We’ve acquired Playliner!

AI Insights · Timothy · January 2025

Leading Brands in Australia’s Shopping Category: Q4 2024 Analysis

Explore how Kmart, Temu, and eBay excelled in Australia's shopping category in Q4 2024 through compelling website metrics, app usage data, and advertising insights, with Sensor Tower's analytics providing unique advantages for strategic decision-making.

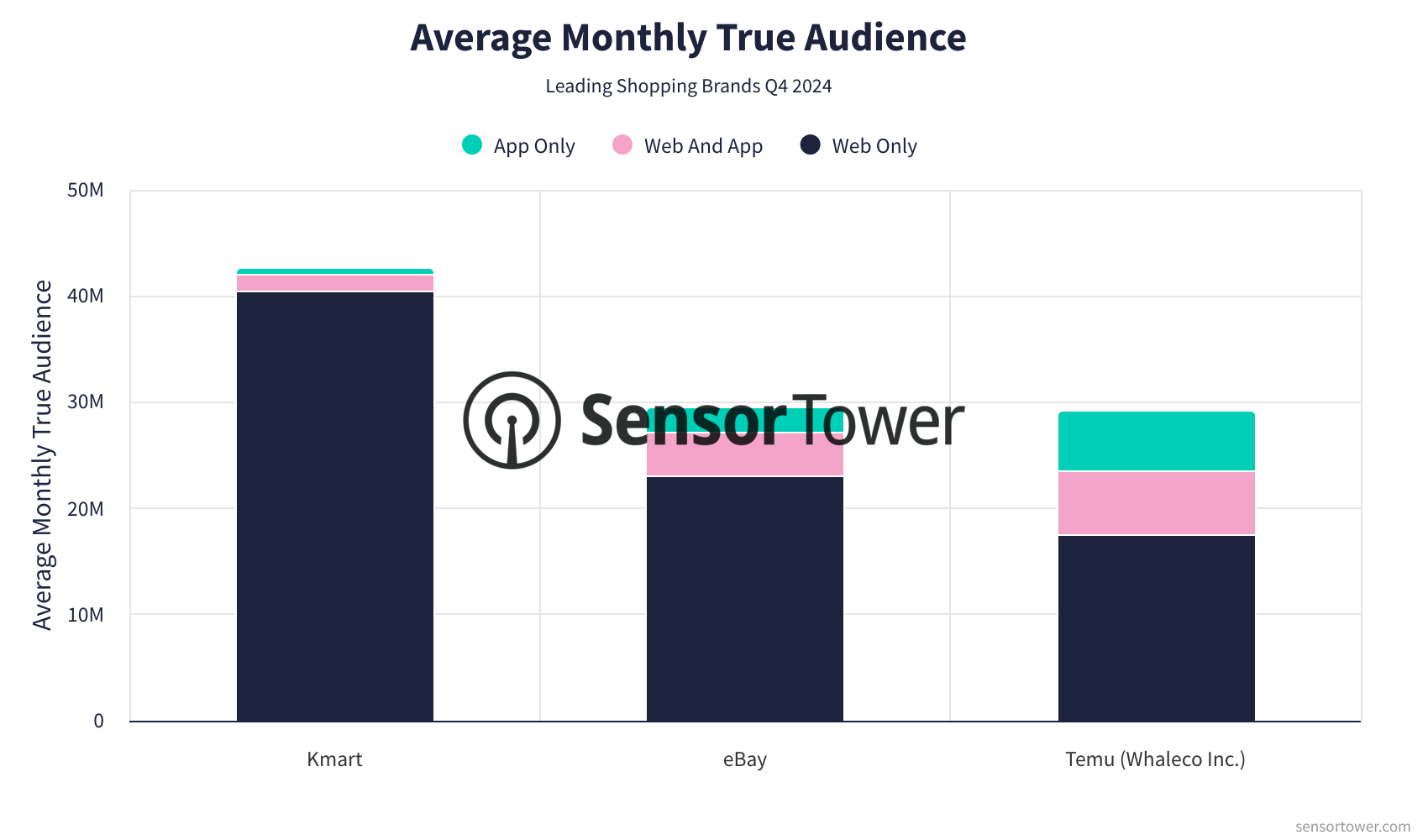

As the digital landscape continues to evolve, the shopping category in Australia has experienced significant shifts in consumer behavior and platform engagement. In Q4 2024, leading brands like Kmart, Temu (Whaleco Inc.), and eBay have maintained strong positions, driven by robust online and mobile strategies. Sensor Tower's comprehensive data provides unique insights into these brands' cross-platform performance, highlighting trends from Q3 to Q4 2024.

Kmart

Kmart's digital presence is anchored by its websites, kmart.com.au and kmartphotos.com.au, along with the Shop Kmart Low Prices For Life app.

Audience Trends: From Q3 to Q4, kmart.com.au saw a notable increase in visits, peaking in December with over 113M visits. Monthly unique visits remained stable, averaging above 8.5M. Kmartphotos.com.au also experienced growth, with visits doubling from 3.4M in September to over 7.1M in December.

App Engagement: The Kmart app's monthly active users grew steadily, reaching over 900K by December, reflecting a consistent upward trend in mobile engagement.

Ad Spend & Channels: Kmart's monthly advertising expenditure peaked in November at approximately $1.3M, with substantial impressions across desktop video and Facebook, indicating a strategic focus on visual platforms.

Temu (Whaleco Inc.)

Temu's digital ecosystem is centered around temu.com and the Temu: Shop Like a Billionaire app.

Audience Trends: Temu.com experienced fluctuating visits, with a peak in October at over 104M visits. The monthly true audience remained robust, consistently exceeding 9M throughout Q4.

App Engagement: The app maintained high monthly active user numbers, peaking at over 7M in October, highlighting strong mobile engagement.

Ad Spend & Channels: Temu's monthly ad spend was significant, with a peak in August at over $4.2M. Facebook and Instagram were primary channels, driving massive impressions above 1B.

eBay

eBay's platform includes ebay.com and the eBay app.

Audience Trends: eBay.com saw a decline in visits from Q3, with a recovery in December, reaching over 127M visits. The monthly true audience remained stable, averaging around 7.7M.

App Engagement: The app saw slight fluctuations in monthly active users, maintaining around 3.5M throughout Q4.

Ad Spend & Channels: eBay's ad strategy included diverse channels, with TikTok and YouTube seeing increased activity. December's monthly spend exceeded $900K, with impressions peaking over 150M.

Conclusion

The Q4 2024 data reveals distinct strategies and performance trends among Australia's leading shopping brands. Kmart, Temu, and eBay have leveraged both web and app platforms effectively, with Sensor Tower's data providing critical insights into their cross-platform dynamics. As these brands continue to innovate, understanding user behavior across digital touchpoints remains essential.

Sensor Tower's unparalleled data capabilities, including Web Insights, App Performance Insights, and Pathmatics, are crucial for brands looking to navigate the ever-evolving digital marketplace. This comprehensive view empowers decision-makers with the clarity needed to drive strategic growth and innovation.