2026 State of Mobile is Live!

Digital Advertising Insights · Matt Bozin · March 2023

How the Super Bowl Propelled Rihanna’s Retail Media Showcase

Dive into how Rihanna’s halftime show affected the digital strategies of her personal brands, partnerships, and endorsements -- in the age of the influencer.

There are very few once-in-a-lifetime events that can propel brands forward, or capture views in the hundreds of millions. The Super Bowl is one of them. And while that kind of exposure for a brand is enormous, having transparency into that competitor is just as important as your own advertising strategy.

So, how do smaller brands or retailers compete with celebrity ownership or endorsements, especially in the age of the influencer? Should you bury your head in the sand and assume you can’t spar in the digital arena? Or is it more advantageous to see how that brand is advertising, what channels, and what messaging, so you’re able to counter that strategy?

We took a deep dive into how Rihanna’s halftime show affected the digital strategies of her personal brands and partnerships, compared them to other celebrity brands, and offer some insight into how you, as a beauty brand or retailer yourself, could use that competitive intelligence to influence your own strategy. In effect, we’re removing the concealer for a fresh new look! That might not be the last beauty joke, so buckle up.

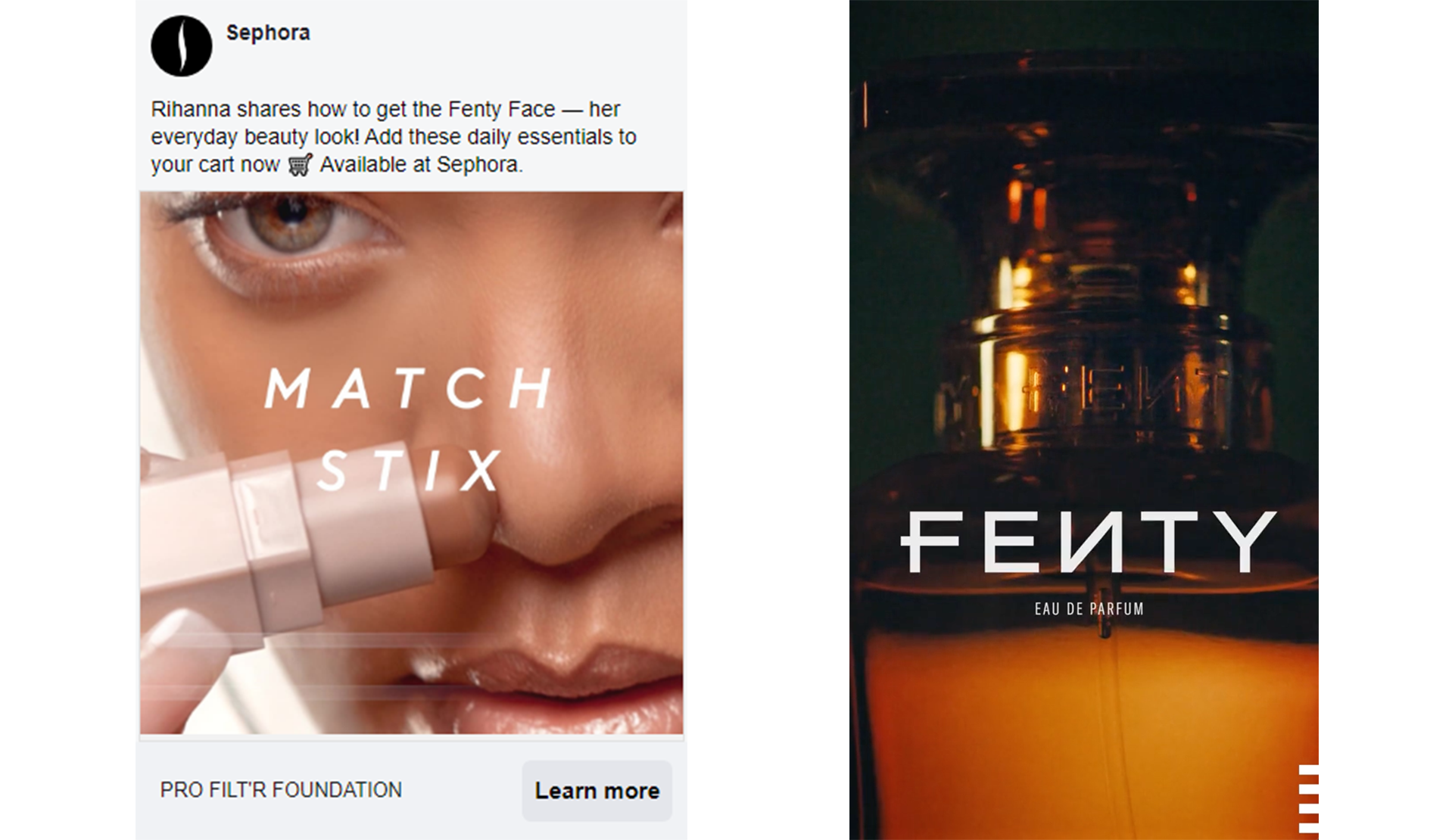

A Sephora Exclusive

Fenty Beauty launched in 2017 in partnership with LVMH, a massive beauty and lifestyle brand with everything from wines and spirits to perfume and watch sub-brands under their umbrella. With that partnership, Sephora, owned by the beauty conglomerate, is the exclusive retailer for Fenty in the U.S. Taking a look at Sephora’s spend from January 1st, through February 20th, 2023, the retailer promoted several Fenty creatives the week before the game, spending $24k and grabbing over 2.7M impressions for their top two ads served across TikTok and Facebook. Though not a large number, in contrast, for the same period in 2022, Sephora only spent about $4,300 on Fenty product ads.

