We’ve acquired Playliner!

AI Insights · Timothy · July 2024

Leading Brands in the UK’s Consumer Packaged Goods Sector: Q2 2024 Insights

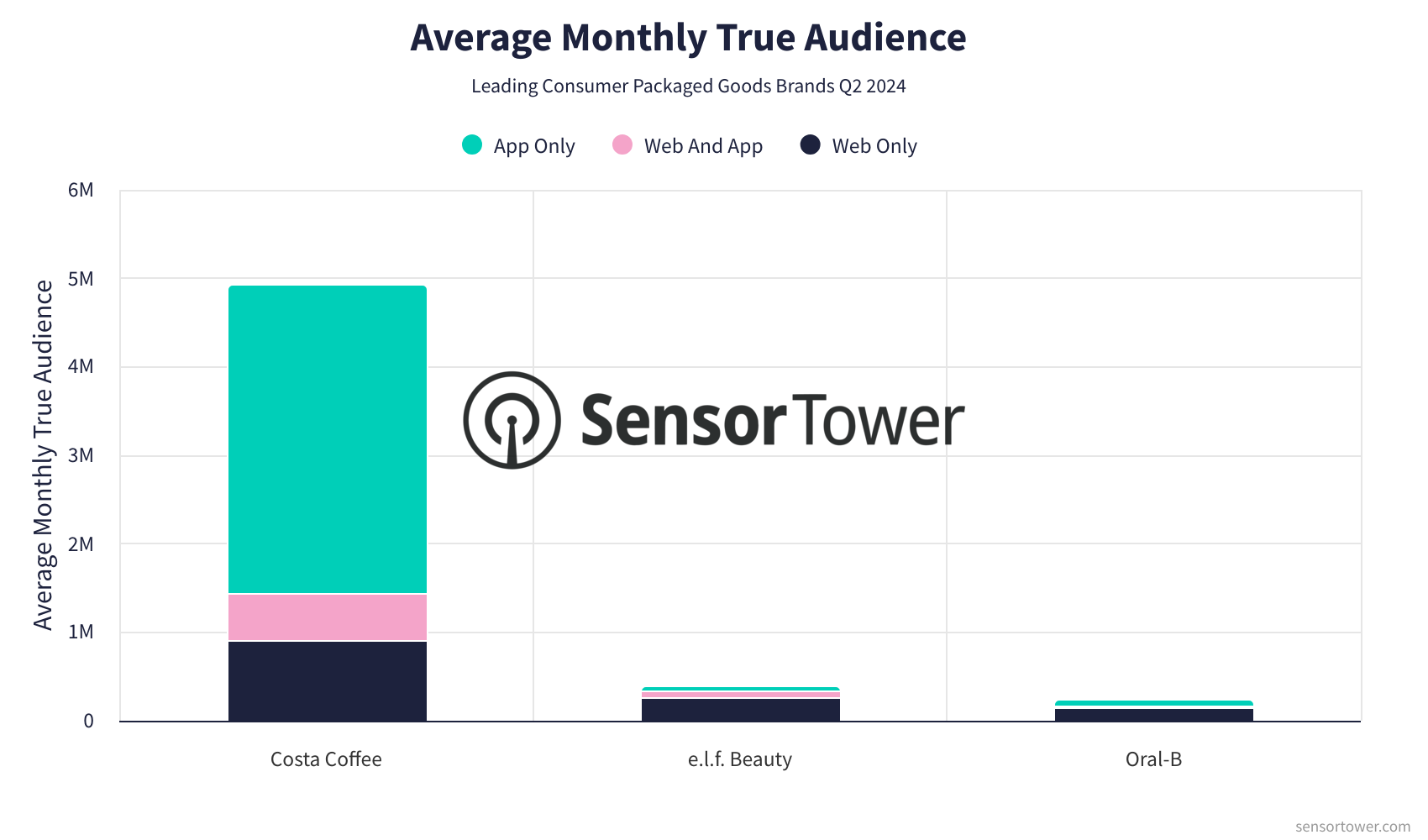

Explore the performance of top UK brands in the Consumer Packaged Goods sector, focusing on Costa Coffee, e.l.f. Beauty, and Oral-B. Discover their audience engagement metrics, app usage data, and advertising strategies for Q2 2024.

In the dynamic landscape of consumer packaged goods in the UK, several brands have emerged as leaders in Q2 2024, capturing significant audiences across their digital platforms. This article delves into the performance of Costa Coffee, e.l.f. Beauty, and Oral-B, highlighting trends in audience engagement and advertising strategies.

Costa Coffee

Costa Coffee has made a robust impact in the UK market, leveraging both its website, costa.co.uk, and the Costa Coffee Club app.

Audience Trends: The monthly true audience for Costa Coffee experienced a steady rise, maintaining above 3.9M throughout the quarter. The app-only visitors consistently outnumbered web-only visitors, indicating a strong preference for mobile engagement.

App Engagement: The Costa Coffee Club app saw a notable increase in monthly active users, starting from approximately 3.5M in April and climbing to over 4M by June.

Ad Spend & Channels: Costa Coffee’s monthly advertising expenditure varied, with a significant spike in June exceeding $880K, primarily through platforms like Facebook and Instagram. This strategic push resulted in over 124M impressions.

e.l.f. Beauty

e.l.f. Beauty continues to capture attention with its website, elfcosmetics.com, and the e.l.f. Cosmetics and Skincare app.

Audience Trends: Monthly true audience figures for e.l.f. Beauty remained stable, hovering around 200K. The website consistently attracted more visitors than the app, with visits per unique visitor maintaining a high average.

App Engagement: The app’s monthly active users remained steady, fluctuating between 76K and 86K throughout the quarter, indicating consistent user engagement.

Ad Spend & Channels: e.l.f. Beauty’s monthly ad spend saw fluctuations, peaking in April at over $270K. Facebook and Instagram were the dominant channels, contributing to significant impressions.

Oral-B

Oral-B has maintained a strong presence with its website, oralb.com, and the Oral-B app.

Audience Trends: Oral-B’s monthly true audience showed a gradual increase, reaching approximately 160K by June. The website consistently attracted more visitors than the app, with visits per unique visitor remaining stable.

App Engagement: The app saw a steady rise in monthly active users, increasing from about 75K in April to over 93K in June.

Ad Spend & Channels: Oral-B demonstrated a robust advertising strategy, with monthly ad spend peaking in June at over $3.3M. Instagram and Facebook were the primary channels, generating substantial impressions.

Conclusion

The data provided by Sensor Tower underscores the intricate dynamics of the consumer packaged goods sector in the UK. Costa Coffee, e.l.f. Beauty, and Oral-B have each leveraged their digital platforms to engage audiences effectively. Sensor Tower’s comprehensive insights, spanning web and app data to advertising metrics, offer unparalleled visibility into these brands’ cross-platform strategies. For more detailed insights, explore our Web Insights, App Performance Insights, and Pathmatics offerings.