State of AI Apps Report 2025 is Live!

AI Insights · Timothy · April 2024

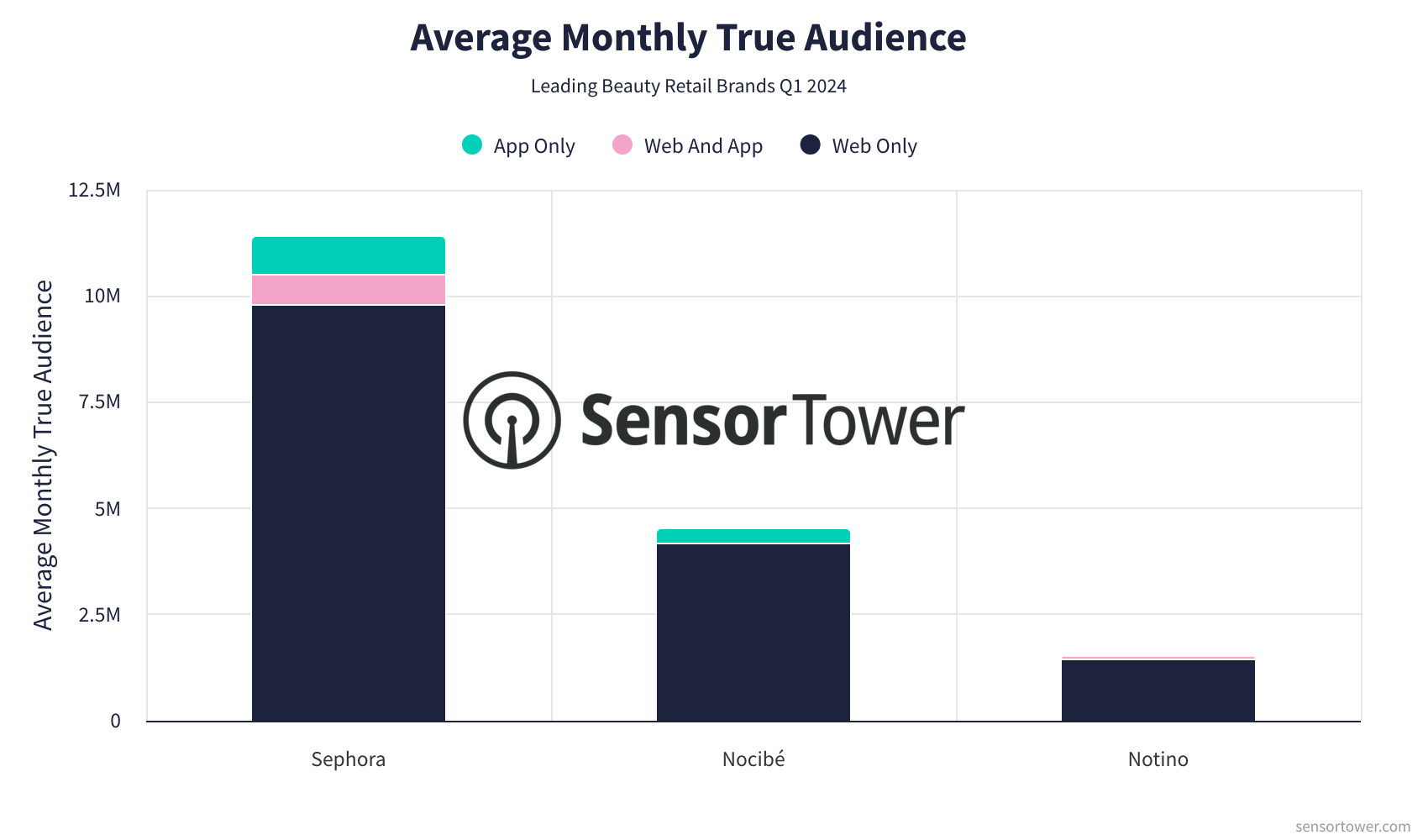

Leading Beauty Retail Brands in France: Q1 2024 Analysis

Explore the digital strategies of Sephora, Nocibé, and Notino in France's beauty retail market, focusing on audience metrics, app engagement, and advertising insights.

In the dynamic world of beauty retail, brands like Sephora, Nocibé, and Notino have consistently captured the attention of consumers in France. This article delves into the performance and trends of these leading brands from Q4 2023 to Q1 2024, leveraging comprehensive data insights provided by Sensor Tower.

Sephora

Sephora is renowned for its extensive range of beauty products and innovative digital experiences. Its digital presence is robust, featuring its website, sephora.com, and the Sephora app.

Audience Trends: The website maintained a strong presence with visits ranging from 18M to 39M monthly. Unique visits hovered above 3M monthly, with a noticeable dip in February. The monthly true audience remained stable above 4M throughout the quarter.

App Engagement: The app saw a peak in monthly active users in January at over 1.2M, indicating a preference for mobile experiences during the holiday season. This number slightly decreased by March, stabilizing above 1M.

Ad Spend & Channels: Sephora's advertising efforts were significant on platforms like Facebook and Instagram, with monthly ad spend peaking at over $1.9M in October. Monthly impressions were highest in October at over 670M.

Nocibé

Nocibé, a key player in the beauty retail sector, operates through its website, nocibe.fr, and the Nocibé app.

Audience Trends: The website attracted between 9M and 18M visits monthly, with unique visits remaining around 1.3M. The monthly true audience showed a peak in November, reaching close to 2.8M.

App Engagement: Monthly app active users peaked in December at nearly 390K before gradually declining to around 310K by March.

Ad Spend & Channels: Nocibé's monthly ad spend was highest in November, exceeding $600K, with impressions peaking at over 190M. Facebook and Instagram were the primary channels for reaching audiences.

Notino

Notino's digital strategy includes notino.com and the Notino: profumi e cosmetici app.

Audience Trends: The website's visits ranged from 5M to 10M monthly, with unique visits showing a significant peak in November. Monthly true audience figures remained around 600K to 1M during the period.

App Engagement: The app's monthly active users peaked in November at over 110K, with a gradual decline to around 87K by March.

Ad Spend & Channels: Notino's advertising efforts were modest, with the highest monthly spend in November at approximately $64K. Monthly impressions peaked at over 20M.

Conclusion

The beauty retail landscape in France is both vibrant and competitive, with Sephora, Nocibé, and Notino leading the charge. Sensor Tower’s unparalleled data insights provide a comprehensive view of these brands' digital strategies, highlighting audience trends, app engagement, and advertising effectiveness. For those interested in detailed insights into the digital behavior of beauty consumers, Sensor Tower remains an invaluable resource.

For more information on our offerings, explore Web Insights, App Performance Insights, and Pathmatics.