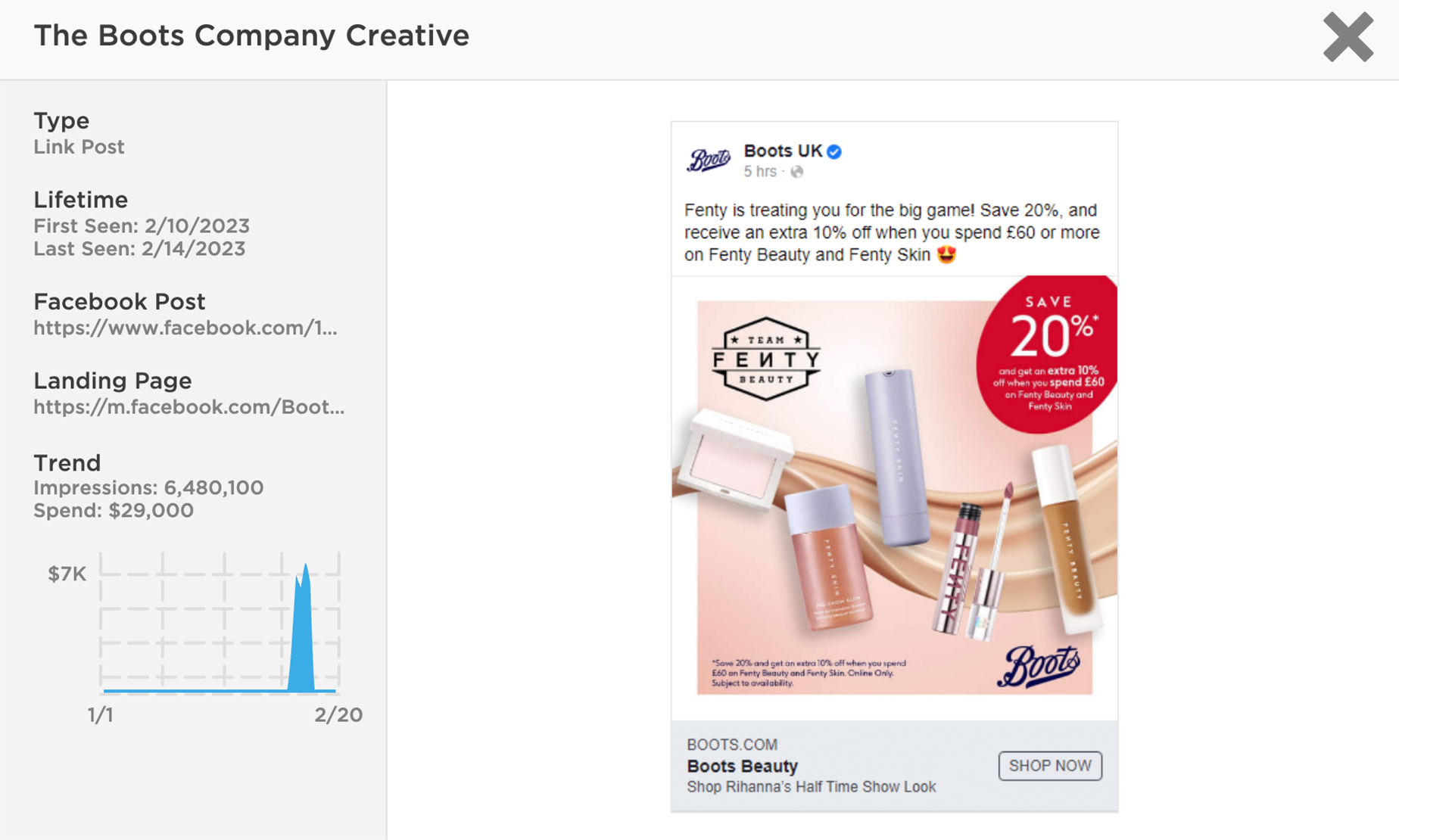

These UK Boots Were Made for Walkin’

As the Brits are usually focused on a different kind of Futbol, the Super Bowl presented a unique opportunity for Boots UK, a British retailer of Fenty beauty, to siphon the local pig-skin crazed audience - or die-hard Rihanna fans - to their stores. The popular British retailer released their own campaign with creative messaging: “Fenty is treating you for the big game!” on Facebook, spending only $65k in a 4-day run leading up to the game. The result? Over 14.4M impressions combined for their Super Bowl-focused ad. However, once again, this small amount of ad spend dwarfs in comparison to Boots UK’s total spend of $5.2M overall in the time frame.

What might be surprising is that Fenty, a seemingly stand-alone brand with star power behind it, is also promoted in separate co-marketed ads for the retailer, like this ad, promoting Fenty along with Benefit and No7.

