2026 State of Mobile is Live!

AI Insights · Timothy · January 2025

Leading Brands in UK Beauty Retail: Q4 2024 Performance Overview

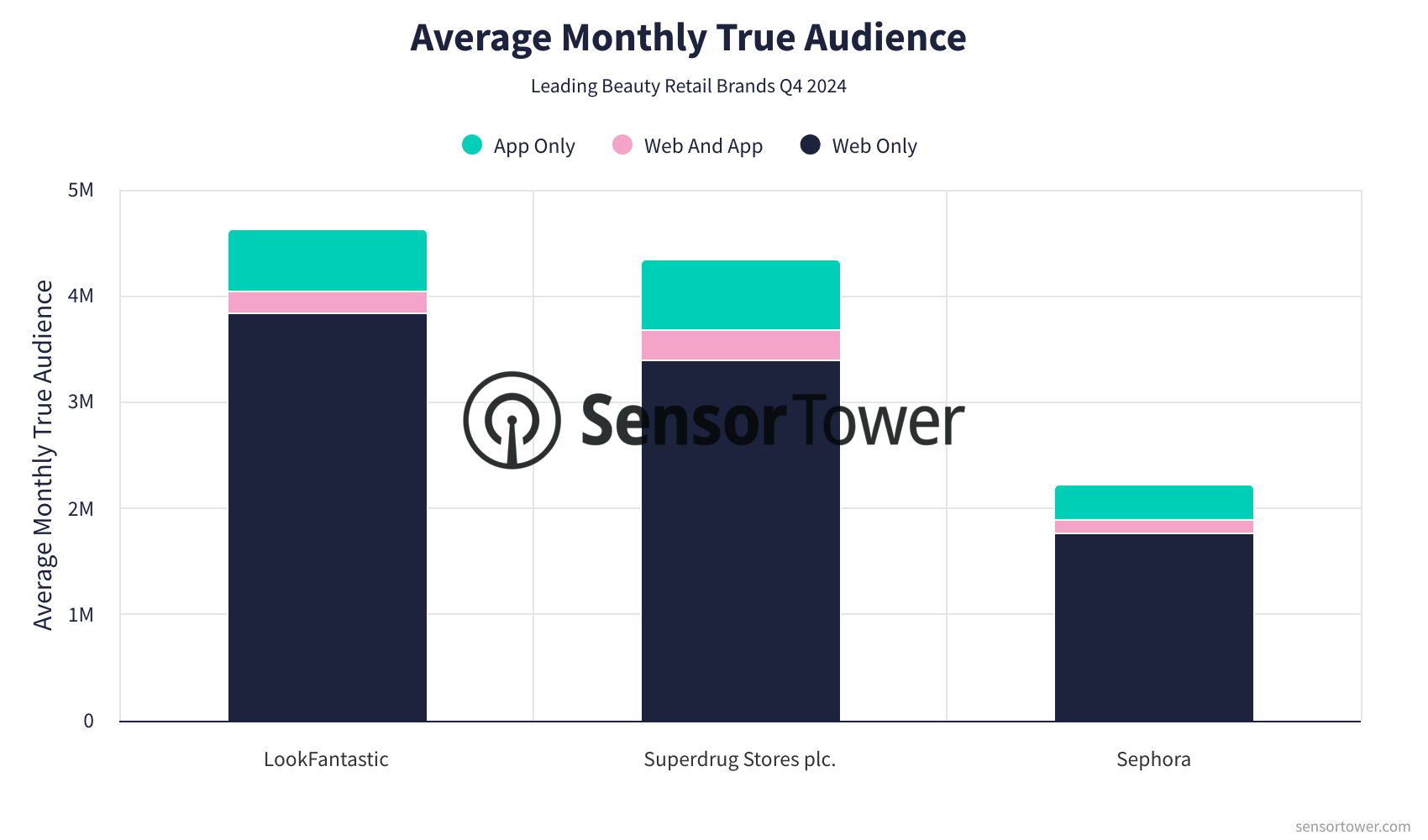

Explore the Q4 2024 digital performance of LookFantastic, Superdrug, and Sephora in the UK beauty retail sector, focusing on audience metrics, app engagement, and advertising strategies.

Introduction

In the fast-paced world of beauty retail, understanding digital performance is crucial for staying ahead. This article delves into the Q3 to Q4 2024 data of three leading beauty retail brands in the UK: LookFantastic, Superdrug Stores plc., and Sephora. Utilizing Sensor Tower's comprehensive datasets, we analyze their websites and apps to provide insights into monthly audience trends, app engagement, and advertising strategies.

LookFantastic

LookFantastic's digital presence is anchored by its website, lookfantastic.com, and the LOOKFANTASTIC: Beauty & Makeup app.

Audience Trends: LookFantastic saw a notable increase in its monthly true audience, rising from around 3.8M in October to over 5.2M by December. The website consistently attracted more visitors than the app, with web-only visitors surpassing 4.4M in December.

App Engagement: The app's monthly active users grew steadily, starting at approximately 690K in July and reaching over 850K by December, indicating strong mobile engagement.

Ad Spend & Channels: LookFantastic's monthly advertising spend peaked in November at over $2.6M, with major investments in Facebook and Instagram, which collectively garnered significant impressions.

Superdrug Stores plc.

Superdrug's online reach is showcased through its website, superdrug.com, and the Superdrug - Beauty and Health app.

Audience Trends: The monthly true audience numbers for Superdrug experienced growth, particularly in December, reaching approximately 4.7M. The website maintained a robust lead in visits compared to the app.

App Engagement: The app's monthly active user base expanded from around 750K in July to over 1M by December, reflecting increased user engagement.

Ad Spend & Channels: Superdrug's monthly advertising spend was highest in December, exceeding $1.3M, with Facebook and Instagram being the primary channels for ad impressions.

Sephora

Sephora's digital strategy includes its website, sephora.com, and the Sephora app.

Audience Trends: Sephora experienced a significant spike in web visits, particularly in December, with visits surpassing 19M. The monthly true audience remained strong at nearly 2.4M in December.

App Engagement: The app's monthly active users were stable, hovering around 470K in December, suggesting consistent mobile engagement.

Ad Spend & Channels: Sephora's monthly ad spend reached its peak in December at over $1.5M, with a diversified channel approach including TikTok and YouTube, which provided substantial impressions.

Conclusion

The digital landscape in the beauty retail sector is vibrant and competitive. LookFantastic, Superdrug, and Sephora have demonstrated strong online presences through strategic use of websites, apps, and advertising. Sensor Tower's data highlights these brands' ability to adapt and thrive in a dynamic market, offering unparalleled insights into cross-platform user behavior. For more detailed insights, explore Sensor Tower's Web Insights, App Performance Insights, and Pathmatics offerings. Sensor Tower's consolidated data offers unique advantages for decision-makers, enabling them to make informed strategic choices in a competitive landscape.

By leveraging these insights, brands can better position themselves in the evolving beauty retail market, ensuring sustained growth and engagement.