2026 State of Mobile is Live!

Mobile App Insights · Stephanie Chan · June 2020

Global App Revenue Reached $50 Billion in the First Half of 2020, Up 23% Year-Over-Year

Sensor Tower Store Intelligence data reveals that worldwide consumer spending in apps for the first two quarters of 2020 grew significantly more than in 1H 2019.

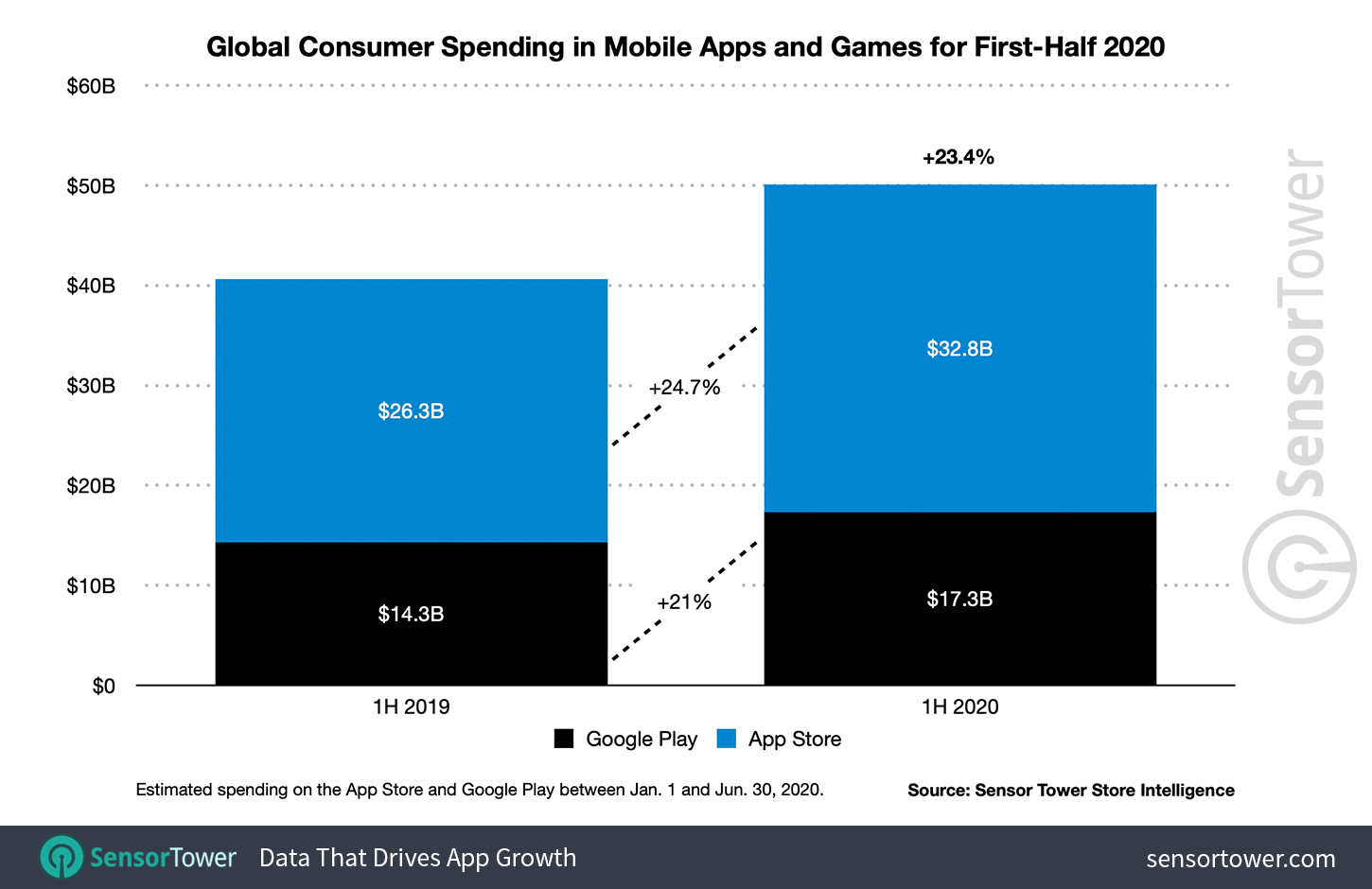

Consumers spent a combined total of $50.1 billion worldwide on the App Store and Google Play in the first half of 2020, preliminary Sensor Tower Store Intelligence estimates and projections through June 30 show. This was 23.4 percent more than the $40.6 billion we estimate mobile users spent across both stores during the same period in 2019. Previously, revenue had increased 20 percent between the first half of 2018 and 2019; this year's more significant growth reflects a trend of greater overall spending as a result of COVID-19's impact on the global app ecosystem.