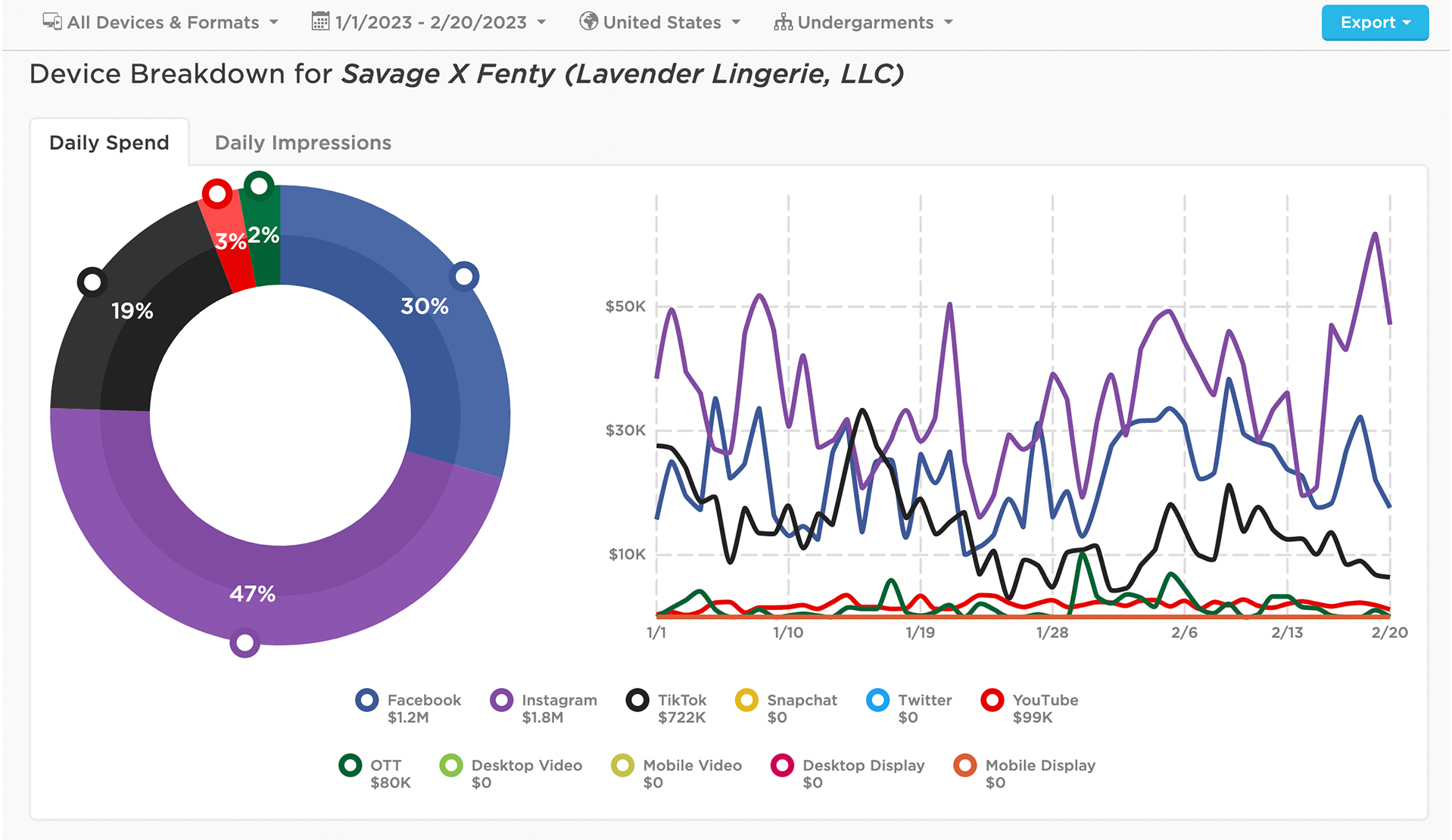

A Savage Sport

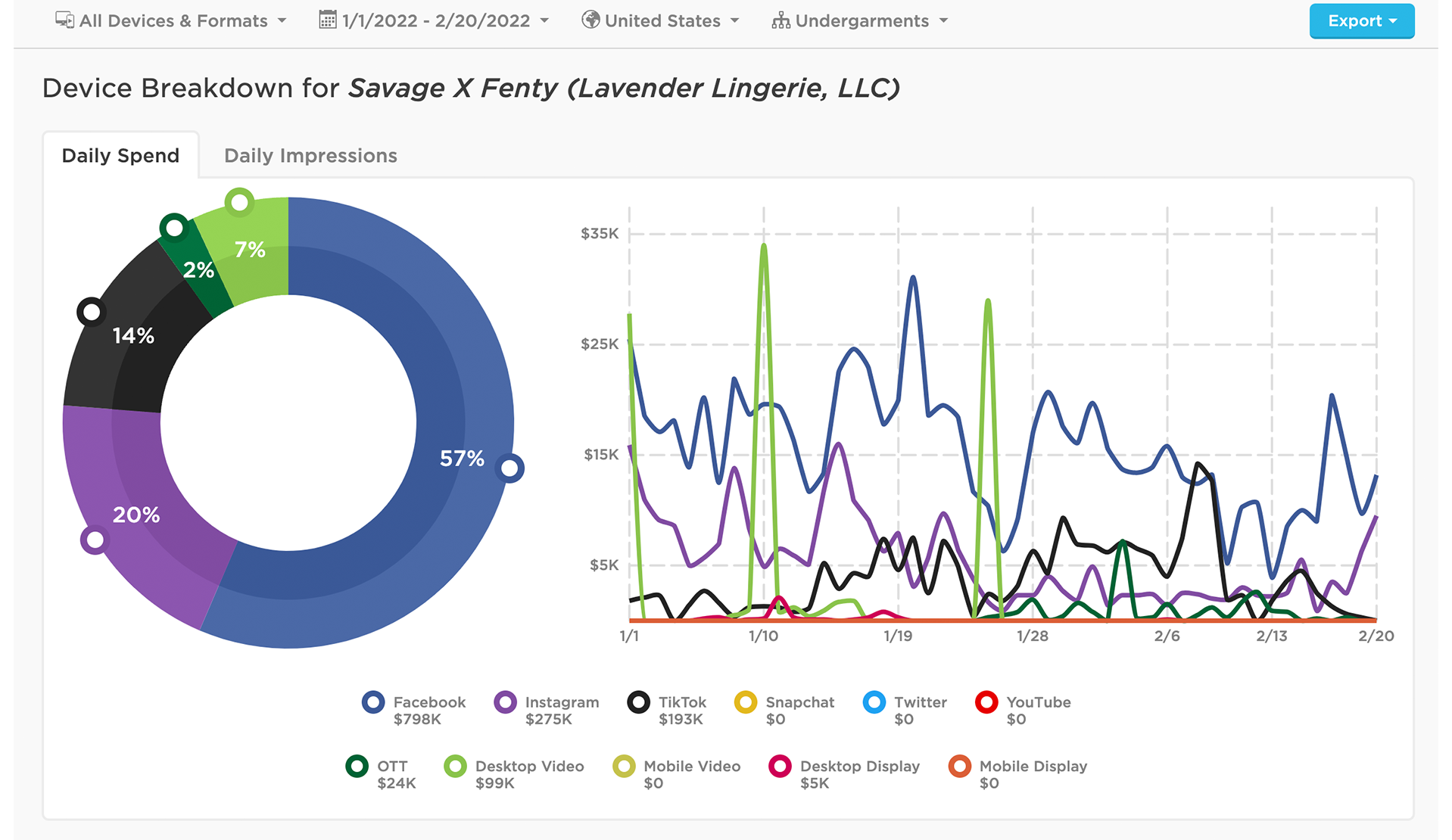

Savage X, Rihanna’s clothing/lingerie brand, got its own boost during the Super Bowl as the Fenty off-shoot launched a “Game Day Drop” campaign, riding on the heels of the halftime hype, spending $55k, and $3.9M total spend between January 1st and February 20th – a 50% increase from their ad spend during the same time period last year, with no upcoming halftime performance.

