Predictions for the Digital Economy in 2026 Report is Live!

AI Insights · Timothy · April 2025

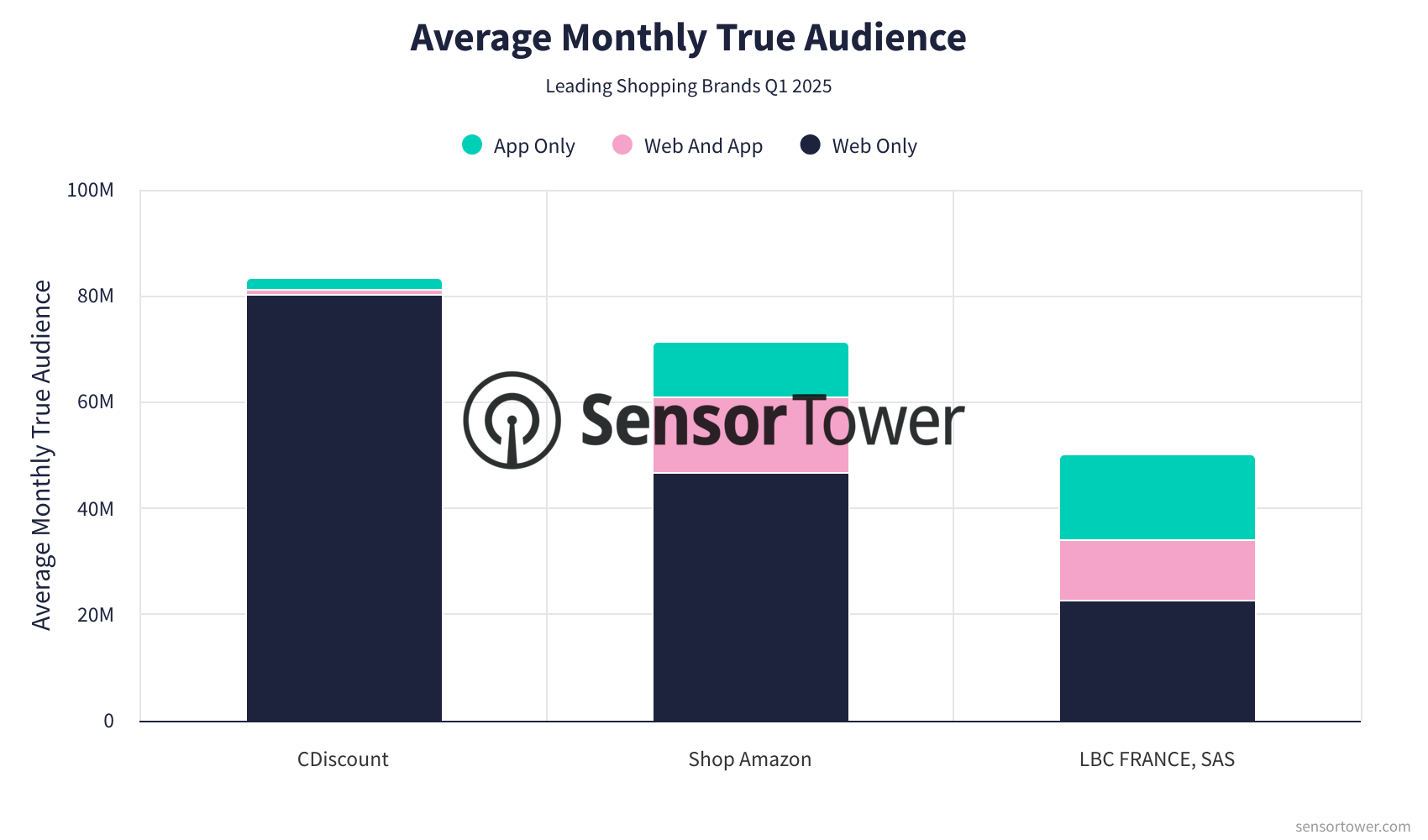

Leading Shopping Brands in France: Q1 2025 Performance Overview

Explore the performance of top shopping brands in France, focusing on website metrics, app usage, and advertising strategies, using Sensor Tower's comprehensive data.

Introduction

In the dynamic landscape of France's shopping category, several brands have emerged as leaders by leveraging their websites and apps to capture a significant audience. This article delves into the performance of CDiscount, Shop Amazon, and LBC FRANCE, SAS from Q4 2024 to Q1 2025. Utilizing comprehensive data from Sensor Tower, we explore audience trends, app engagement, and advertising strategies across platforms.

CDiscount

CDiscount’s digital ecosystem includes cdiscount.com and the Cdiscount app.

Audience Trends: Throughout the period, cdiscount.com maintained a robust presence with unique monthly visits peaking at over 36M in November. Monthly true audience figures remained stable, fluctuating around 27M to 31M between January and March. Notably, the platform saw a consistent web dominance, with web-only visitors significantly outnumbering app-only visitors.

App Engagement: The Cdiscount app experienced varied monthly active users, with numbers hovering around 2.3M to 2.5M in Q1 2025, indicating a stable mobile user base.

Ad Spend & Channels: Monthly advertising efforts saw a decline from approximately $1.9M in October to around $0.7M in March. Facebook and Instagram were the primary channels, with Facebook consistently delivering the highest impressions.

Shop Amazon

Amazon’s reach extends through amazon.com and the Amazon Shopping app.

Audience Trends: Amazon's website attracted a substantial audience, with unique monthly visits remaining above 22M. Monthly true audience figures were consistently above 30M, with a balanced split between web and app users.

App Engagement: The Amazon Shopping app maintained a strong user base, with monthly active users consistently above 20M throughout the observed period.

Ad Spend & Channels: Amazon’s monthly ad spend peaked in November at over $5.5M, with significant investments in Facebook and YouTube, resulting in extensive impressions across these platforms.

LBC FRANCE, SAS

LBC FRANCE, SAS operates leboncoin.fr and the leboncoin app.

Audience Trends: Leboncoin.fr experienced steady traffic, with unique monthly visits consistently around 11M to 12M. Monthly true audience figures were stable, maintaining levels above 27M.

App Engagement: The leboncoin app showed stable engagement with monthly active users ranging from 19M to 20M.

Ad Spend & Channels: Monthly ad spend decreased from around $480K in October to approximately $420K in March, with Facebook being the dominant channel for impressions.

Conclusion

These leading brands demonstrate diverse strategies in engaging audiences across web and mobile platforms. Sensor Tower's unique cross-referencing capabilities provide invaluable insights into these trends, highlighting the balance between web and app presence and the strategic use of advertising channels. As the digital shopping landscape evolves, these insights remain crucial for understanding market dynamics.

For more detailed data, explore Sensor Tower’s Web Insights, App Performance Insights, and Pathmatics.