Worldwide Mobile App Revenue and Downloads

Apple's App Store generated an estimated $32.8 billion globally from in-app purchases, subscriptions, and premium apps and games in the first half of 2020. This figure is 24.7 percent more year-over-year from the $26.3 billion spent during the same period in 2019. Spending on Apple's marketplace was nearly twice the estimated gross revenue on Google Play, which clocked in at $17.3 billion. That was up 21 percent Y/Y from the first half of 2019, when we estimate consumers spent $14.3 billion on Google Play.

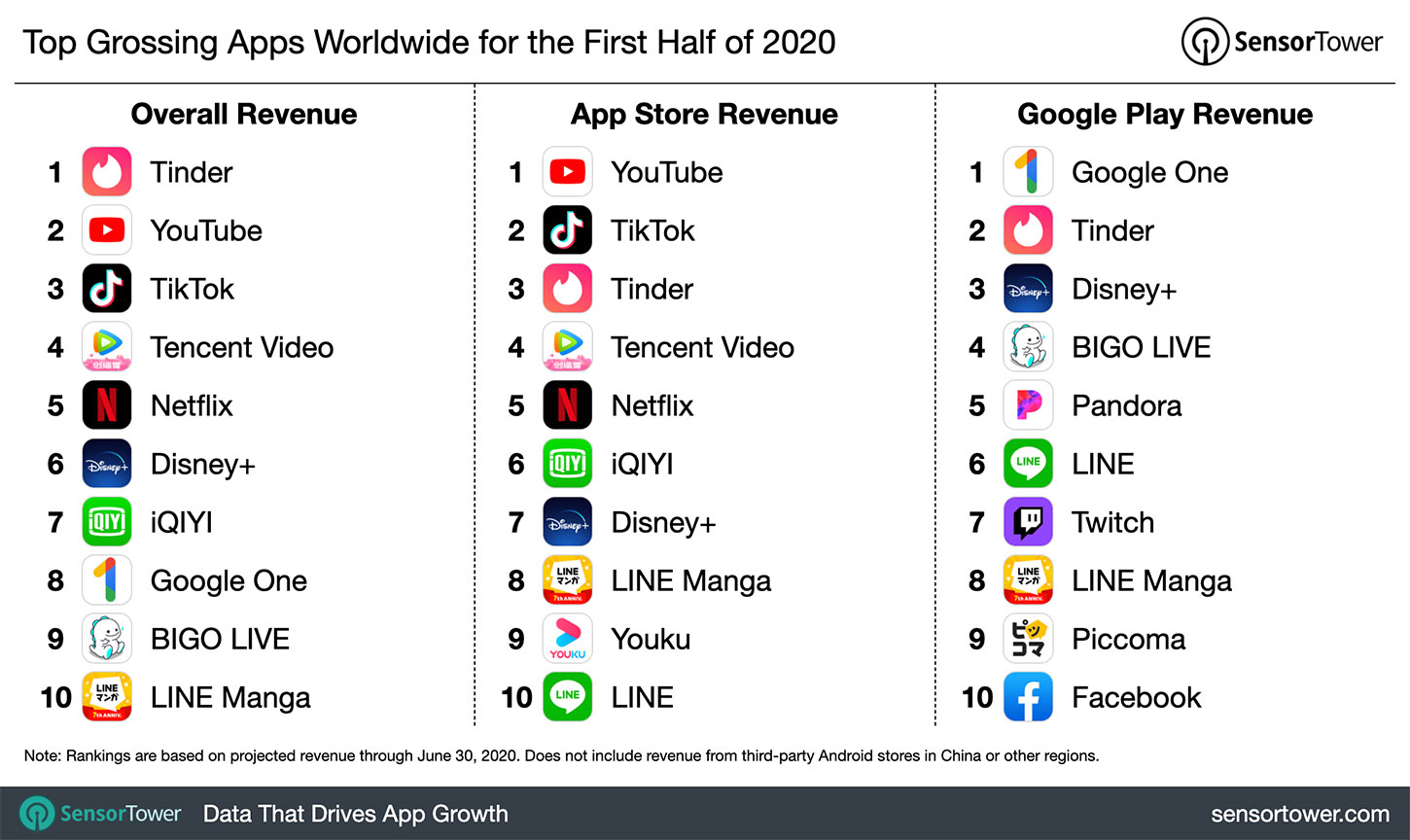

Tinder maintained its No. 1 spot as the highest earning non-game app in 1H20, generating an estimated $433 million in spending across both stores. This figure represents a dip of about 19 percent Y/Y, down from $532 million in 1H19. The decrease in revenue may be due to COVID-19, whether from changes in users' spending behavior or perhaps because Tinder made its premium feature Passport available for free to all users in April 2020.

At No. 2, YouTube had an estimated consumer spend of $431 million globally. ByteDance's TikTok, ranked No. 3, generated $421 million on the App Store and Google Play in 1H20. The social video app, which includes Douyin in China, broke download records earlier this year with the best quarter ever for any app and has now surpassed 2 billion global downloads. Tencent Video and Netflix rounded out the top five non-game apps at No. 4 and No. 5, respectively.

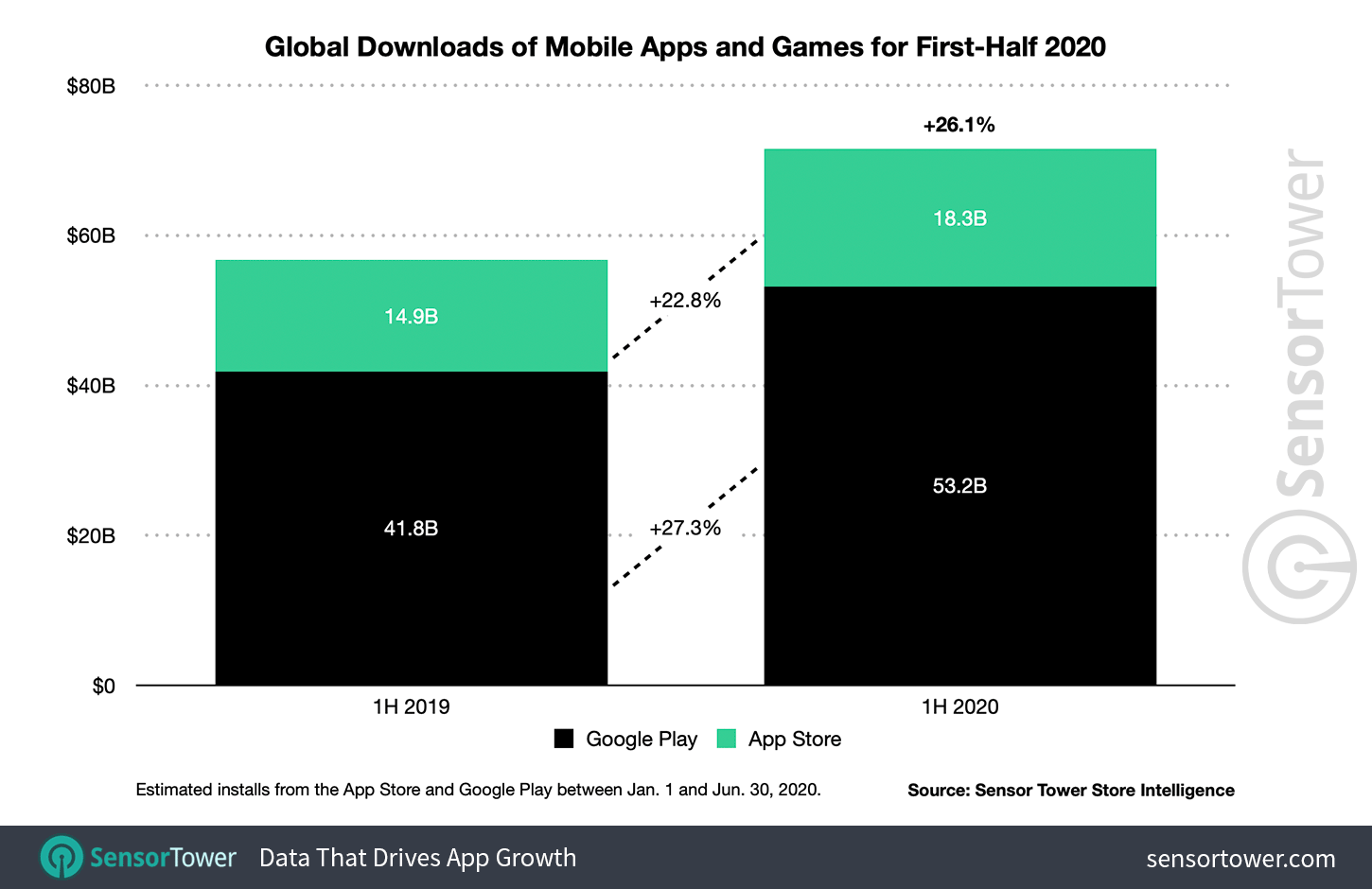

There were an estimated 71.5 billion first-time app installs during the first half of 2020, up 26.1 percent Y/Y. Apple's App Store accounted for 18.3 billion of those, a figure that represents 22.8 percent growth Y/Y from 14.9 billion downloads from the App Store in the first half of 2019. The growth was driven in part by how COVID-19 has impacted user behavior during global lockdowns. As we previously shared, shelter-in-place orders have affected a wide swath of apps, from shopping and entertainment to education.

