State of AI Apps Report 2025 is Live!

AI Insights · Timothy · October 2023

Leading Food Delivery Brands in the U.S. in Q3 2023: A Comprehensive Analysis

Explore the robust digital presence and strategic advertising of top U.S. food delivery brands in Q3 2023, with data-driven insights from Sensor Tower.

Introduction

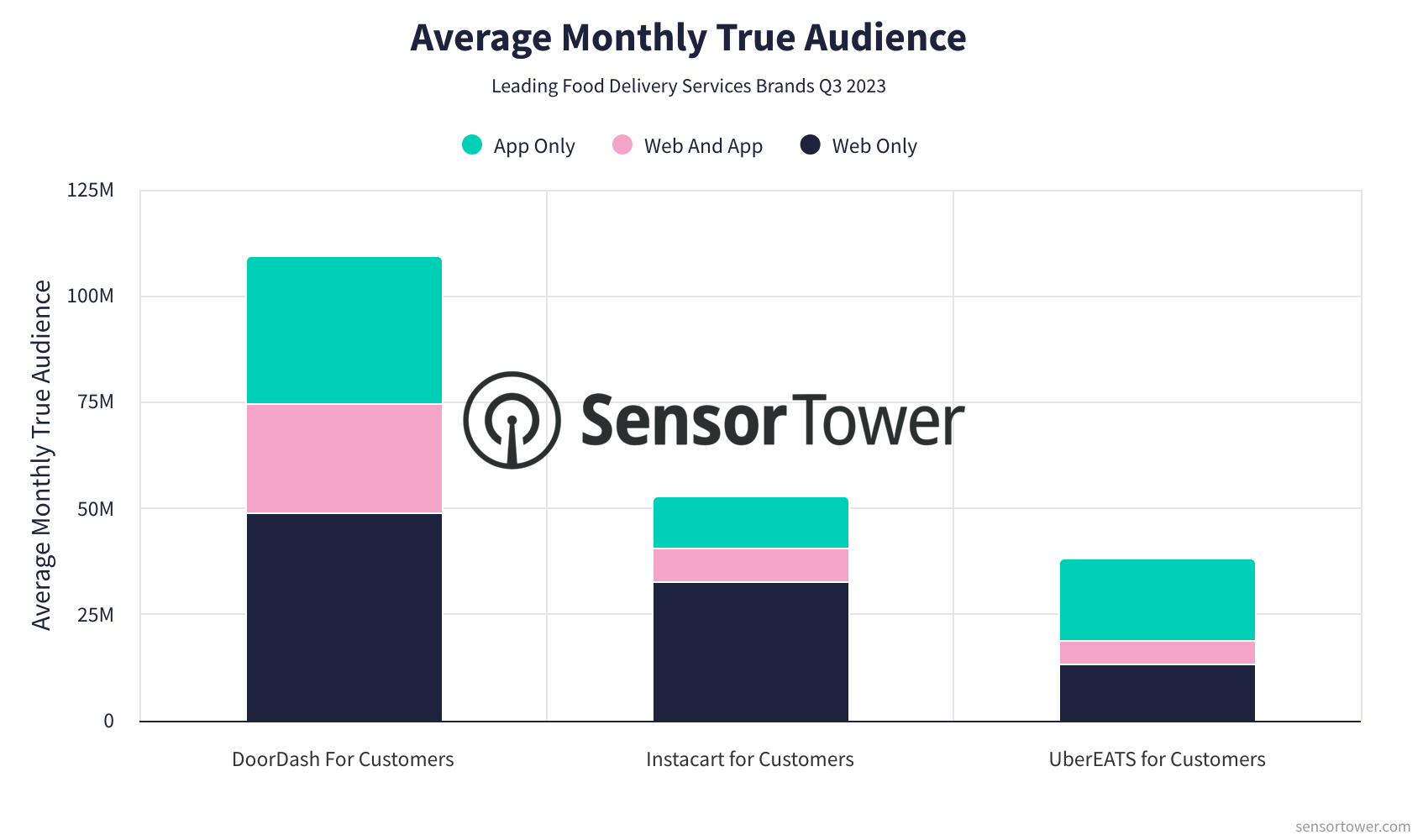

The food delivery service landscape in the United States experienced significant shifts in Q3 2023. Leading this transformation are DoorDash, Instacart, and UberEATS, each showcasing unique trends and performances across their websites and apps. This article delves into their data from Q2 to Q3 2023, highlighting their audience trends, app engagement, and advertising strategies. Sensor Tower's comprehensive data provides critical insights into these dynamics, enabling a nuanced understanding of cross-platform user behavior.

DoorDash: Leading the Charge

DoorDash's digital presence is robust, featuring its websites, doordash.com and order.online, along with the DoorDash - Food Delivery app.

doordash.com maintained stable monthly visits between 180M to 200M, with unique monthly visits above 15M.

order.online consistently attracted around 12M monthly visits, with unique visits increasing from 2.6M to over 3M.

The monthly true audience for DoorDash exceeded 46M, with app-only visitors rising from 30M to 33M.

The DoorDash app saw a steady rise in monthly active users, reaching nearly 40M by September 2023.

Monthly advertising spend peaked in September at over $28M, with impressions surpassing 2B. Significant investment was seen in OTT channels, delivering the highest impressions.

Instacart: Seamless Shopping Experience

Instacart offers a seamless shopping experience through its website, instacart.com, and the Instacart: Groceries & Food app.

instacart.com maintained stable monthly visits around 120M, with unique monthly visits slightly over 10M.

The monthly true audience consistently exceeded 20M, with app-only visitors peaking at 13M.

Active monthly users on the Instacart app grew steadily, reaching approximately 15M by the end of Q3.

Instacart's monthly ad spend saw a slight decline towards September, with OTT being the dominant channel, reflecting significant impressions.

UberEATS: Expanding Reach

UberEATS continues to expand its reach through its website, ubereats.com, and the Uber Eats: Food Delivery app.

ubereats.com experienced fluctuating monthly visits, ranging from 58M to 66M, with unique monthly visits stabilizing around 4.7M.

The monthly true audience consistently hovered around 24M, with a balanced distribution between app and web users.

The Uber Eats app maintained stable monthly active user numbers, consistently over 20M throughout the quarter.

UberEATS increased its monthly ad spend modestly to over $2M by September, with TikTok and Instagram being prominent platforms for impressions.

Conclusion

In Q3 2023, DoorDash, Instacart, and UberEATS demonstrated strong performances in the food delivery sector. Each brand showcased unique patterns in audience engagement, app usage, and advertising strategies. Sensor Tower's unparalleled data insights offer a comprehensive view of these trends, underscoring the importance of cross-platform analysis for understanding consumer behavior in the evolving digital landscape. For more detailed insights, explore our Web Insights, App Performance Insights, and Pathmatics offerings.