2026 State of Mobile is Live!

Mobile App Insights · Randy Nelson · July 2019

Global App Revenue Reached $39 Billion in the First Half of 2019, Up 15% Year-Over-Year

Sensor Tower Store Intelligence data reveals that the first half of 2019 TK for worldwide app store spending.

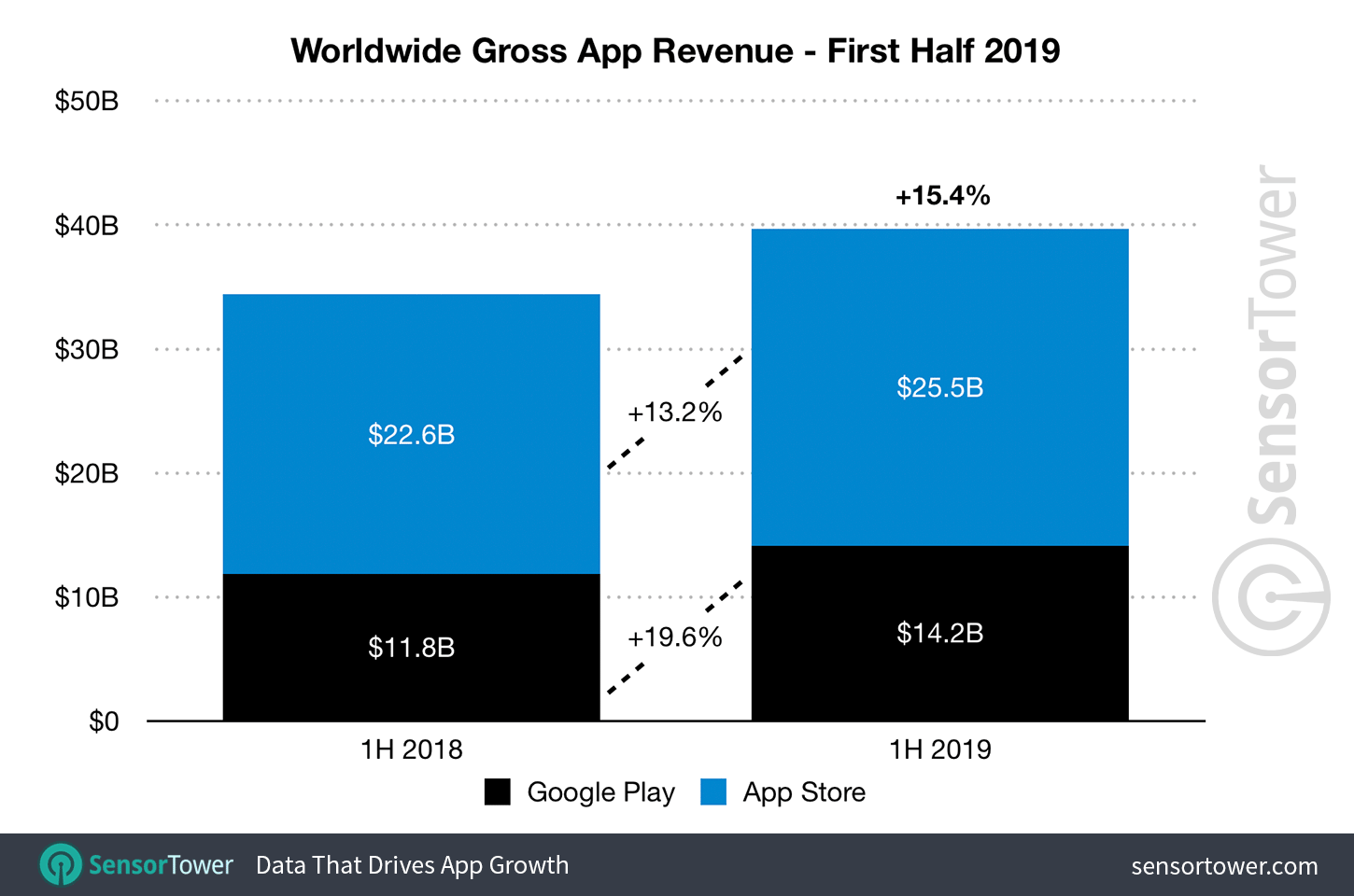

The world's App Store and Google Play users generated a combined $39.7 billion in spending on mobile apps and games during the first half of 2019, Sensor Tower Store Intelligence estimates reveal. This was 15.4 percent more than the $34.4 billion consumers spent across both stores in the first half of 2018.