First-time app installs for 1H20 totalled 53.2 billion from Google Play, up 27.3 percent Y/Y from 41.8 billion in the same period in 2019. Similar to historic performance, the number of downloads from Google's platform was nearly three times higher than those on the App Store.

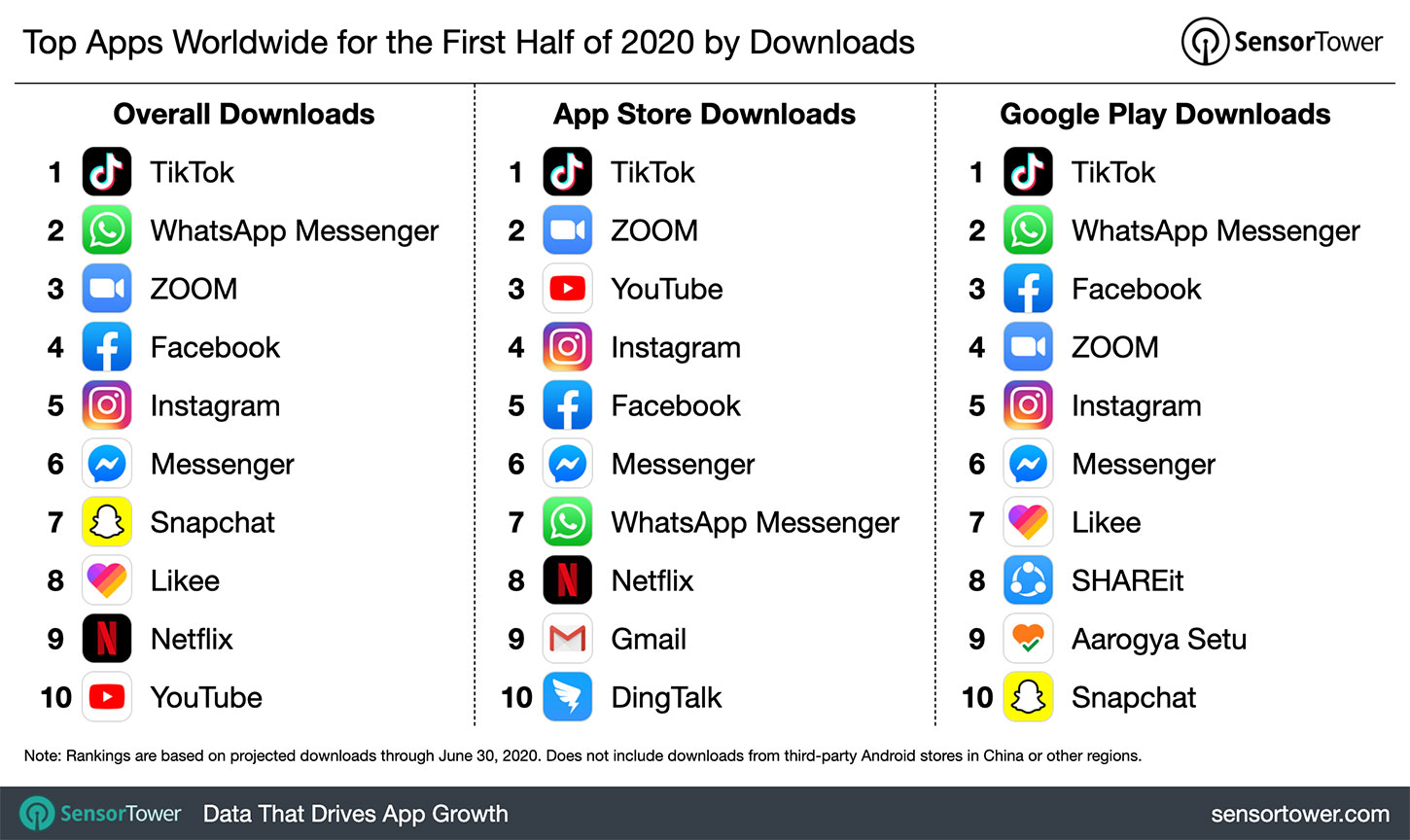

Across both the App Store and Google Play, TikTok ranked as the top non-game app by downloads, clocking in at 626 million installs in the first half of 2020 alone, including Douyin's iOS version in China. WhatsApp and Zoom followed at No. 2 and 3, respectively, while Facebook and Instagram rounded out the top five as No. 4 and No. 5, respectively.

