2026 State of Mobile is Live!

Digital Advertising Insights · Rui Ma · December 2025

2025 Holiday Shopping Season: How eCommerce Apps & Brands Capture Growth

This report covers recent trends in eCommerce app downloads, changes across global and APAC markets, rankings of leading e-commerce apps and the digital advertising performance of major global platforms.

The surge in online consumption during the pandemic laid a solid foundation for the long-term growth of eCommerce apps. Emerging markets have become the primary sources of incremental demand, while innovations such as AI-driven recommendations, short form video content, social commerce and instant delivery are propelling global mobile commerce into a new competitive era.

This report examines recent trends in eCommerce app downloads, changes in global and APAC download volumes, rankings of leading e-commerce apps and the digital advertising performance of major global platforms. It also features case studies highlighting the market performance and winning strategies of top shopping platforms such as Temu, regional leaders like Blinkit and Naver Plus Store.

Note: Sensor Tower's downloads figures are derived from estimated downloads on the App Store and Google Play, excluding pre-installs, duplicate downloads and downloads from third-party Android app-store. Google Play is not available in Mainland China.

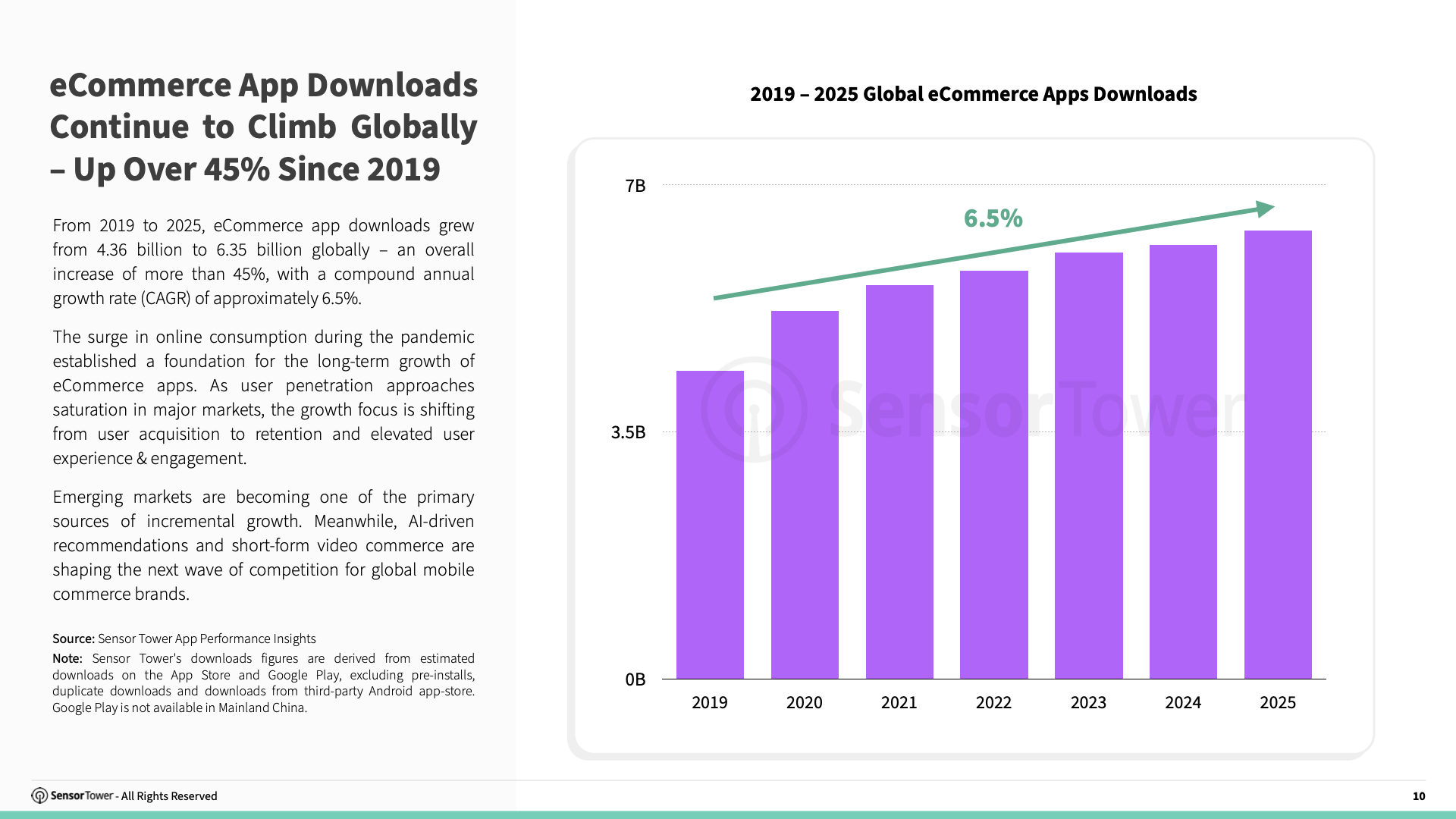

Global eCommerce app downloads grew at a CAGR of 6.5% from 2019 to 2025

From 2019 to 2025, annual global eCommerce app downloads rose from 4.36 billion to 6.35 billion, an increase of more than 45%, representing a compound annual growth rate (CAGR) of approximately 6.5%.

