2026 State of Mobile is Live!

Trusted by global digital leaders

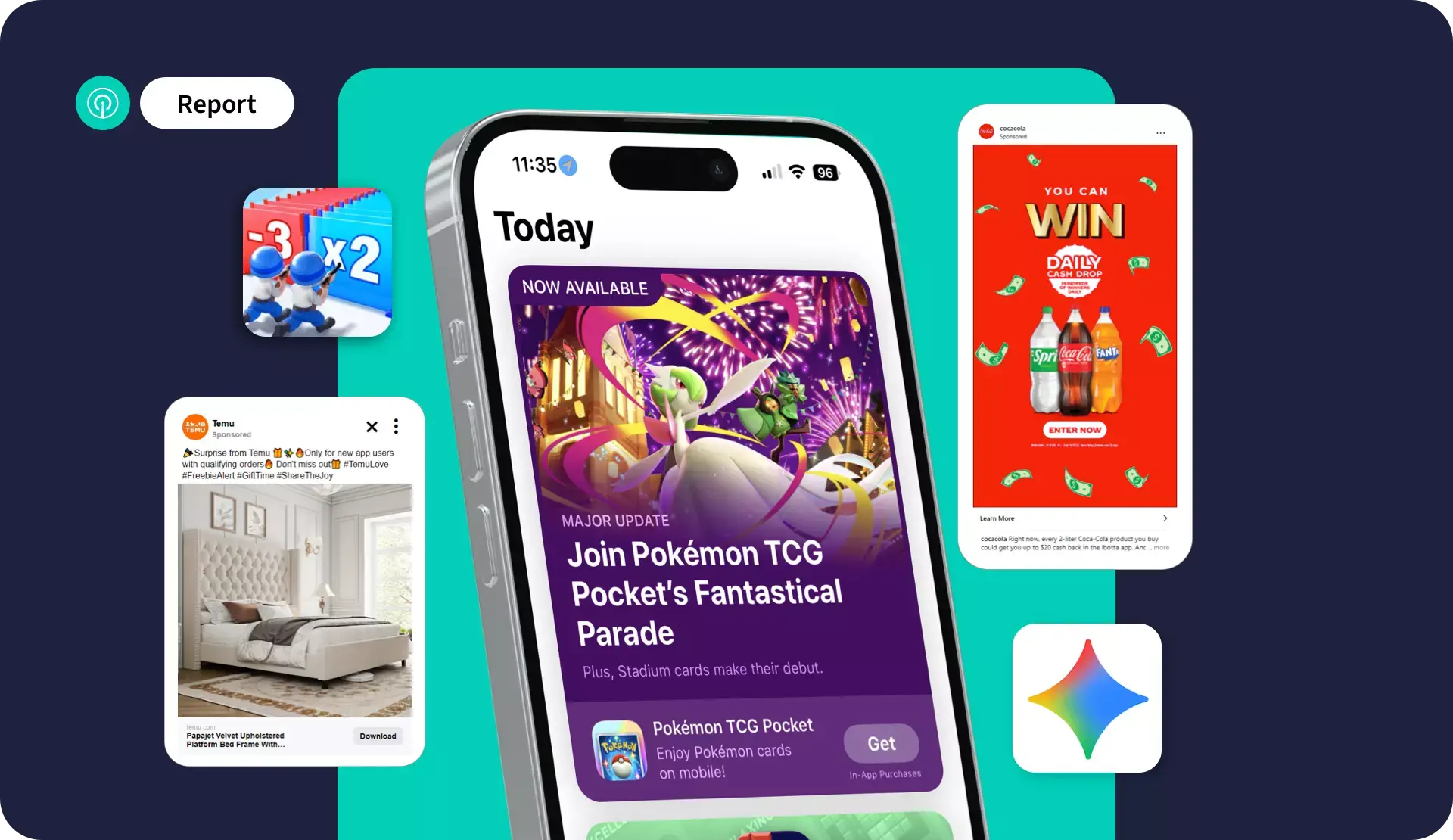

Set engagement benchmarks for the world’s top apps

Explore user behavior trends across mobile categories—from social networks to SVOD and gig apps. Compare time spent, session counts, and performance over time to see real-world engagement for major players.

Set benchmarks for real-world app performance

Estimate the success of top apps with proprietary panel data

Get a clear, unfiltered picture of user retention

Articulate actual week-to-week retention, session count and time spent

Assess the apps that compete for the same audience

Segment user engagement by important category or app-level behaviors

Build custom cohorts and analyze retention trends

Define engagement benchmarks and churn behaviors for specific user segments using real-life data. Measure app performance against broader categories, identify user groups inclined to certain apps, and uncover week-over-week and month-over-month retention insights for major apps.

Uncover daily and hourly mobile behaviors

Gain deep insights into user behavior with our proprietary panel. Analyze how users engage with apps hourly, compare usage across similar app categories, and explore differences between regional and global audiences.

Analyst, NYC-based Hedge Fund ($2bn AUM)

“Sensor Tower offers a critical lever for us to make important investment decisions on behalf of our clients, and ensure we’re staying on top of key market-moving trends in mobile.”

Frequently Asked Questions

1. What is Advanced Usage Insights?

Advanced Usage reports give subscribers direct access to Sensor Tower’s proprietary panel of mobile users in order to better understand consumer behavior and changing usage patterns of the world’s most popular mobile apps.

2. What data does it provide?

Advanced Usage Insights allows you to analyze:

Time spent

Session counts

Week-to-week retention

Hourly and daily user engagement

Cross-app usage

Acquisition and churn analysis

3. Who benefits from Advanced Usage Insights?

Mobile product teams, product, growth, and analyst teams use Advanced Usage Insights to benchmark app performance and identify areas for user engagement improvements.

4. Can Advanced Usage Insights help with retention strategy?

Yes, it allows you to see real-world, week-to-week retention and churn patterns across user segments and app categories.

5. How do you use Advanced Usage Insights to assess competition?

By comparing usage trends (like sessions and time spent) across competing apps and categories, teams can understand where they lead or lag behind.

6. What is unique about its panel data?

The insights are based on a proprietary panel of millions of mobile users, giving a real-world view of engagement rather than solely store-derived metrics.Unlike our other usage data, Advanced Usage reports are free of additional filtering, allowing for the most robust picture of the global engagement of many of the most popular apps in the world.

7. Can you build custom cohorts in Advanced Usage Insights?

Yes, you can segment users into cohorts to analyze engagement and retention behaviors tailored to specific audiences.

Sensor Tower Blog

Gaming Insights • February 2026

State of Gaming 2026: Mobile, PC, & Console Trends

State of Gaming 2026 take a cross-platform view of the industry before diving into mobile game performance, marketing, and Live Ops trends. We’ll then explore the ins and outs of PC/Console dynamics, closing with a deep-dive case study on the Shooters genre.

Digital Advertising Insights • February 2026

Q4 Digital Market Index: App, Ads & Web Data

Our quarterly post-mortem on the digital economy is here — and there's a lot to say about Q4 2025. From AI's industry-spanning takeover to Europe's status as a growth leader, we're diving into the mobile, app, ad and web data that you need to understand a rapidly-evolving landscape.