2026 State of Mobile is Live!

Mobile App Insights · Craig Chapple · January 2020

Pokémon GO Has Best Year Ever in 2019, Catching Nearly $900 Million in Player Spending

Pokémon GO had two of its highest grossing months ever in 2019 thanks to in-game events and big updates, Sensor Tower data shows.

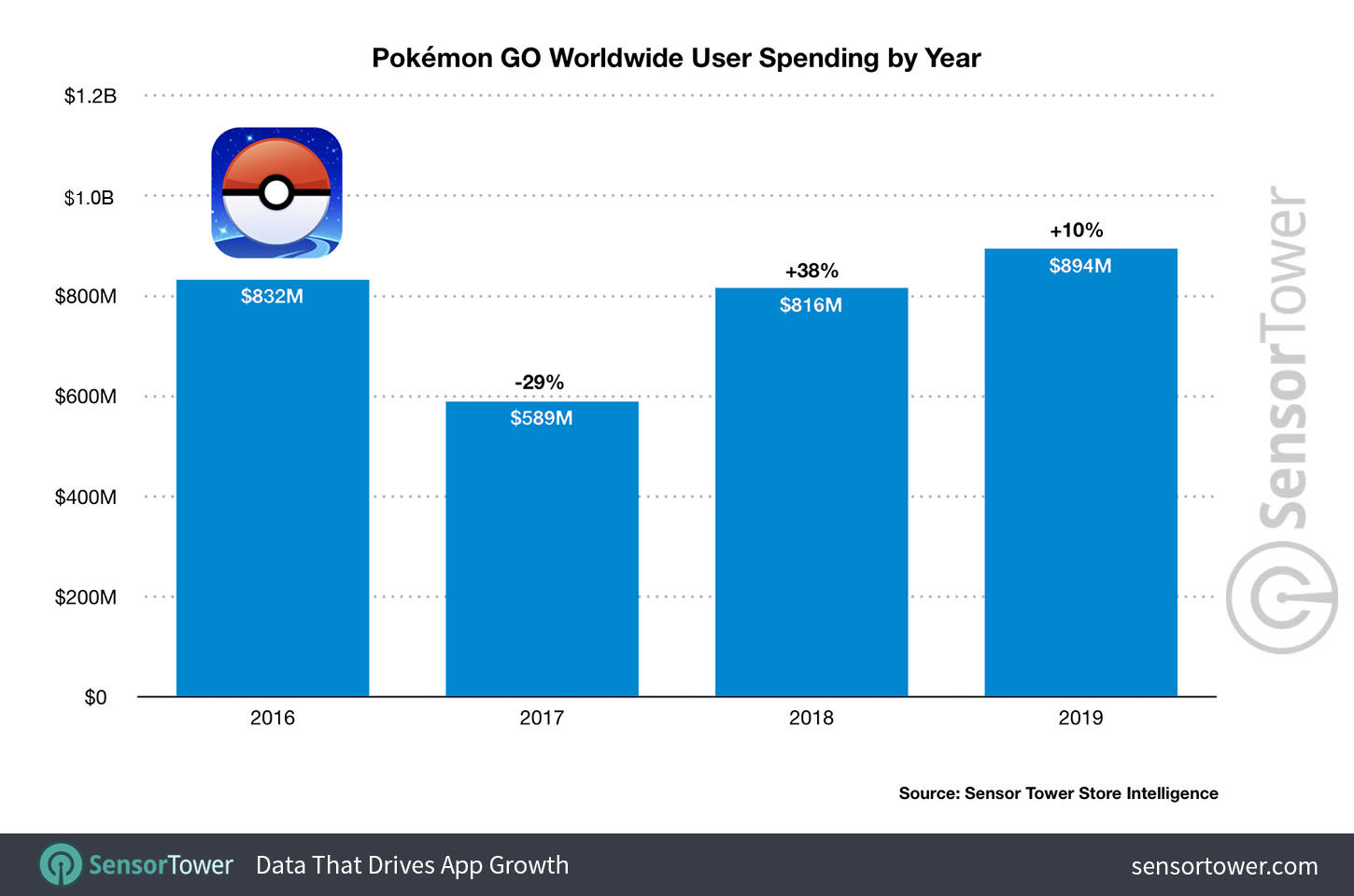

Pokémon GO from Niantic had its best year yet in 2019 after generating an estimated $894 million in gross player spending, according to Sensor Tower Store Intelligence estimates. This marks the location-based mobile blockbuster’s best year since it launched in 2016, when it grossed $832 million after taking the world by storm.

2017 represented a down year for the game, although it still accumulated an estimated $589 million in player spending. The title rebounded and proceeded to rack up approximately $816 million in 2018.

Much of the game’s growth since 2017 can be attributed to significant updates and both in-game and real-world events. Last year saw the introduction of franchise antagonists Team Rocket at the end of July, sparking its fourth and fifth best months ever, generating $116 million in August and $126 million in September.

Its top three months for user spending came in 2016 when hype for the game was at its highest and it generated $256 million in July, $195 million in August, and $141 million in September of that year.

Pokémon GO caught most of its 2019 revenue in the United States, where it picked up $335 million, or 38 percent of all user spending. Japan ranked No. 2 for revenue with $286 million, or 32 percent of the total, and Germany was No. 3 with $54 million, or 6 percent.