Worldwide Mobile Game Revenue and Downloads

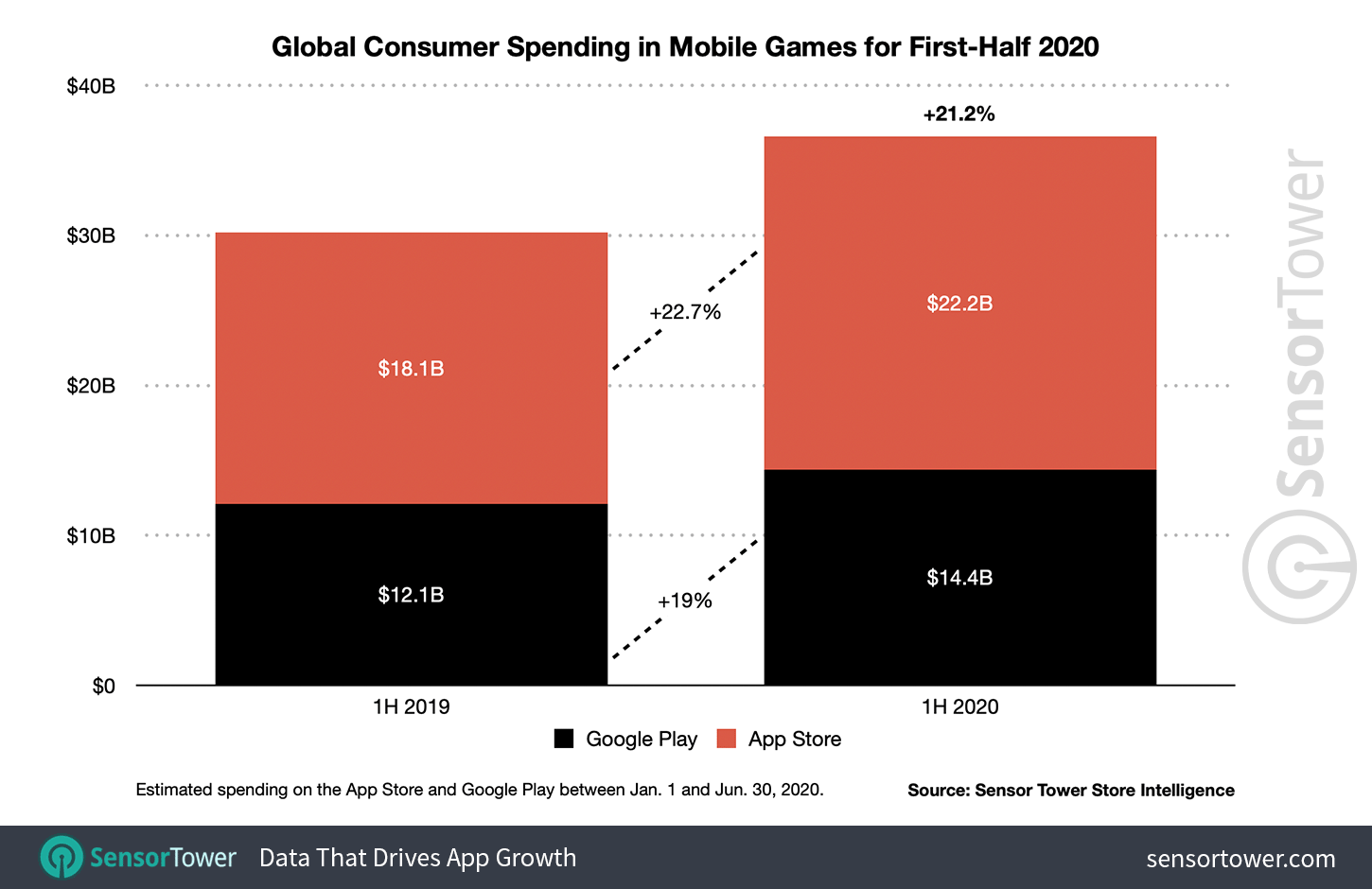

Interest in mobile games surged in the first half of 2020 due in part to shelter-in-place orders around the world. Mobile game spending was up 21.2 percent Y/Y, bringing in an estimated $36.6 billion on the worldwide App Store and Google Play. The App Store experienced in-game spending growth of 22.7 percent Y/Y, reaching $22.2 billion. Gross revenue generated by Google Play games hit $14.4 billion, reflecting 19 percent growth Y/Y for 1H20.

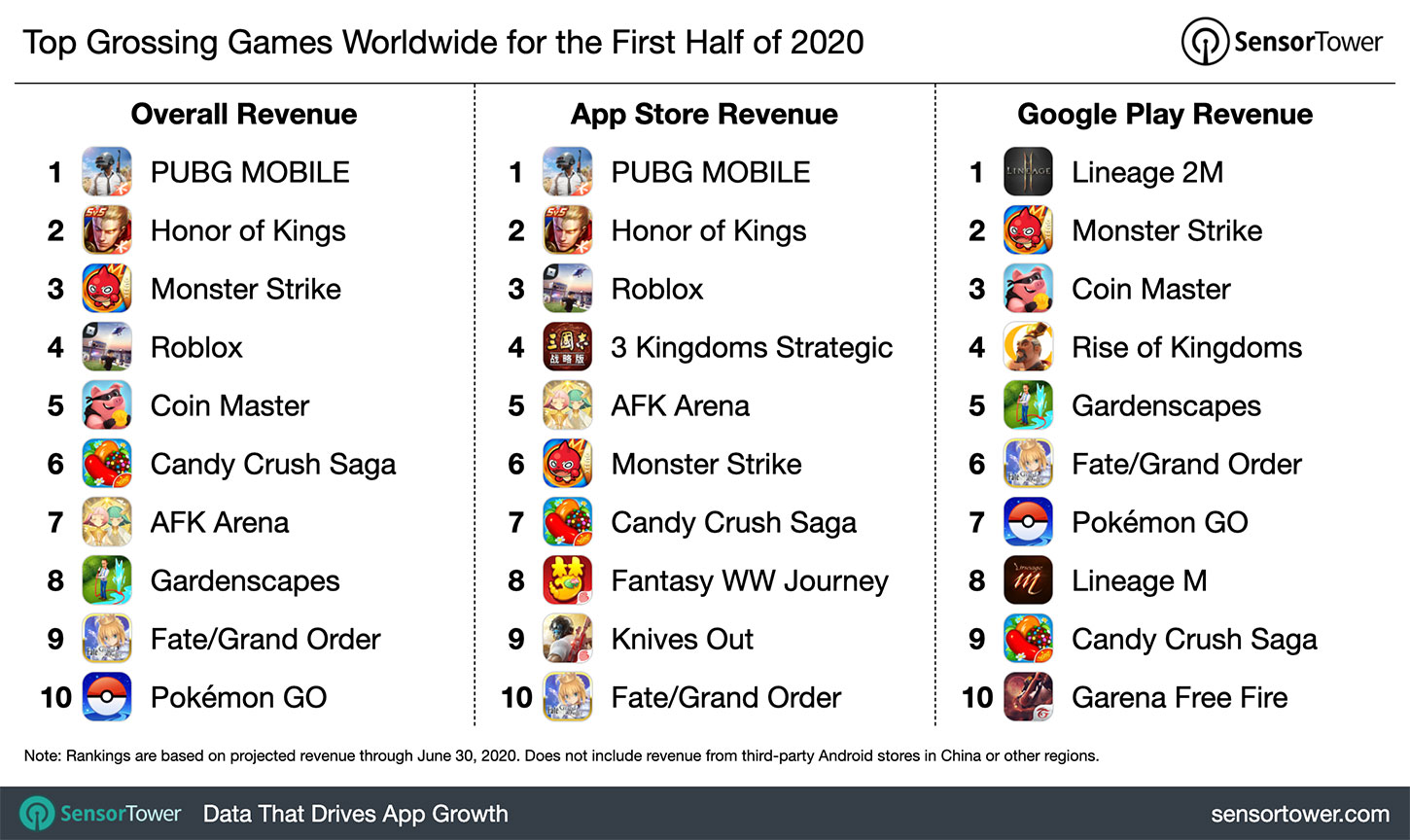

Tencent's PUBG Mobile unseated Honor of Kings as the top-grossing game for the first half of the year. The mobile battle royale game, which includes Tencent's localized versions Game for Peace and Peacekeeper Elite, earned a hefty estimated $1.3 billion globally on the App Store and Google Play, not including China's third-party Android marketplaces.

Honor of Kings was the second highest-grossing game, bringing in roughly $1 billion worldwide outside of third-party Android stores, up 24.5 percent Y/Y. The mobile MOBA also comes from Tencent, which means the publisher generated more than $2 billion from its two chart-toppers.

Mixi's Monster Strike maintained its No. 3 position from 1H19, generating about $632 million in the first half of this year. Roblox and Coin Master rounded out the top five highest-grossing mobile games at No. 4 and 5, respectively. Roblox recently passed $1.5 billion in lifetime revenue, and Coin Master is approaching the $1 billion milestone, racking up about $780 million gross revenue since it launched in 2016.