Fenty from the Source

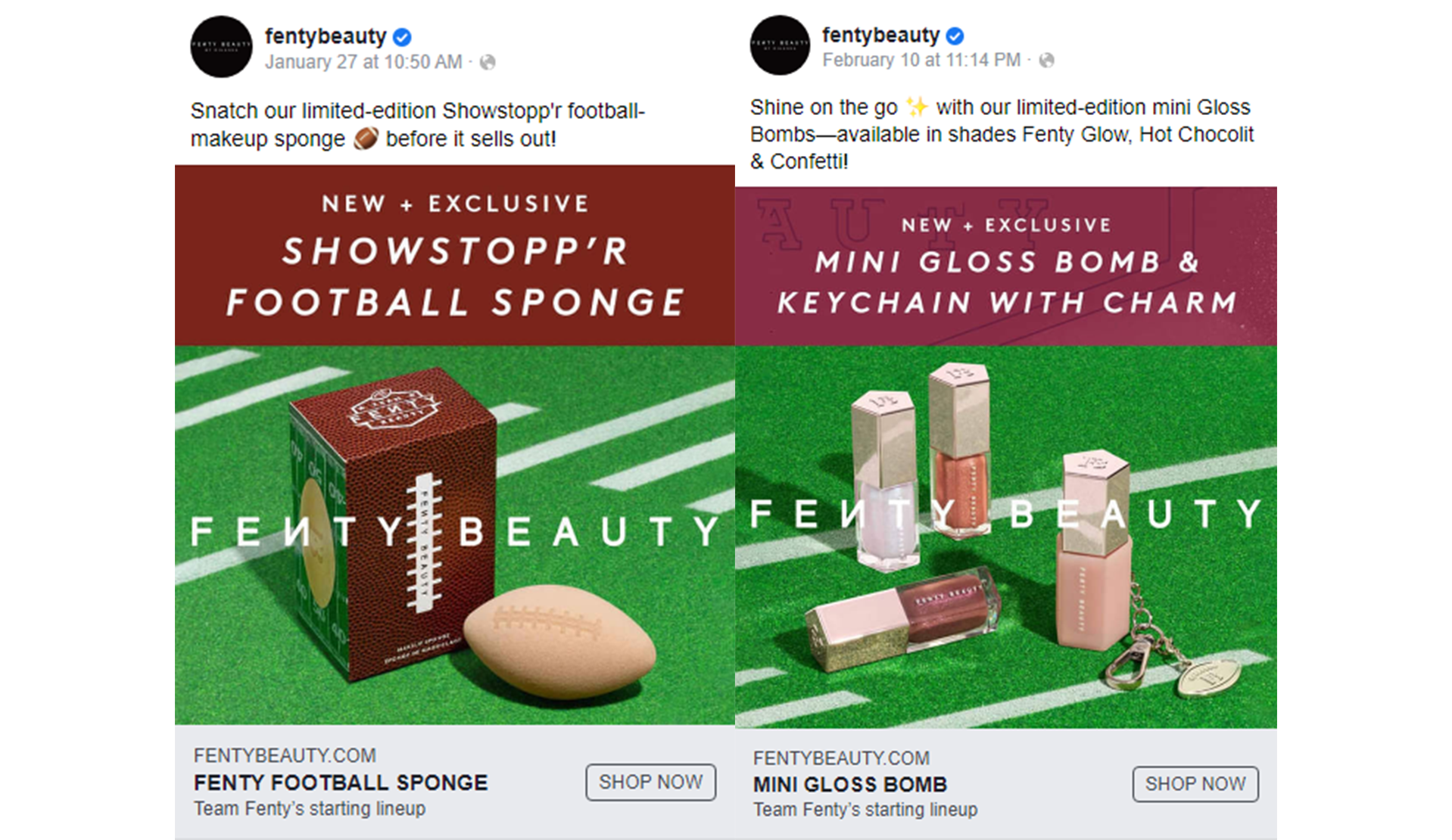

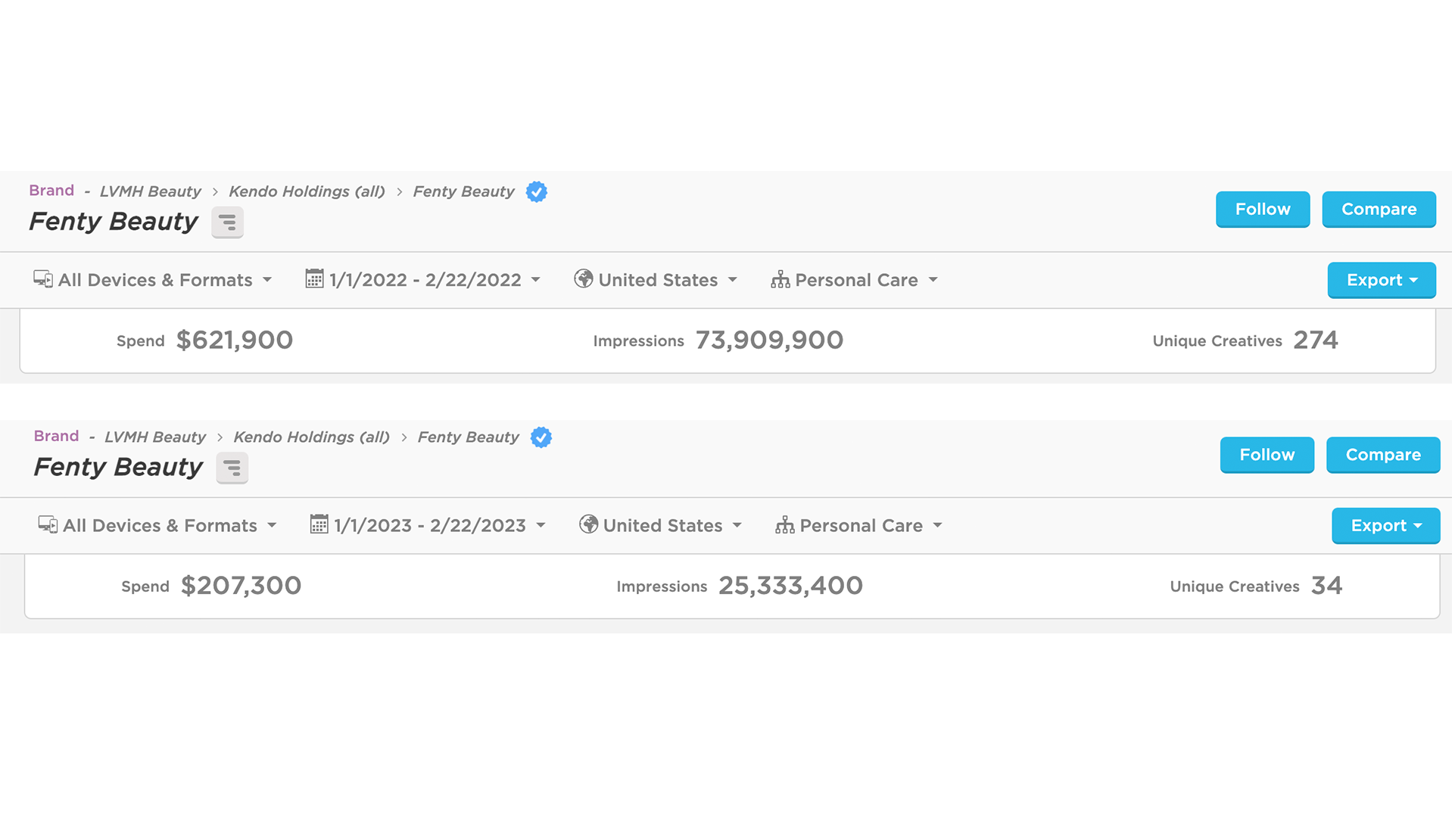

But, what better way to measure Fenty’s ad spend and strategy than to go to the source itself? Fenty.com seems to have taken an opposing strategy to the Savage X brand, cutting their spend almost 50% from the same time period last year, choosing to let Rihanna’s 30-minute infomercial – ahem, we mean, halftime show – do the marketing for them, running only a couple football-themed creatives across Facebook and Instagram.

