2026 State of Mobile is Live!

Mobile App Insights · Randy Nelson · April 2019

Global App Revenue Reached $19.5 Billion Last Quarter, Up 17% Year-Over-Year

Sensor Tower Store Intelligence data reveals that Apple's App Store earned TK% more than Google Play in Q1 2019.

Mobile consumers spent an estimated $19.5 billion globally on the App Store and Google Play during the first quarter of 2019, Sensor Tower Store Intelligence data reveals. This represented a 16.9 percent year-over-year increase from the year-ago quarter, when we estimate the stores saw a combined $16.7 billion in gross consumer spend on in-app purchases, subscriptions, and premium apps. This report examines the breakdown of spending and first-time app installs across both stores last quarter, along with their top apps and games by revenue and installs.

Worldwide Mobile App Revenue and Downloads

Apple's App Store accounted for approximately 64 percent of revenue generated by the two stores last quarter, with consumer spending on the platform totaling approximately $12.4 billion globally. This was an increase of 15 percent from the year-ago quarter when spending reached an estimated $10.8 billion.

Google Play revenue grew 20.2 percent year-over-year to approximately $7.1 billion, or about 57 percent of the App Store's total, up from $5.9 billion in Q1 2018.

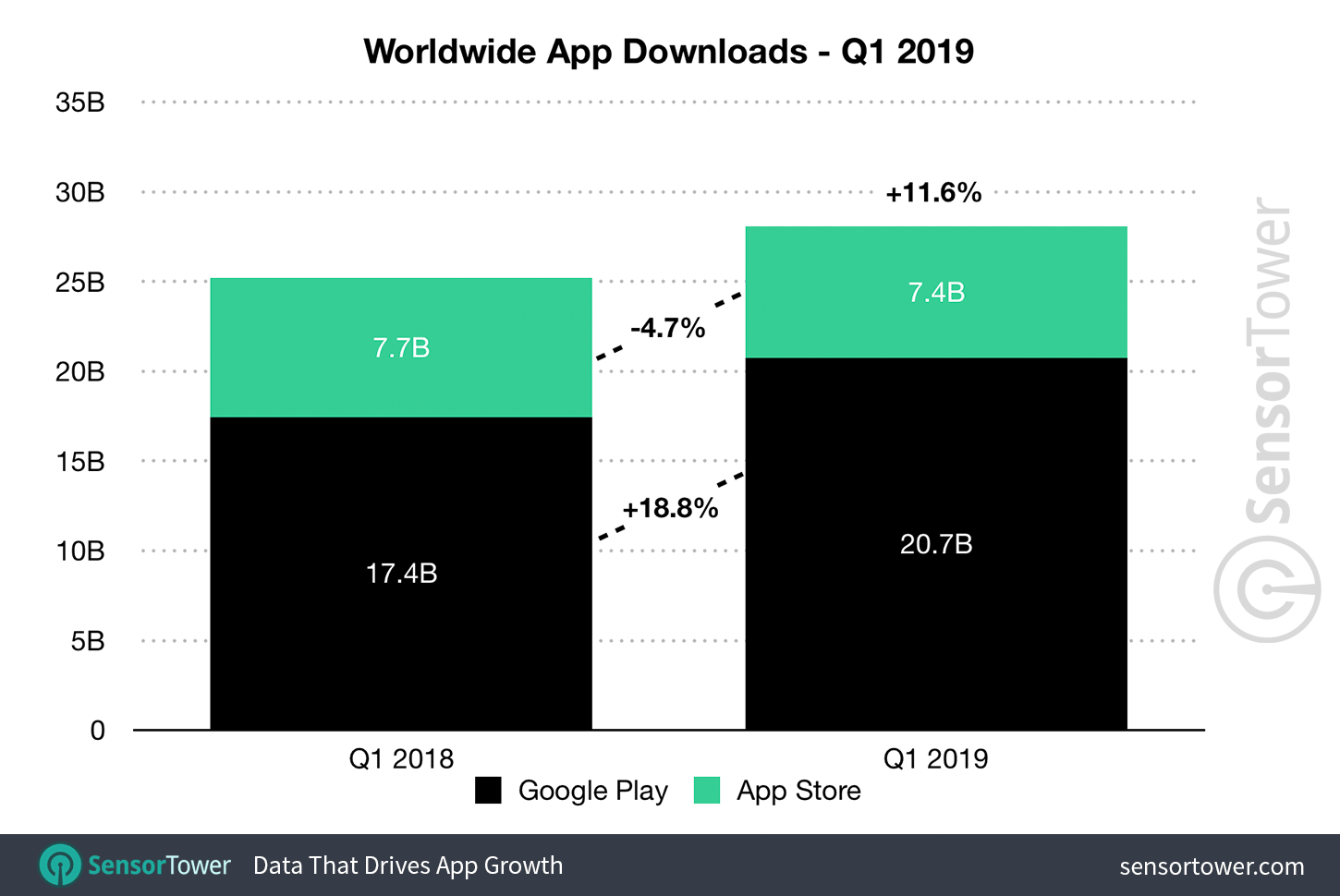

First-time app installs grew a combined 11.6 percent Y/Y to 28.1 billion, with Google Play accounting for nearly 74 percent of those. This was Y/Y growth of 18.8 percent for Google's store, which saw 17.4 billion in the year-ago quarter.

The App Store's total installs decreased slightly Y/Y last quarter to 7.4 billion, a 4.7 percent decline which resulted from reduced installs in China due to a governmental pause on mobile game certification. Downloads for the quarter fell 21 percent Y/Y on China's App Store, but grew 3.6 percent outside the country. For reference, worldwide App Store installs grew 1.5 percent Y/Y in 4Q18. Sensor Tower projections from our 2019-2023 App Market Forecast call for first-time app installs on Apple's platform to grow Y/Y for full-year 2019.

