State of AI Apps Report 2025 is Live!

AI Insights · Timothy · July 2024

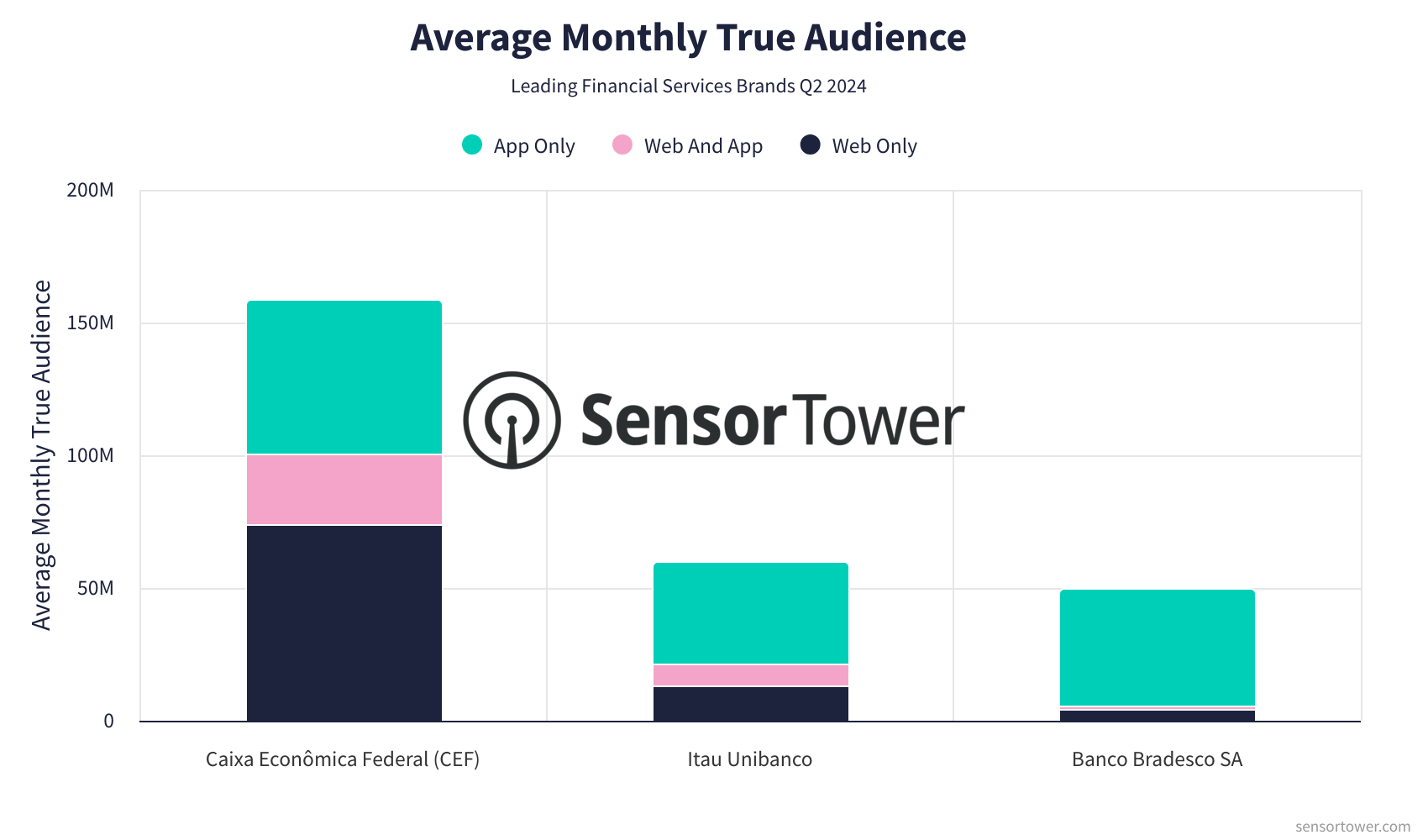

Leading Financial Services Brands in Brazil: Q2 2024 Analysis

Explore the digital strategies of top Brazilian financial services brands in Q2 2024, focusing on website metrics, app usage data, and advertising spend. Discover how Caixa Econômica Federal, Itau Unibanco, and Banco Bradesco SA leverage Sensor Tower's insights for strategic advantage.

Introduction

In the competitive landscape of Brazil's financial services, certain brands have emerged as leaders in digital presence and audience engagement. This article delves into the performance of three key players: Caixa Econômica Federal (CEF), Itau Unibanco, and Banco Bradesco SA. By examining data from Q1 to Q2 2024, we gain insights into their strategies across websites, apps, and advertising channels. Sensor Tower’s comprehensive data offerings, including Web Insights, Pathmatics, and App Performance Insights, provide unparalleled insights into these trends.

Caixa Econômica Federal (CEF)

Caixa Econômica Federal's digital footprint is substantial, with a focus on its websites, caixa.gov.br and youse.com.br, alongside the CAIXA app.

caixa.gov.br saw fluctuating visits, peaking in March with over 800M visits and stabilizing around 700M by June.

youse.com.br had a consistent monthly audience, with visits averaging around 10M, showing a slight increase in June.

The CAIXA app maintained high monthly activity with over 60M active users, peaking in May.

Monthly ad spend was dynamic, with significant increases in March and June, reaching over $400K. Facebook and Instagram were dominant channels, with TikTok seeing notable growth in June.

Itau Unibanco

Itau Unibanco's digital presence is marked by its websites, itau.com.br and userede.com.br, and the Banco Itaú: Conta, Cartão e + app.

itau.com.br experienced a dip in April but rebounded in May with visits exceeding 100M monthly.

userede.com.br showed variability in visits, with a notable increase in June.

The app consistently engaged over 38M monthly active users, maintaining stability throughout Q2.

Monthly ad spend decreased from January to April, before stabilizing around $700K. Facebook and Instagram remained key advertising platforms.

Banco Bradesco SA

Banco Bradesco's digital strategy includes bradescoseguros.com.br and the Banco Bradesco app.

The website's monthly visits peaked in March at around 38M, with a decline in subsequent months.

The app saw a stable monthly user base with over 45M active users, peaking in May.

Monthly ad spending showed fluctuations, with a peak in March exceeding $750K. TikTok emerged as a significant channel in June.

Conclusion

Through Sensor Tower's comprehensive data analysis, we observe that Caixa Econômica Federal, Itau Unibanco, and Banco Bradesco SA have each cultivated strong digital presences. Their strategic use of web platforms, mobile apps, and diverse advertising channels highlights their adaptability and commitment to engaging Brazil's financial services market. As the digital landscape evolves, these insights are crucial for understanding consumer behavior and guiding strategic decisions. Sensor Tower’s data provides unique advantages, empowering decision-makers with actionable insights to navigate this dynamic environment.