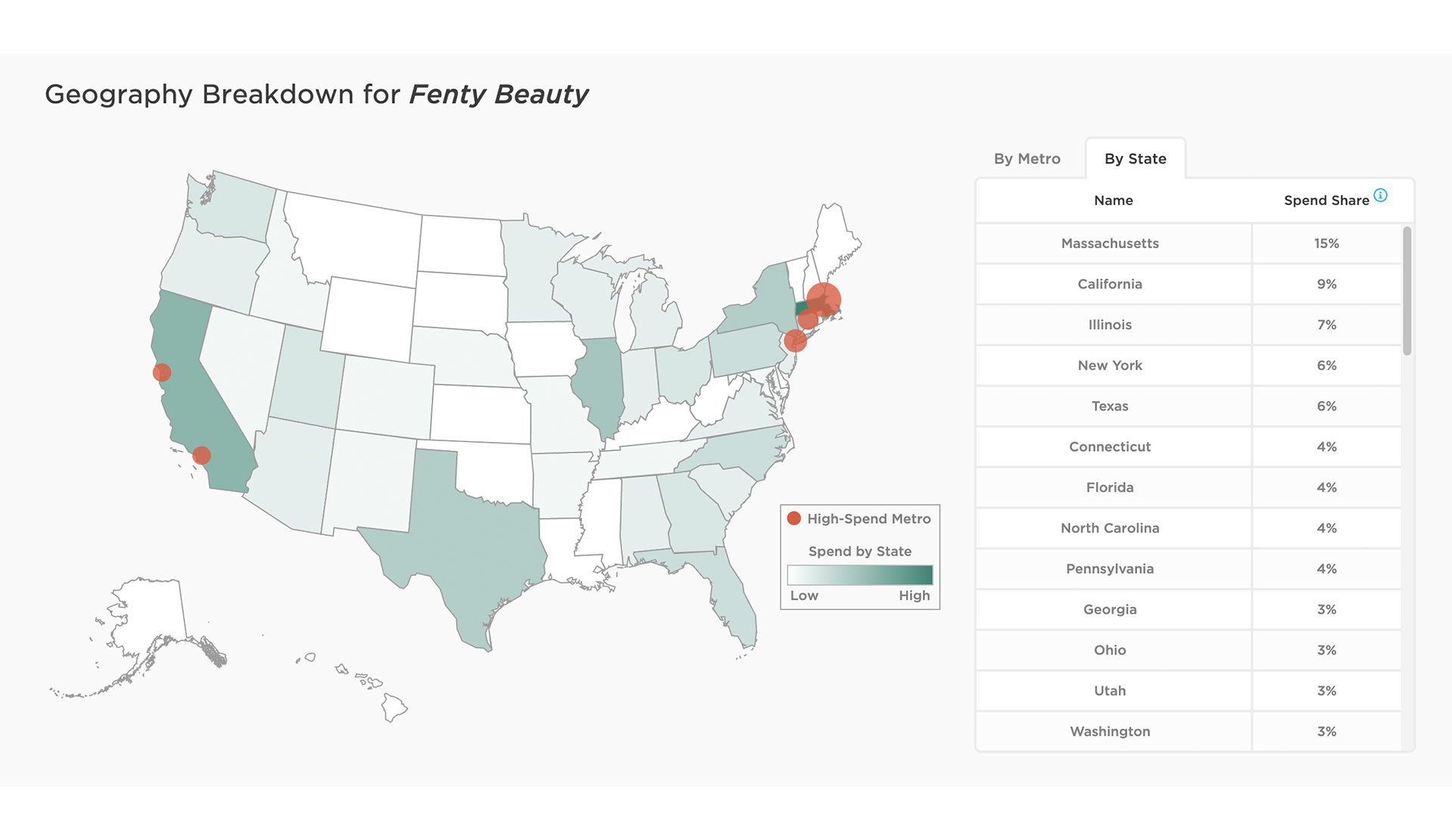

However, where geographically a brand spends can be just as informative as how much it spends. Fenty, like many celebrities, sticks to the coasts with 24% of their spend on social channels concentrated in Massachusetts and California during that time frame. We’re not saying cold weather has anything to do with it, but have you ever seen lipstick applied at a summit in the Colorado Rockies? Neither have we, and we’d like to keep it that way.

An Apple A Day…Makes Rihanna a Retail Media Intelligence Story

What do you get when you co-market one of the biggest brands in music with an international music superstar in the most-watched television event of the year? You get the retail media opportunity of a lifetime. As Pepsi relinquished its hold over the halftime sponsorship in over a decade, Apple music made its presence known, with $1.2M in spend across YouTube with video ads cross-promoting the halftime show and teasing new music by Rihanna. Having not released new music in over 6 years, Rihanna stirred massive anticipation from her fans online with the new music to be released exclusively on the Apple Music platform.

