2026 State of Mobile is Live!

Mobile App Insights · Stephanie Chan · October 2021

Time Spent in Rival Apps Grew Up to 23% During Facebook Platforms Outage

Sensor Tower data reveals time spent in rival apps such as Snapchat grew up to 23 percent during Facebook platforms outage.

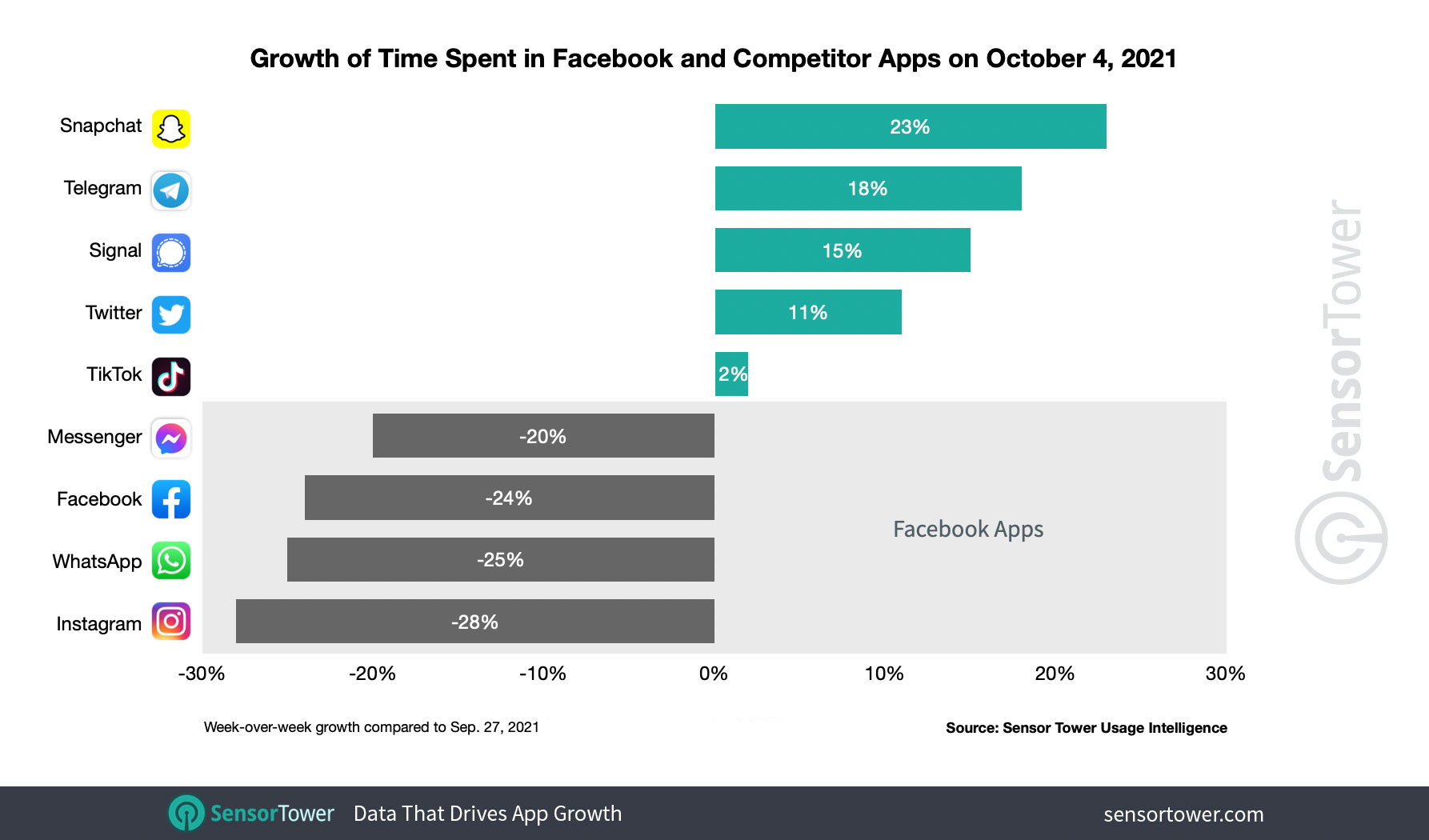

The outage that struck Facebook's apps on October 4 led consumers to seek out alternatives for social media and messaging, precipitating a surge in time spent among apps from the company's competitors. On the social media front, Snapchat saw the biggest increase as average time spent by existing users climbed 23 percent week-over-week during the outage, according to an analysis of preliminary Sensor Tower Usage Intelligence data.

Time Spent in Facebook's Rival Apps Grew up to 23 Percent

Snapchat led social media platforms in growth, with time spent climbing 23 percent W/W. Other services saw a slight increase, with Twitter's usage climbing 11 percent and TikTok experiencing a 2 percent bump.

Additionally, time spent in Signal grew 15 percent while Telegram saw time spent climb 18 percent W/W.

