2026 State of Mobile is Live!

Mobile App Insights · Marco Scacchi · February 2022

Health & Fitness App Installs in Europe Are Set to Reach 80 Million in Q1 2022

According to Sensor Tower Store Intelligence data, installs of Health & Fitness apps in Europe reached 290 million in 2021. Download the report for an analysis of download trends and more.

Back in 2020, downloads of Health & Fitness category apps saw a significant surge in Europe, rising by nearly 50 percent year-over-year. While user adoption was down in 2021 from numbers recorded during the height of the pandemic in 2020, it remained significantly above pre-COVID levels. According to Sensor Tower Store Intelligence data, installs of Health & Fitness apps in Europe reached 290 million in 2021, up 14 percent versus 2019. In our latest report on the State of Health & Fitness Apps, you’ll find an analysis of download and consumer spending trends (in U.S. dollars) across Europe, digital ad spend trends, and more.

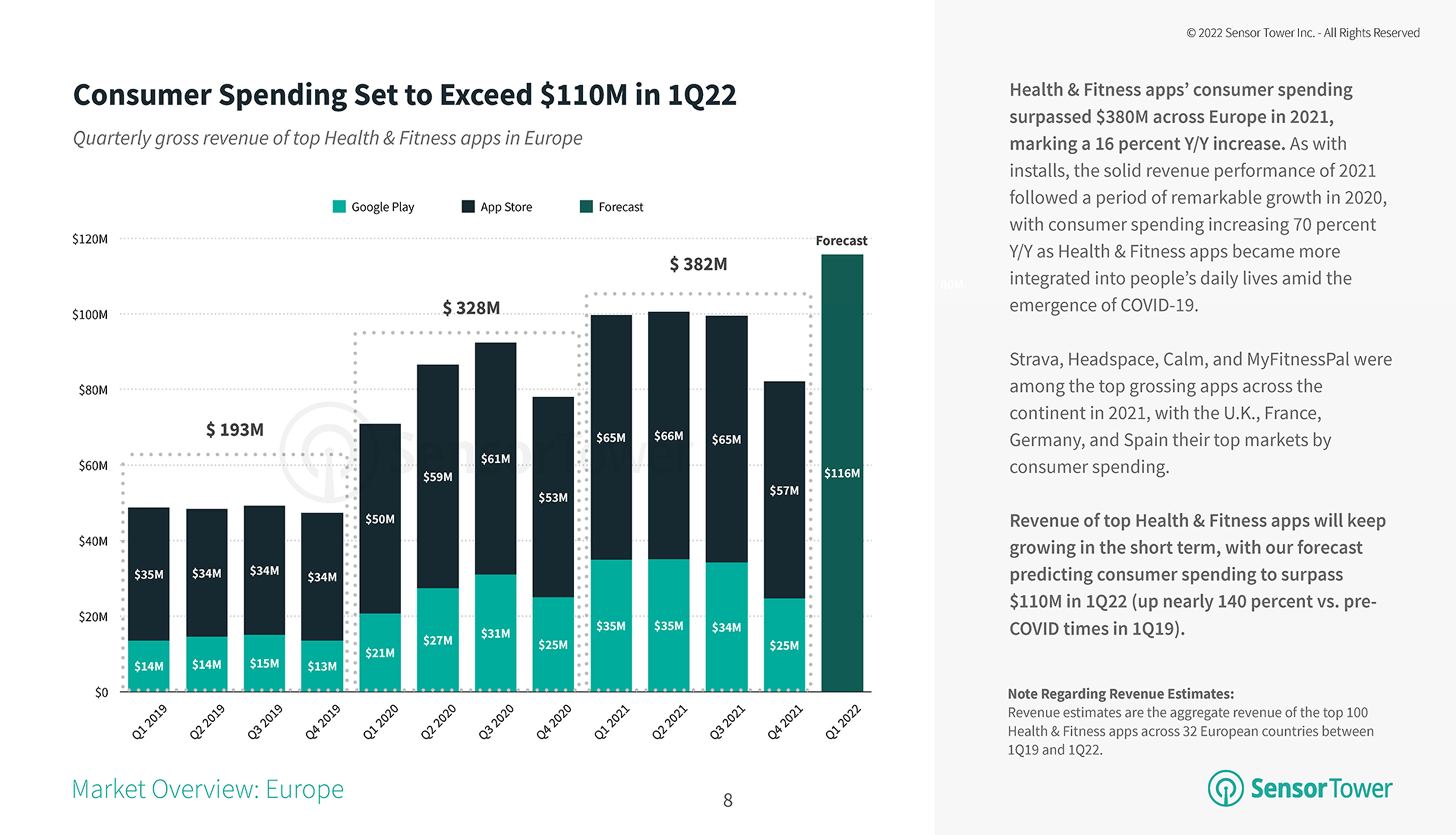

Revenue of Top Health & Fitness Apps Will Continue Growing

Health & Fitness app consumer spending peaked in Q2 2021 reaching $66 million on the App Store and $35 million on Google Play. Meditation & Sleep apps, Headspace and Calm, were two of the four top grossing apps in Europe in 2021. Calm also ranked No. 1 for top Meditation & Sleep apps by downloads.

