State of AI Apps Report 2025 is Live!

AI Insights · Timothy · January 2025

Leading Brands in Canada's Dating & Social Discovery Category: Q4 2024 Analysis

An insightful analysis of the top Canadian dating brands in Q4 2024, focusing on web metrics, app engagement, and advertising strategies, supported by Sensor Tower's comprehensive data.

Introduction

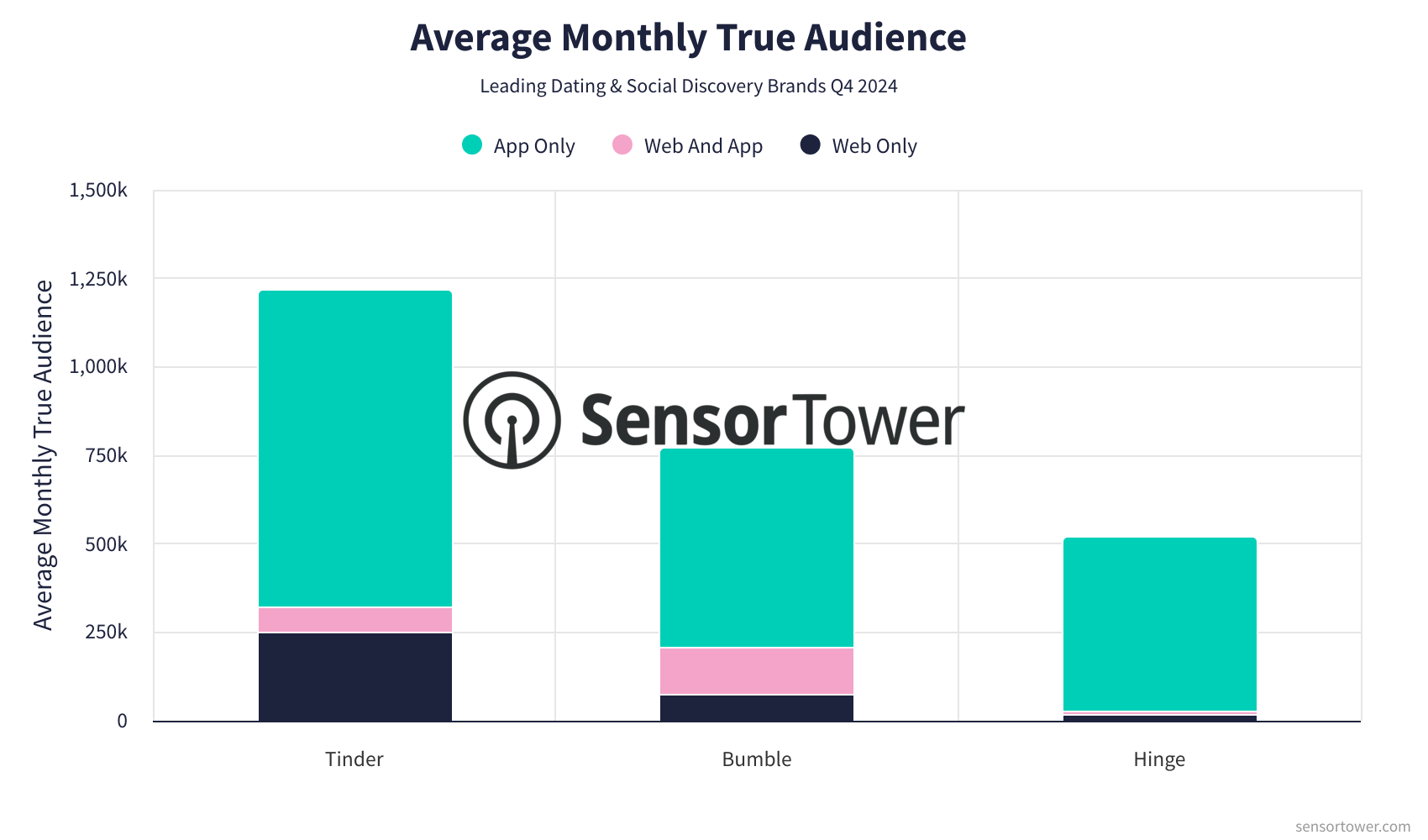

In the ever-evolving landscape of dating and social discovery, Canada has witnessed significant trends in Q4 2024. At the forefront are prominent brands like Tinder, Bumble, and Hinge, each showcasing unique growth and engagement patterns. Leveraging Sensor Tower's comprehensive data insights, including Web Insights, Pathmatics, and App Performance Insights, we delve into these brands' performances across web and app platforms.

Tinder

Tinder's digital ecosystem, featuring tinder.com and the Tinder Dating App: Date & Chat, continues to dominate the market.

Audience Trends: Throughout Q4 2024, tinder.com experienced a notable increase in visits, peaking at approximately 6.9M in December. Monthly unique visits, however, remained below 120K. The monthly true audience hovered around 1M in October and November, slightly dipping by December.

App Engagement: The app maintained a steady monthly active user base, starting at about 958K in October, gradually decreasing to around 868K by December.

Ad Spend & Channels: Tinder's monthly advertising investment saw a sharp decline from over $800K in October to under $10K by December, primarily using channels like Instagram, TikTok, and YouTube for impressions exceeding 54M.

Bumble

Bumble's presence, through bumble.com and the Bumble Dating App: Meet & Date, shows dynamic trends.

Audience Trends: Bumble.com witnessed an impressive rise in visits, reaching close to 6.5M by December. Monthly true audience numbers remained consistent, slightly above 650K in October and November, with a small dip in December.

App Engagement: Monthly app users began at about 631K in October, experiencing a gradual decline to approximately 571K by December.

Ad Spend & Channels: Bumble's monthly ad expenditure remained robust, investing over $340K in October, with consistent impressions across Facebook, Instagram, and TikTok.

Hinge

Hinge's digital strategy incorporates hinge.co and the Hinge Dating App: Match & Meet.

Audience Trends: The website's traffic was relatively stable, with visits around 150K throughout Q4. Monthly true audience figures showcased a steady climb, surpassing 500K by December.

App Engagement: The app saw a consistent increase in monthly active users, starting at 486K in October and reaching 504K by December.

Ad Spend & Channels: Hinge's monthly ad spend varied, peaking in December at over $280K, with TikTok and Instagram delivering substantial impressions exceeding 34M.

Conclusion

Q4 2024 has been a dynamic period for Canada's dating and social discovery sector, with Tinder, Bumble, and Hinge leading the charge. Each brand demonstrates unique strategies and growth patterns, underscoring the importance of cross-platform insights. Sensor Tower's unparalleled data offerings enable a comprehensive understanding of these trends, providing critical insights into user behavior across web and app ecosystems. By leveraging these insights, decision-makers can strategically navigate the competitive landscape with precision and confidence.