2026 State of Mobile is Live!

Trusted by global digital leaders

Marcus Burke, Senior Marketing Manager, Paid Social, Blinkist

I love browsing Sensor Tower at least once a week. You can find a ton of great insights on your competitors' strategies, general market trends, new creative ideas plus everything you need for in-depth ASO and your Apple Search Ads. The perfect all-around platform.”

Pull the right levers to generate organic interest on mobile

A compelling organic marketing campaign involves much more than just search optimization, and Sensor Tower collects a variety of signals that help generate a holistic view of organic marketing and branding on mobile. See how competitors are taking advantage of images, featured text, and CTAs to drive installs, and track updates to live-ops and other in-app UA deals to better understand how they affect downloads and revenue.

Create an end-to-end iterative paid ad strategy

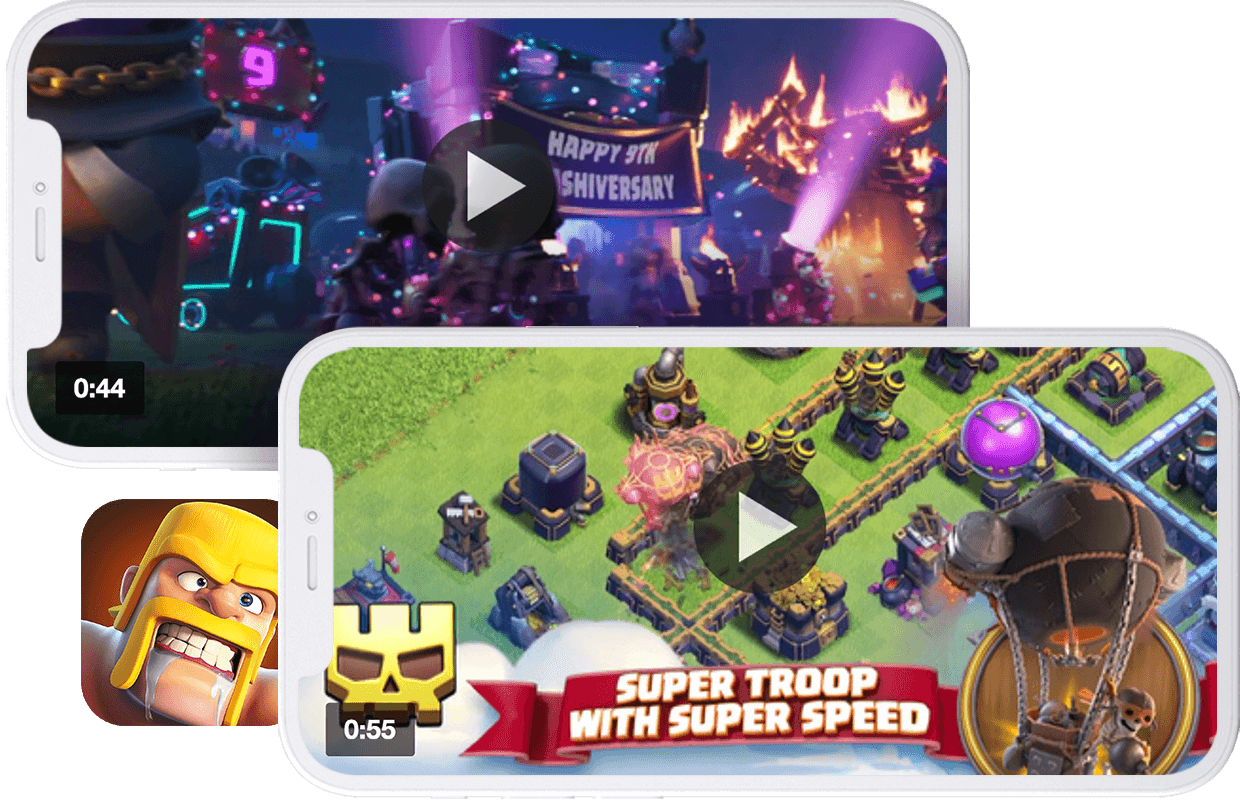

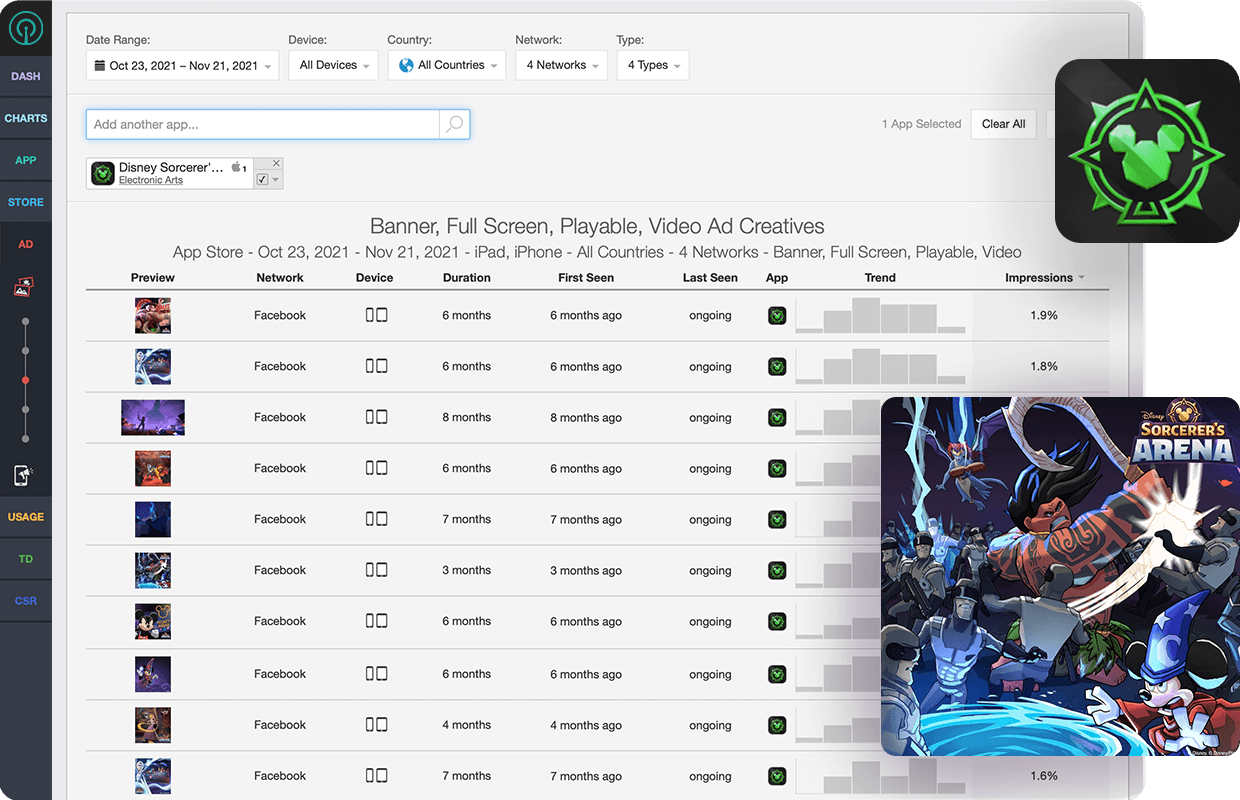

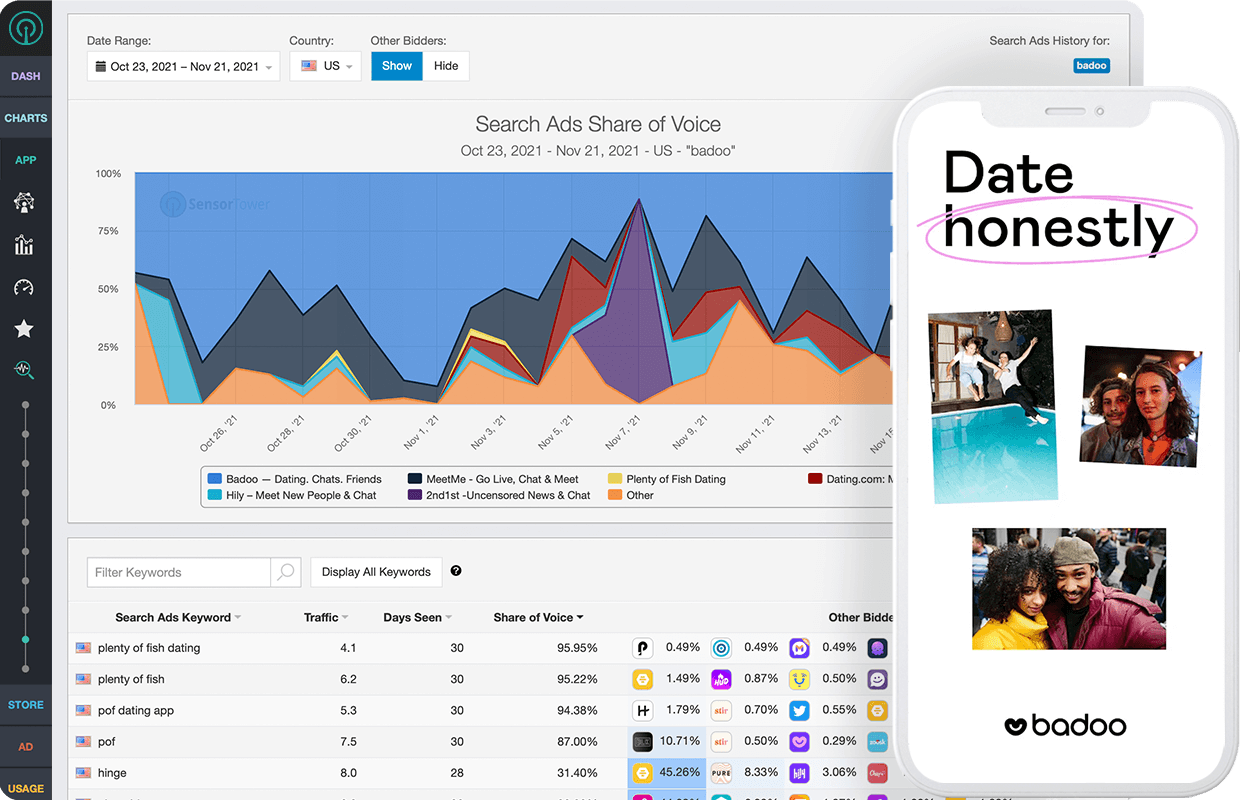

Sensor Tower layers multiple datasets to offer a holistic look into the paid mobile landscape. Access an expansive library of in-app mobile creatives and insights across some of the most popular ad networks, including social networks like Facebook, TikTok and more. Zero in on the creatives gaining the most traction by Share of Voice, including playable ads, and apply learnings to quickly iterate and amplify paid ad campaigns.

Develop new signals to understand users Post-IDFA

Mobile behaviors critically drive marketing programs, but in the wake of changes to Identifier for Advertisers (IDFA), more metrics are needed to fill in the gaps. Create a Custom Dashboard within Sensor Tower that places ad performance alongside downloads and revenue to clearly see how competitors are benefitting from different targeting practices, or set up Custom Alerts for when a creative hits an exceptionally high Share of Voice. Sensor Tower’s data makes it easy to develop an agile ad program without IDFA.

Master in-store UA

From ASO to branding, leverage data to stand out on app stores

Optimize paid channels

Build a strategy based on learnings from the best paid mobile ads

Understand user behavior

Create critical dataflows to help target and understand your app’s user base

Sensor Tower Blog

Digital Advertising Insights • February 2026

Q4 Digital Market Index: App, Ads & Web Data

Our quarterly post-mortem on the digital economy is here — and there's a lot to say about Q4 2025. From AI's industry-spanning takeover to Europe's status as a growth leader, we're diving into the mobile, app, ad and web data that you need to understand a rapidly-evolving landscape.

Digital Advertising Insights • December 2025

Predictions for the Digital Economy in 2026

Our 2026 Predictions report walks you through the six major trends we expect to see in the new year — covering everything from Gen AI to gaming. Dive into the insights ahead of Q1 to gain the intel you need to sharpen your strategy.