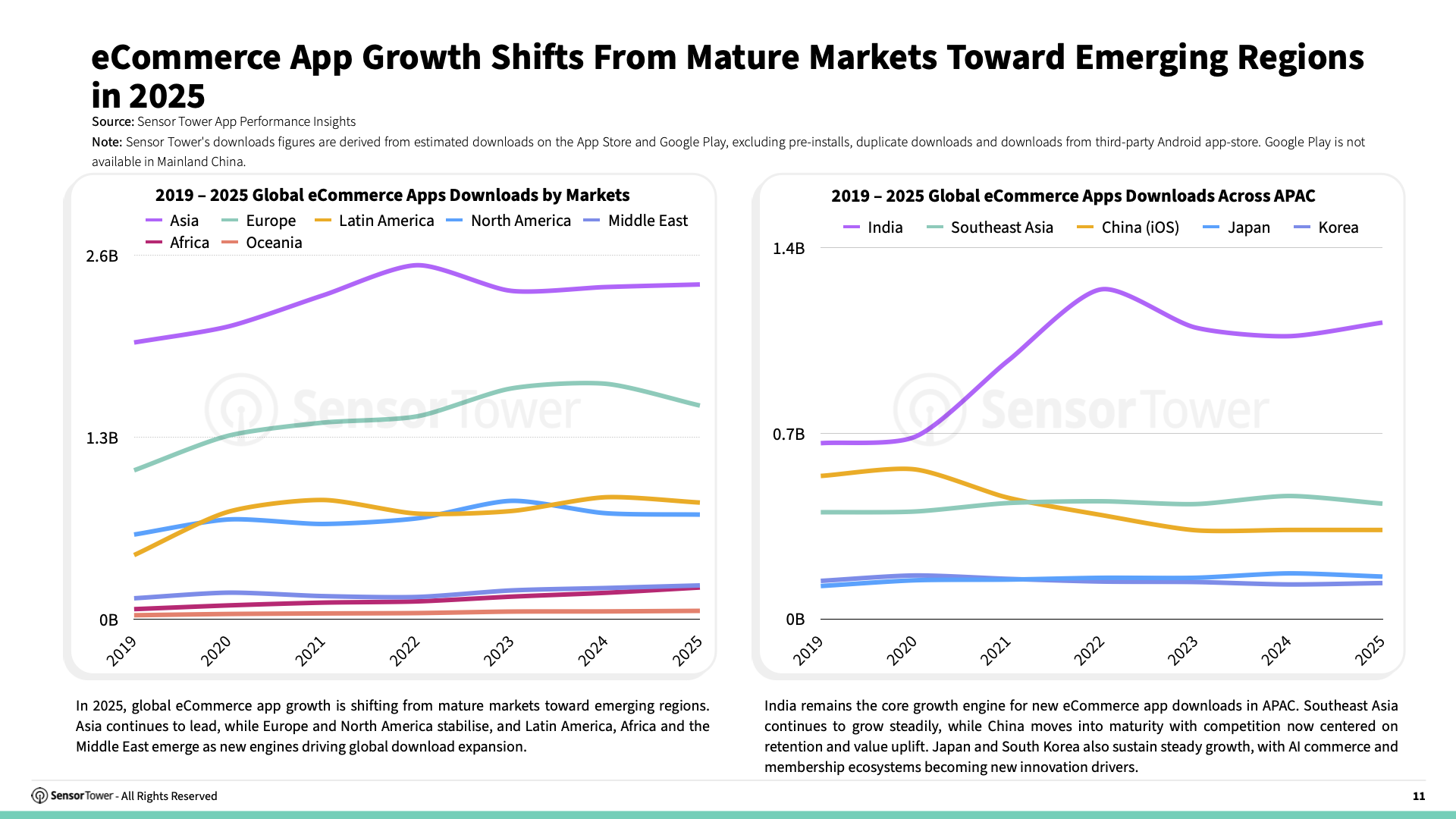

In 2025, the center of growth in global eCommerce apps is shifting from mature markets to emerging regions. Asia continues to lead, while Europe and North America have stabilised. Meanwhile, Latin America, Africa and the Middle East have become new engines driving global download growth.

In the APAC region, India remains the frontrunner, serving as the primary driver of incremental downloads. Southeast Asia continues to show steady growth, while China’s market has entered a mature phase, with competition increasingly focused on user retention and enhancing service value. In Japan and South Korea, growth remains stable, with AI-driven commerce and membership ecosystems emerging as key areas of innovation.