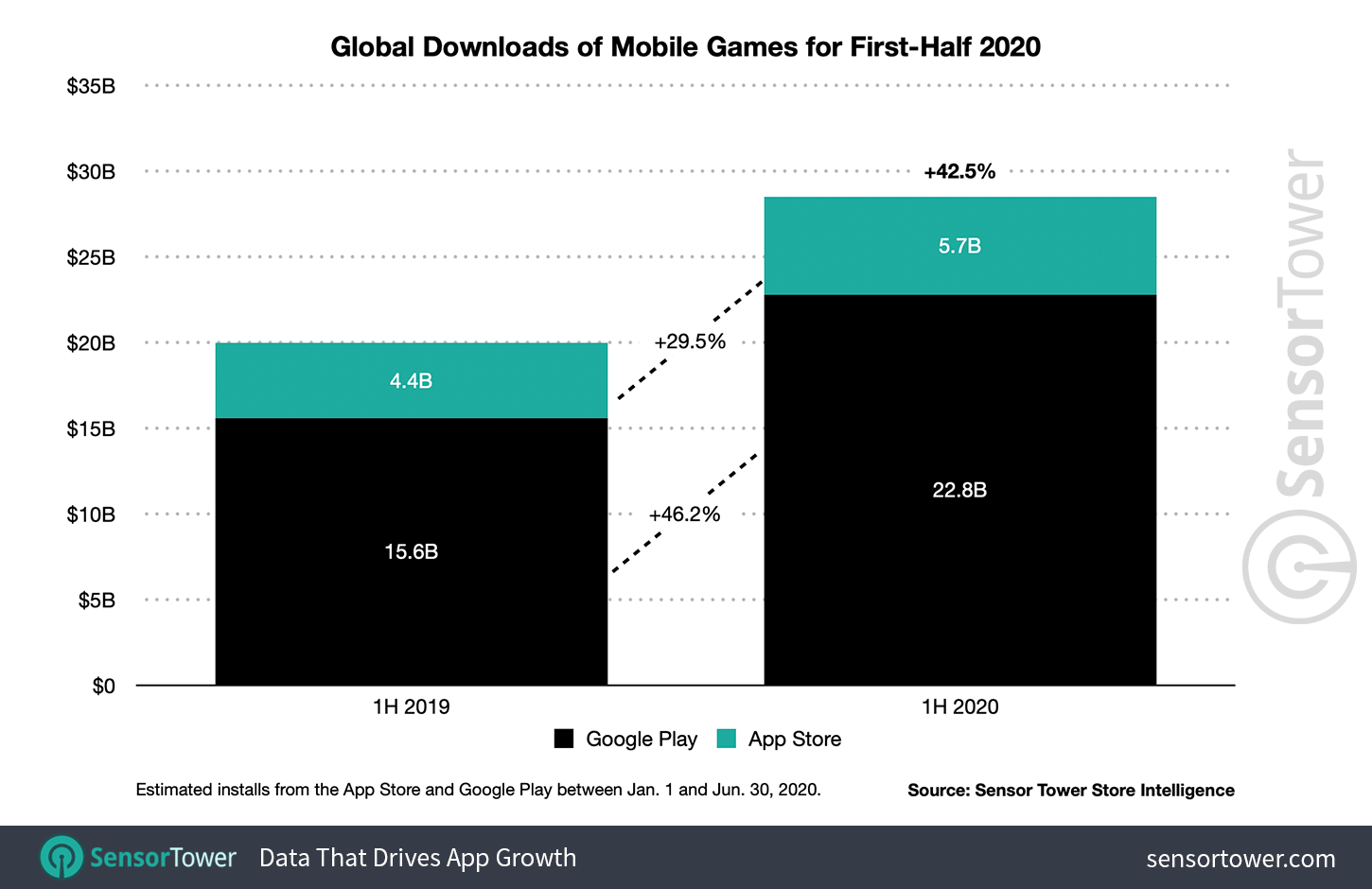

New mobile game downloads were on the rise in the first half of 2020, totaling an estimated 28.5 billion first-time installs across the App Store and Google Play worldwide. This was up 42.5 percent Y/Y from the same period in 2019, which saw about 20 billion installs. Downloads on Google Play increased nearly 1.5 times, growing 46.2 percent Y/Y to 22.8 billion in 1H20. The App Store also grew, jumping 29.5 percent Y/Y to 5.7 billion downloads.