Worldwide Mobile App Revenue and Downloads

Consumers spent an estimated $25.5 billion globally on Apple's App Store during the first half, an increase of 13.2 percent year-over-year from $22.6 billion in Q1 and Q2 of 2018. The amount generated by Apple's platform was approximately 80 percent greater than Google Play's estimated gross revenue of $14.2 billion for the half. That was up 19.6 percent Y/Y from first half 2018's total of $11.8 billion.

Tinder was the highest grossing non-game app in 1H19, generating an estimated $497 million in spending across both stores. This was about 32 percent more than users spent in the app during the first half of 2018.

Netflix was the second highest earning non-game app for Q1 and Q2 with estimated consumer spend of close to $399 million globally. It had been No. 1 for in-app revenue in 1H18, but has since declined following Netflix's decision to remove subscriptions from the iOS version of the app. Tencent Video grossed $278 million outside of China's third-party Android stores, making it the third largest app of the half by revenue. iQIYI and YouTube were the No. 4 and No. 5 grossing non-game apps, respectively.

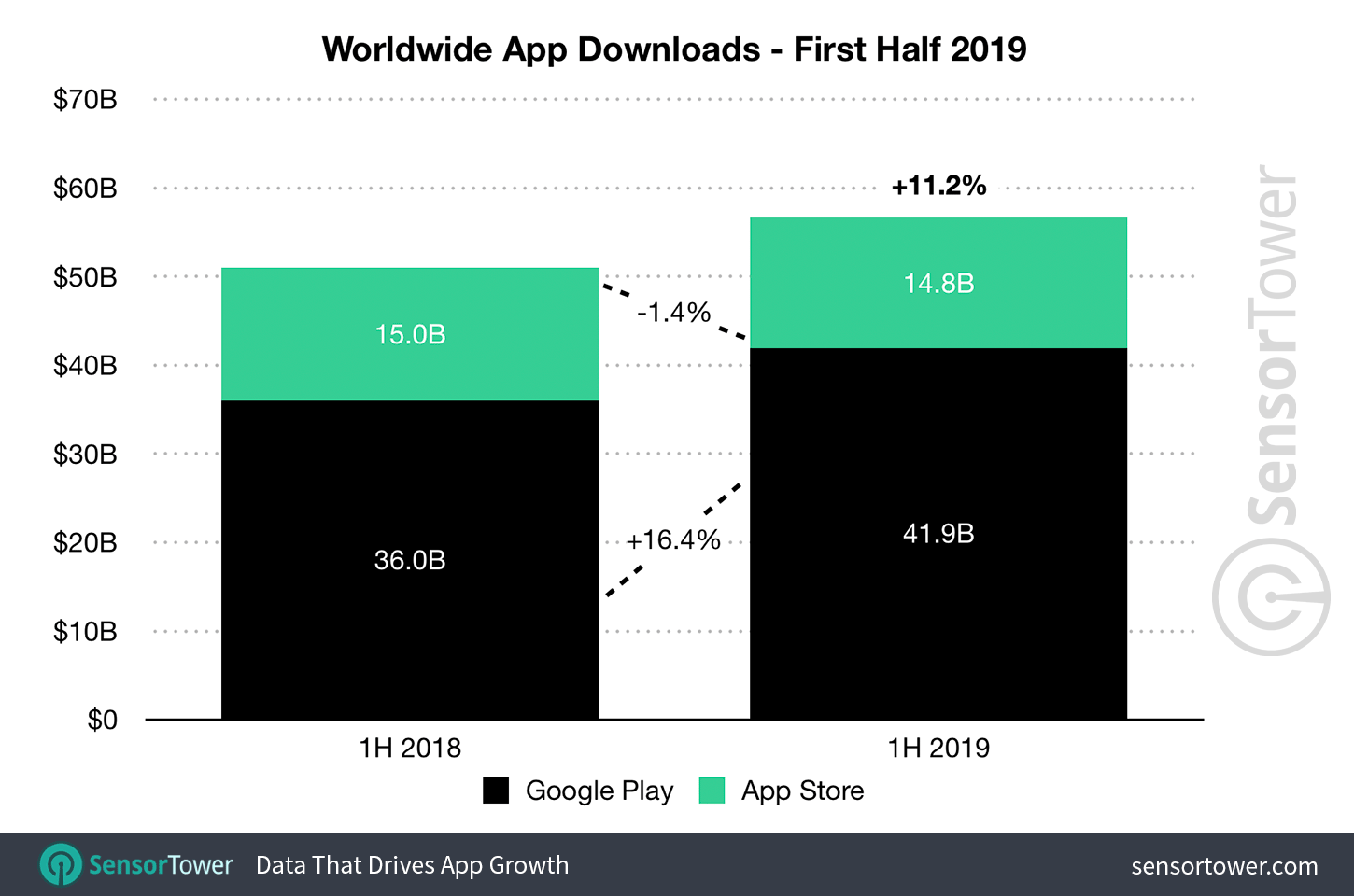

First-time app installs totaled 56.7 billion for the half with the App Store accounting for 14.8 billion of those, a decrease of 1.4 percent from 1H18. As we previously shared, the Q1 2019 was the first quarter where iOS downloads fell Y/Y overall, due to a downturn in China. App Store installs bounced back in Q2, growing nearly 3 percent Y/Y to about 7.4 billion worldwide, but the decline in Q1 was enough to drag the entire first half into negative territory.

Google Play installs grew 16.4 percent Y/Y for the half to 41.9 billion, up from 36 billion in 1H18. This was about 2.8 times greater than the volume of first-time downloads on iOS for the first two quarters of this year. Still, Apple's platform continued to generate nearly 1.8 times more revenue than Google's on only about a third as many installs.

The top three apps by global downloads remained unchanged over 1H18, with Facebook's WhatsApp, Messenger, and Facebook holding onto the top of the chart. TikTok again ranked No. 4 ahead of Instagram but saw its first-time installs grow about 28 percent Y/Y for the half to nearly 344 million worldwide despite a two-week ban in its largest market during Q2.

