State of AI Apps Report 2025 is Live!

AI Insights · Timothy · January 2024

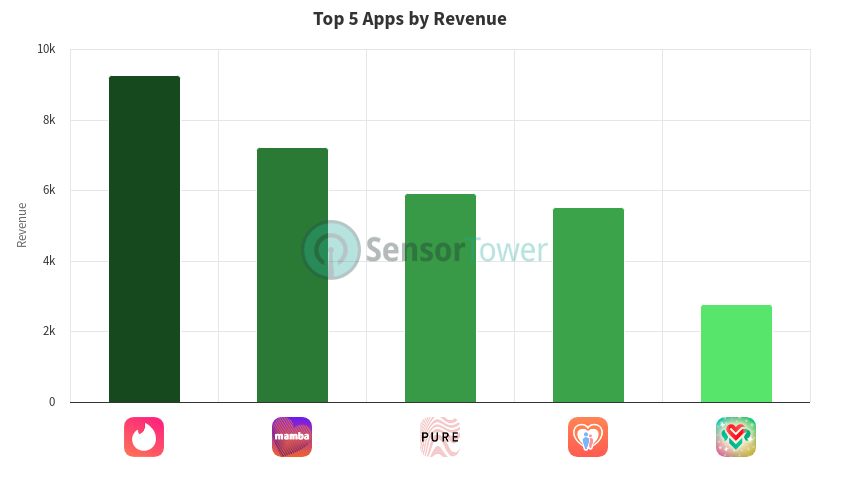

Top 5 Dating Apps on Android in Belarus, Q4 2023

Discover the performance of the leading dating apps in Belarus on the Android platform during Q4 2023, with insights on downloads, revenue, and active users.

In the fourth quarter of 2023, the top dating apps on the Android platform in Belarus showcased varied performance trends in terms of downloads, revenue, and weekly active users. Here’s a detailed breakdown of the top five apps based on data from Sensor Tower.

Tinder Dating App: Chat & Date

Throughout Q4 2023, Tinder experienced a gradual decline in weekly revenue, starting at approximately $0.9K at the end of September and descending to around $0.7K by the end of December. Downloads saw a slight downward trend, beginning the quarter with around 1.7K and ending at approximately 1.3K. Weekly active users also showed a decrease, from about 35.7K at the start of the quarter to around 33.4K by the end.

Mamba Dating App: Make friends

Mamba exhibited fluctuations in its revenue, starting Q4 with about $0.6K and ending with approximately $0.5K. Downloads varied significantly, with a peak of around 3.8K in early October and a lower point of about 1.8K later in the month, eventually stabilizing at around 2.5K by the end of December. Weekly active users remained relatively stable, starting at around 31.2K and ending the quarter with roughly 31.6K.

PURE: Anonymous Dating & Chat

PURE’s revenue showed a positive trend, increasing from approximately $0.4K at the end of September to about $0.6K by the end of December. Downloads were steady, fluctuating around the 500 mark throughout the quarter. However, weekly active users experienced a slight decline, starting at around 3.2K and dropping to approximately 2.9K by the end of December.

Tabor – Dating

Tabor’s revenue saw a gradual decrease from about $0.5K at the end of September to around $0.4K by the end of December. Downloads followed a similar downward trend, from approximately 2.4K to about 1.7K. Weekly active users also declined, from around 20.5K at the start of the quarter to about 17.2K by the end.

Mint - Dating

Mint’s revenue remained relatively stable, fluctuating between $0.2K and $0.3K throughout the quarter. Downloads showed minor fluctuations, starting at around 1.1K and ending at approximately 1K. Weekly active users saw a steady decline from about 3.1K at the beginning of the quarter to roughly 2.2K by the end.

For more detailed insights and data on the performance of these apps, visit Sensor Tower.