Unsurprisingly, the outage on Monday affected usage of Facebook's apps as a large portion of users couldn't access the services. Instagram's average time spent on Android to fall 28 percent W/W. Usage of Facebook's Android app fell by 24 percent, while WhatsApp usage declined by 25 percent and Messenger's by 20 percent.

However, this isn't necessarily an indication of a permanent shift in user behavior. Facebook's apps have proven to be resilient in the past, with WhatsApp's monthly active users remaining steady even despite the backlash earlier this year to its new privacy policy.

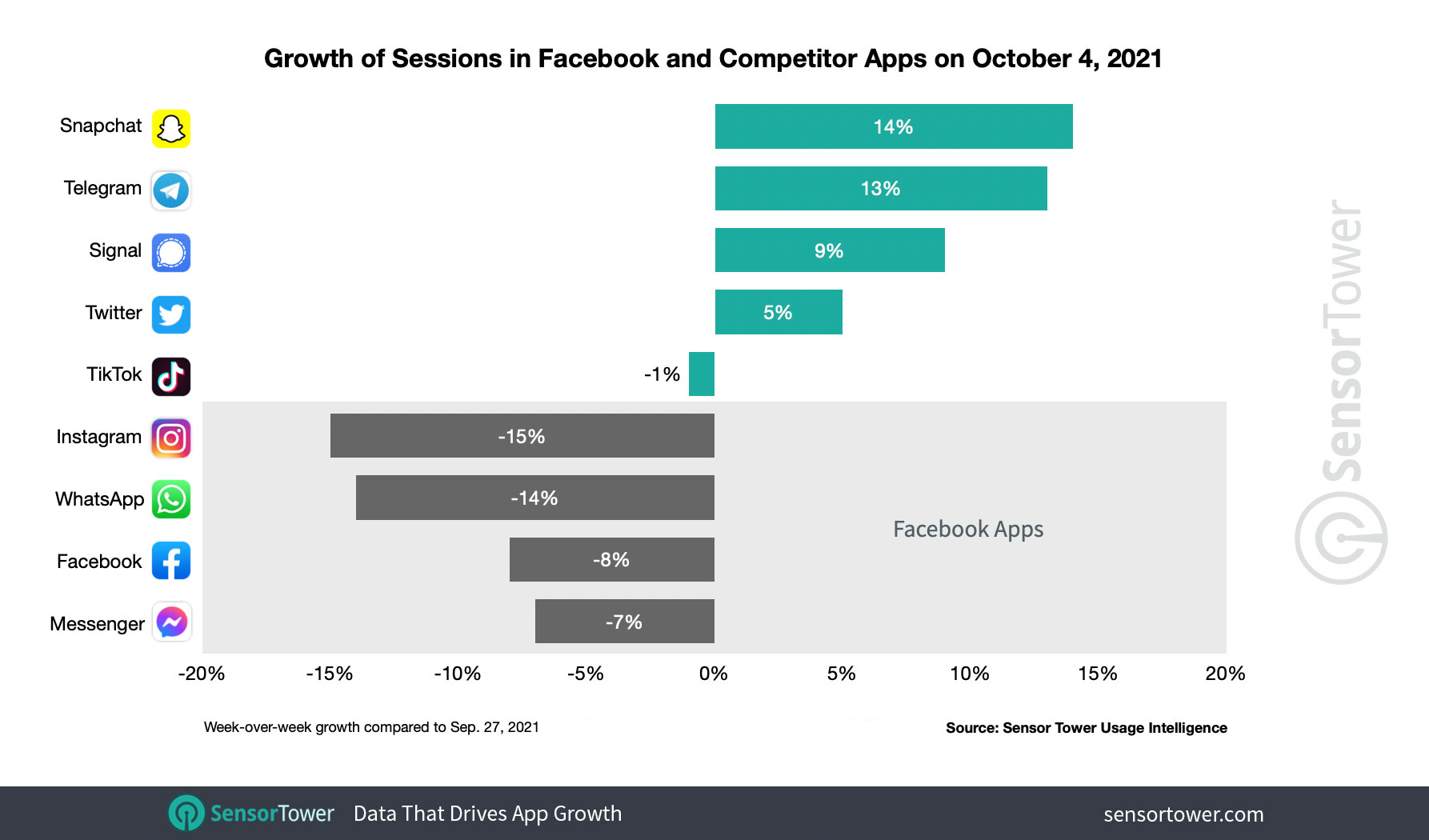

Snapchat Led Session Count Growth

An analysis of the same cohort of apps focusing on the number of sessions among existing, daily active Android users worldwide showed similar trends, with Snapchat experiencing the most W/W growth. When comparing October 4 to the week-ago day, the app saw a 14 percent increase in sessions. Twitter saw 5 percent growth W/W while TikTok saw a dip of 1 percent.

Messaging apps Telegram and Signal also saw an uptick in session count compared to September 27, climbing 13 percent and 9 percent, respectively.

