Predictions for the Digital Economy in 2026 Report is Live!

AI Insights · Timothy · April 2025

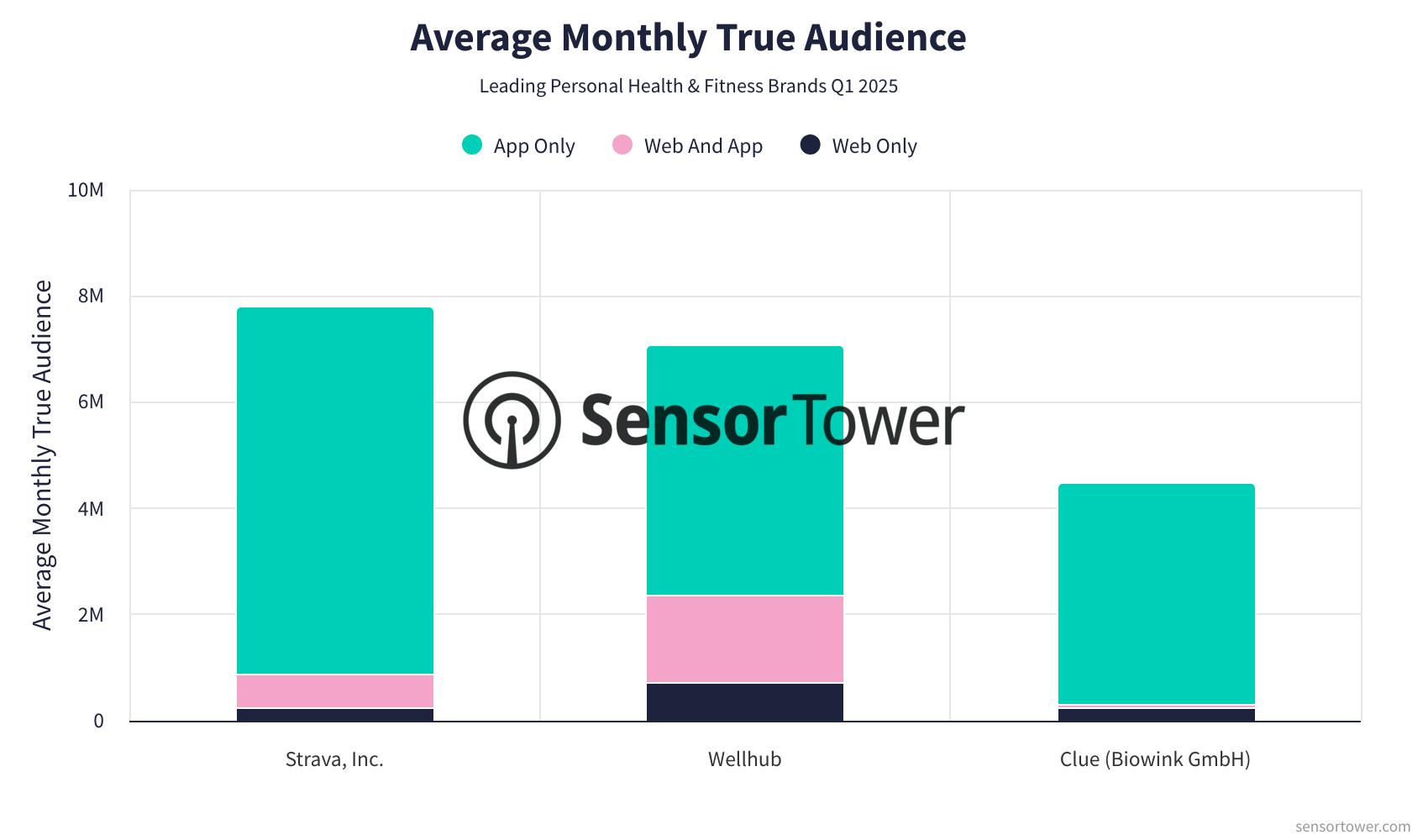

Leading Personal Health & Fitness Brands in Brazil: Q1 2025 Insights

An in-depth analysis of top personal health and fitness brands in Brazil for Q1 2025, focusing on website metrics, app usage, and advertising strategies, highlighting their strategic impact and growth.

Introduction

As the personal health and fitness industry flourishes in Brazil, Q1 2025 has unveiled significant trends among leading brands. Sensor Tower's comprehensive data analysis provides a detailed view of top performers such as Wellhub, Strava, Inc., and Clue (Biowink GmbH). This article explores their digital presence, emphasizing unique audience behaviors across websites and apps.

Wellhub

Wellhub's expansive digital ecosystem, including wellhub.com and the Wellhub (Gympass) app, underscores its robust market presence.

Audience Trends: From Q4 2024 to Q1 2025, wellhub.com saw a notable rise in visits, peaking at 29M in January before stabilizing around 23M in March. The monthly true audience consistently exceeded 6M, with a balanced mix of web and app users.

App Engagement: The app maintained a strong monthly active user base, growing from 5.4M in October to approximately 6.4M by March, indicating consistent user engagement.

Ad Spend & Channels: Wellhub's advertising spend decreased from $94K in November to around $31K in March, primarily utilizing Facebook and Instagram for impressions.

Strava, Inc.

Strava's online presence, through strava.com and the Strava: Run, Bike, Hike app, continues to captivate a diverse audience.

Audience Trends: Website visits rose steadily, reaching 14M in March. The monthly true audience consistently surpassed 6M, with a dominant app user base.

App Engagement: The app's monthly active user base grew from 5.8M in October to approximately 7.4M in March, reflecting its popularity among fitness enthusiasts.

Ad Spend & Channels: Strava's ad spend remained minimal, focusing solely on Instagram, with impressions peaking at over 200K in December.

Clue (Biowink GmbH)

Clue's digital footprint, featuring helloclue.com and the Clue Period & Cycle Tracker app, exhibits a steady engagement pattern.

Audience Trends: Website visits fluctuated, with a high of 2.7M in January. The monthly true audience remained stable, exceeding 4M throughout the quarter, primarily driven by app users.

App Engagement: The app's monthly active users increased from 3.8M in October to approximately 4.4M in March, highlighting its expanding user base.

Ad Spend & Channels: Clue's ad spend was modest, with a noticeable increase in March, focusing on TikTok, which generated significant impressions.

Conclusion

The Q1 2025 landscape for personal health and fitness brands in Brazil underscores the critical importance of a strong digital presence across platforms. Sensor Tower's unparalleled data insights offer a comprehensive view into these trends, providing essential information for understanding cross-platform user behavior. As these brands continue to innovate, their ability to engage users across web and mobile platforms remains a key driver of success. Sensor Tower's consolidated data insights empower decision-makers with the tools to navigate this dynamic market effectively.