We’ve acquired Playliner!

AI Insights · Timothy · October 2024

Leading Health Care Services Brands in Q3 2024: A Comprehensive Analysis

An in-depth analysis of Mayo Clinic, CVS, and Walgreens, highlighting their digital engagement and strategic impacts in Q3 2024, supported by Sensor Tower's data insights.

Introduction

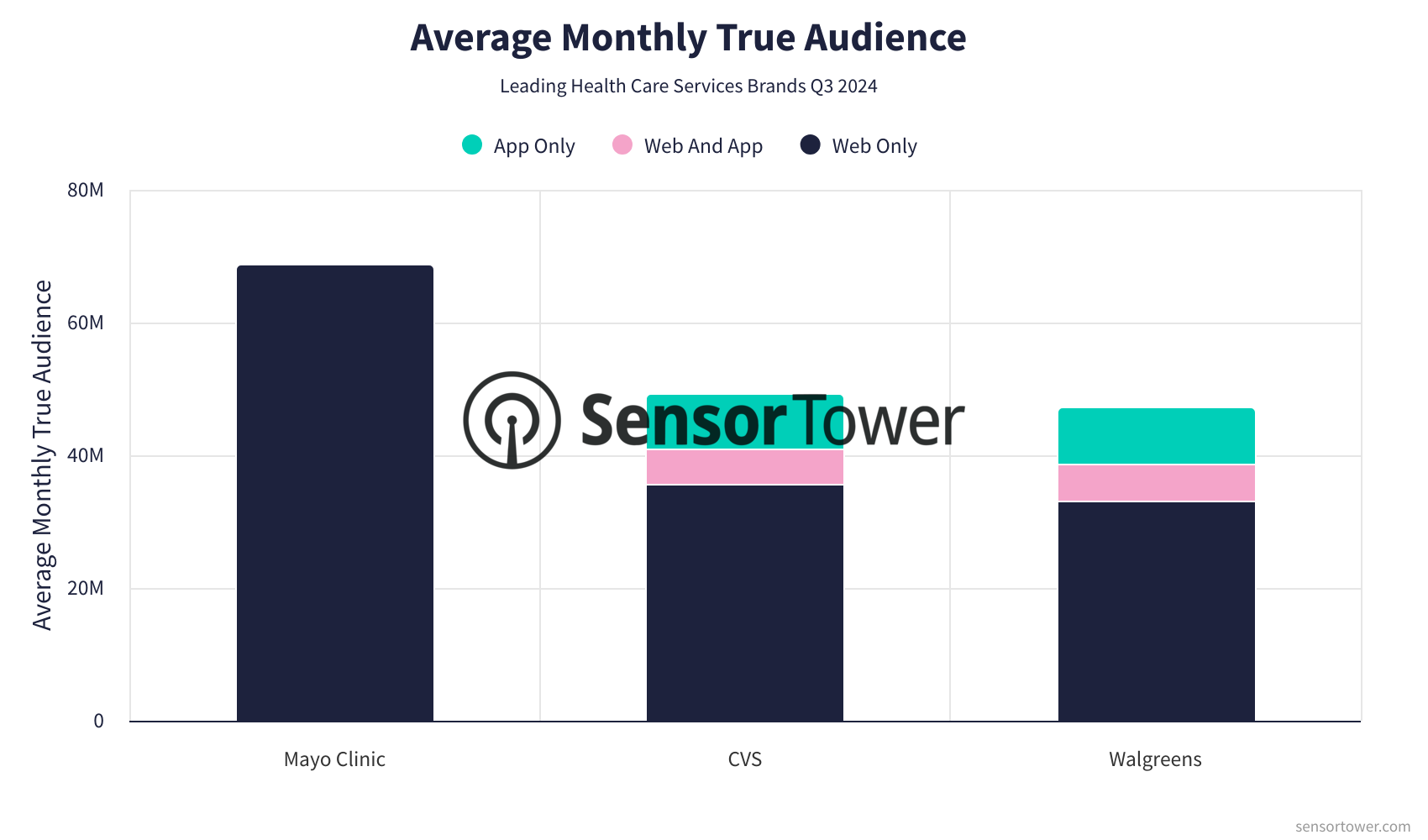

In the dynamic landscape of health care services, understanding audience engagement across platforms is essential. In Q3 2024, Mayo Clinic, CVS, and Walgreens stood out as leading brands in the United States, boasting significant monthly true audience numbers across their websites and apps. Here, we delve into their performance trends from Q2 to Q3 2024, highlighting key insights drawn from Sensor Tower's unparalleled data capabilities.

Mayo Clinic

Mayo Clinic's digital presence is robust, featuring multiple websites: mayo.edu, mayoclinic.org, and mayoclinichealthsystem.org, alongside the Mayo Clinic app.

mayo.edu saw fluctuating visits, with a peak of 5.9M in July before stabilizing around 5.1M in September.

mayoclinic.org consistently attracted a large audience, reaching 114.6M monthly visits in September.

mayoclinichealthsystem.org experienced steady growth, peaking at 2.6M monthly visits in September.

App Engagement: The Mayo Clinic app's monthly active users increased steadily, peaking at approximately 181K in August before a slight dip in September.

Ad Spend & Channels: Monthly advertising spend peaked in June at over $1.1M, with significant impressions across OTT and Facebook channels.

CVS

CVS's digital ecosystem is anchored by cvs.com and the CVS Health app.

cvs.com experienced a strong upward trend, reaching 158M monthly visits in September.

Monthly true audience numbers increased consistently, with over 30M in September.

App Engagement: The CVS Health app maintained robust engagement, with monthly active users peaking at approximately 11.4M in August.

Ad Spend & Channels: Monthly ad spend varied, with a notable increase to over $5.8M in September. Instagram and Facebook were key channels for impressions.

Walgreens

Walgreens' digital reach extends through walgreens.com and the Walgreens app.

walgreens.com saw a steady increase in monthly visits, culminating at 158M in September.

Monthly true audience numbers remained stable above 28M throughout Q3.

App Engagement: The Walgreens app kept a strong user base, with monthly active users fluctuating around 11M.

Ad Spend & Channels: Significant monthly ad spend was observed, with a peak of $8.5M in September. YouTube and Facebook were prominent channels for impressions.

Conclusion

Mayo Clinic, CVS, and Walgreens have demonstrated significant digital engagement across their platforms in Q3 2024. Sensor Tower's comprehensive data, encompassing web, app, and advertising insights, provides an unparalleled view into these brands' cross-platform performance. By leveraging Sensor Tower's Web Insights, Pathmatics, and App Performance Insights, businesses can gain critical insights into user behavior and market trends, empowering decision-makers with strategic advantages.