Celebrity Competition

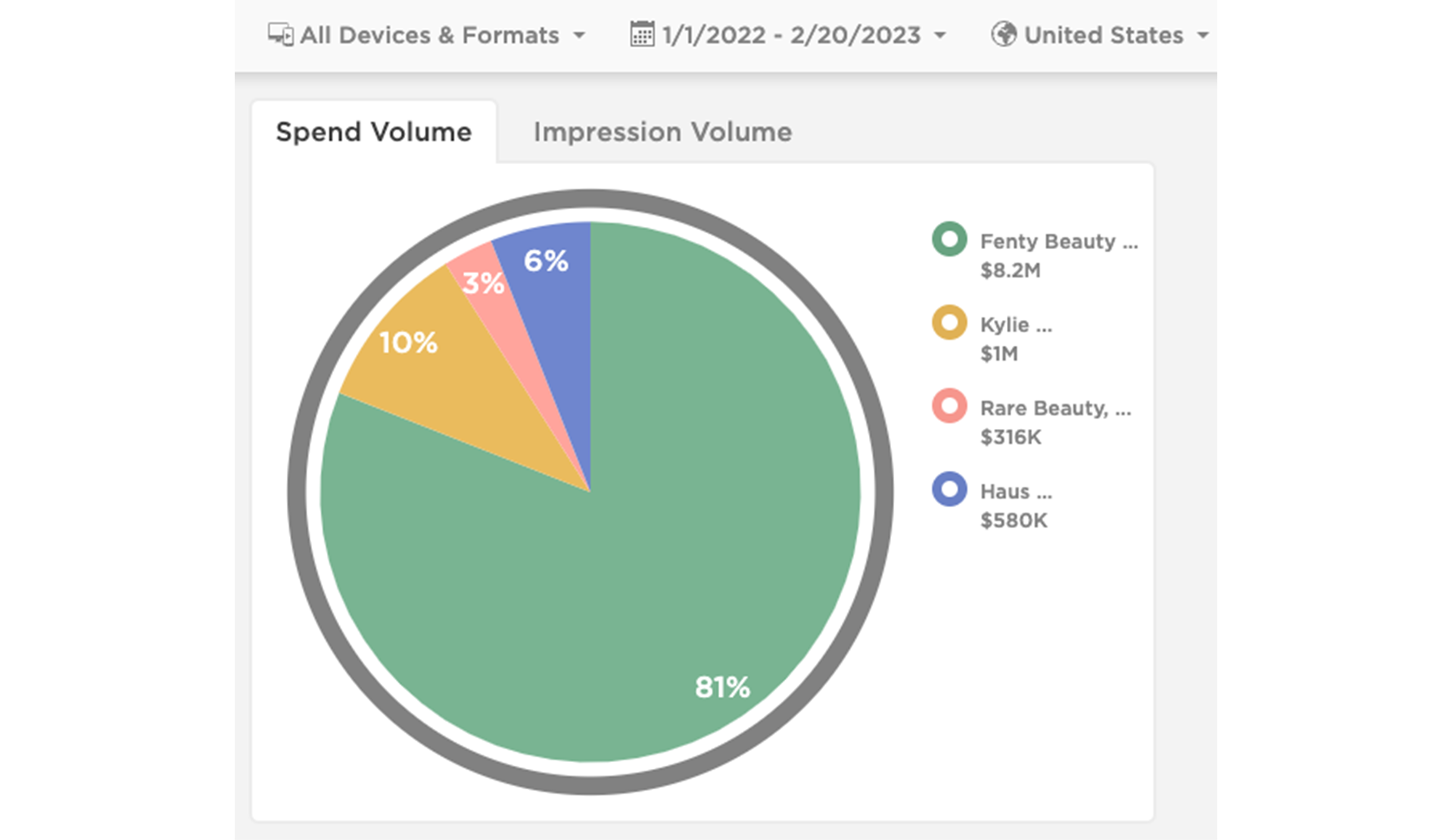

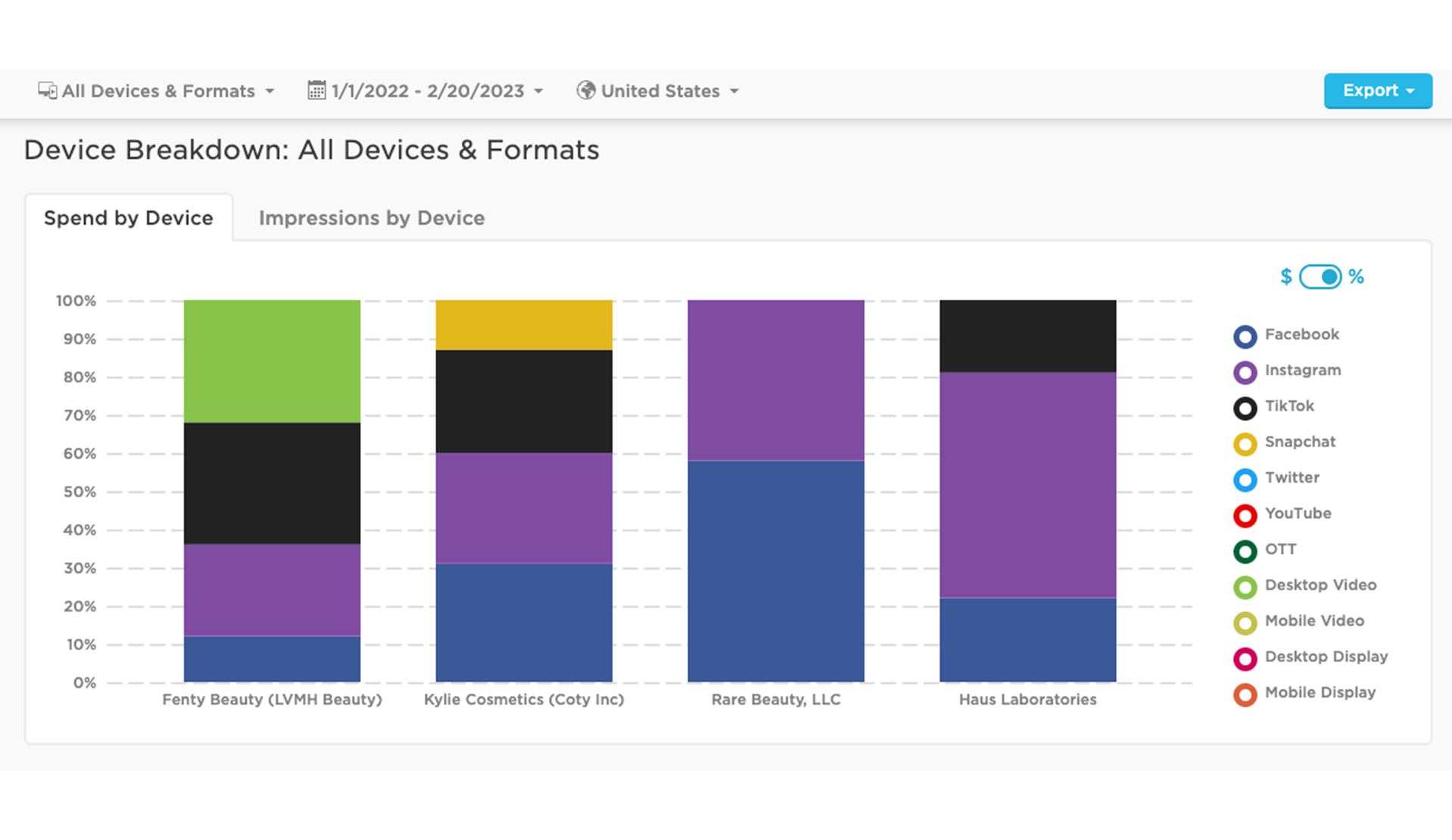

There’s no question Fenty is one of the largest celebrity brands in terms of spend and market share in the industry, but they’re not the only game in the celebrity-beauty zip code. Comparing Fenty to celeb brands, Kylie Cosmetics, by Kylie Jenner, Rare Beauty, by Selina Gomez, and Haus Laboratories, by Lady Gaga, since 2022, Fenty outspent everyone, with 81% share of wallet, while each brand varied their channel usage.

Instagram and Facebook dominate the channel strategies for most of the brands, with Fenty using a more evenly distributed channel strategy, leveraging TikTok and Desktop Video. But you have to take into account the percentage of their total spend to understand the true impact. For example, with 33% focused in Desktop video (primarily YouTube), Fenty spent $2.7M in the channel vs. Haus, who invested 61% of their total ad dollars in Instagram, which only equates to $347K.

Celebrities – They’re Just Like Us

Why does this matter to you, a small, or large beauty brand or retailer, who has stuck with us to the end of this beauty journey? We’re not telling you anything you don’t know by saying it’s hard to compete with a celebrity brand, especially when their Instagram following can be higher than your annual digital budget. However, knowing their strategy can help you craft your own. Some key takeaways:

Even without a Super Bowl performance, neither Sephora, Boots UK or Savage X puts millions of dollars behind the Fenty brand.

Pathmatics by Sensor Tower data shows you where that money is invested, and how many impressions they’re getting from those ad dollars. Challenging the brands in those channels which offer more impressions could improve your share of voice and turn more people onto your brand.

Similarly, seeing which channels these celebrity brands have leveraged, that don’t get impressions, is a clear sign to invest your money elsewhere and avoid those channels altogether.

Fenty seems to have invested in social channels primarily in states on the East and West coasts, limiting a broad swath of the country. Focusing your social spend in areas where Fenty isn’t, could boost your impressions with little competition.

Differentiate your messaging. While Boots UK offered discounts in their ads, the other brands mentioned didn’t. What makes your brand different? Tailoring your creative messaging directly to your customer personas could establish trust and turn them toward your brand.

Though, perhaps it's not all doom and gloom for brands that don’t have the power of celebrity. In fact, according to Digital Commerce 360, when Fenty launched in 2017, general “concealer” searches increased 28% while “highlighter” search clicks increased 27%. The conclusion: smaller brands can survive the crush of celebrity by riding that wave of consumer interest. Counter messaging, offering more competitive pricing, using high-value keywords – all avenues that can be explored by knowing how any of your competitors (even celebrity brands) are spending.

And hey, If that doesn’t work, it’s never a bad time to reach out to Taylor Swift.