State of AI Apps Report 2025 is Live!

AI Insights · Timothy · October 2024

Leading Brands in the UK Energy & Utilities Sector: Q3 2024 Insights

Explore the performance of top UK energy brands like Octopus Energy, British Gas, and EDF in Q3 2024, focusing on website metrics, app usage, and advertising strategies.

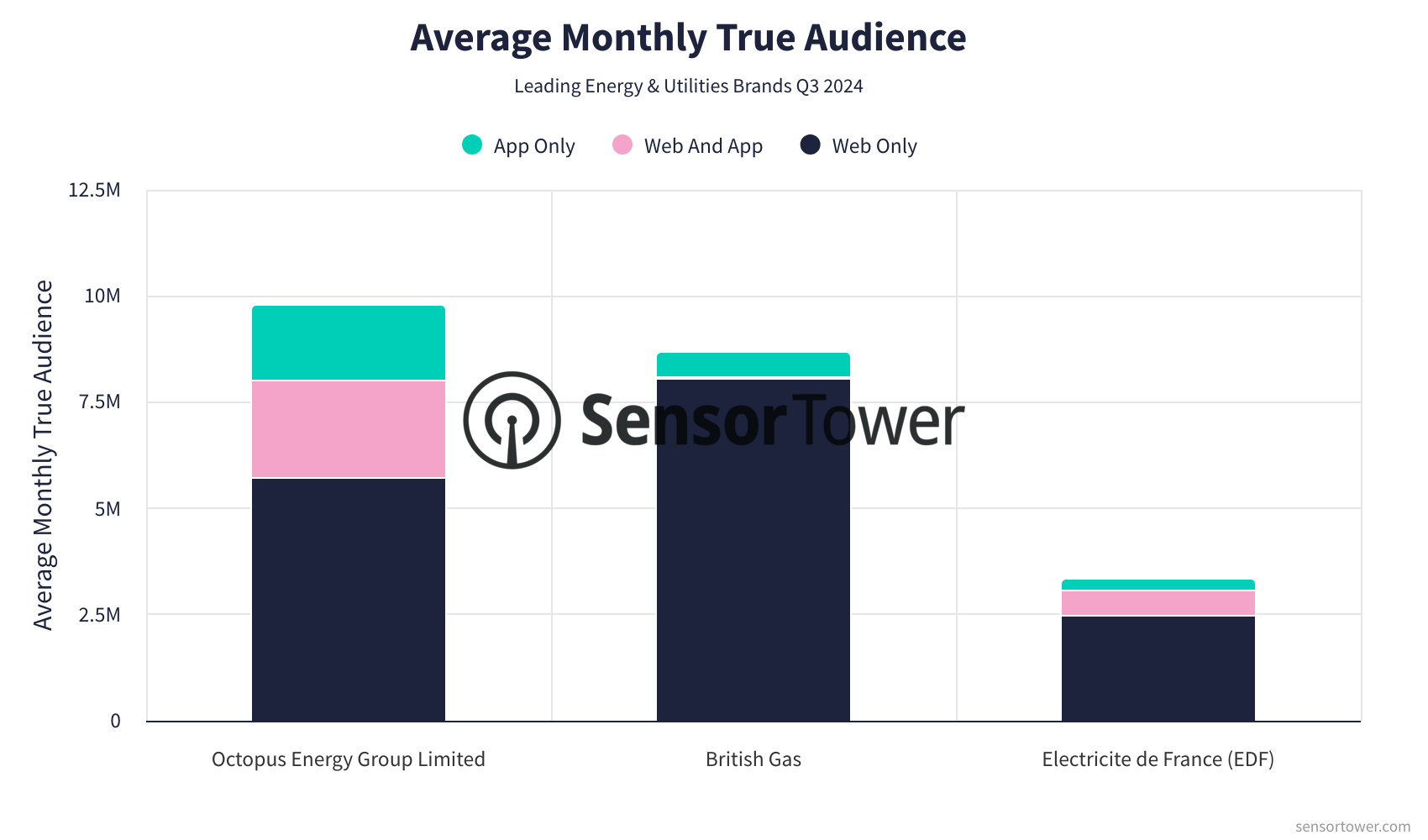

The Energy & Utilities sector in the United Kingdom has seen significant developments in Q3 2024. This article examines the performance of leading brands such as Octopus Energy Group Limited, British Gas, and Electricite de France (EDF), utilizing comprehensive data from Sensor Tower. Our analysis reveals key trends in web and app audiences, advertising spend, and user engagement across platforms.

Octopus Energy Group Limited

Octopus Energy has established a robust digital presence through its website, octopus.energy, and the Octopus Energy app.

Audience Trends: The website's monthly visits surged from 18.5M in July to nearly 29.2M in September. Unique visits also increased, with a notable rise in the visits per unique visitor ratio, indicating strong user engagement.

App Engagement: Monthly active users of the Octopus Energy app grew steadily, reaching over 2.6M by September.

Ad Spend & Channels: Monthly advertising spend rose significantly from $1.1M in July to approximately $4.8M in September, driven primarily by Facebook and Instagram, which delivered substantial impressions.

British Gas

British Gas maintains a strong digital footprint through its website, britishgas.co.uk, and the British Gas app.

Audience Trends: Monthly website visits surged from around 17M in July to over 36M in September. Unique visits showed fluctuations, peaking in August.

App Engagement: The app's monthly active users remained stable, hovering around 600K throughout the quarter.

Ad Spend & Channels: British Gas reduced its monthly ad spend from $1.3M in July to approximately $790K in September, with Facebook and Instagram as dominant channels.

Electricite de France (EDF)

EDF's digital strategy is reflected in its website, edfenergy.com, and the EDF UK app.

Audience Trends: The website experienced growth from 7.5M monthly visits in July to nearly 10M in September, indicating increased user interest.

App Engagement: Monthly active users of the EDF UK app remained relatively stable, slightly declining to around 460K by September.

Ad Spend & Channels: EDF's monthly advertising expenditure decreased over the quarter, with spend dropping to about $99K in September. YouTube and Facebook were the primary channels for ad impressions.

Conclusion

The Q3 2024 data underscores how leading brands in the UK's Energy & Utilities sector are effectively leveraging web and app platforms to engage users. Sensor Tower's extensive datasets provide unparalleled insights into cross-platform user behavior, highlighting the critical role of digital strategies in this evolving market. For more detailed insights, explore our Web Insights and Pathmatics offerings.