Worldwide Mobile Game Revenue and Downloads

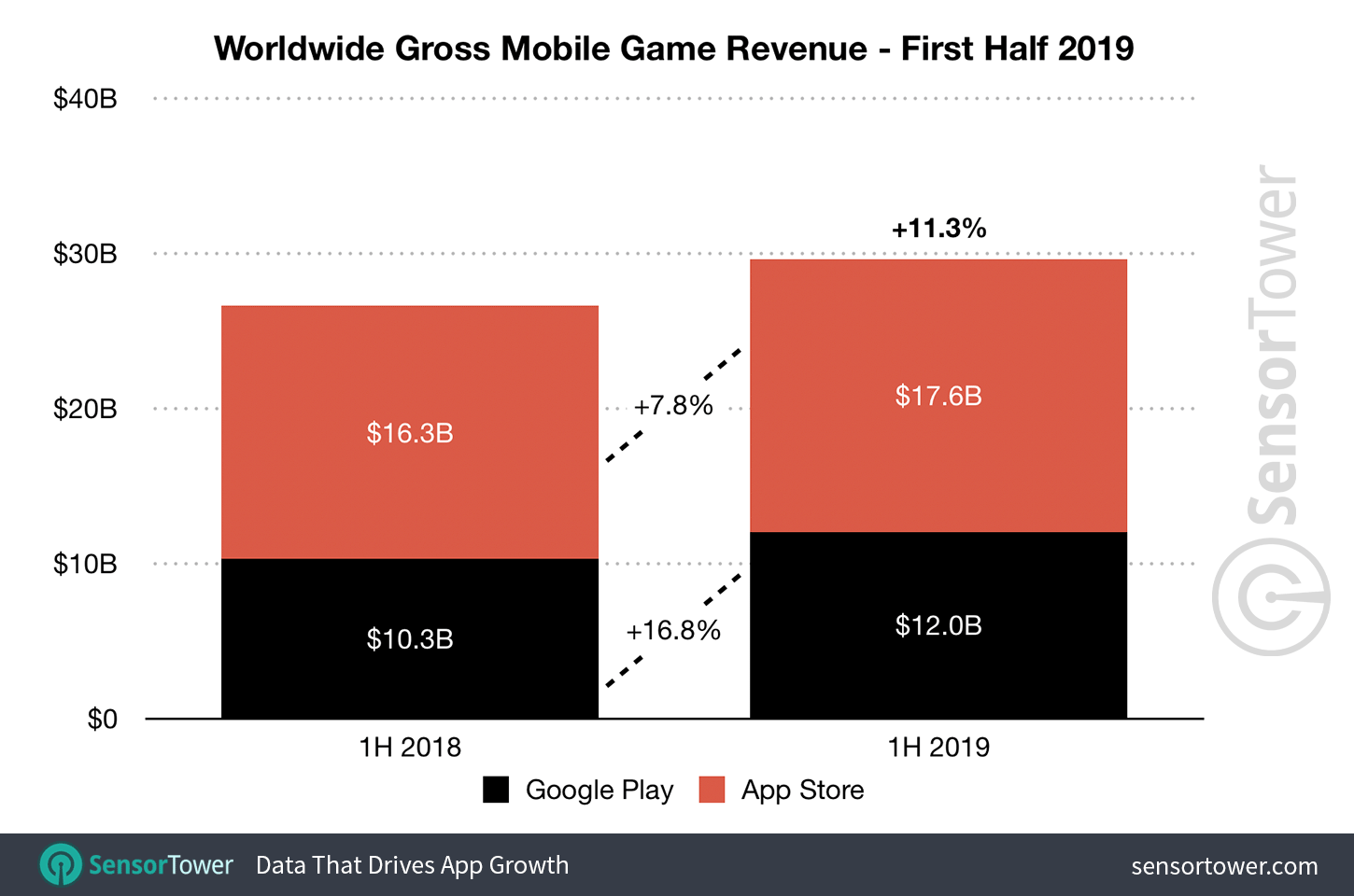

Mobile game spending was up 11.3 percent Y/Y in the first half, reaching an estimated $29.6 billion across both stores. Due to an overall downturn in consumer spending on iOS apps in China, along with the lingering effects of a pause on new mobile game approvals in the country, App Store revenue grew at a modest 7.8 percent Y/Y during the half to $17.6 billion. Google Play games spending grew more considerably at 16.8 percent, reaching $12 billion for the half.

Honor of Kings from Tencent continued its run at the No. 1 grossing mobile game globally in the first half, bringing in more than $728 million, not including China's third-party Android stores. Fate/Grand Order from Sony Aniplex, the No. 3 game by revenue in 1H18, moved to No. 2 in 1H19 and grossed an estimated $628 million. Monster Strike from Mixi dropped to No. 3 overall, generating approximately $566 million.

Candy Crush Saga from King and PUBG Mobile from Tencent ranked No. 4 and No. 5 for spending, respectively. The latter rocketed into the top five thanks to Chinese user spending in Game For Peace, the PUBG Mobile variant designed specifically for that market. It grossed an estimated $141 million during the first half on iOS alone.