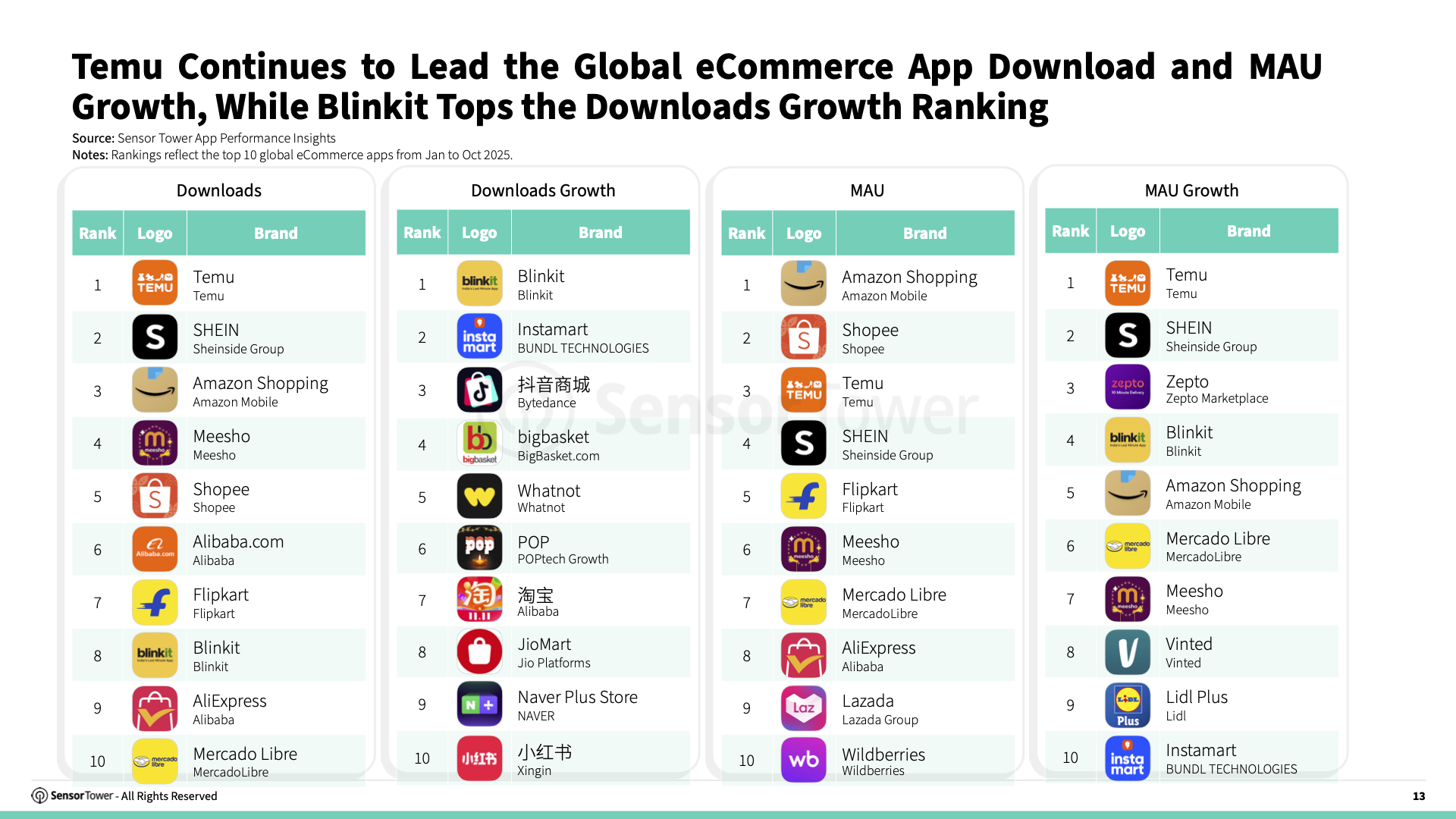

Temu Retains the Global Lead in Both Download and MAU Growth Rankings, While Blinkit Tops the Download Growth Chart

Temu continues to dominate the global eCommerce landscape, once again securing the #1 position in both global downloads and monthly active user (MAU) growth. Its strong momentum across multiple regions – particularly Latin America, Africa and the Middle East – has fueled sustained expansion, boosting both user acquisition and engagement. This reinforces Temu’s position as a leading global cross-border eCommerce platform.

At the same time, India’s instant commerce platform Blinkit has surged to the top of the 2025 global eCommerce download growth rankings, powered by its “10-minute delivery” model and deep integration with local lifestyle services. Blinkit’s rapid rise highlights its emergence as one of the fastest-growing forces in regional commerce. Together, Temu and Blinkit showcase the increasingly diversified dynamics of global consumer behavior.

In China’s iOS market, Douyin Mall delivered an outstanding performance, ranking #1 in both downloads and download growth among eCommerce apps. Through the seamless integration of short-form video content and immersive shopping scenarios, the platform has attracted a massive influx of new users while driving sustained engagement among existing ones. Its powerful recommendation algorithms and personalised shopping experience have enabled Douyin Mall to stand out in China’s highly competitive eCommerce landscape, making it a critical channel for brand discovery and user conversion.