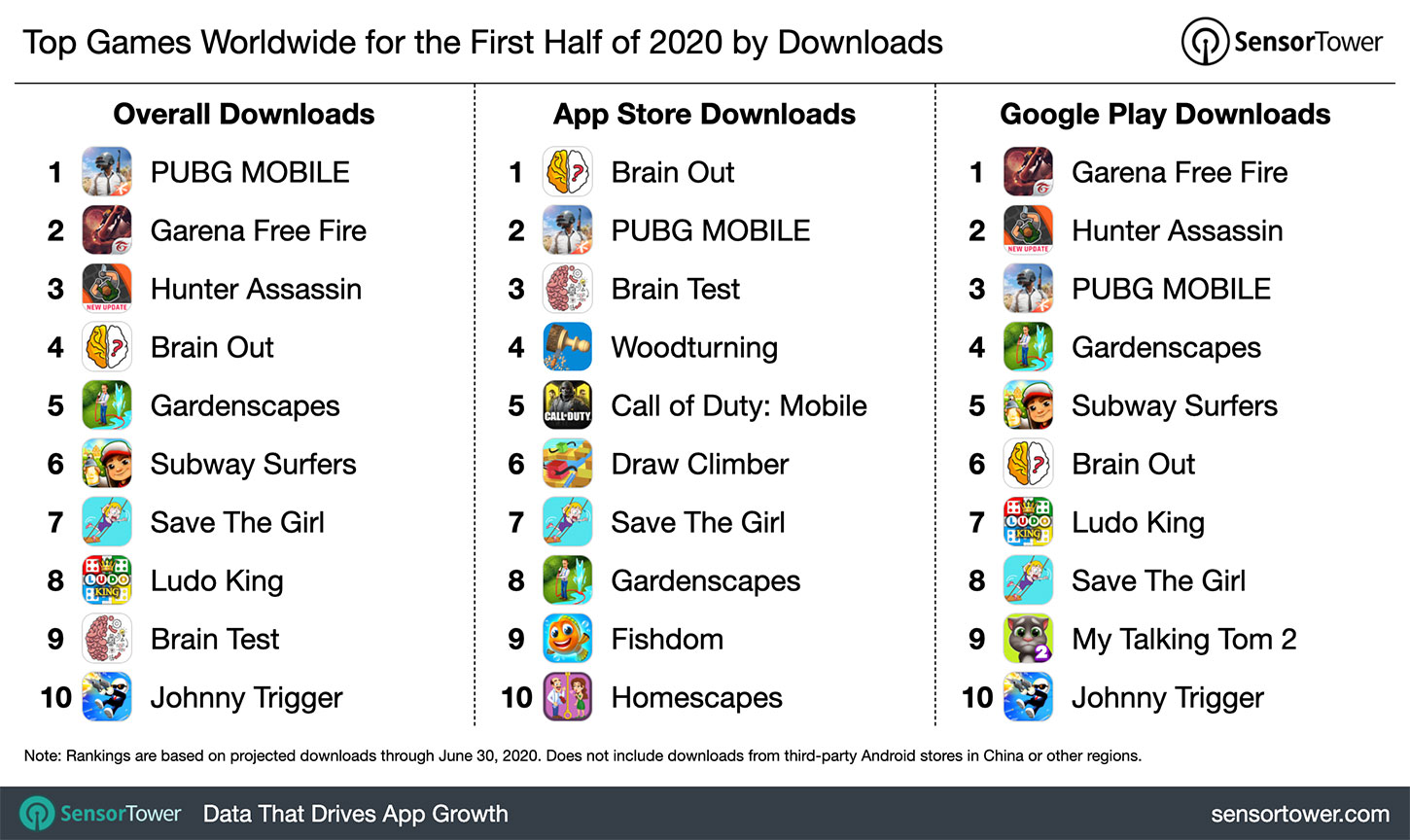

Battle royale titles were king of the hill when it came to the top downloaded games, with Tencent's PUBG Mobile and Garena's Garena Free Fire taking the No. 1 and No. 2 spots, respectively. Rounding out the top five were Ruby Game Studio's Hunter Assassin, Eyewind Limited's Brain Out, and Playrix's Gardenscapes.

Q2 2020 App Revenue and Downloads

Our full report on the global app ecosystem in the second quarter of 2020 is coming soon, but our initial projections show that consumers spent $26.4 billion worldwide in 2Q20, up 28.8 percent Y/Y. The majority of the spending came from the App Store, which climbed 29.3 percent Y/Y and hit an estimated $17.2 billion. Google Play's gross revenue grew 27.8 percent, totaling about $9.2 billion.

New app downloads in Q2 reached around 37.8 billion globally, a figure that represents 31.7 percent growth Y/Y. App Store installs grew 23 percent Y/Y to 9.1 billion, and Google Play downloads increased 34.7 percent to 28.7 billion.

Due to the impact of COVID-19 on user behavior, both revenue and downloads showed outsized quarter-over-quarter growth this year compared to past periods. Consumer spending in Q2 jumped up about 11 percent Q/Q from Q1 of this year, a significant increase from the 1.4 percent growth between 1Q19 and 2Q19 the year before. Downloads were also up 12 percent Q/Q in the second quarter this year compared to just 2.5 percent growth between 1Q19 and 2Q19.

Note: The revenue estimates contained in this report are not inclusive of local taxes, in-app advertising, or in-app user spending on mobile commerce, e.g., purchases via the Amazon app, rides via the Uber app, or food deliveries via the GrubHub app. Refunds are also not reflected in the provided figures.