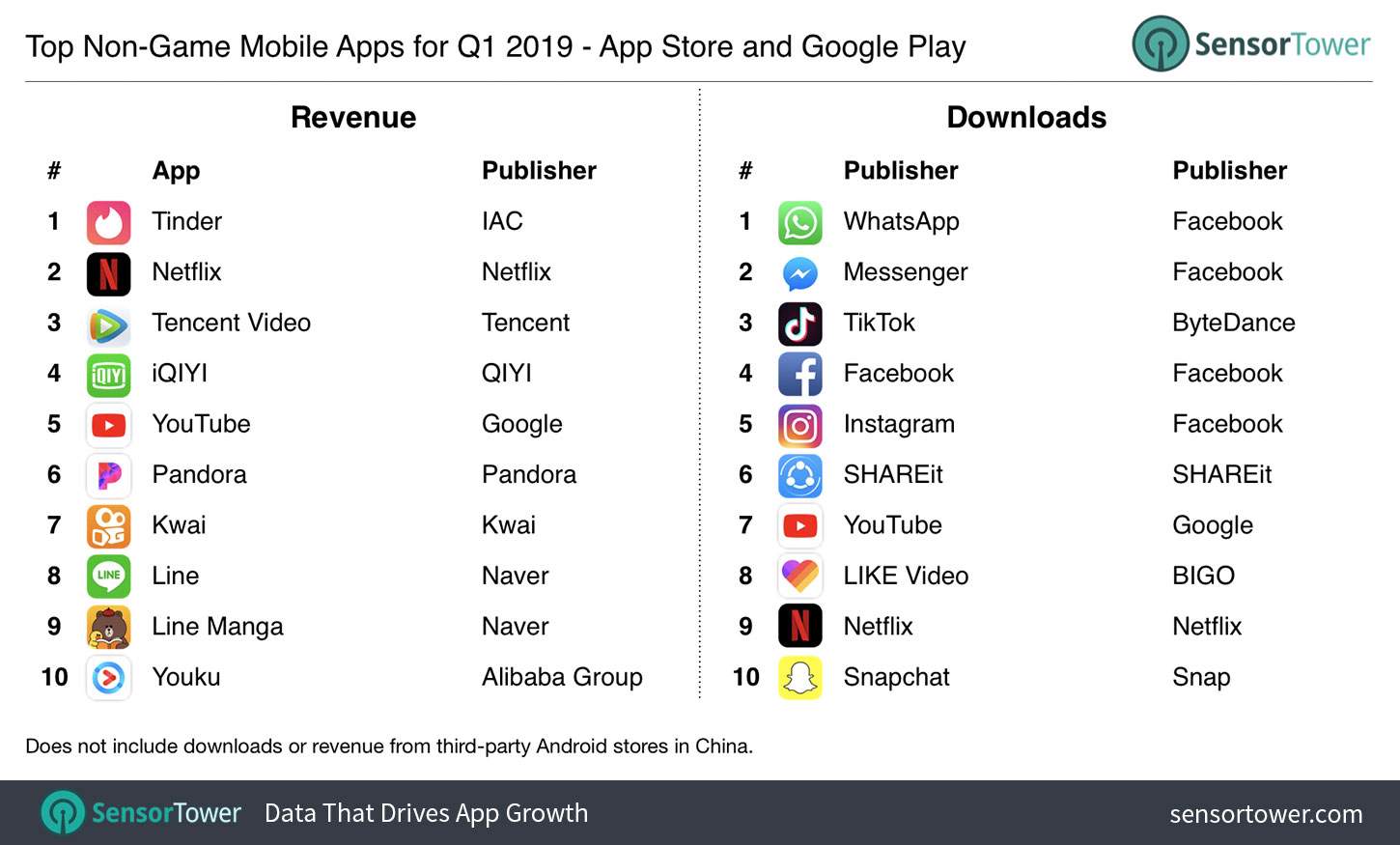

Last quarter was the first since 4Q16—more than two years–that Netflix was not the world's top-earning non-game app across both stores. This came as the result of Netflix removing in-app subscriptions on iOS, a move that means it retains 15 to 30 percent more subscriber revenue on users not billed through the App Store—and Apple, in turn, loses that revenue. Total Netflix user spending across the App Store and Google Play for Q1 was approximately $216.3 million globally, down 15 percent quarter-over-quarter from $255.7 million in 4Q18.

Netflix's decline and Tinder's growth results in the latter app claiming the top revenue spot for the quarter. For its part, IAC's dating app saw its revenue grow 42 percent Y/Y in Q1 to approximately $260.7 million, up from $183 million in 1Q18.

Bytedance's popular short-video app TikTok retained its No. 3 ranking in for first-time installs from 4Q18, while the remaining four of the top five most-downloaded apps—all from Facebook—were also unmoved from their positions in the previous quarter. TikTok grew new users 70 percent Y/Y for the quarter, reaching 188 million worldwide, up from 110 million in 1Q18.

Worldwide Mobile Game Revenue and Downloads

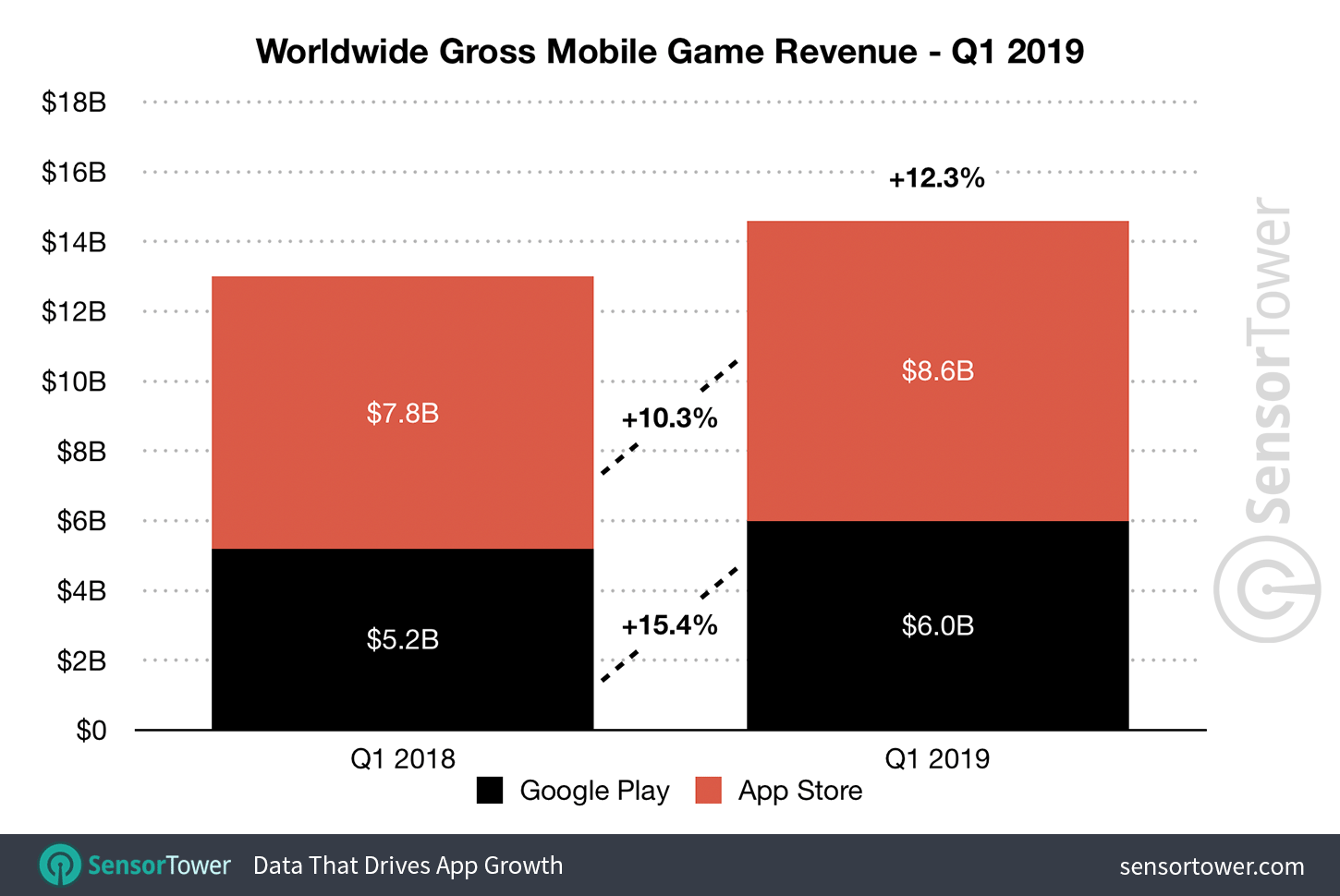

Looking at mobile games, spending in the category increased 12.3 percent Y/Y to $14.6 billion globally, up from $13 billion in 1Q18, and accounted for 76 percent of all app revenue. Apple's App Store represented the largest portion of this revenue at $8.6 billion or 59 percent, up 10.3 percent Y/Y. Google Play games spending totaled $6 billion, a 15.4 percent Y/Y increase from $5.3 billion in 1Q18.

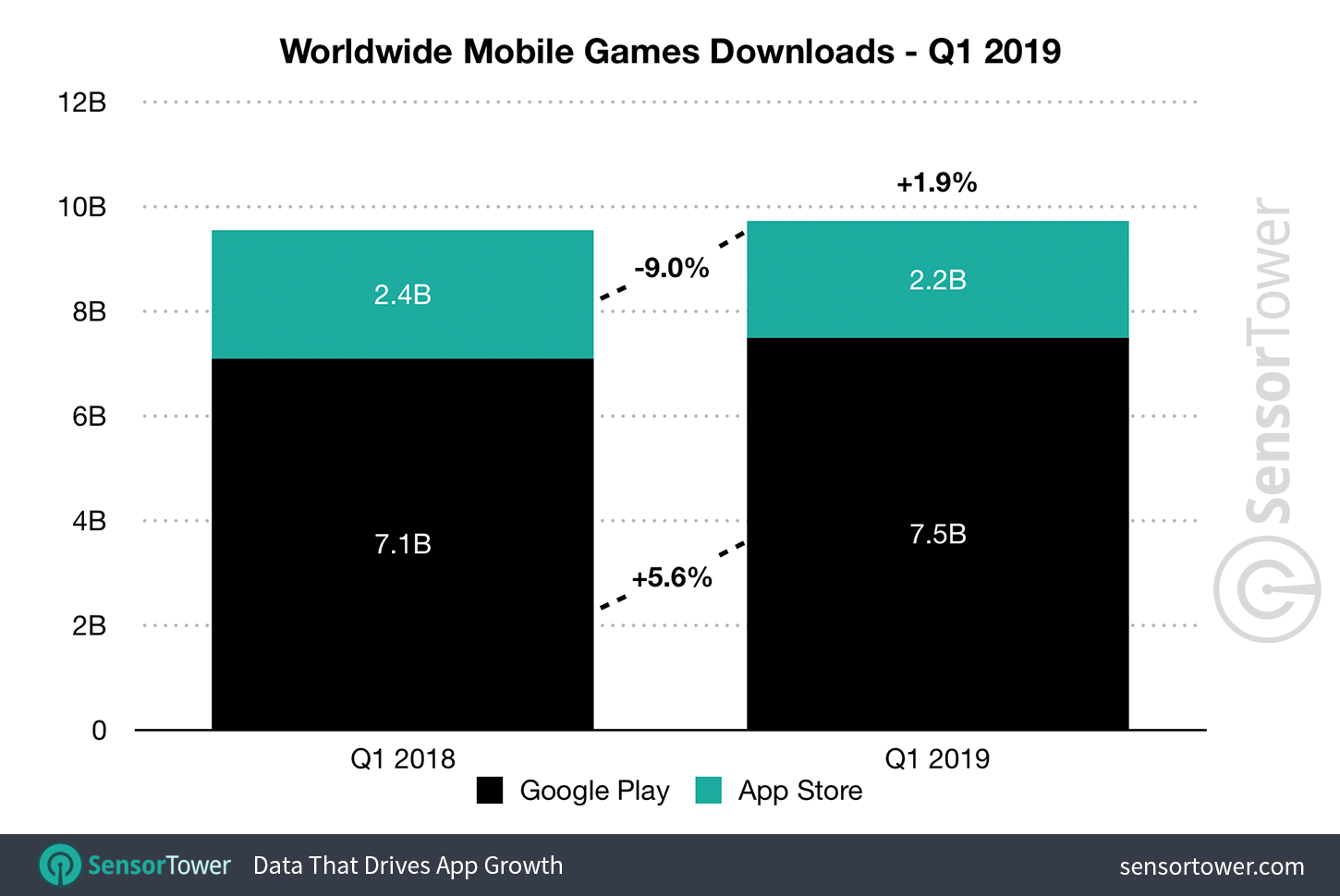

Mobile game downloads grew marginally at 1.9 percent Y/Y to 9.7 billion worldwide. The App Store saw 2.2 billion of these, down 9 percent Y/Y from 2.4 billion in 1Q18 due to the aforementioned game approval freeze in China. Google Play game installs grew 4.5 percent Y/Y to 7.5 billion, from 7.1 billion in the year-ago quarter.