Facebook's apps saw a decline in session counts by existing users due to the outage, with WhatsApp falling by 15 percent W/W, Instagram by 14 percent, Facebook by 8 percent, and Messenger by 7 percent.

Messaging App Adoption Surges

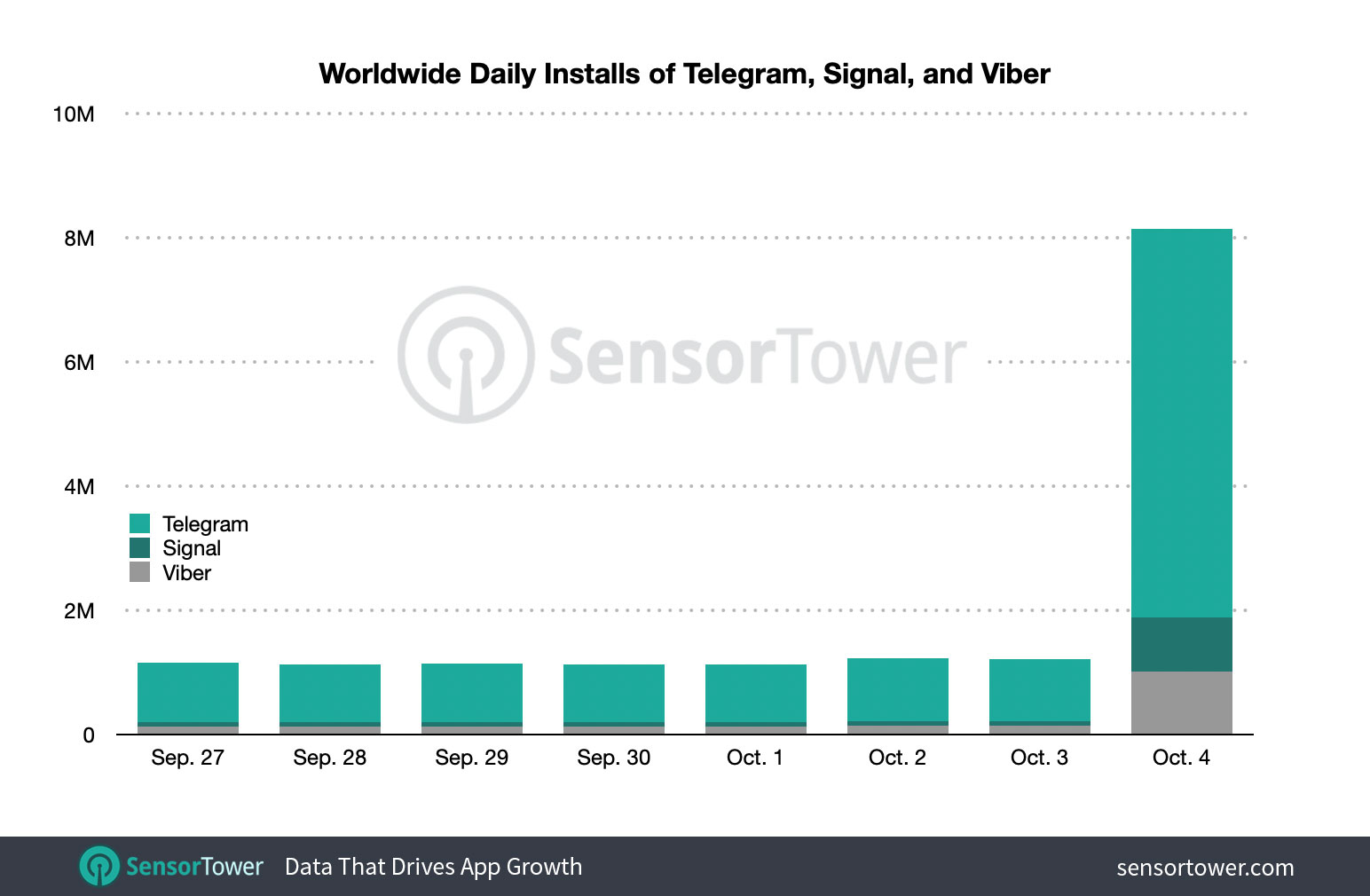

As a result of WhatsApp's outage, messaging alternatives such as Telegram and Signal saw a spike in adoption on October 4. According to preliminary Sensor Tower estimates, Signal's installs grew nearly 12 times from 74,000 worldwide on October 3 to 881,000 on the following day.

Viber experienced 630 percent day-over-day growth from 137,000 installs to 1 million, while Telegram reached 6.3 million on October 4, up 530 percent from 1 million on the previous day.

Since January 2014, WhatsApp has accrued 6 billion global installs since January 2014, while Telegram has seen approximately 1 billion installs globally and Signal has reached 113 million.

Trends to Come

This analysis of preliminary data shows that messaging alternatives such as Signal and Telegram experienced a surge in user interest; however, the long tail effect of Facebook's outage has yet to be seen.