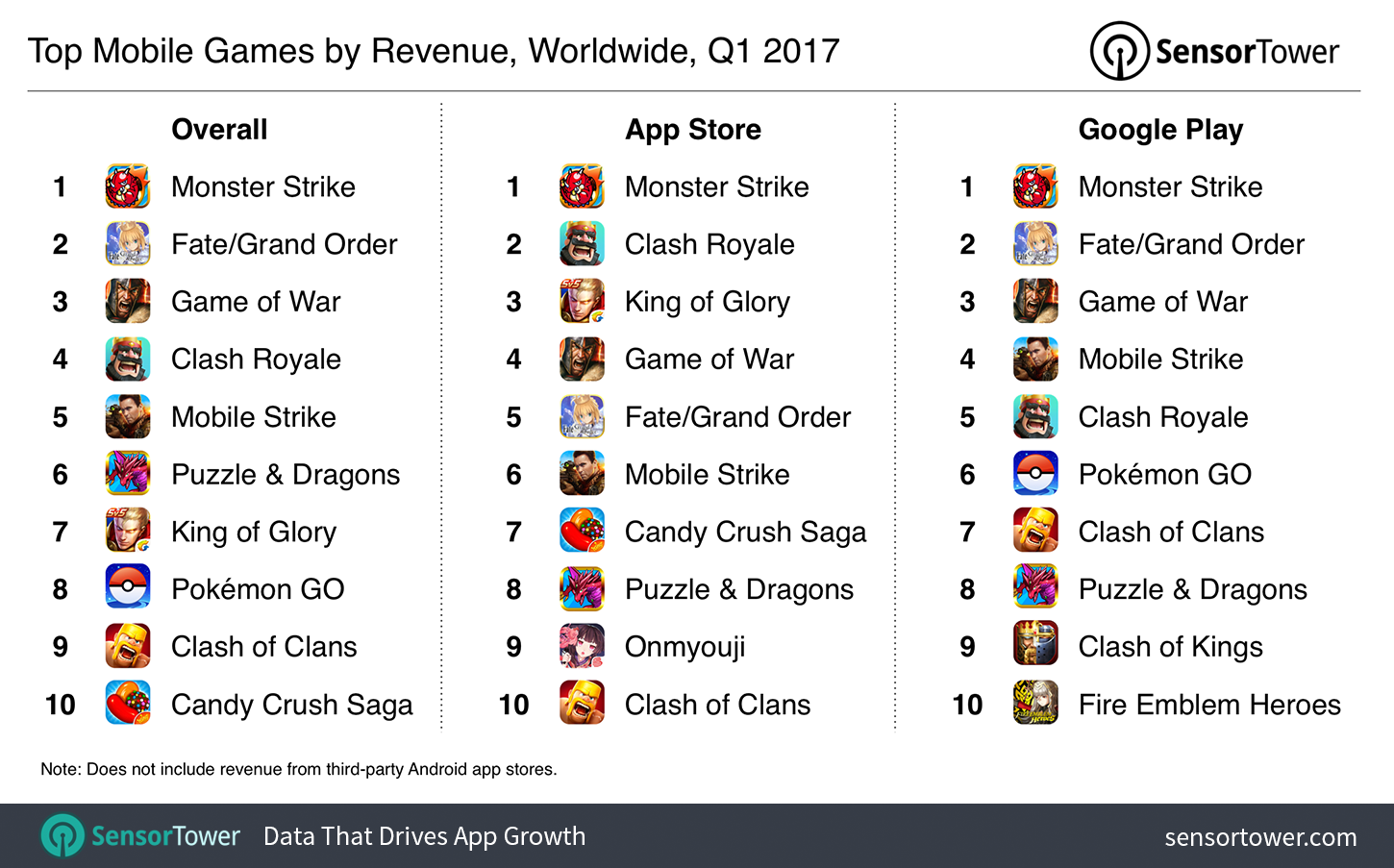

On the revenue side, Monster Strike retained its first place position across the overall and per-store rankings last quarter. As the top earning game for the entirety of 2016 as well, Mixi's popular title continued to monetize extremely well in Japan and dominate revenue in the worldwide mobile gaming market overall.

The runner-up on the overall revenue chart was Type-Moon's Fate/Grand Order, another popular mobile game hailing from Japan and generating the majority of its revenue from Japanese players. Although it was one of the top 10 across all three rankings in Q4 2016, Fate/Grand Order increased its position last quarter, securing second place on Google Play and a spot in the top five on the App Store.

Similar to its downloads story, Tencent's King of Glory (shown below), became a revenue contender last quarter even without a top 10 ranking in Q4 2016. It climbed up to No. 7 in Q1 from No. 11 in Q4 last year, thanks to increasing player spend from China. In fact, last quarter it nearly swapped positions with NetEase's Onmyouji—another popular title from China—which ranked No. 9 in Q4 2016 but dropped to No. 11 three months later. The competition between the two China-based mobile gaming giants was visibly heated.

Supercell's huge hit Clash Royale surpassed $1 billion in lifetime gross revenue in February 2017, placing it among the top five across all three of our rankings for last quarter. On the other hand, Niantic's Pokémon GO continued to lose revenue momentum in the new year. Although it still ranked within the top 10 overall, Pokémon GO dropped from No. 4 in Q4 2016 to No. 8 last quarter. Its in-game events during Q1 (Valentine's event and Gen 2 update) simply couldn't manage to sustain the game's popularity last year. Specifically on the App Store, Pokémon GO dropped out of the top 10 altogether in Q1 even though it was there in the preceding two quarters.

Another much anticipated launch in Q1—Nintendo's second mobile game, Fire Emblem Heroes—made it to the top 10 for revenue on Google Play, ranking No. 10. Grossing $2.9 million on its first day of worldwide release, more than 75 percent of its overall revenue in Q1 came from Japan.

Following an impressive year in 2016 with major mobile game launches, our analysis revealed how some of these viral hits are progressing so far in the new year, and more interesting trends will unfold throughout the rest of 2017. We're also assembling data on our top non-game apps of Q1, as well as top publishers and categories in our latest Store Intelligence Data Digest, coming in the next two weeks. As always, keep an eye on the Sensor Tower Blog and our social media for the latest insights.