2026 State of Mobile is Live!

Mobile App Insights · Randy Nelson · January 2019

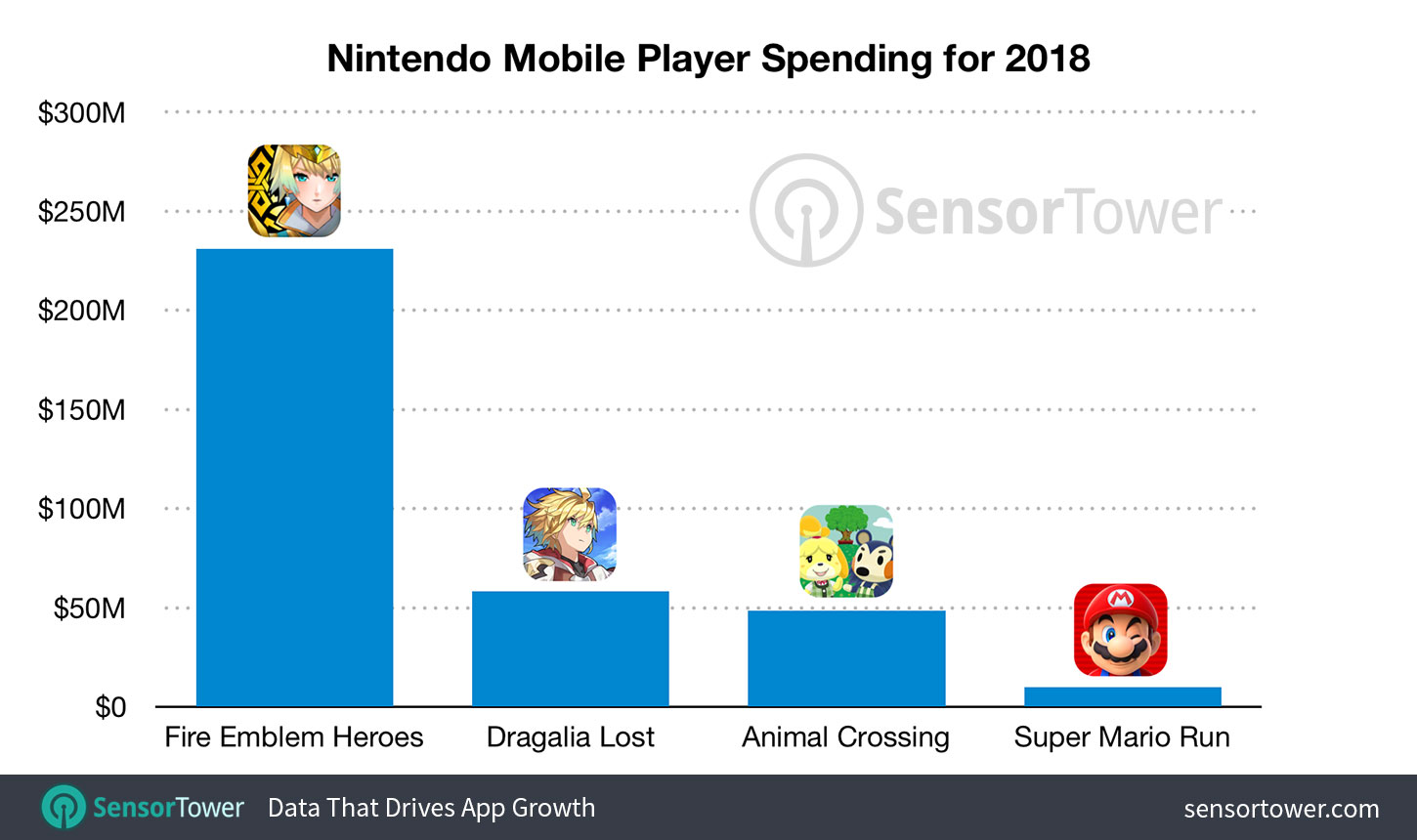

Nintendo's Mobile Revenue Reached $348 Million in 2018, Led by Fire Emblem Heroes

Nintendo's four mobile games grossed a combined $348 million in 2018 and grew 15% over 2017, Sensor Tower Store Intelligence data shows.

Nintendo's mobile ambitions saw the publisher reach a new record of nearly $117 million in worldwide player spending across the App Store and Google Play during the fourth quarter of 2018, according to Sensor Tower Store Intelligence estimates. This represented a 47 percent increase over 4Q17 and was driven primarily by its latest release, Dragalia Lost, which pulled in $54.2 million during the quarter. All told, Nintendo took in $348 million during calendar year 2018, an increase of 15 percent over 2017.

Free-to-Play Front Runners

Launched in February 2017, the publisher's strategy RPG, Fire Emblem Heroes, accounted for approximately 66 percent of its 2018 revenue, topping $230 million in player spending globally. The game has grossed $487 million to date.

Despite releasing at the end of Q3, the newest of Nintendo's four mobile games, Dragalia Lost, ended up generating close to 17 percent of its mobile revenue for the year at an estimated $58.4 million worldwide. The title has just passed $60 million grossed as of this writing, with 66 percent of that coming from players in Japan. This was despite only being available in five territories, compared to the 40 in which Fire Emblem Heroes generated revenue during 2018.

Animal Crossing: Pocket Camp, the third mobile title from Nintendo, turned one year old in November and closed out 2018 with an estimated $48.6 million in player spending. Its $4.5 million in gross revenue during November, however, was down about 44 percent from the $8.1 million we estimate it generated in November 2017.

Nintendo's Mobile Origin—and Its Future

Finally, Nintendo's first mobile game, Super Mario Run, saw player spending of just over $10 million last year, a far cry from the $31 million it pulled in during 2017. The game had been available for more than two years as of the end of 2018, having launched in September 2016 as a timed exclusive on Apple's App Store.

As we head into 2019, Nintendo's focus will soon turn to the launch of its next mobile release, Mario Kart Tour, which is pegged to debut before the end of March. Unlike Super Mario Run, the title is expected to feature traditional in-app purchase microtransactions to fuel its monetization, as opposed to a premium priced one-time IAP to unlock all content.