We’ve acquired Playliner!

AI Insights · Timothy · January 2024

Leading Shopping Brands in France: Analyzing Q4 2023 Trends

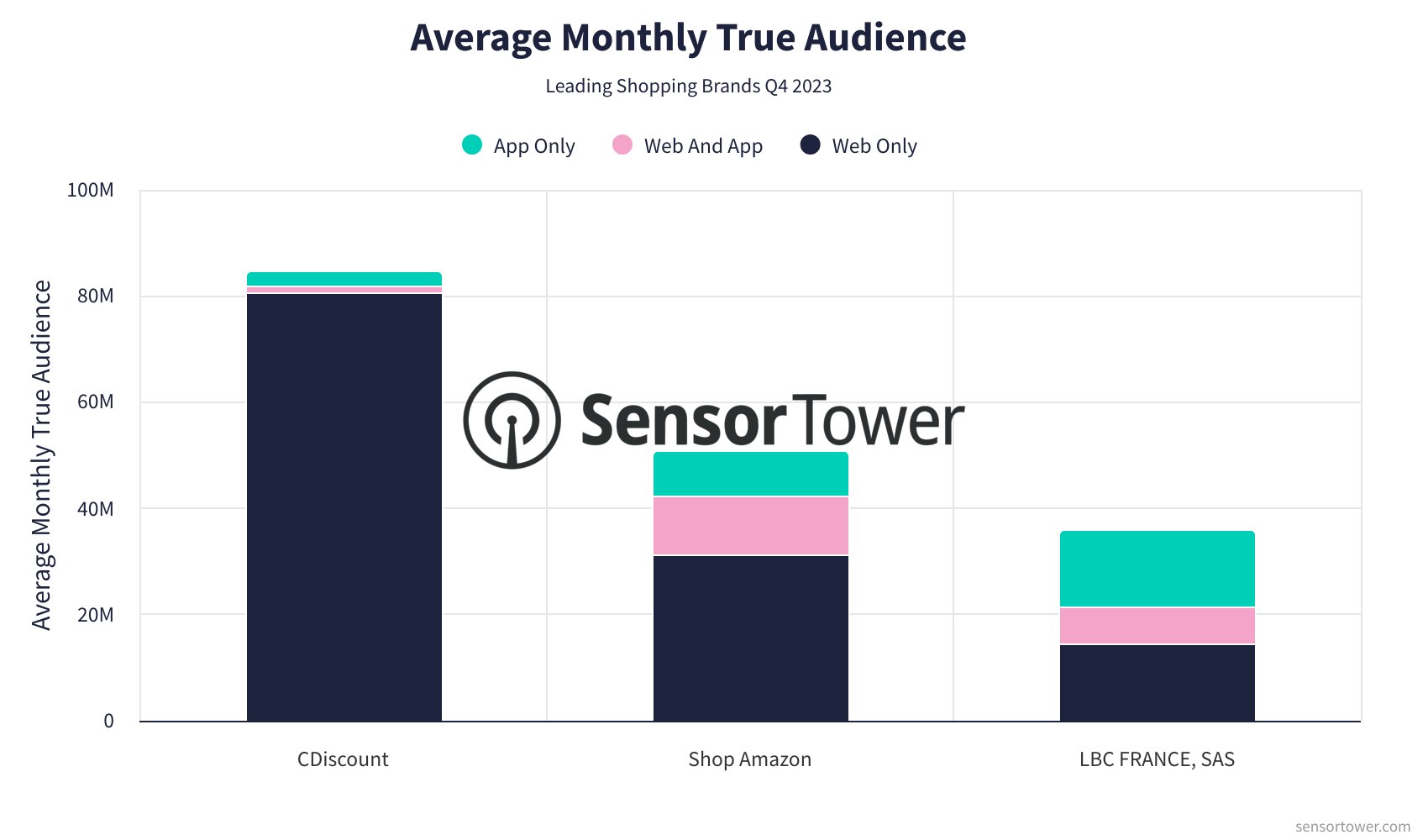

Explore the Q4 2023 performance of top shopping brands in France, focusing on CDiscount, Amazon, and LBC FRANCE, SAS. Discover insights into their website metrics, app usage, and advertising strategies, highlighting the strategic impact through Sensor Tower's analytics.

Introduction

In the dynamic landscape of online shopping in France, a few key players have emerged as leaders in Q4 2023. This article delves into the performance and trends of some of the most prominent brands in the Shopping category, including CDiscount, Shop Amazon, and LBC FRANCE, SAS. Leveraging data from Sensor Tower's comprehensive insights, we explore the cross-platform audience behavior and advertising strategies that have shaped the quarter's outcomes.

CDiscount

CDiscount maintains a robust presence through its website, cdiscount.com, and its Cdiscount app.

Audience Trends: The website saw a notable spike in November, with visits exceeding 420M, while unique visits surpassed 48M. This surge was followed by a slight decrease in December, stabilizing the unique visits around 39M. Monthly true audience figures also peaked in November, reaching over 51M, before settling above 41M in December.

App Engagement: The Cdiscount app experienced a significant increase in monthly active users, peaking at 4.1M in November before slightly declining to 3.8M in December.

Ad Spend & Channels: CDiscount's monthly advertising spend saw a sharp increase in November, with expenses over $1.2M and impressions nearing 400M. Facebook remained the dominant channel, accounting for the majority of impressions.

Shop Amazon

Amazon's digital ecosystem is anchored by its website, amazon.com, alongside the Amazon Shopping app.

Audience Trends: Amazon's website visits remained consistently high, with December visits reaching 636M. Unique visits steadily increased throughout Q4, culminating in over 24M in December. The monthly true audience grew steadily, surpassing 30M by the end of the year.

App Engagement: The Amazon Shopping app showed a continuous rise in monthly active users, closing the quarter with around 18M users in December.

Ad Spend & Channels: Amazon's advertising efforts were substantial, with December's monthly ad spend exceeding $3.3M and impressions surpassing 1B. Facebook was the primary channel, delivering the most impressions.

LBC FRANCE, SAS

LBC FRANCE, SAS drives its reach through leboncoin.fr and the leboncoin, petites annonces app.

Audience Trends: The website experienced a decline in visits, from 465M in July to 354M in December. Unique visits also decreased, ending the year at around 11M. The monthly true audience slightly decreased to approximately 24M by December.

App Engagement: The app maintained a stable monthly active user base, with active users peaking at 18.3M in September and normalizing to 17.5M by December.

Ad Spend & Channels: Monthly advertising spend was consistent, with December's expenditure around $185K and impressions nearing 60M, primarily driven by Facebook.

Conclusion

The Q4 2023 trends in France's Shopping category reveal a dynamic interplay between web and app engagement, with each brand leveraging its strengths across platforms. Sensor Tower's unparalleled data insights offer a comprehensive view into these patterns, enabling a deeper understanding of cross-platform user behavior. With tools like Web Insights, Pathmatics, and App Performance Insights, businesses can navigate the complexities of digital commerce with precision and clarity. These insights empower decision-makers to strategize effectively, ensuring sustained growth and competitive advantage in the ever-evolving digital marketplace.