Predictions for the Digital Economy in 2026 Report is Live!

AI Insights · Timothy · April 2025

Leading Brands in the US Cruises & Cruise Services Category: Q1 2025 Insights

Explore the digital performance of Carnival Cruise Line, Royal Caribbean, and Norwegian Cruise Line in Q1 2025. Discover key metrics on audience engagement, app usage, and advertising strategies that highlight their leadership in the Cruises & Cruise Services category.

In the dynamic landscape of Cruises & Cruise Services, several brands have emerged as frontrunners in the United States. This article delves into the performance and trends of Carnival Cruise Line, Royal Caribbean, and Norwegian Cruise Line from Q4 2024 to Q1 2025. Sensor Tower's comprehensive data provides detailed insights into these brands' digital presence, audience engagement, and advertising strategies.

Carnival Cruise Line

Carnival Cruise Line is renowned for its fun-filled voyages and extensive fleet. Its digital landscape is anchored by its website, carnival.com, and the Carnival HUB app.

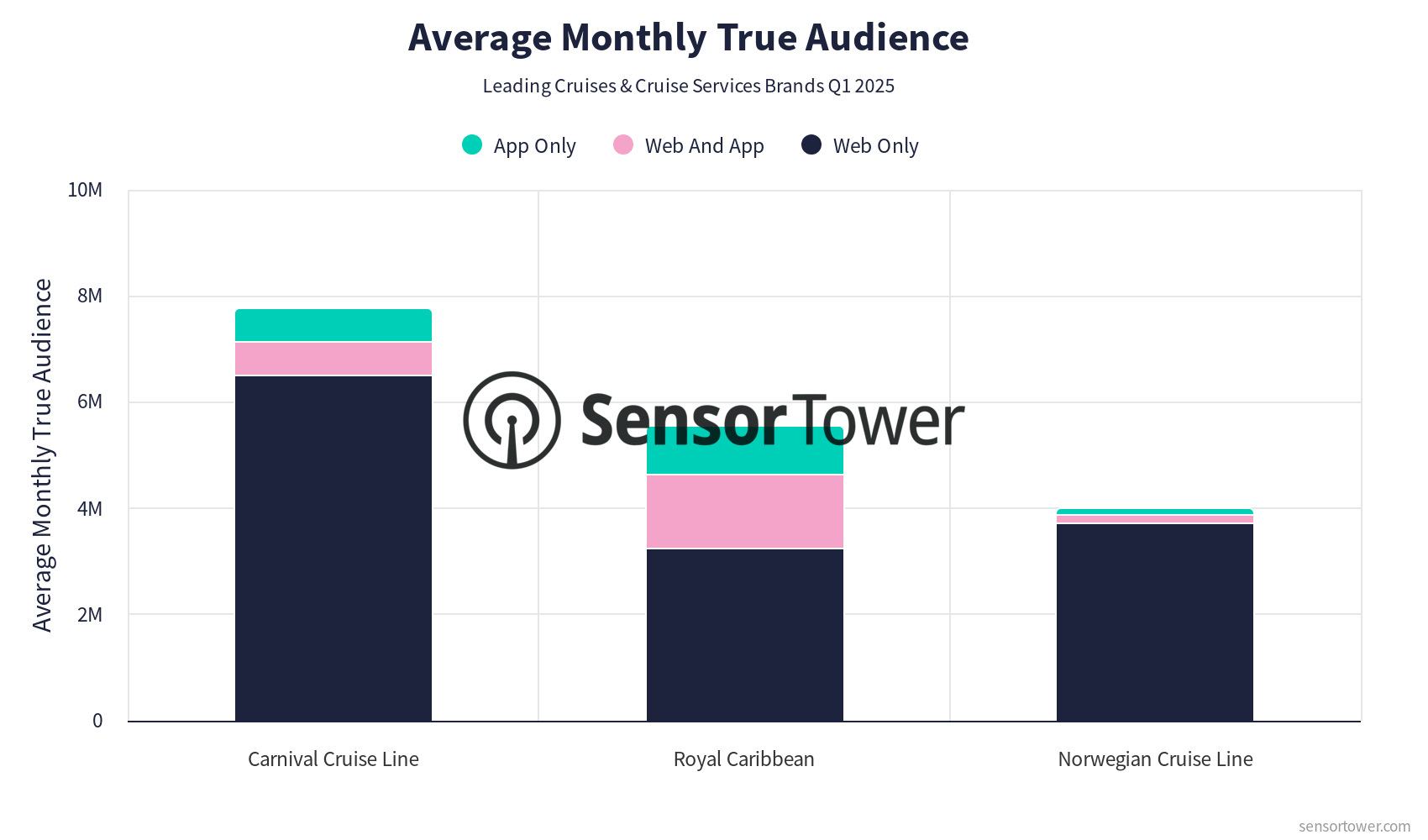

Audience Trends: The website experienced significant fluctuations, peaking at over 61M visits in December, before stabilizing around 48M in March. The monthly true audience consistently remained above 3.5M, with web-only visitors dominating over app-only visitors.

App Engagement: The Carnival HUB app saw a notable rise in monthly active users, starting at 586K in October and surpassing 1.1M by March, indicating increasing mobile engagement.

Ad Spend & Channels: Carnival's monthly advertising efforts peaked in December with a spend of over $3.5M, primarily across OTT and Facebook channels, delivering substantial impressions.

Royal Caribbean

Royal Caribbean is known for its innovative ships and immersive experiences. Its online presence includes royalcaribbean.com and the Royal Caribbean International app.

Audience Trends: The website maintained robust monthly visits, consistently over 24M. The true audience exceeded 2.5M, with a balanced distribution between web and app visitors.

App Engagement: The app's monthly active users steadily increased from 1.3M in October to over 1.6M in March, reflecting a growing preference for mobile interaction.

Ad Spend & Channels: Royal Caribbean's monthly ad spend peaked in January at over $4.7M, with OTT being the dominant channel, providing extensive reach and impressions.

Norwegian Cruise Line

Norwegian Cruise Line is celebrated for its flexible cruising options and premium offerings. Its digital channels include ncl.com and the Cruise Norwegian - NCL app.

Audience Trends: The website visits grew steadily, reaching over 18M by March. The monthly true audience remained above 1.8M, with a strong web presence compared to app engagement.

App Engagement: The app saw a decline in monthly active users, starting at 441K in October and dropping to around 112K by March, suggesting a shift in user preference towards the web.

Ad Spend & Channels: Norwegian's monthly ad expenditure was highest in March, exceeding $4.6M, with desktop video and OTT channels generating significant impressions.

Conclusion

Sensor Tower's unparalleled data insights reveal that Carnival Cruise Line, Royal Caribbean, and Norwegian Cruise Line have demonstrated varied strategies and successes across their digital platforms. With detailed cross-referencing of web, app, and advertising data, Sensor Tower provides critical insights into the evolving Cruise Services landscape, enabling brands to fine-tune their digital strategies for enhanced engagement and growth.

For more detailed analytics, visit Sensor Tower's Web Insights, App Performance Insights, and Pathmatics.