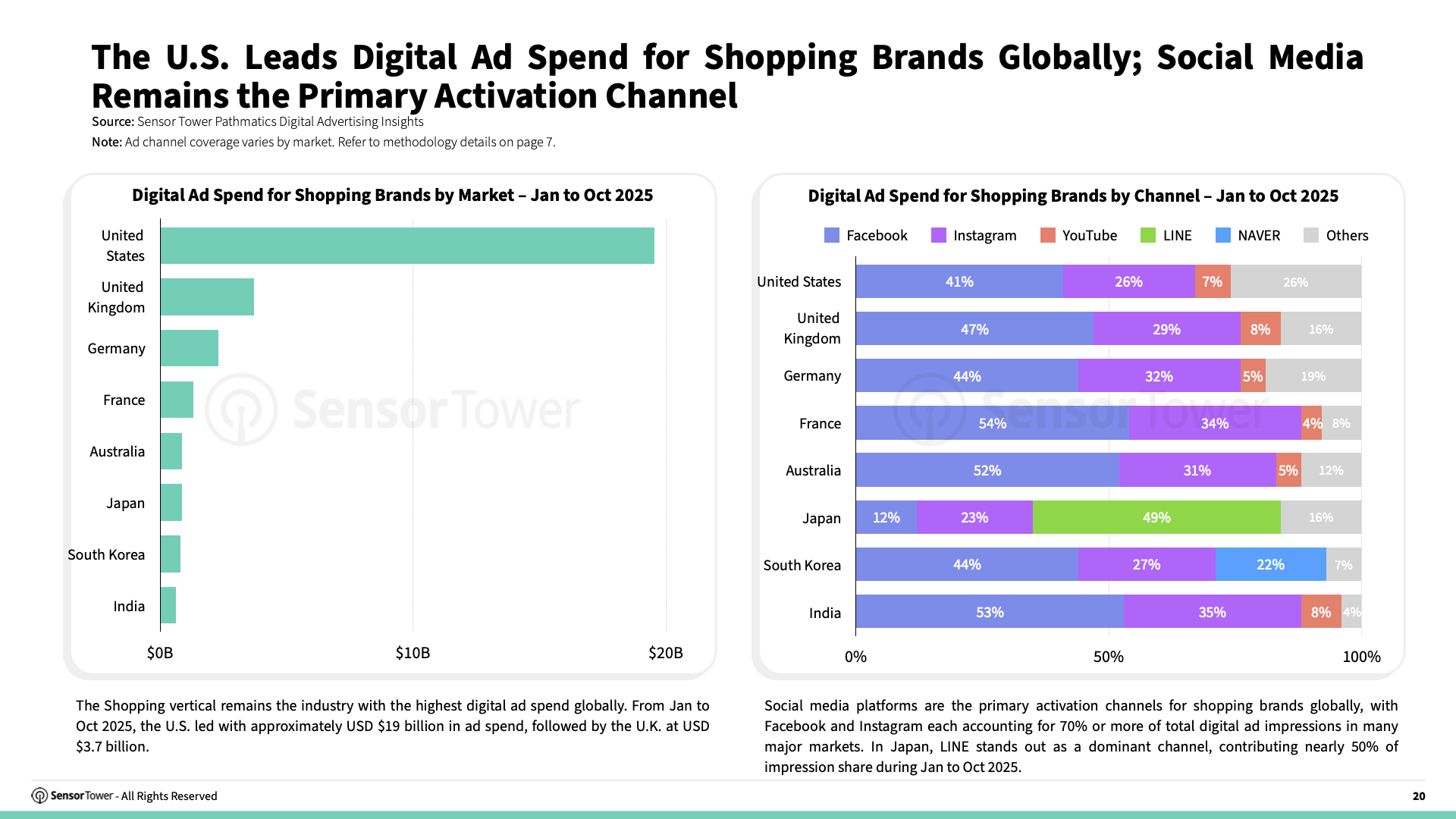

Social Media Is the Primary Digital Advertising Channel for the Global Shopping Industry

Across global markets, online shopping has become the largest category for digital advertising spend. From Jan to Oct 2025, the U.S. led all markets with USD 19 billion in shopping-related ad spend, followed by the U.K. at USD 3.7 billion.

Social media platforms remain the dominant channel for shopping brands worldwide. Facebook and Instagram together account for more than 70% of total ad impressions across major markets. In Japan, however, LINE leads the digital advertising landscape, contributing nearly 50% of total ad impressions from Jan to Oct 2025.

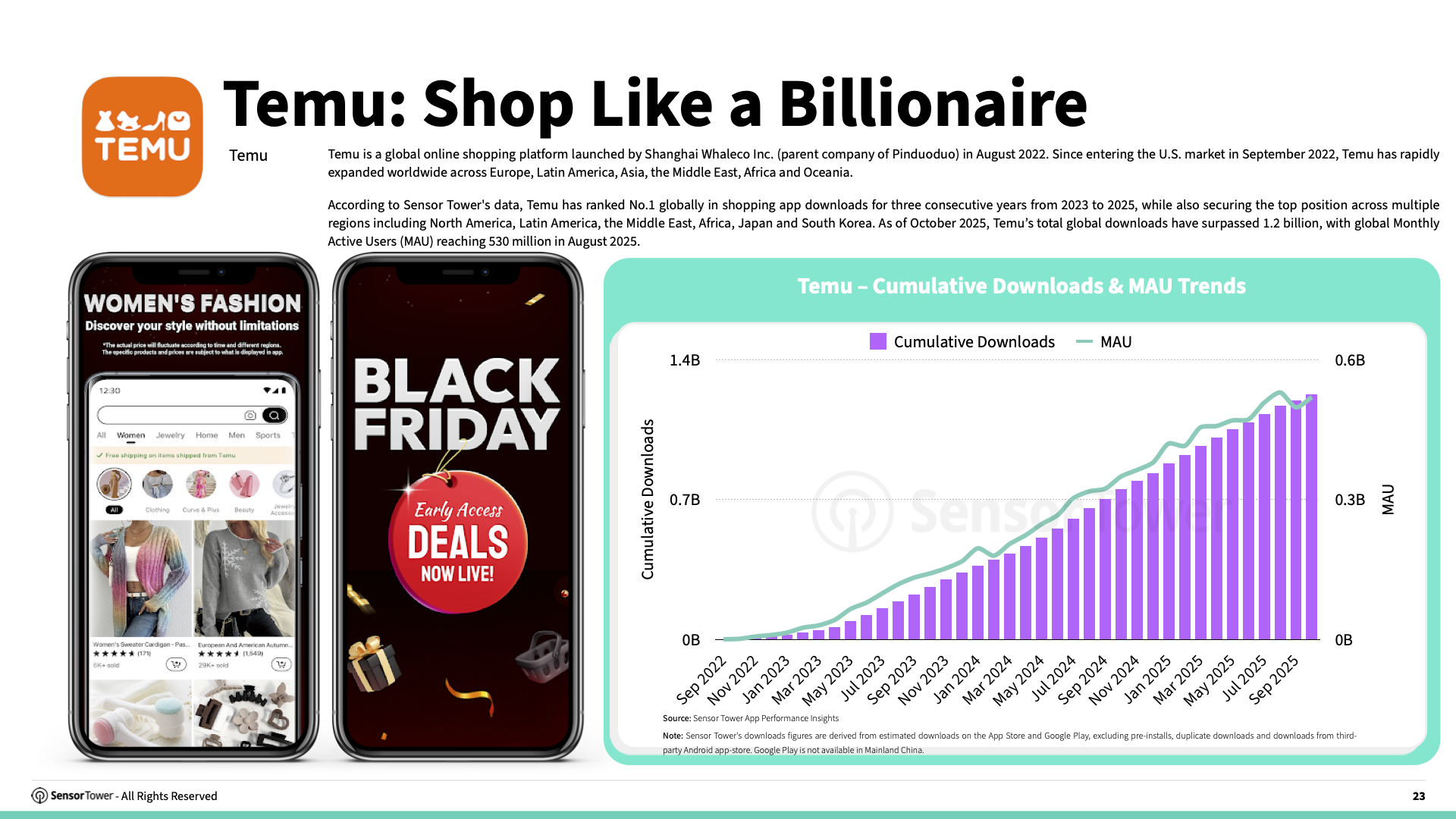

Temu Surpasses 1.2 Billion Global Downloads, Reaching a New Peak in Active Users

Sensor Tower data shows that from 2023 to 2025, Temu remained the world’s most-downloaded shopping app for 3 consecutive years, also topping category rankings across North America, Latin America, the Middle East, Africa, Japan and South Korea. As of Oct 2025, Temu’s global cumulative downloads exceeded 1.2 billion, and in Aug 2025, the platform reached a record-high 530 million monthly active users (MAU).