Across the App Store and Google Play, Europe Health & Fitness apps saw $382 million in consumer spending in 2021, up 16 percent Y/Y from 2020. Our forecast predicts this growth will continue in 2022 with spending surpassing $110 million in Q1 2022, up nearly 140 percent from pre-COVID times in Q1 2019.

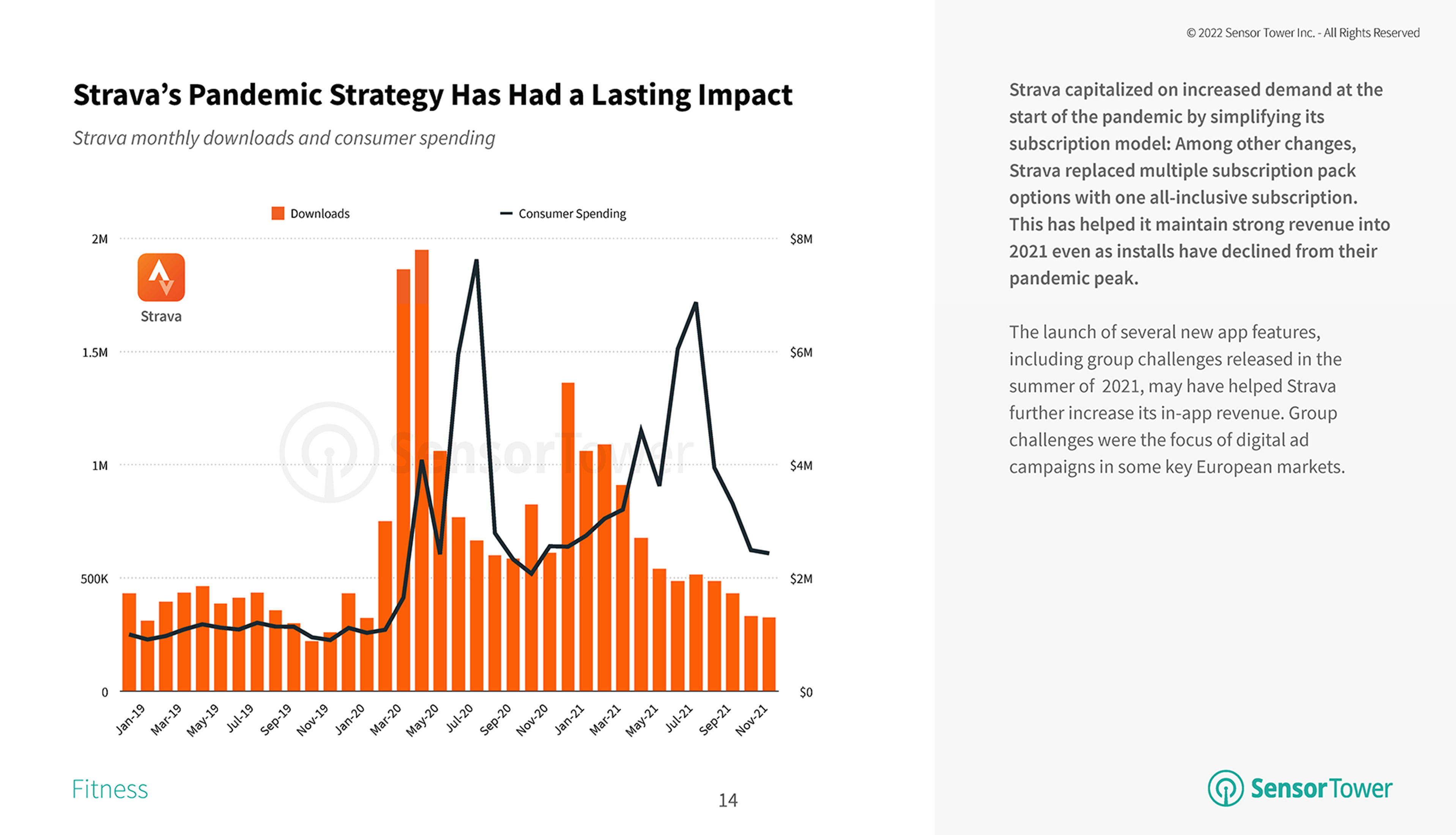

Strava’s Pandemic Strategy Helps It Remain Strong Into 2021

Strava, a popular running and cycling app, was the fourth most downloaded fitness app in Europe in 2021 on the App Store and Google Play. During the pandemic, Strava replaced its multiple subscription packages with an all-inclusive subscription. Currently, new users can subscribe to the app for $5.00 per month when billed annually. Even as installs declined in the months following March 2021, consumer spending in Europe continued to remain strong and surpassed $6 million in July 2021.

