Predictions for the Digital Economy in 2026 Report is Live!

AI Insights · Timothy · March 2025

Leading Brands in Japan's Transportation Category: Q1 2025 Analysis

Explore the digital performance of top transportation brands in Japan for Q1 2025, with insights into website metrics, app usage, and advertising strategies.

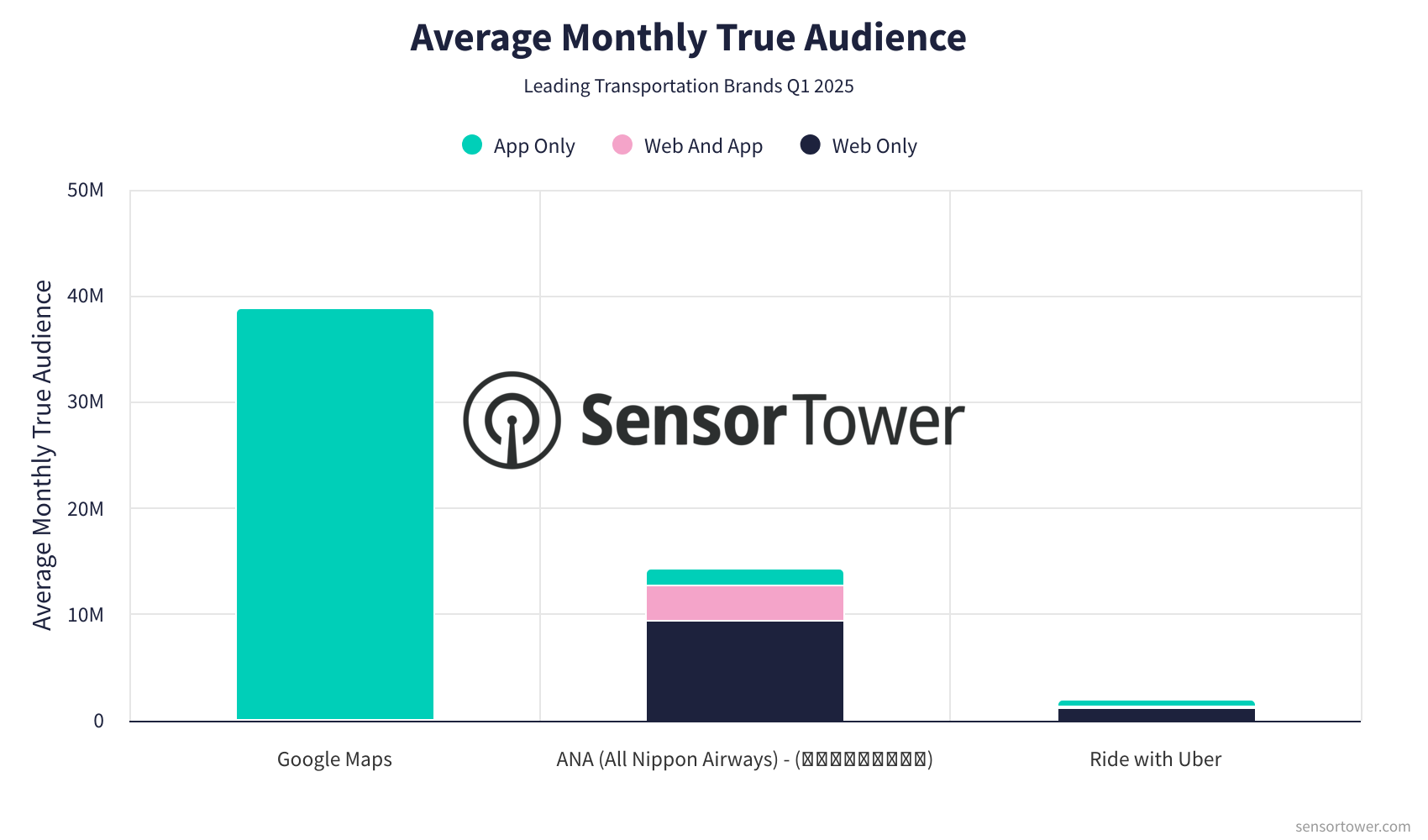

In the ever-evolving transportation landscape of Japan, several leading brands have maintained a strong digital presence in Q1 2025. Our analysis focuses on Google Maps, ANA (All Nippon Airways), and Ride with Uber. By leveraging Sensor Tower's comprehensive data, we offer insights into these brands' performance across websites and apps from Q4 2024 to Q1 2025.

Google Maps

Google Maps continues to dominate the transportation category with its extensive reach through both web and app platforms.

Audience Trends: The website, maps.google.com, experienced fluctuations in visitor numbers, peaking at approximately 1.3M visits in November 2024 before stabilizing around 860K visits by March 2025. Monthly true audience figures were consistently high, remaining above 57M throughout the quarter.

App Engagement: The Google Maps app showed robust monthly active user numbers, starting at 57M in October 2024 and rising to nearly 59M by March 2025. This indicates a strong preference for mobile usage.

Ad Spend & Channels: Interestingly, Google Maps did not allocate spending towards advertising in the transportation category during this period, highlighting its organic reach and user reliance.

ANA (All Nippon Airways)

ANA has shown dynamic growth across its digital platforms, reflecting its strategic emphasis on both web and app engagements.

Audience Trends: The ANA website, ana.co.jp, saw significant visitor traffic with visits exceeding 53M in March 2025. The monthly true audience surpassed 5M, indicating a balance between web-only and app-only visitors.

App Engagement: The ANA app recorded a steady increase in monthly active users, reaching over 2.5M by March 2025, suggesting growing user engagement with mobile services.

Ad Spend & Channels: ANA's advertising strategy was diversified, with significant investments across platforms like Facebook, Instagram, and YouTube. Monthly ad spend peaked at around $585K in November 2024, with impressions exceeding 110M.

Ride with Uber

Uber's presence in Japan's transportation sector is marked by its strategic use of digital platforms to enhance user engagement.

Audience Trends: Uber.com saw a remarkable increase in visits, reaching over 3M by March 2025. Monthly true audience figures showed a noticeable climb, surpassing 990K in the same period.

App Engagement: The Uber - Request a ride app maintained a healthy user base, with monthly active users rising to approximately 660K in March 2025.

Ad Spend & Channels: Uber's advertising efforts were robust, with monthly ad spend reaching around $385K in March 2025. Platforms like TikTok and YouTube played key roles in driving impressions, which topped 86M in December 2024.

Conclusion

These insights, powered by Sensor Tower's unparalleled data capabilities, highlight the diverse strategies employed by leading transportation brands in Japan. By cross-referencing web, app, and advertising data, Sensor Tower provides an invaluable resource for understanding cross-platform user behavior, essential for navigating today’s digital landscape. For further insights, explore our Sensor Tower products and services.