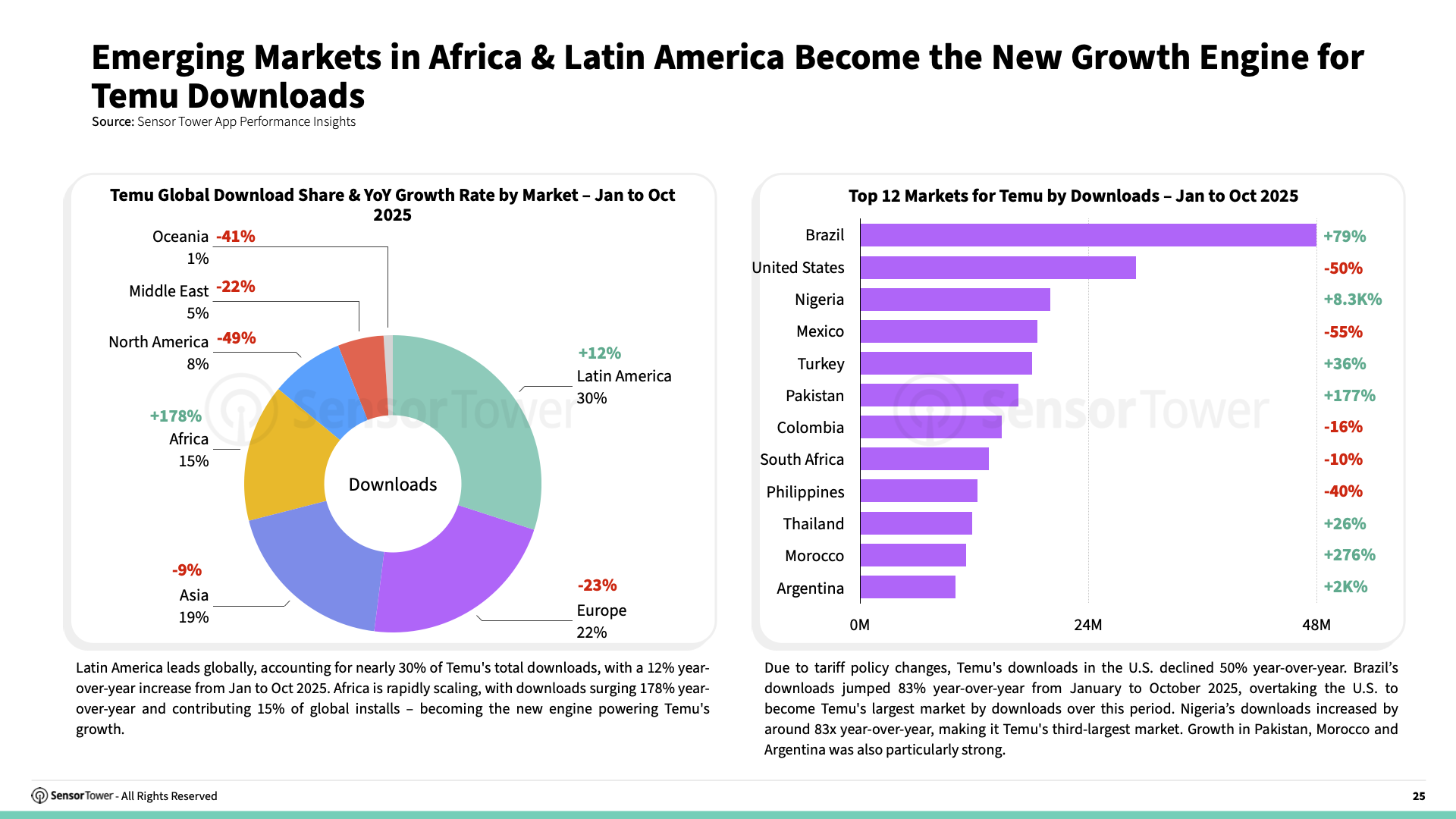

Emerging markets – particularly Africa and Latin America – are becoming Temu’s new global growth engines. Latin America leads all regions, contributing nearly 30% of total global downloads. Africa continues its rapid ascent, with downloads surging 168% year-over-year and adding substantial new users. Brazil saw 84% year-over-year growth, becoming Temu’s largest individual market in 2025, while Nigeria surged 84x, rising to the #3 global market, underscoring Temu’s strong appeal and growth potential across high-momentum emerging regions.

