State of AI Apps Report 2025 is Live!

AI Insights · Timothy · January 2024

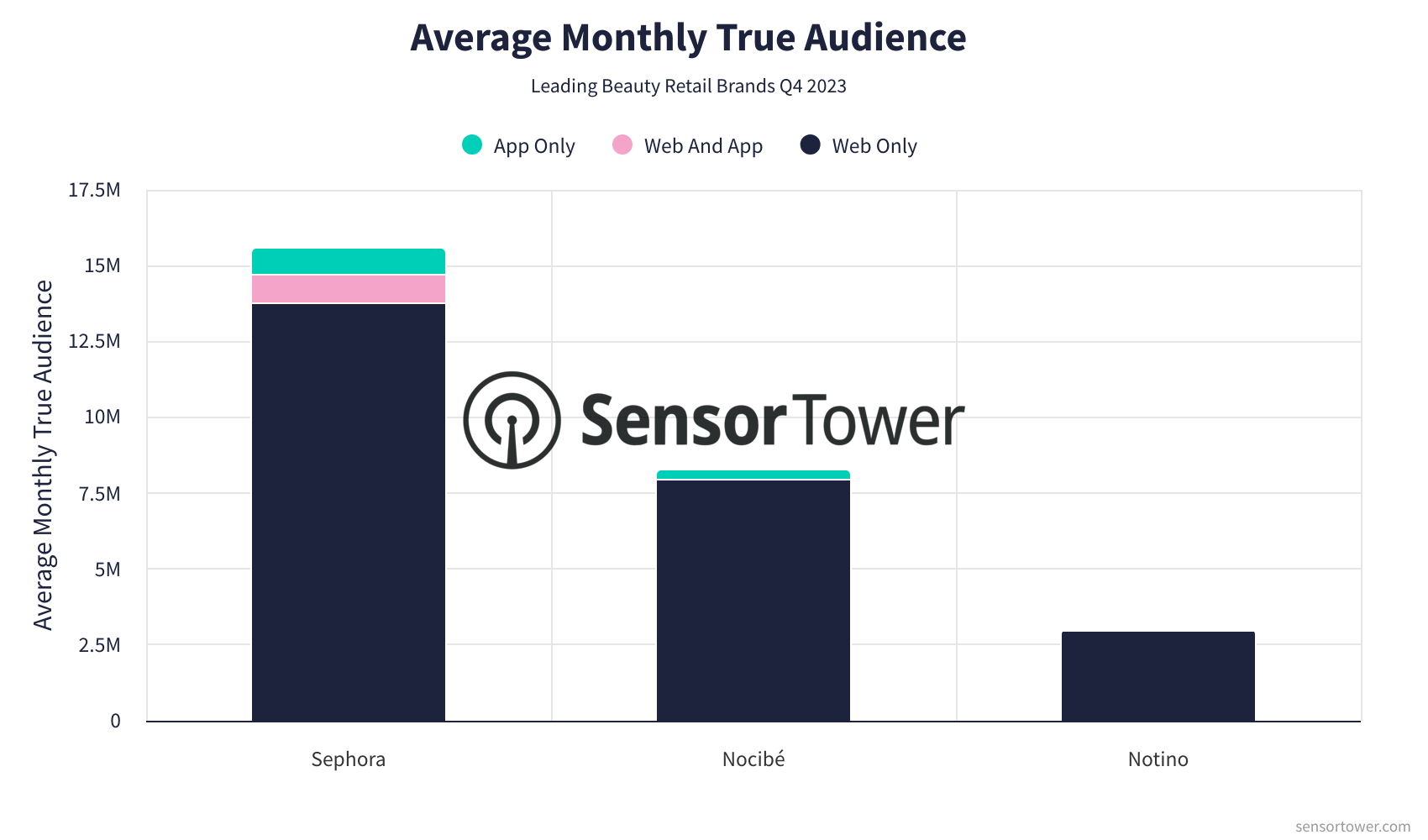

Leading Beauty Retail Brands in France: Q4 2023 Analysis

Explore the Q4 2023 performance of top beauty retail brands in France, including Sephora, Nocibé, and Notino, with insights into their website metrics, app engagement, and advertising strategies using Sensor Tower's analytics.

Introduction

In the dynamic world of beauty retail in France, Q4 2023 saw significant shifts among leading brands like Sephora, Nocibé, and Notino. Leveraging Sensor Tower's comprehensive data, we explore the performance and trends of these key players across their websites and apps. Sensor Tower's unique capabilities provide unparalleled insights into cross-platform user behavior, offering valuable perspectives on audience trends, app engagement, and advertising strategies.

Sephora

Sephora is renowned for its extensive range of beauty products and innovative digital strategies. Its digital presence is robust, featuring its website, sephora.com, and the Sephora app.

Audience Trends: From Q3 to Q4 2023, Sephora experienced a notable increase in website visits, peaking in November with over 39M visits. The monthly true audience grew significantly, surpassing 5M by December. The web platform consistently attracted a larger audience compared to the app.

App Engagement: Monthly active users on the app rose from 760K in July to over 1.1M in December, indicating a strong preference for mobile interactions.

Ad Spend & Channels: Sephora's monthly advertising spend peaked in October, reaching nearly $2M, primarily via Facebook and Instagram, which delivered substantial impressions.

Nocibé

Nocibé is a key player in the beauty retail sector, known for its wide array of products and customer-centric approach. Its digital strategy includes its website, nocibe.fr, and the Nocibé app.

Audience Trends: The website visits peaked in November at approximately 18M, with a monthly true audience exceeding 2.8M. The web platform remains dominant with no significant overlap with app users.

App Engagement: The app's monthly active users climbed steadily, reaching around 387K by December.

Ad Spend & Channels: Nocibé increased its monthly ad spend significantly in November, reaching about $600K, focusing on Facebook and Instagram for maximum reach.

Notino

Notino is recognized for its competitive pricing and broad selection of perfumes and cosmetics. Its digital footprint is marked by its website, notino.com, and the Notino: profumi e cosmetici app.

Audience Trends: The website saw a spike in visits in November, exceeding 10M. Monthly true audience numbers also peaked at over 1M during this period.

App Engagement: Monthly active users on the app increased, reaching over 116K in November, reflecting a growing mobile user base.

Ad Spend & Channels: Notino's monthly ad spend remained relatively stable with a peak in November at around $64K, utilizing Facebook and Instagram effectively for audience engagement.

Conclusion

The beauty retail sector in France is marked by dynamic shifts and strategic digital engagements. Sephora, Nocibé, and Notino have each leveraged their online platforms and apps to capture significant audience shares. Sensor Tower's comprehensive data offerings, including Web Insights, App Performance Insights, and Pathmatics, provide critical insights into these trends, showcasing the power of cross-platform analysis in understanding consumer behavior.

For decision-makers, Sensor Tower's analytics offer a unique advantage, enabling informed strategic decisions in a competitive market.