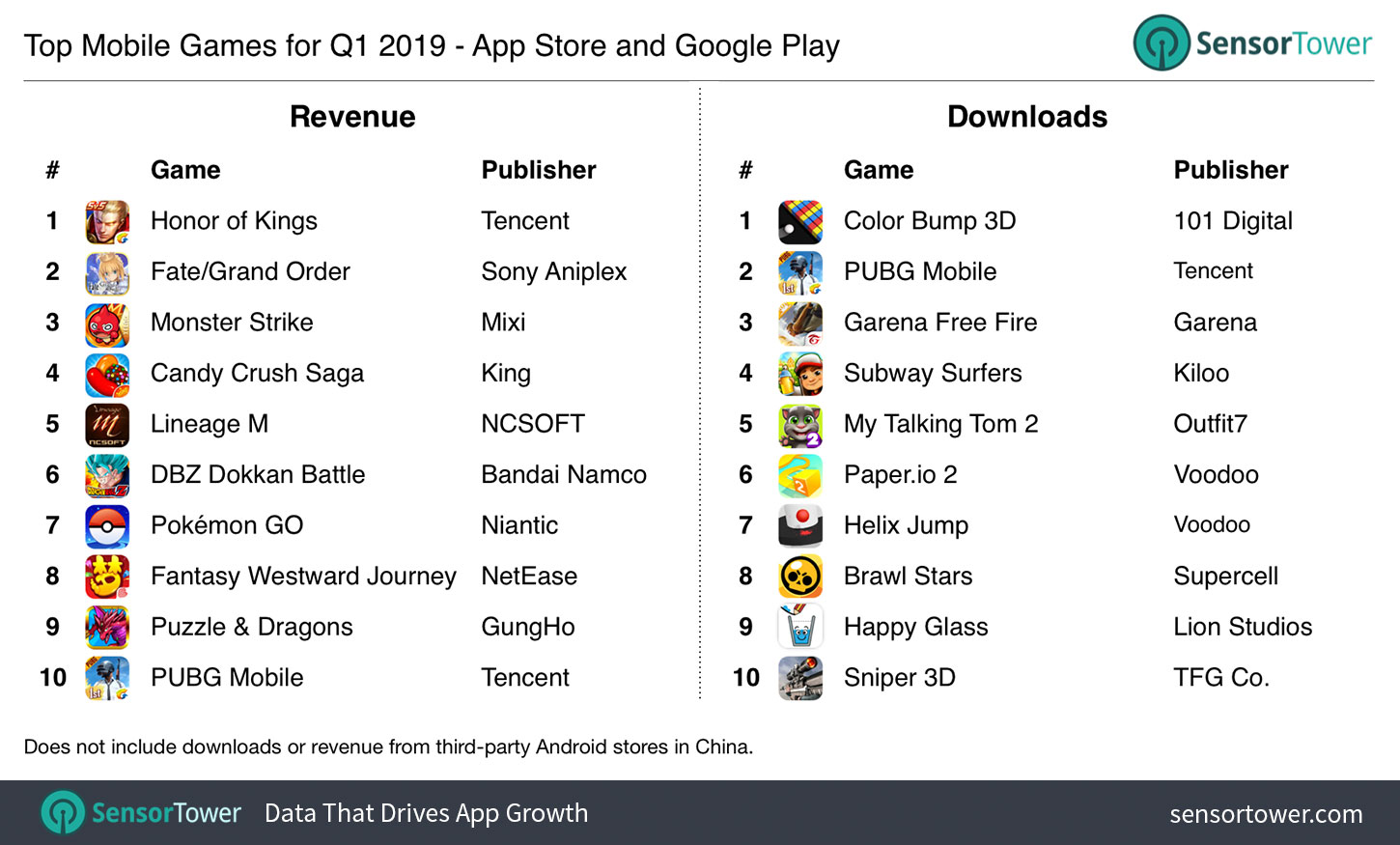

Eight of the top 10 grossing mobile games in Q1 were developed in Asia, led by Tencent's MOBA Honor of Kings, which was once again the world's No. 1 earning mobile app across all categories. PUBG Mobile, also from Tencent, entered the revenue top 10 for the first time last quarter, replacing its chief rival, Fortnite from Epic Games, which was ranked at No. 10 for revenue in 4Q18. It grossed an estimated $149 million worldwide last quarter.

Dragon Ball Z Dokkan Battle from Bandai Namco was another standout in terms of player spending for the quarter, ranking No. 6 when it had been the No. 13 grossing game in 4Q18. Sensor Tower estimates that it grossed $213 million in Q1, up 29 percent Y/Y from $166 million in the year-ago quarter.

Battle Royale titles also made their presence felt in the top 10 for game downloads, with PUBG Mobile and Garena Free Fire occupying the No. 2 and No. 3 positions, respectively. Another realtime multiplayer title, Brawl Stars from Supercell, ranked No. 8 for the quarter with more than 43 million new players globally, having ranked No. 14 overall during 4Q18, its first quarter of global availability.

Sensor Tower will have further analysis of Q1 2019's top publishers, apps, and trends soon.

Note: The revenue estimates contained in this report are not inclusive of local taxes, in-app advertising, or in-app user spending on mobile commerce, e.g., purchases via the Amazon app, rides via the Uber app, or food deliveries via the GrubHub app. Refunds are also not reflected in the provided figures.