Q3 2025 Digital Market Index

Despite economic headwinds, Q3 2025 was one of strong performance across the mobile app and digital advertising ecosystem. While tariffs put a damper on certain categories, others were able to persevere and achieve growth, even in the face of rising costs. Our Q3 2025 Digital Market Index report takes a granular look at the last quarter’s performance across top markets, categories, apps, and games — before diving into an analysis of the digital advertising realm, and finishing off strong with key insights on retail media. You won’t want to miss this intel!

Get the Report

Trusted by global digital leaders

Here’s a sneak peek of the highlights:

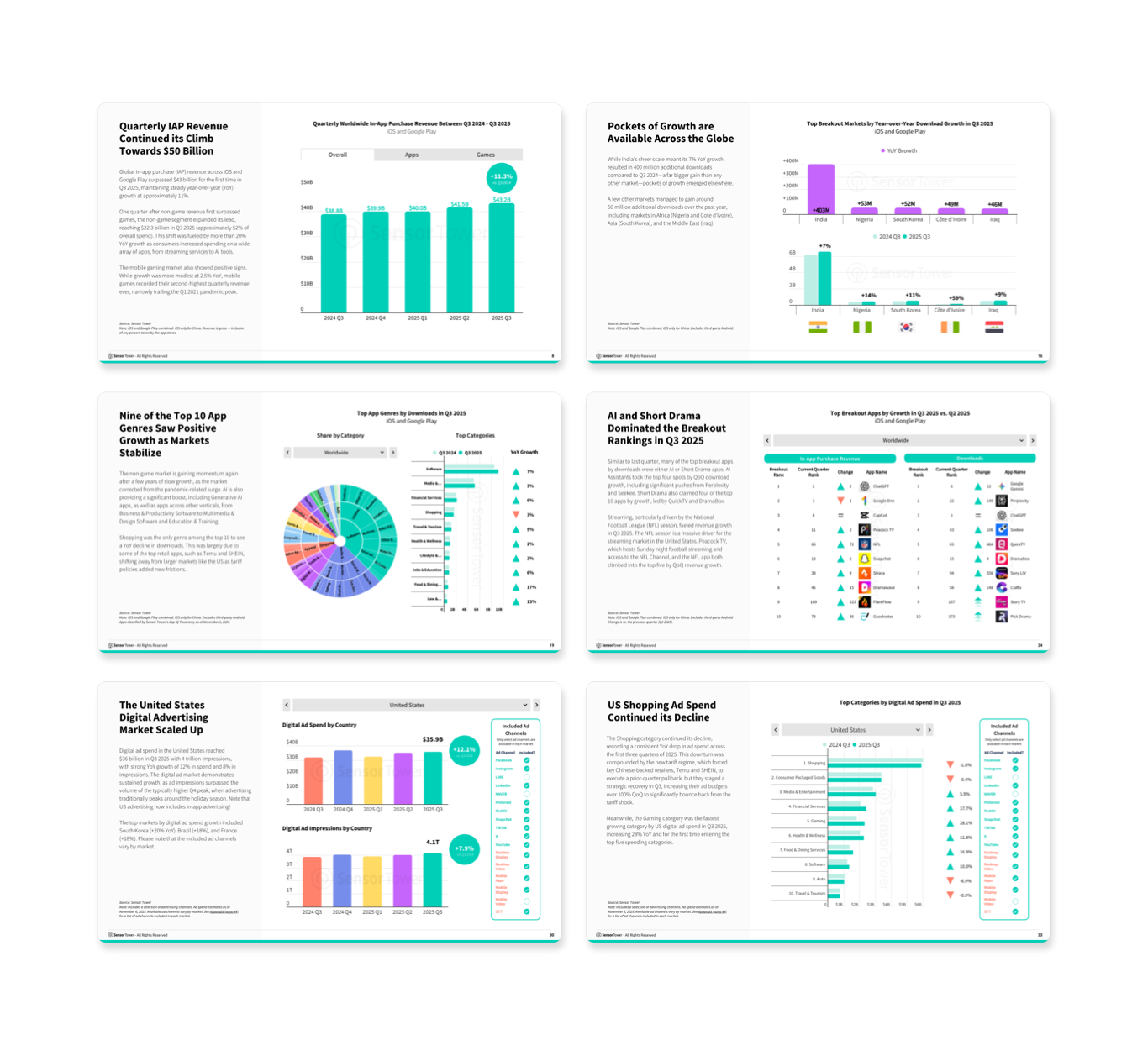

Top Markets - The US generates more IAP revenue than the next five markets combined, while Japan was the only market among the top 20 by IAP revenue to see a YoY decline.

Top Categories - Media & Entertainment leads mobile revenue, with Software apps also driving significant growth.

Top Apps - ChatGPT has quickly flown up the top charts, ranking #2 by IAP revenue in Q3 2025, just behind TikTok — it ranked #16 only a year ago.

Top Games - "Kings" were a popular theme among the top games by IAP revenue, including two new entrants to the top 10 this quarter: Clash Royale and Kingshot.

Digital Advertising - Digital ad spend in the US reached $36 billion in Q3 2025 with 4 trillion impressions, and a strong YoY growth of 12% in spend and 8% in impressions.

Retail Media - Retail media ad impressions in the US climbed 7% YoY to 72 billion across top retailers like Walmart and Target.