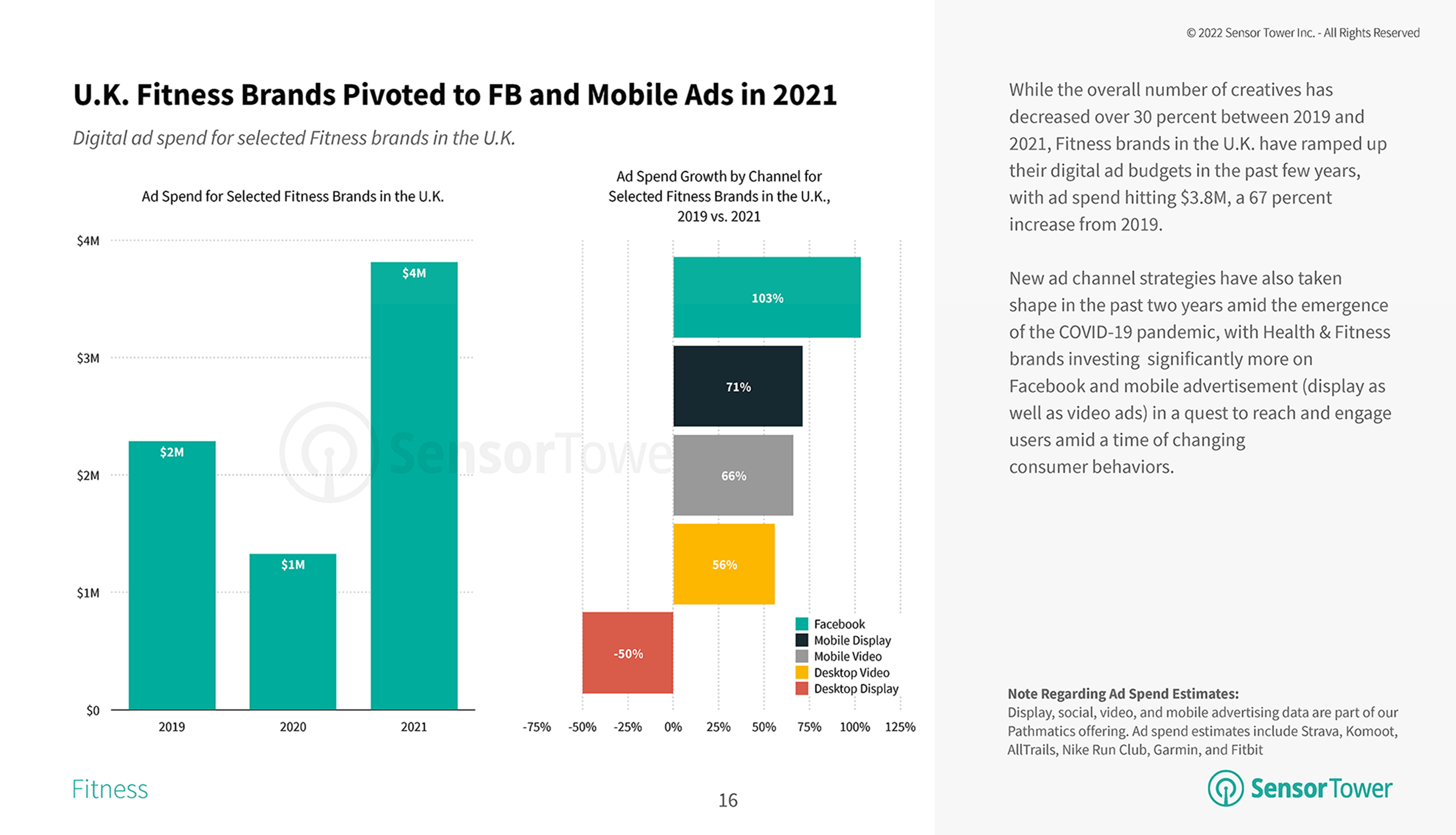

U.K. Fitness Brands Ramped Up on Facebook and Mobile Ads

Fitness brands such as Strava, Komoot, AllTrails, Nike Run Club, Garmin, and Fitbit have been ramping up their digital advertising budgets on Facebook and mobile ads. Facebook, Mobile Display, and Mobile Video respectively saw a 103 percent, 71 percent, and 66 percent increase in U.K. ad spend from selected fitness brands between 2019 and 2021. In 2021, fitness brands invested nearly $4 million in the U.K. market, a 67 percent increase from 2019.

With consumers spending more time on their phones, fitness brands may continue investing in creatives on mobile channels. Health & Fitness app installs are expected to grow, with our forecast predicting a 13 percent increase from pre-COVID times.

Early results from January 2022, a key month for new user adoption driven by New Year’s resolutions, also point towards solid growth. Initial data for 2022 show a slight uptick compared to January 2021.

The Sensor Tower Store Intelligence and Usage Intelligence platforms unlock even deeper analysis potential around the retail app category, including key insights on app adoption trends, monthly active users for selected geographies, and more. Take a look at Pathmatics Explorer for more data on digital advertising spend and impressions.

Download the complete State of Health & Fitness in PDF form below to see our full analysis: