2026 State of Mobile is Live!

Mobile App Insights · Craig Chapple · July 2020

Mobile Gaming Revenue Surged 27% Year-Over-Year to $19.3 Billion in Q2 2020 Amid COVID-19

Revenue in the first half of the year peaked in May at $6.6 billion, Sensor Tower data shows.

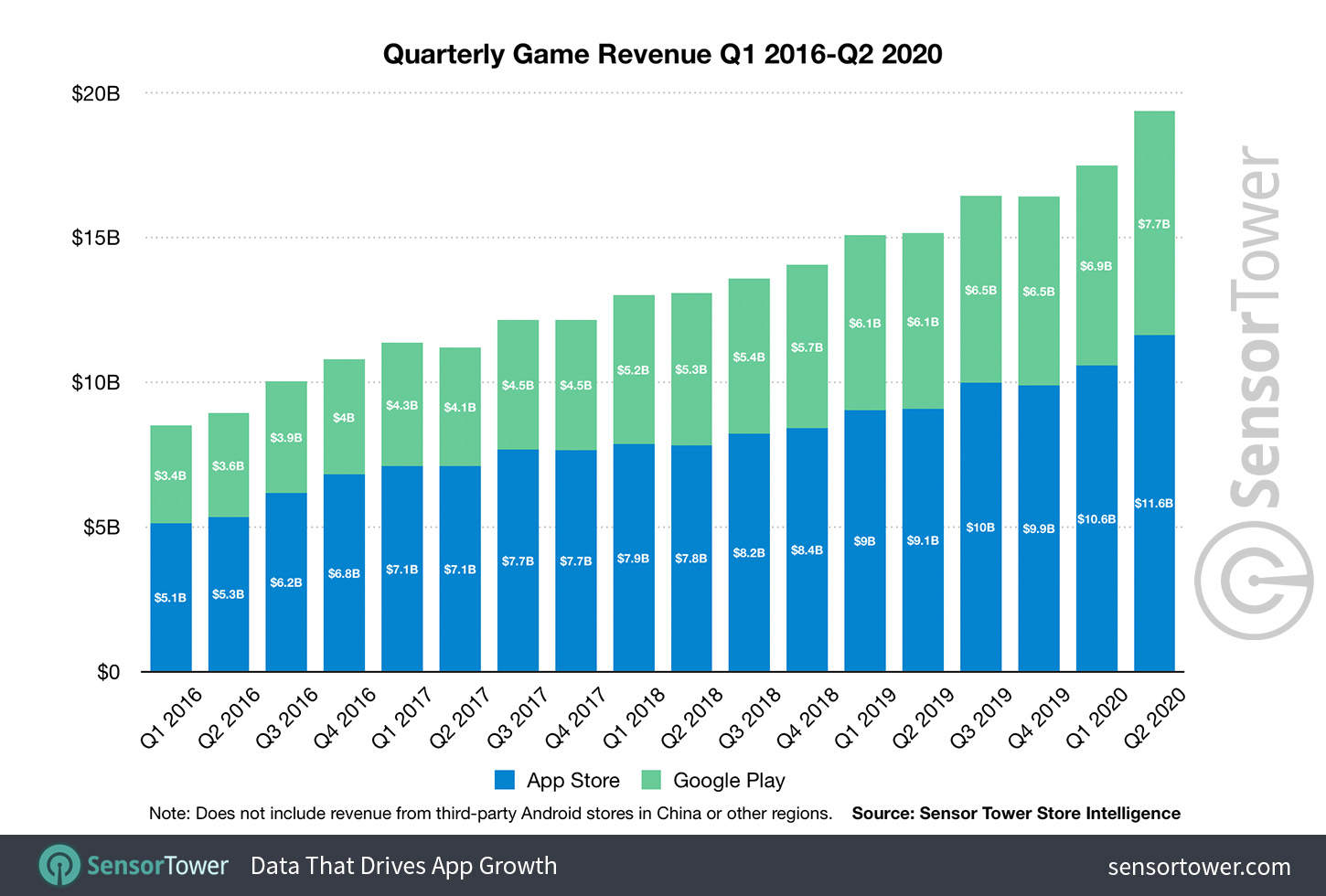

Global player spending in mobile games surged by 27 percent year-over-year in Q2 2020 to $19.3 billion for the quarter, according to Sensor Tower Store Intelligence estimates.

Revenue for the quarter was up 10.3 percent from Q1 2020, when the outbreak began in China and started its spread worldwide. Player spending in Q1 rose 6.7 percent quarter-over-quarter, and 16 percent Y/Y to $17.5 billion. Revenue in the first half of the year peaked in May at $6.6 billion for the month, up 21.5% Y/Y.

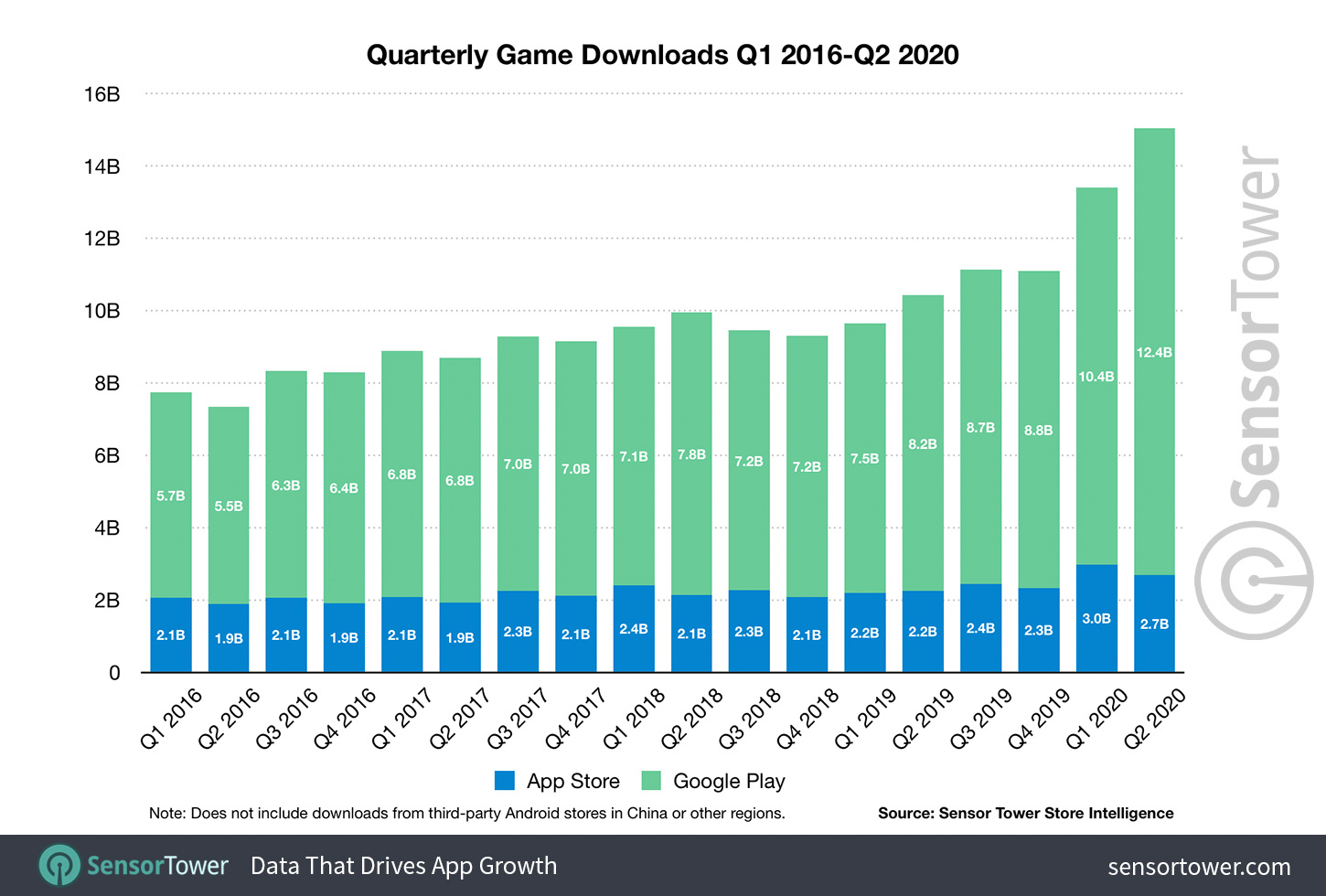

The peak in player spending lagged behind the growth in downloads, leading to slower growth in Q1 compared to Q2 2020. New game installs exploded in the first quarter, up 20.7 percent Q/Q and 38 percent Y/Y to 13.4 billion. Downloads grew further in Q2 2020 to more than 15 billion, up 12.7 percent Q/Q and 45.2 percent Y/Y. Throughout the first half of the year, new installs peaked in April 2020 at 5.5 billion.

Games that helped connect consumers remotely benefited during the lockdown, with titles such as Roblox from Roblox Corporation and Fortnite from Epic Games experiencing a surge in popularity on mobile.

Game Downloads Increase by Nearly 1 Billion in India

From Q1 to Q2 2020, the top three countries for downloads were India, the United States, and Brazil, though all three saw an increase in new installs Q/Q.

India generated close to 1.8 billion game downloads in Q1, a figure that rose by 50 percent to 2.7 billion in Q2. The country entered lockdown in late March. The U.S., meanwhile, saw a more modest increase in downloads, accumulating more than 1.4 billion in both quarters. Brazil generated close to 1.1 billion installs in Q1, with downloads increasing 9 percent to 1.2 billion in Q2. It should be noted, however, that lockdown measures in Brazil have not been as widespread or long-lasting compared to other countries.

In China, where the pandemic began, downloads on the country’s App Store hit 743 million in Q1, and dropped 35.8 percent to close to 477 million in Q2. The country entered lockdown in January, with measures lifted in April.

The U.S. ranked No. 1 for game revenue in H1 2020, generating more than $10 billion during the period. User spending increased 24.4 percent from $4.5 billion in Q1 to $5.6 billion in Q2. Japan ranked No. 2, with players spending more than $8 billion in the first half of the year. Revenue climbed 13.2 percent from $3.8 billion in Q1 to $4.3 billion in Q2. China ranked No. 3, meanwhile, generating $6.7 billion in 1H20 from the App Store alone. Unlike other countries, which went into lockdown later, China game revenue decreased by 8.6 percent from $3.5 billion in Q1 to $3.2 billion in Q2.

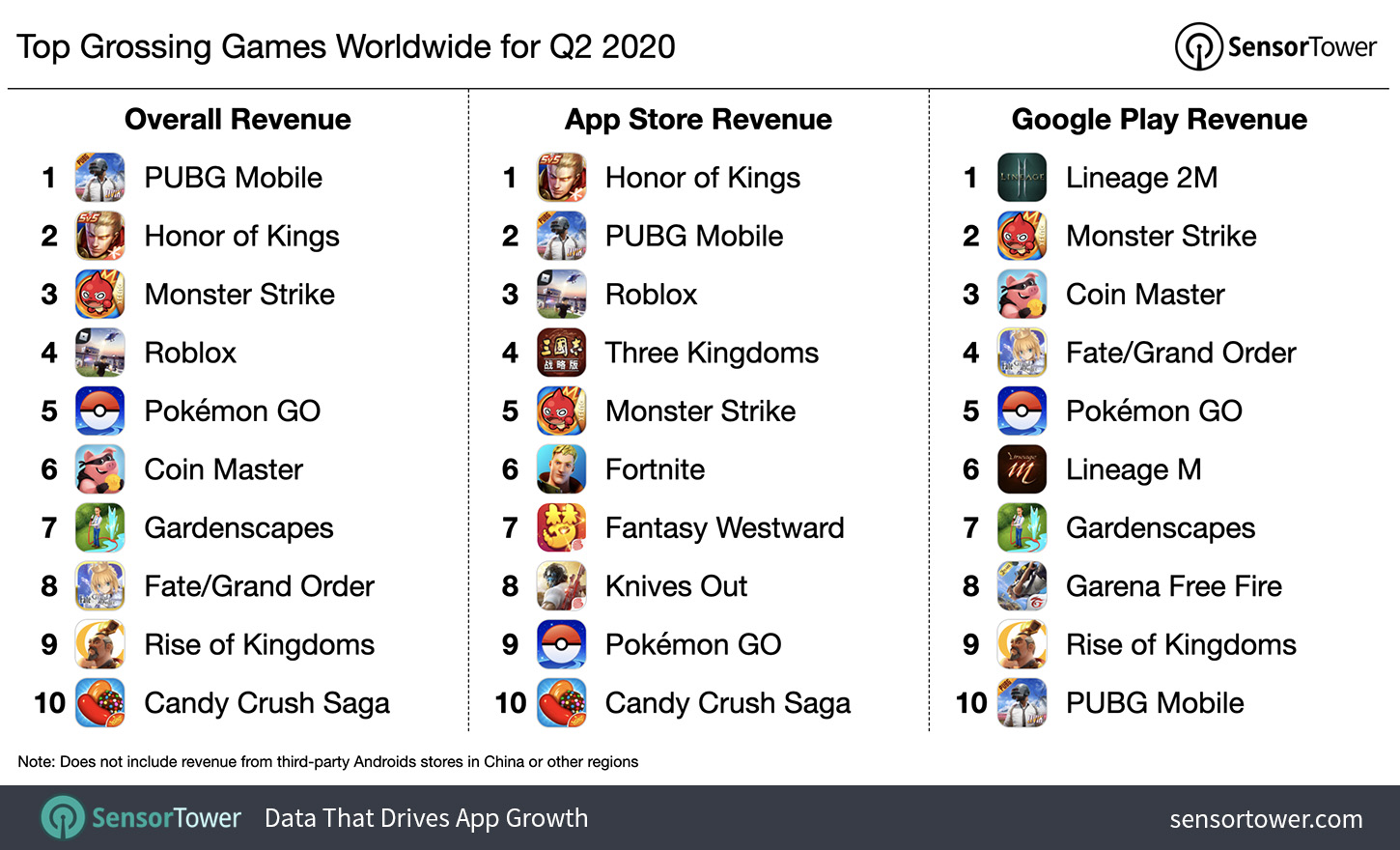

Top Games in Q2 2020

PUBG Mobile from Tencent was the top grossing game in the world during Q2 2020, generating close to $621 million in the quarter. That was down 8 percent from Q1 2020, when it accumulated $674.5 million. The game’s peak came in March, just prior to the end of lockdown in China, at approximately $270 million.

One of the big risers during the pandemic was kids MMO Roblox, which accumulated $302.8 million in Q2 for its mobile version, up 58.8 percent from $190.7 million in Q1. Player spending rose significantly during lockdown, peaking at $108.6 million in May, up 188.6 percent Y/Y. Pokémon GO from Niantic also saw a significant boost in revenue in Q2 2020, rising 32.7 percent Q/Q to more than $254 million in Q2. This was thanks to a combination of factors including the easing of lockdown restrictions across the globe, and changes made in the location-based title that have made it easier to play at home. Despite the stay-at-home orders, Pokémon GO has had its best first half to a year ever.

Fortnite was one of the top grossing games on the App Store globally in Q2, with player spending rising 110.7 percent Q/Q to $146.5 million. The surge in revenue coincided with the addition of the new Party Royale mode, where players can hang out with one another, and events such as the Astronomical concert with Travis Scott and Christopher Nolan movie screenings.

Long-Term Impact

The COVID-19 pandemic has clearly had a significant impact on the mobile games market, particularly in the short-term, with lockdowns leading to surges in downloads and revenue. Over the next few years, we expect the pandemic to result in an increase in the number of downloads through to 2024 above our pre-COVID-19 forecasts. User spending, however, will likely remain at similar levels to our previous predictions, due to factors such as a worsened economic outlook for consumers globally.