2026 State of Mobile is Live!

AI Insights · Timothy · January 2023

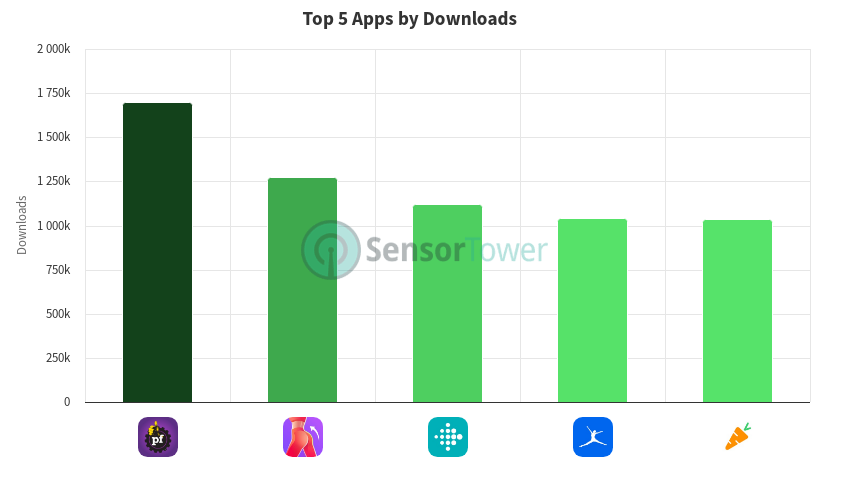

Top 5 Fitness and Weight Loss Programs Apps in the US Q4 2022

Explore the performance of the top 5 fitness and weight loss programs apps in the US during Q4 2022, including trends in downloads, revenue, and active users.

In the fourth quarter of 2022, the top 5 fitness and weight loss programs apps in the United States showed varied performance in terms of downloads, revenue, and active users. Data from Sensor Tower provides insights into these trends.

Planet Fitness Workouts experienced fluctuating weekly downloads, peaking at around 238K in the last week of December. Weekly revenue showed a slight decline from $8.3K in late September to $5.9K by the end of December. Active users increased from approximately 2.7M to 3.2M over the same period.

JustFit: Lazy Workout & Fit saw a steady increase in weekly revenue, reaching about $249K at the end of October before a slight dip to $176K in the last week of December. Weekly downloads peaked at around 127K in late October, with active users increasing from 78.9K to 257K by the end of the quarter.

Fitbit: Health & Fitness maintained a strong revenue stream, peaking at approximately $1.3M in the final week of December. Weekly downloads and active users both saw significant increases in the last week of December, with downloads reaching around 226K and active users peaking at 6.6M.

MyFitnessPal: Calorie Counter showed a consistent revenue stream throughout the quarter, peaking at around $2.1M in the last week of December. Weekly downloads varied, peaking at around 100K in the final week. Active users showed a slight decline from approximately 3.8M to 3.2M by the end of the quarter.

Yuka - Food & Cosmetic Scanner experienced steady weekly downloads, peaking at 108K in the last week of December. Weekly revenue saw a gradual increase, reaching about $35K by the end of the quarter. Active users remained relatively stable, ending the quarter at approximately 343K.

These insights, derived from Sensor Tower data, highlight the varying performance trends across the top fitness and weight loss programs apps in the US during Q4 2022. For more detailed insights, visit Sensor Tower.