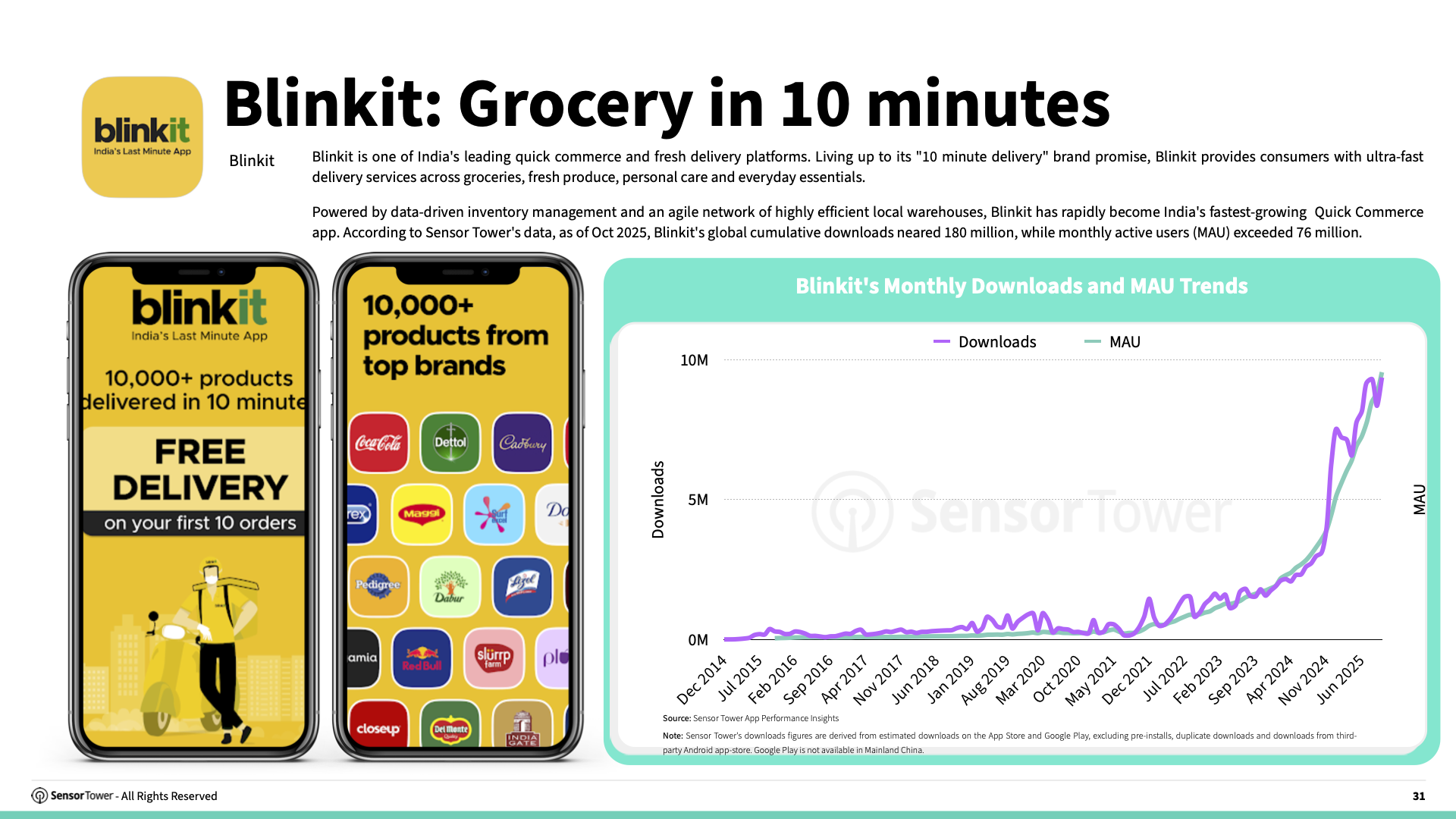

India’s Quick Commerce Sector Accelerates, With Blinkit Emerging as the Breakout Leader

In 2025, India’s quick commerce sector experienced rapid expansion as major platforms – including Blinkit, Zepto, bigbasket, Instamart, Flipkart and Swiggy – increasingly adopted the “10-minute delivery” model.

Powered by data-driven inventory management and a highly efficient network of localized dark stores, Blinkit has become the fastest-growing eCommerce app in India. Sensor Tower data shows that from January to October 2025, Blinkit’s downloads increased 165% compared with the previous period, pushing its global cumulative downloads to nearly 180 million by October 2025.

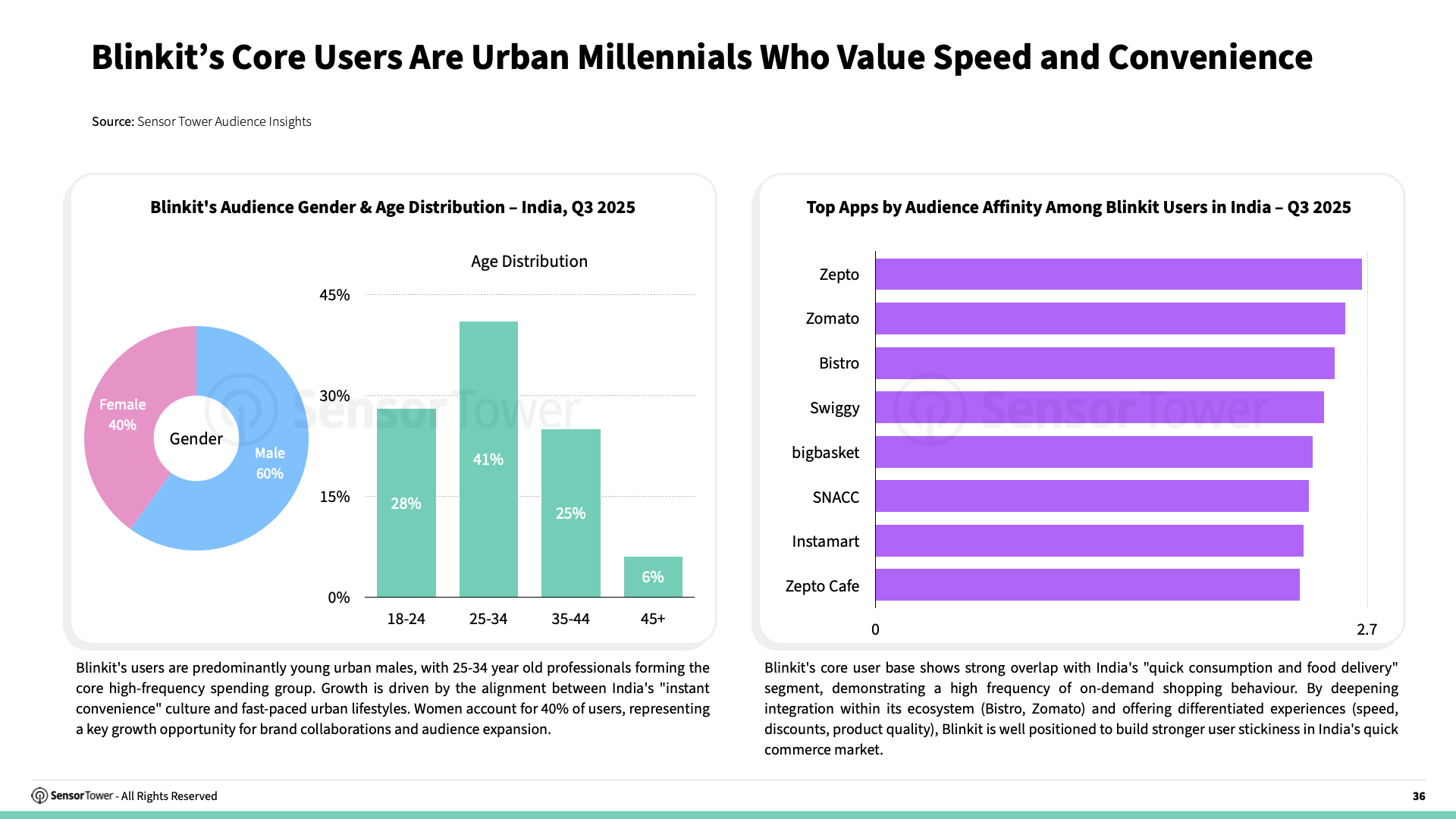

Blinkit’s user base is dominated by urban, young male consumers, with 25–34 year old professionals forming the core spending group. Women account for 40% of users, representing a strong growth opportunity for brand partnerships and audience expansion. Blinkit’s core audience also closely overlaps with India’s quick-service and food delivery consumption scenarios, demonstrating a strong propensity for instant purchases.

By strengthening its own ecosystem (Bistro, Zomato) and enhancing differentiated value propositions – speed, savings and product quality – Blinkit is well-positioned to build deeper user stickiness and reinforce its leadership in India’s fast-commerce market.

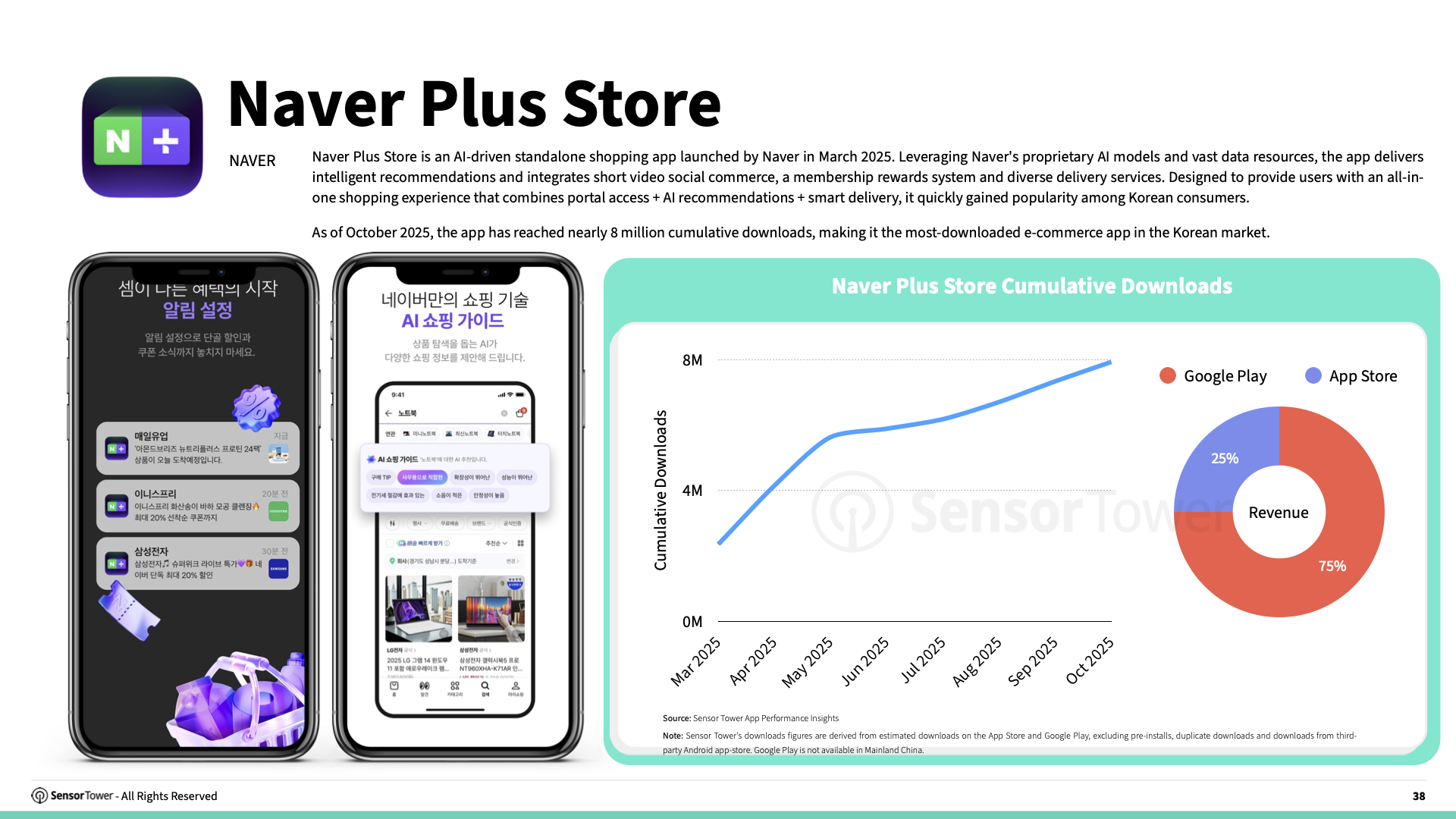

Naver Plus Store Becomes Korea’s Most-Downloaded eCommerce App in 2025

The AI-driven standalone shopping app Naver Plus Store has quickly risen to prominence in Korea, powered by Naver’s proprietary AI models and extensive data capabilities. By combining intelligent recommendations with short-form video commerce, a robust membership points ecosystem and diverse delivery options, the platform delivers a fully integrated “Portal + AI Recommendations + Smart Fulfillment” shopping experience that has rapidly resonated with Korean consumers.

According to Sensor Tower's data, Naver Plus Store topped both the Google Play and App Store download charts in Korea on its launch day in Mar 2025. From Mar to May, it repeatedly ranked #1 on the Google Play overall download chart, securing nearly 60 days at the top. As of Oct 2025, total downloads have reached 7.9 million, making it the most-downloaded eCommerce app in the Korean market.

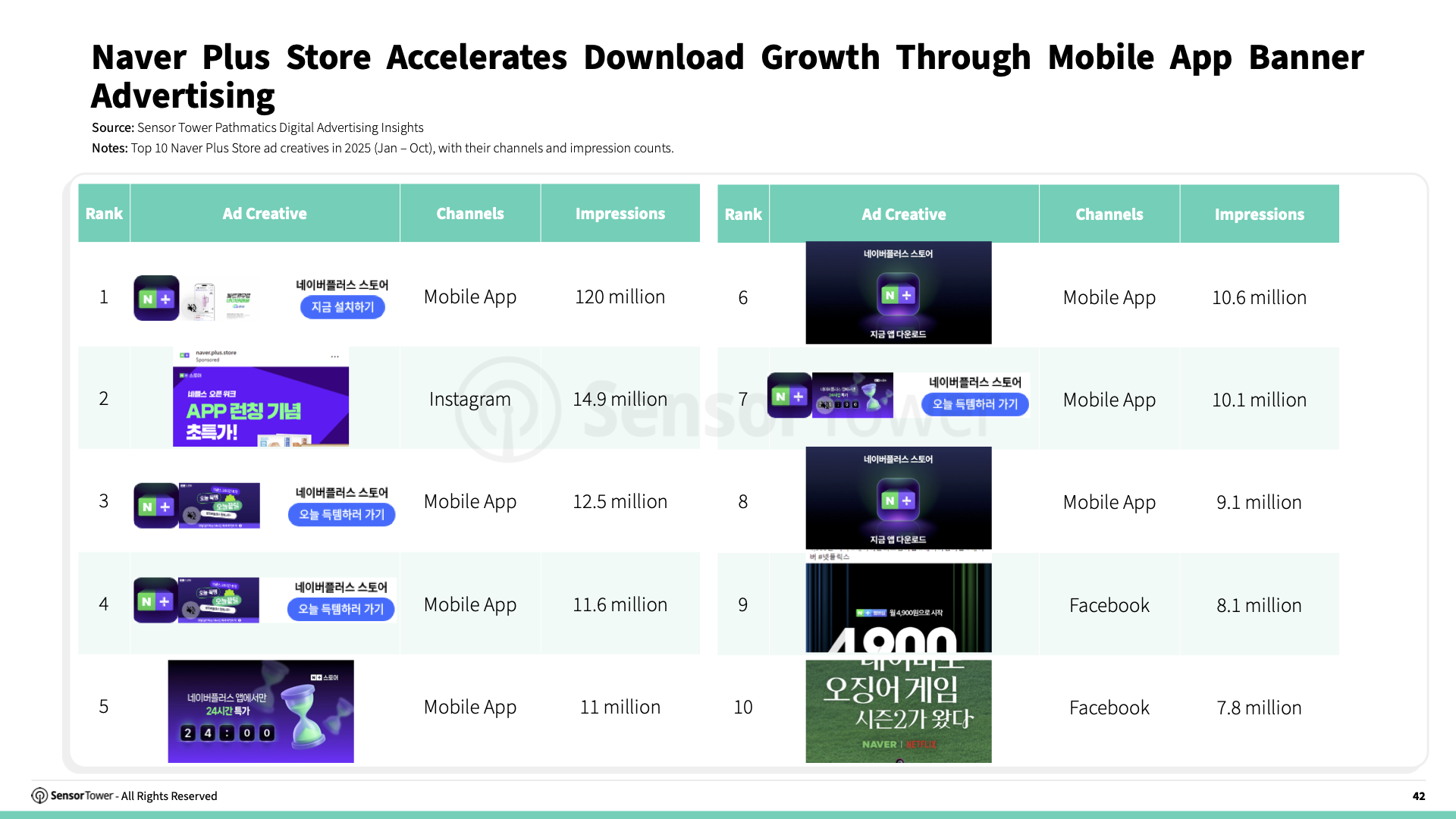

In its early launch phase, Naver Plus Store drove rapid user acquisition through large-scale mobile banner advertising. With eye-catching visuals and prominent limited-time offers, the ads captured user attention immediately and effectively boosted conversions. From Mar to May 2025, Naver Plus Store surpassed ChatGPT to become the most-downloaded mobile app in Korea, marking a strong debut in an increasingly competitive market.

To access the full insights, click the button below to download the complete report.

Sensor Tower provides mobile app, digital advertising and audience intelligence to help you stay ahead of market shifts, outperform competitors and drive sustainable growth. Contact us to request a product demo:

Sensor Tower: https://sensortower.com/demo

Sensor Tower Video Game Insights – PC/ Console: https://sensortower.com/video-game-insights-demo

Sensor Tower Playliner – Live Ops Insights: https://sensortower.com/live-ops-demo

This article was written by Rui Ma, Senior Analyst, APAC at Sensor Tower, and authorised by Nan Lu, VP of Marketing, APAC. Please credit Sensor Tower if you wish to reprint or share this content.

Sensor Tower – Your Guide to Global Mobile App Growth

Press Inquiries: press-apac@sensortower.com

Business Inquiries: sales@sensortower.com

Reproduction Notice: Please credit Sensor Tower as the source if you share or republish this content.