We’ve acquired Video Game Insights (VGI)!

AI Insights · Timothy · October 2023

Leading Brands in US Health & Wellness: Q3 2023 Insights

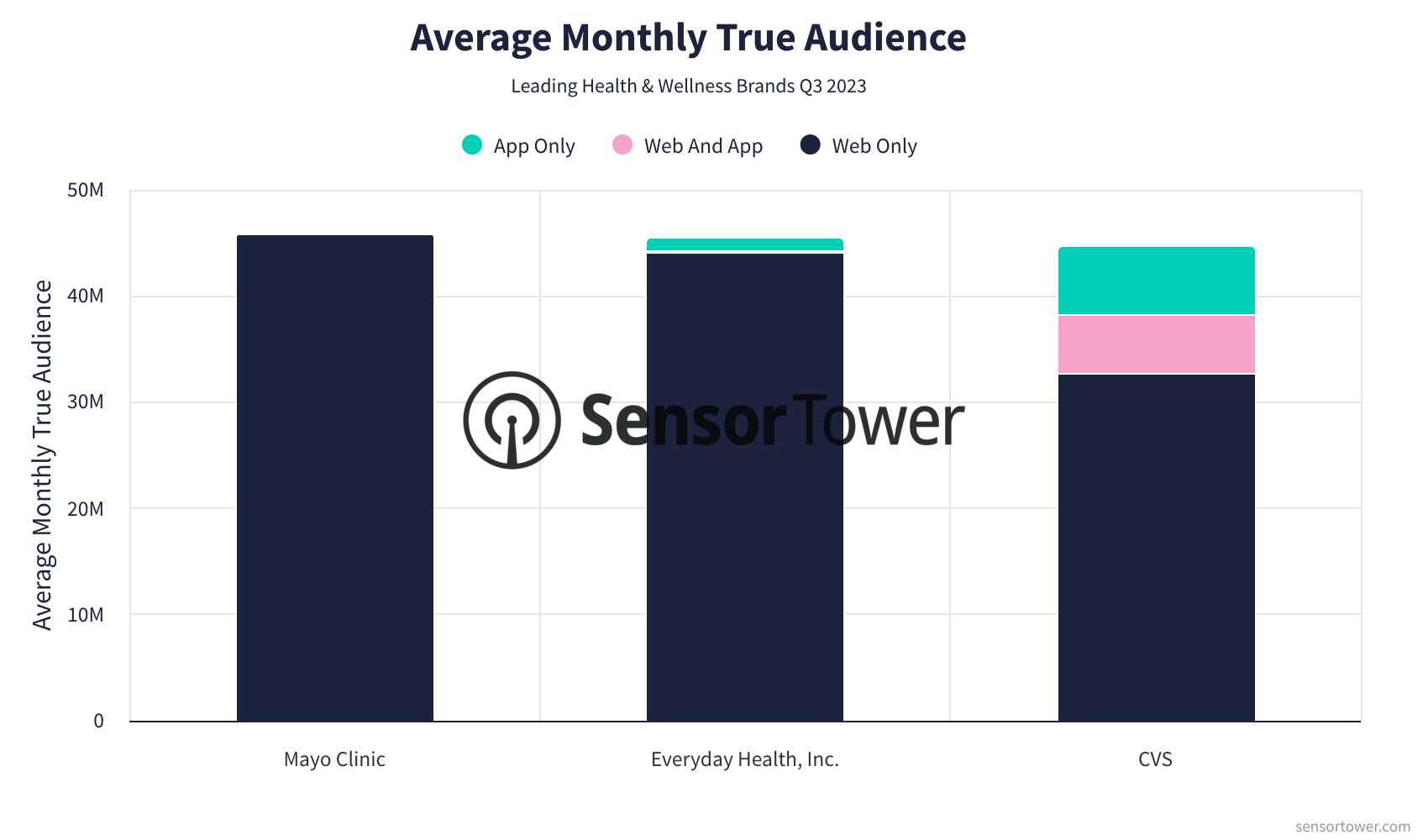

Explore the performance of top brands like CVS, Everyday Health, Inc., and Mayo Clinic in the US Health & Wellness category during Q3 2023, highlighting audience trends, app engagement, and advertising strategies using Sensor Tower's data insights.

Introduction

In Q3 2023, the Health & Wellness category in the US experienced significant engagement across leading brands such as CVS, Everyday Health, Inc., and Mayo Clinic. Utilizing Sensor Tower's unparalleled data insights, this analysis delves into the performance of these brands across their websites and apps, highlighting monthly audience trends, app engagement, and advertising strategies.

CVS

CVS maintains a robust digital presence with its website, cvs.com, and the CVS Health app.

Audience Trends: From Q2 to Q3 2023, cvs.com experienced a notable increase in visits, peaking at over 194M in September. The true monthly deduplicated audience remained consistently above 23M, with web-only visitors playing a dominant role.

App Engagement: The CVS Health app saw steady monthly growth in active users, reaching approximately 2.8M by September, reflecting the increased demand for mobile health solutions.

Ad Spend & Channels: CVS's monthly advertising spend varied throughout the quarter, peaking in September at over $6.5M. Significant impressions were delivered through channels like Facebook and Instagram, while OTT (Over-the-top media service) also contributed notably.

Everyday Health, Inc.

Everyday Health, Inc. operates two major websites, everydayhealth.com and whattoexpect.com, alongside the Pregnancy & Baby Tracker - WTE app.

Audience Trends: Everydayhealth.com saw fluctuations, with visits peaking in July at over 54M. Whattoexpect.com maintained a stable monthly deduplicated audience, averaging around 30M visits.

App Engagement: The Pregnancy & Baby Tracker - WTE app had consistent monthly active user numbers, slightly decreasing to about 2.3M in September.

Ad Spend & Channels: Monthly advertising spend was moderate, peaking in April with over $161K. Facebook dominated ad impressions, while other channels like desktop display contributed modestly.

Mayo Clinic

Mayo Clinic's online platforms include mayoclinic.org and the Mayo Clinic app.

Audience Trends: The website maintained a stable monthly deduplicated audience with visits around 75M in September, supported mainly by web-only visitors.

App Engagement: The Mayo Clinic app had a stable monthly active user base, with active user numbers slightly below 40K throughout the quarter.

Ad Spend & Channels: Monthly ad spend peaked in August at over $1.1M, with Facebook and OTT as key channels for impressions.

Conclusion

The Q3 2023 insights reveal that CVS, Everyday Health, Inc., and Mayo Clinic effectively leveraged their digital platforms to engage audiences across web and mobile. Sensor Tower's comprehensive data offerings, including Web Insights, App Performance Insights, and Pathmatics, were instrumental in uncovering these trends, providing critical insights into cross-platform user behavior. These insights offer unique advantages for decision-makers, enabling strategic planning and investment in digital health solutions.