State of AI Apps Report 2025 is Live!

AI Insights · Timothy · July 2025

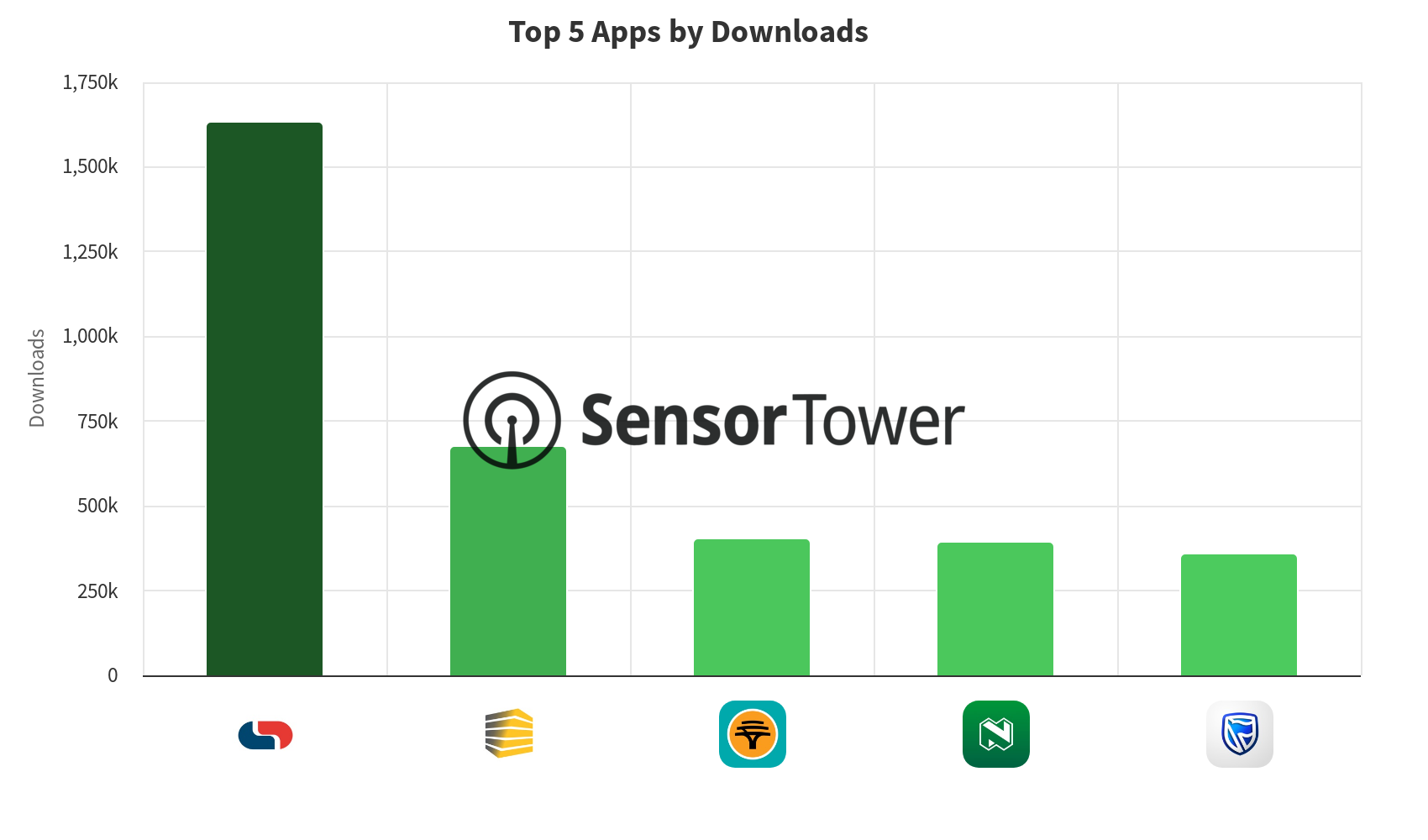

Top 5 Consumer Finance Apps in South Africa: Q2 2025 Performance

Explore the performance trends of the top consumer finance apps in South Africa for Q2 2025, with insights on downloads and active users from Sensor Tower.

In the second quarter of 2025, the top consumer finance applications in South Africa demonstrated varying trends in downloads and active users, as reported by Sensor Tower. Here's a detailed look at each app's performance on the unified platform.

Capitec Bank saw its weekly downloads peak at about 193.5K by late May, with a notable dip to 80.7K in early June. Active users remained strong, fluctuating around 14.5M to 15.3M throughout the quarter.

TymeBank experienced a steady range in weekly downloads, reaching a high of 65.8K in late April and stabilizing around 54.3K by the end of June. Active users showed an upward trend, growing from 2.1M to over 2.5M.

The FNB Banking App maintained consistent weekly download numbers, starting at 41.9K and seeing a slight increase to 35K by the end of the period. Active users remained relatively stable, averaging around 5.5M.

Nedbank Money had a modest increase in downloads, rising from 40K to 36.1K by the end of June. Active users showed a positive trend, increasing from 3.1M to nearly 3.4M.

Finally, Standard Bank / Stanbic Bank saw weekly downloads grow from 35.4K to 33.2K. Active users hovered around 3.4M, with minor fluctuations throughout the quarter.

For more detailed insights and data, visit Sensor Tower's platform.