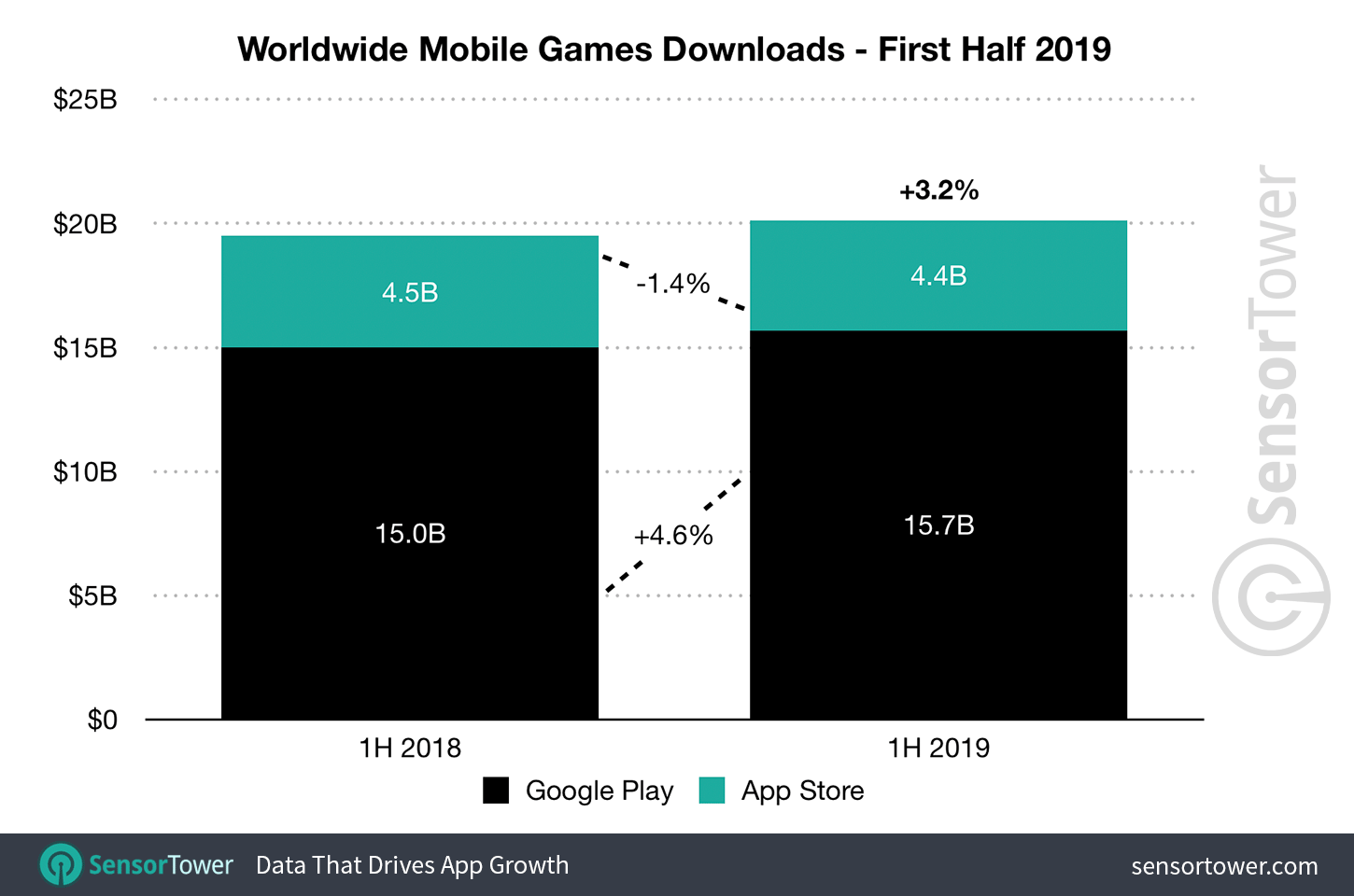

New mobile game downloads totaled 20.1 billion in the first half, up 3.2 percent from 1H18. Game downloads on iOS fell 1.4 percent Y/Y to 4.4 billion due to aforementioned factors, while they grew 4.6 percent Google Play to 15.7 billion.

Color Bump 3D from Good Job Games, Garena Free Fire from Garena, and PUBG Mobile from Tencent were the three most downloaded mobile games across both stores during 1H19.

Q2 2019 App Revenue and Downloads — First Look

We'll publish our full report on the global app ecosystem in the second quarter of 2019 soon, but initial figures show that global spending in mobile apps during Q2 2019 reached a total of nearly $20 billion, up 17.2 percent Y/Y. App Store spending totaled approximately $12.9 billion, a Y/Y increase of 17.8 percent, while Google Play's gross revenue grew 16.3 percent to $7.1 billion. First-time app downloads in Q2 totaled 28.7 billion worldwide, an increase of 11.5 percent over Q2 2018. As mentioned earlier, App Store downloads grew about 3 percent Y/Y to 7.4 billion while Google Play installs climbed 14.9 percent to 21.3 billion.

Note: The revenue estimates contained in this report are not inclusive of local taxes, in-app advertising, or in-app user spending on mobile commerce, e.g., purchases via the Amazon app, rides via the Uber app, or food deliveries via the GrubHub app. Refunds are also not reflected in the provided figures.