Google Play accounted for the majority of revenue, with users spending $482 million in the game, or 54 percent of the total. The App Store, meanwhile, accumulated $412 million, or 46 percent of all spending. While many top mobile games gross more on iOS, Pokémon GO has historically generated the majority of its revenue on Android.

To date, Niantic’s hit has racked up more than $3.1 billion in lifetime player spending.

In terms of downloads, Pokémon GO accumulated more than 55 million installs in 2019. The U.S. accounted for the majority of downloads, picking up more than 10 million installs, or 19 percent of the total. Brazil was No. 2 with more than 5 million downloads, or 10 percent, and India was No. 3 with more than 3 million installs, or 6 percent.

As with revenue, Google Play accounted for the majority of downloads, racking up 38 million installs, or 69 percent of the total. The App Store, meanwhile, generated approximately 17 million downloads, or 31 percent.

Average revenue per download for Pokémon GO currently stands at $5.70.

The Very Best, Like No Game Ever Was

To put Pokémon GO’s best year ever in context with the wider mobile games market, the $894 million in gross revenue it accumulated in 2019 meant it was the No. 5 top earner worldwide. It placed just behind Candy Crush Saga from King at No. 4, which generated close to $1.1 billion and above Monster Strike from Mixi in No. 6, which racked up $881 million. The top grossing game of 2019 was Honor of Kings from Tencent, which generated close to $1.5 billion. This figure does not include user spending from third-party Android stores, such as those available in China.

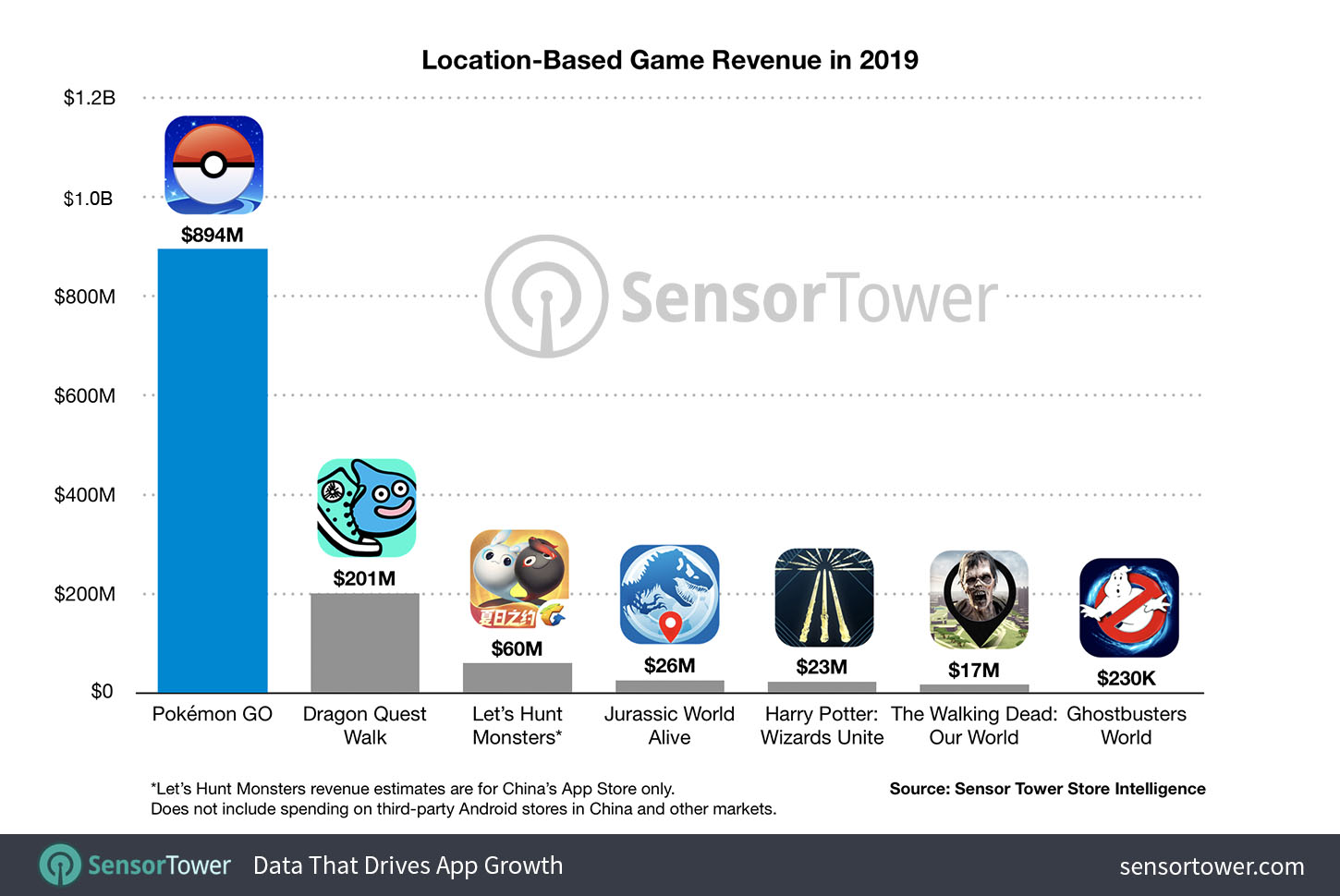

Pokémon GO remains the runaway leader in the location-based gaming category. September 2019 release Dragon Quest Walk from Square Enix had a strong start despite only being available in Japan, grossing $201 million in just under four months. Despite an impressive performance out of the gate, it was unable to outgross Pokémon GO there in any month.

The No.3 location-based game in 2019 was Let’s Hunt Monsters from Tencent, which is only available in China and generated more than $60 million from the App Store.

Other contenders in the category were Jurassic World Alive from Ludia, which picked up close to $26 million, Harry Potter: Wizards Unite from Niantic, which racked up more than $23 million, The Walking Dead: Our World from Next Games, which generated more than $17 million, and Ghostbusters World from Four Thirty Three, which accumulated $230,000.

To date, Pokémon GO is the only location-based game that has been able to increase its revenue from its launch year. Such success can be put down to astute live operations and in-game events that have kept players consistently coming back for more. It remains to be seen in 2020 if Niantic can build once more on 2019’s record year, and whether other new location-based titles released this year can also experience growth.