Predictions for the Digital Economy in 2026 Report is Live!

AI Insights · Timothy · July 2024

Leading Health Care Services Brands in Canada: Q2 2024 Analysis

Explore the digital performance of top Canadian health care brands in Q2 2024, with insights into their website metrics, app usage, and advertising strategies, leveraging Sensor Tower's comprehensive data.

Introduction

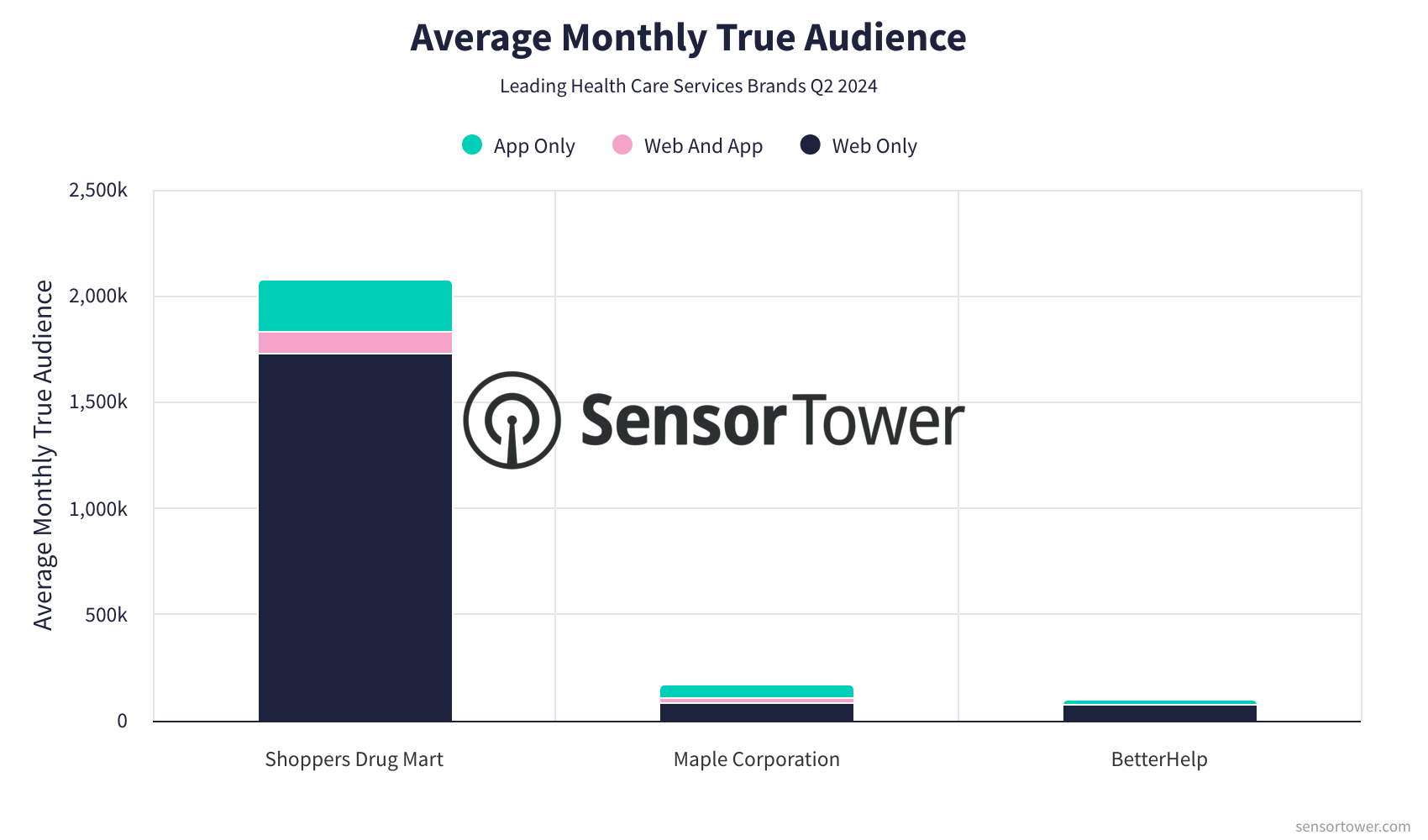

In the dynamic landscape of Health Care Services in Canada, several brands have distinguished themselves by reaching substantial audiences across digital platforms. This article delves into the performance of three leading brands—Shoppers Drug Mart, Maple Corporation, and BetterHelp—during Q2 2024. By leveraging Sensor Tower's comprehensive data, we highlight trends and insights across websites and apps, shedding light on these brands' digital engagements.

Shoppers Drug Mart

Shoppers Drug Mart's digital presence is robust, featuring its website, shoppersdrugmart.ca, along with the Shoppers Drug Mart app.

Audience Trends: The website saw a decline in visits from 16M in January to approximately 13M by June. Despite this, the monthly true audience remained consistently above 2M throughout Q2.

App Engagement: The app maintained a stable monthly active user base, fluctuating around 350K throughout Q2, indicating a steady mobile user base.

Ad Spend & Channels: Shoppers Drug Mart increased its monthly ad spend to over $730K in June, with significant impressions exceeding 158M. Facebook and YouTube were key advertising channels.

Maple Corporation

Maple Corporation operates through its website, getmaple.ca, and the Maple – Online Doctors 24/7 app.

Audience Trends: The website experienced a significant spike in visits in April, reaching over 5M visits, before stabilizing around 2.6M in June. The monthly true audience remained stable, slightly above 170K.

App Engagement: The app's monthly active users hovered around 90K by the end of Q2, showcasing a consistent user base.

Ad Spend & Channels: Maple's monthly ad spend decreased significantly from January to June, with minimal spending in the latter months. Facebook remained the primary advertising channel.

BetterHelp

BetterHelp's digital ecosystem includes its website, betterhelp.com, and the BetterHelp - Therapy app.

Audience Trends: The website visits fluctuated, peaking in March with nearly 1M visits before settling at around 670K in June. The monthly true audience remained above 90K throughout Q2.

App Engagement: The app maintained a steady monthly active user base, around 25K, indicating consistent engagement.

Ad Spend & Channels: BetterHelp's monthly ad spend peaked in May at nearly $1M, with TikTok and Facebook being significant channels, driving impressions over 300M.

Conclusion

In Q2 2024, Shoppers Drug Mart, Maple Corporation, and BetterHelp demonstrated strong digital strategies, leveraging both web and mobile platforms to engage their audiences. Sensor Tower's unparalleled data offerings provide invaluable insights into these cross-platform behaviors, essential for understanding the evolving digital landscape in health care services.

For more detailed insights, explore Sensor Tower's Web Insights, App Performance Insights, and Pathmatics.