2026 State of Mobile is Live!

Mobile App Insights · Stephanie Chan · March 2021

Top U.S. Food Delivery Apps Surpassed 90 Million Installs in 2020

Sensor Tower data reveals that the top food delivery apps reached over 90 million installs in the U.S. last year.

Worldwide installs of Food & Drink category apps grew 21 percent year-over-year to exceed 1.7 billion in 2020, with downloads led by food delivery apps as consumers continue to social distance due to COVID-19. Sensor Tower's new State of Food Delivery Apps report, available now, reveals that top food delivery apps continue to drive adoption into 2021 as the subcategory on the whole has already seen approximately 300 million installs in January and February, up 14 percent Y/Y.

Delivery Apps Drove Food & Drink Category Adoption in the U.S.

Adoption of Food & Drink category apps by consumers in the United States outpaced global trends, climbing 29 percent year-over-year to surpass 400 million installs in 2020 across the App Store and Google Play.

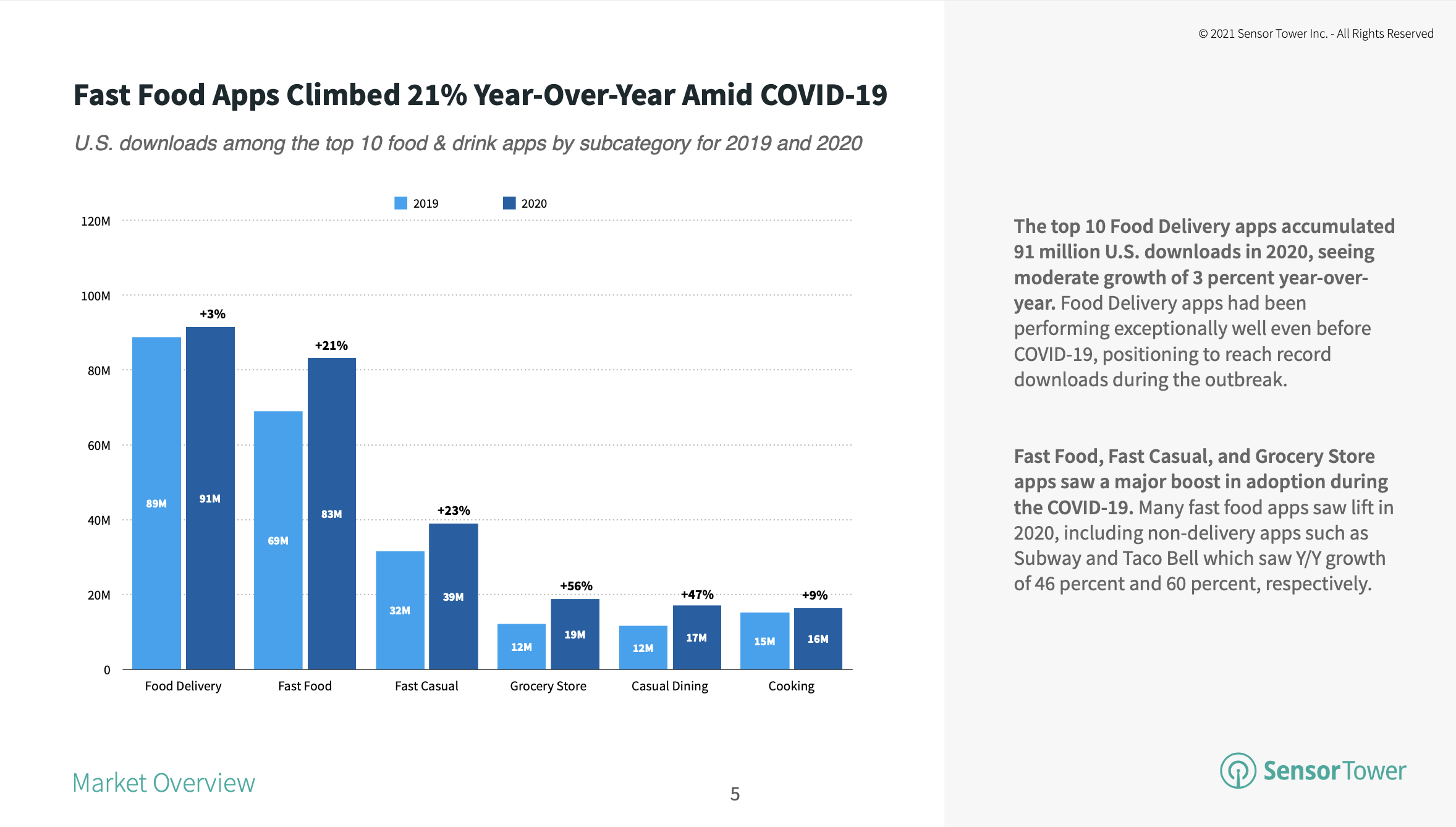

Within the Food & Drink category, the top 10 food delivery apps, such as Uber Eats, already commanded the most installs on U.S. app stores when compared to other subcategories, and this subcategory of Food & Drink maintained its position with modest 3 percent Y/Y growth in 2020, growing from 89 million to 91 million first-time downloads.

Monthly Time Spent in European Food Delivery Apps Is Rising

As user behavior shifted due to COVID-19, consumers spent more time in apps that provided the convenience of socially distanced delivery. The average monthly time spent per user in the top food delivery apps has continued to rise over the last year.

The top food delivery apps from European publishers saw their average monthly time spent per user on Android climb 51 percent when comparing the end of Q4 2020 to Q1 2020, ending the year at more than 23 minutes spent. German food delivery apps in particular saw more time spent, reaching an average of 28 minutes per user each month during 2020 in top apps such as Lieferando and foodpanda.

In addition to climbing monthly time spent, the top food delivery apps in the region have continued to see elevated adoption with monthly installs climbing in early 2021. For instance, Uber Eats's installs exceeded 2 million in January 2021, 10 percent higher than its monthly installs in March 2020 at the start of the pandemic. As COVID-19 vaccines begin rolling out worldwide, some countries have begun to lift restrictions on in-person dining in restaurants; however, the continued demand for food delivery apps indicates that consumers may not yet feel comfortable venturing out. This trend may decline as more people receive vaccinations, or it might persist as a permanent change to consumer habits.

Instacart's Boom Continues into 2021

Third-party delivery services such as DoorDash and Instacart exploded in 2020, with the former maintaining its market share lead and the latter seeing a surge of adoption.

DoorDash overtook top food delivery app competitors in 2019, achieving 32 percent market share of U.S. installs among the top food delivery apps. Its lead continued into 2020 and climbed 1 point to 33 percent in the first two months of 2021. Instacart's market share surged from 5 percent in 2019 to 12 percent in 2020, where it remains for the first two months of 2021.

Both DoorDash and Instacart's continued success suggest that consumers are still interested in apps that can serve multiple needs, delivering food from restaurants as well as groceries. These platforms have leaned into these evolving consumer needs; for instance, Instacart partnered with Walgreens for same-day prescription delivery and DoorDash announced that it will be deliver COVID testing kits.

For more analysis from the Sensor Tower Store Intelligence platform, including key insights on the performance of top food delivery apps in the U.S. and Europe as well as other category trends, download the complete report in PDF form below: