2026 State of Mobile is Live!

Mobile App Insights · Francisco Rabolini · July 2021

Sensor Tower’s State of Card Battler Mobile Games 2021 Report: Downloads Rise by 23% in Q2 as the Fastest-Growing Strategy Sub-Genre

Surge in Card Battler installs comes as downloads for other Strategy sub-genres stay flat or decline, Sensor Tower data shows.

The Card Battler sub-genre has seen a number of hits over the years, including big names like Yu-Gi-Oh! Duel Links from Konami and Hearthstone from Blizzard. This year has also seen new contenders emerge, such as Magic: The Gathering Arena from Wizards of the Coast, showing new growth areas for the market. Sensor Tower’s new State of Card Battlers report utilizes Sensor Tower’s powerful array of services, including our Game Taxonomy and Game Intelligence platforms, to provide an in-depth analysis of the state of the sub-genre and the growth opportunities available therein.

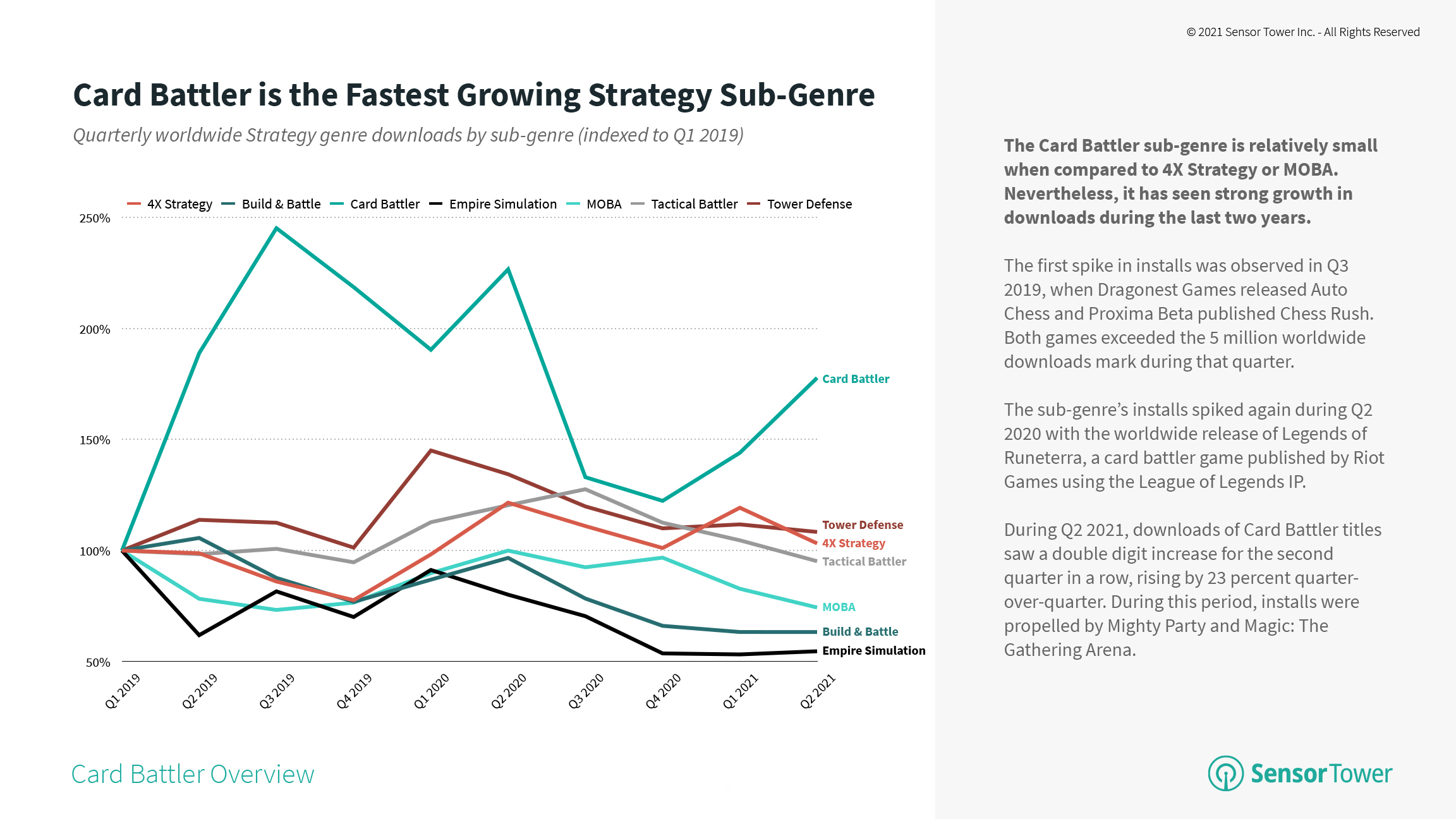

Fastest-Growing Strategy Sub-Genre

While the Card Battler sub-genre is relatively small compared to 4X Strategy and MOBA titles, it has seen a surge in growth this year. Downloads in Q2 2021 increased by 23 percent quarter-over-quarter, spurred on by the new release of Magic: The Gathering Arena and a rise in popularity for Mighty Party from Panoramik Games. Previously, a spike in installs during Q3 2019 was sparked by the emergence of new Auto Chess titles, such as the eponymous Auto Chess from Dragonest, published by Tencent, and Chess Rush, also from Tencent.

The growth of the Card Battler sub-genre contrasts with other sub-categories as the only one of them to experience significant growth in Q2 2021, while they saw downloads remain flat or decline.

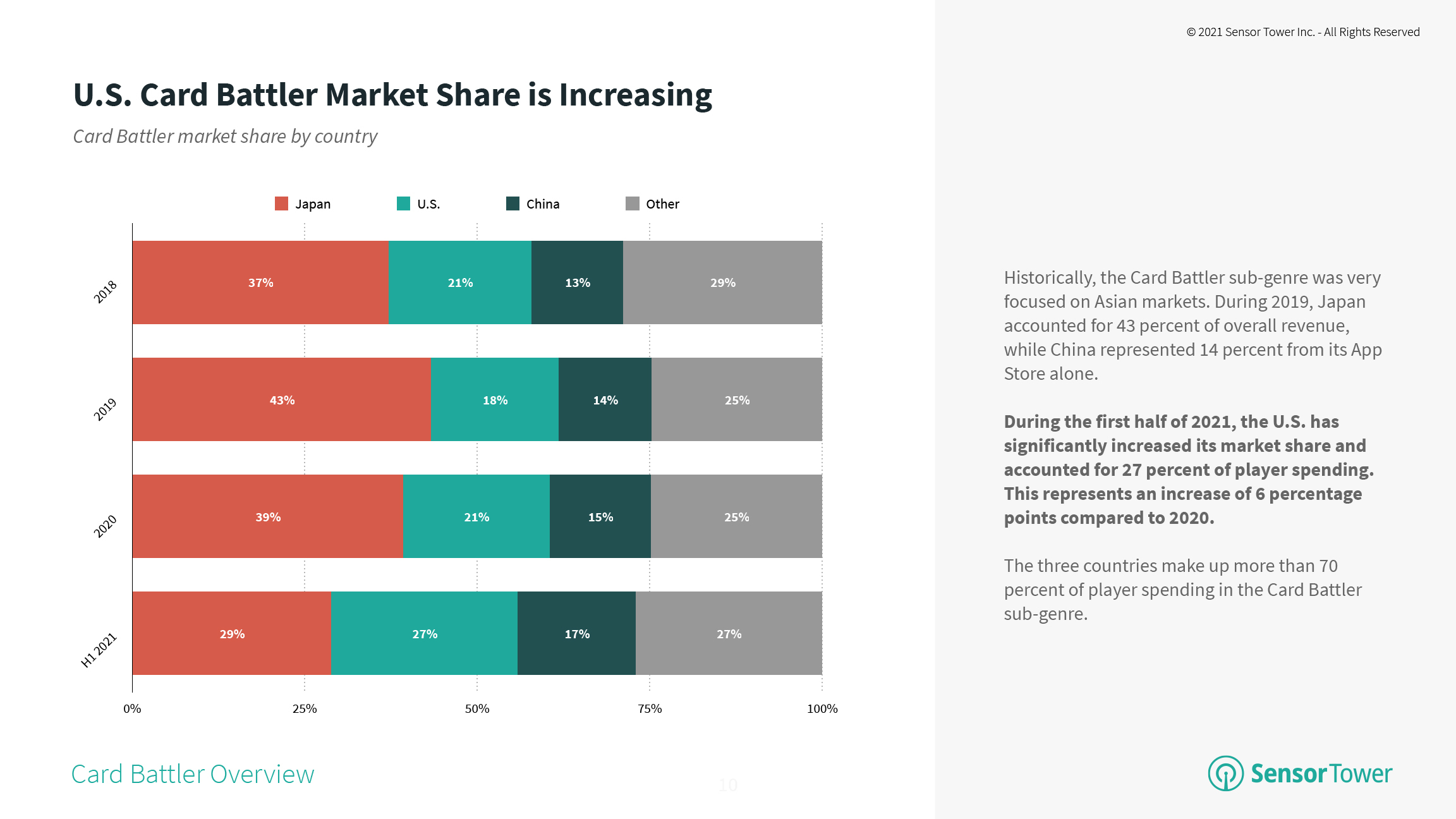

United States Expands Market Share

Historically, the Card Battler sub-genre has seen the majority of its revenue come from Asian markets. In 2019, Japan accounted for 43 percent of overall player spending in the category, while China represented 14 percent.

In 2020, however, Japan’s market share decreased to 39 percent, as the U.S. Card Battler market grew to a 21 percent share. During the first half of 2021, that trend continued, with the U.S. accounting for a 27 percent market share, while Japan shrank further to 29 percent.

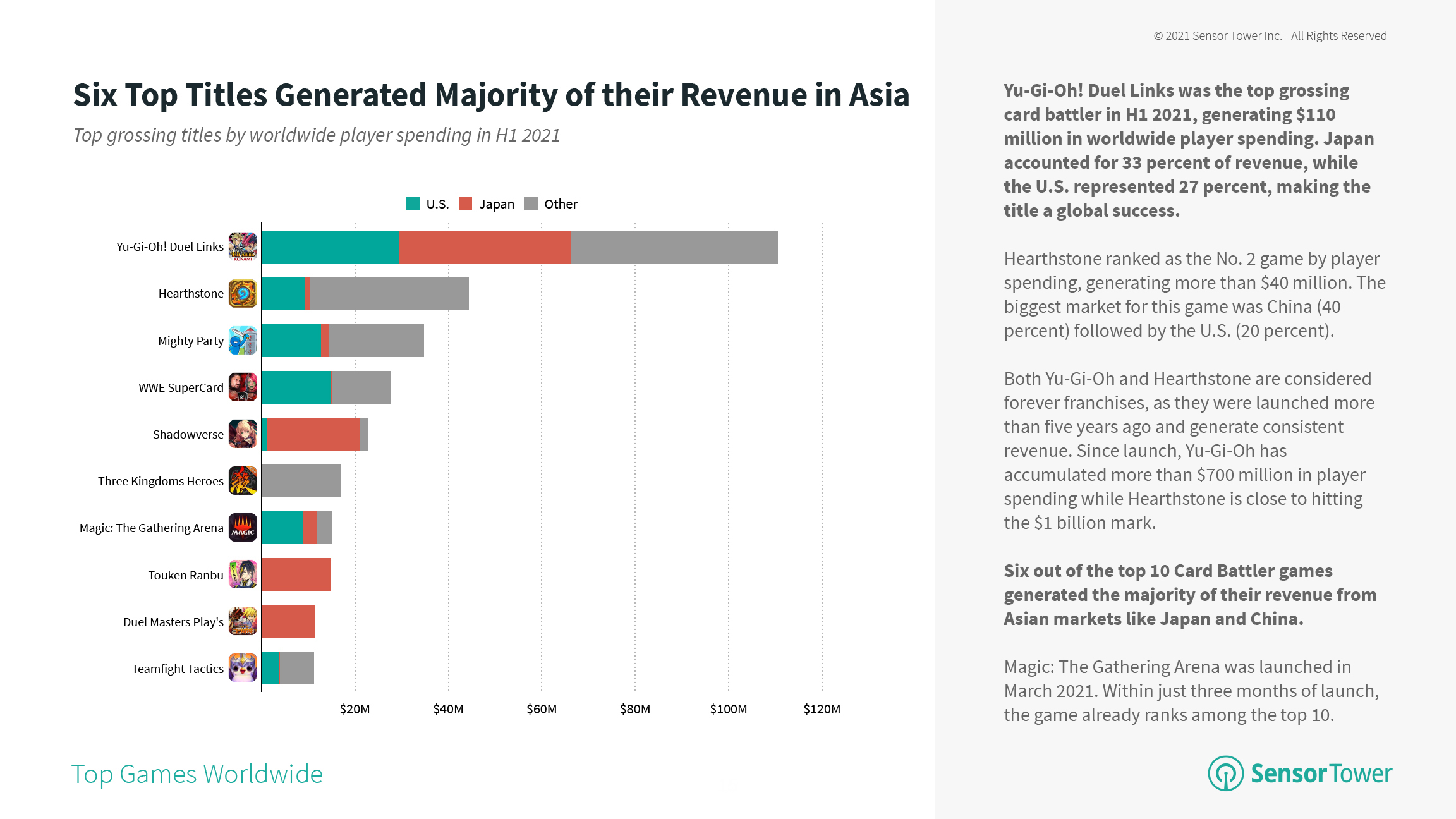

Top Card Battlers

Yu-Gi-Oh! Duel Links was the top revenue generating Card Battler in H1 2021, bringing in $110 million from worldwide player spending. Japan accounted for 33 percent of its revenue, while the U.S. represented 27 percent, making it one of the few successful global card battlers across these key markets.

Six out of the top 10 Card Battler titles generated the majority of their revenue in Asian markets like China and Japan. Few games in the sub-genre have been able to find equal success in both U.S and Asian markets, with Yu-Gi-Oh! Duel Links! and Hearthstone being the exceptions. However, Magic: The Gathering Arena, a new contender in the space launched this year, is showing early signs that it could be a global success, generating revenue in both the U.S. and Japan.

For more in-depth analysis on the state of Card Battler sub-genre, download the complete report in PDF form below: