2026 State of Mobile is Live!

>$20bn AUM, NYC-based Hedge Fund

"Sensor Tower’s app data has been valuable for both our public and private investment research. Its comprehensive global coverage allows us to quickly identify inflection points, monitor new business initiatives, and gain actionable insights across markets. The platform is supported by excellent customer service that enhances our workflow efficiency."

Measure the world’s digital economy

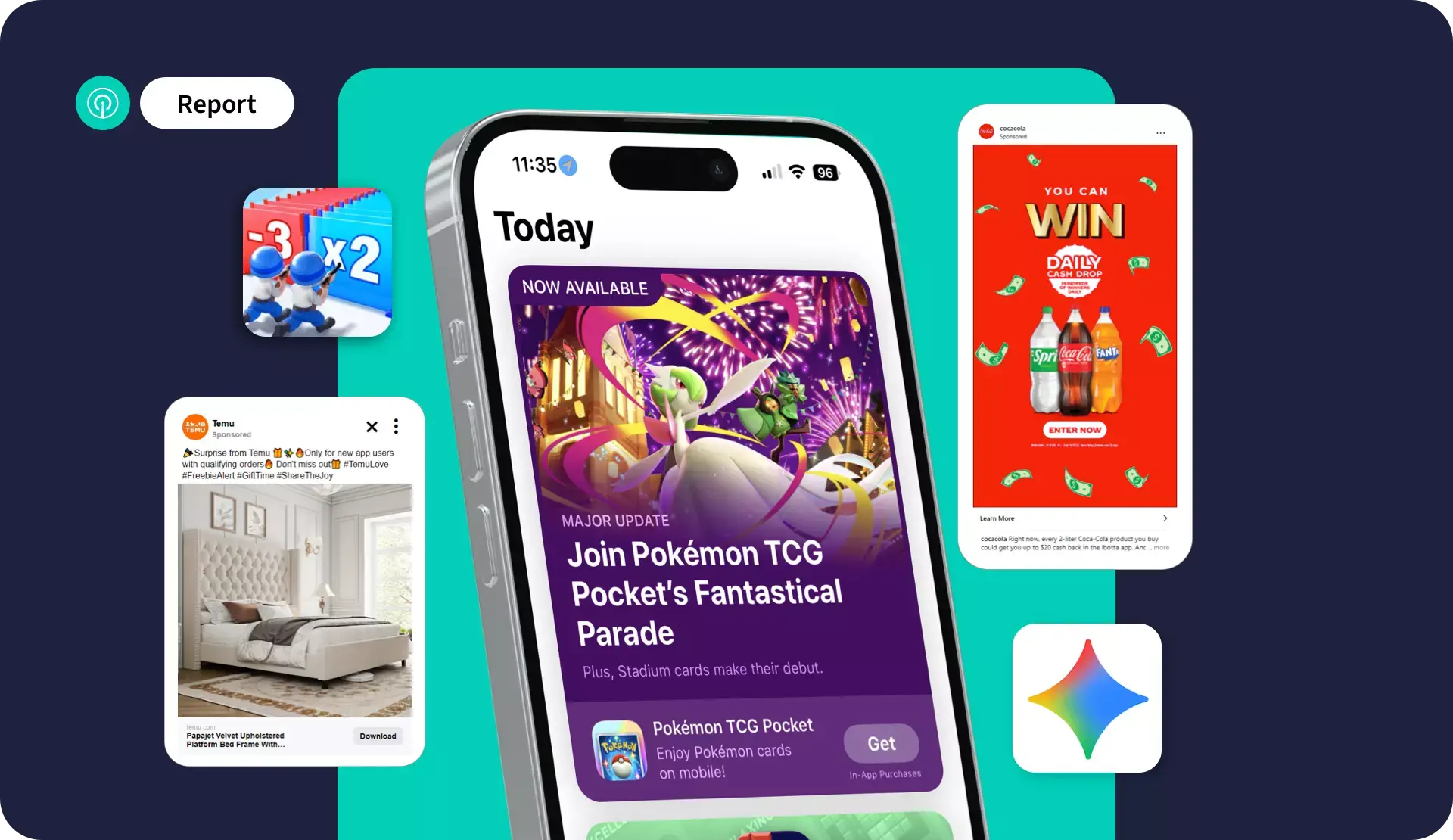

Our award-winning digital market insights platform provides in-depth insights across mobile app, advertising, web, video games, and generative AI. From app downloads and engagement to omnichannel ads served, understanding a company’s digital performance has never been easier. Data can be shared via Snowflake, S3, and API. Point in Time data is available through our Scheduled Data Feed.

Gain access to unparalleled mobile app performance insights

Use App Performance Insights, powered by the world’s largest first-party panel, to evaluate the trends for a company and its competitors. Monitor downloads, revenue, active users, and session metrics to strengthen or challenge your investment theses. Go deeper into the consumer journey with Advanced Usage Insights, which provides unmodeled app estimates on retention, churn, power users, cross-app usage, time spent, and session count. Make decisions fast with data updated on as little as a 24-hour lag.

Track websites across both desktop and mobile

Analyze consumer behavior across web and mobile. With Web Insights, track user behavior across 500K+ websites in 56+ countries, refreshed every 24 hours. Use True Audience to deduplicate users across web and app, so you see real audience reach and engagement without double counting. Understand the impact Gen AI has on web traffic patterns.

Complete your view of the digital landscape

Analyze consumer behavior and advertising with Sensor Tower’s full suite of products. Track brands’ omnichannel ad spend and impressions with Pathmatics across the largest social channels, OTT, desktop, and mobile. Use Video Game Insights to track consumer gaming across Steam, Xbox, and Playstation. Work with our Labs team to access unmodeled panel data to answer your most complex questions.

Measure performance

Gain clear benchmarks on the performance of mobile companies

Analyze audiences

Compare real-life usage data and contextualize engagement

Articulate engagement

Drill down into granular mobile engagement at the hourly level

Proven to track industry trends

Sensor Tower’s estimates are grounded in data from our panel of real people - and they stand up when compared to KPIs shared by publicly traded companies. We monitor earnings and press releases in order to evaluate our accuracy. Our estimates consistently correlate to industry trends, and can be used as a reliable measure of ticker performance.

Sensor Tower Blog

Gaming Insights • February 2026

State of Gaming 2026: Mobile, PC, & Console Trends

State of Gaming 2026 take a cross-platform view of the industry before diving into mobile game performance, marketing, and Live Ops trends. We’ll then explore the ins and outs of PC/Console dynamics, closing with a deep-dive case study on the Shooters genre.

Digital Advertising Insights • February 2026

Q4 Digital Market Index: App, Ads & Web Data

Our quarterly post-mortem on the digital economy is here — and there's a lot to say about Q4 2025. From AI's industry-spanning takeover to Europe's status as a growth leader, we're diving into the mobile, app, ad and web data that you need to understand a rapidly-evolving landscape.