State of AI Apps Report 2025 is Live!

AI Insights · Timothy · June 2023

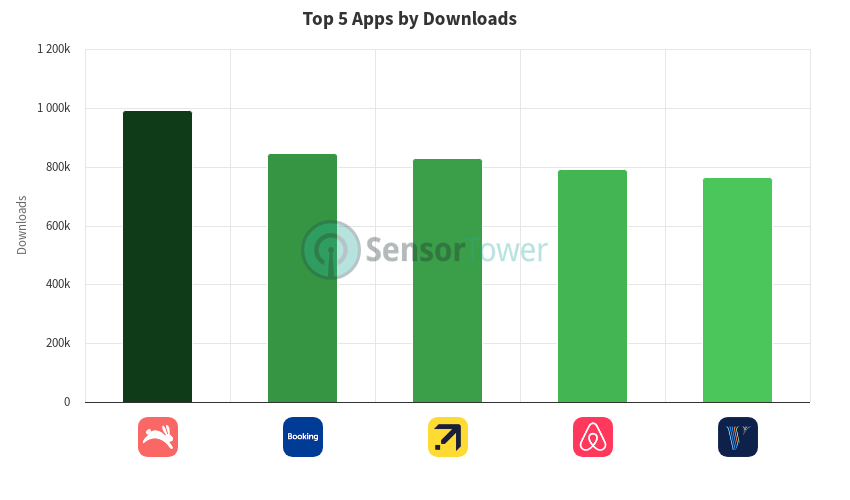

Top 5 Travel and Local Apps in the US: Q2 2023 Performance

Explore the performance of the top 5 travel and local apps in the US for Q2 2023, including trends in weekly downloads and active users. Data provided by Sensor Tower.

In the second quarter of 2023, the top 5 travel and local apps in the United States demonstrated notable trends in weekly downloads and active users. Below is a detailed analysis of each app's performance, with data sourced from Sensor Tower.

Hopper: Hotels, Flights & Cars saw a significant fluctuation in weekly downloads, starting with approximately 270K in late March and peaking at around 288K in early April. The app maintained a steady average of about 230K downloads per week towards the end of the quarter. Weekly active users displayed a slight decline from 1.5M in late March to 1.37M by late April, followed by a resurgence to nearly 1.48M by the end of June.

Booking.com: Hotels & Travel experienced a relatively stable download rate, with a slight dip in mid-April to around 170K and a peak of approximately 253K in mid-June. Active users showed a consistent upward trend, starting at 3M in late March and reaching nearly 3.6M by the end of June.

Expedia: Hotels, Flights & Car maintained a steady download rate throughout the quarter, with figures fluctuating between 175K and 240K. Weekly active users remained stable, starting at 2.1M in late March and slightly increasing to 2.2M by the end of June.

Airbnb showed consistent growth in weekly downloads, starting at 203K in late March and peaking at 267K by the end of June. The app's active users followed a similar trend, increasing from 4.1M in late March to nearly 4.7M by the end of June, indicating strong user engagement.

Vrbo Vacation Rentals had a varied performance in weekly downloads, starting at 221K in late March and experiencing a dip to 161K in early May before rebounding to about 200K by the end of June. Active users saw a slight decline from 2.9M in late March to around 2.76M by the end of June, showing some fluctuation in user retention.

For more detailed insights and comprehensive data, visit Sensor Tower.