2026 State of Mobile is Live!

Mobile App Insights · Craig Chapple · September 2020

State of Mobile Battle Royale: Fortnite Leaves a $1.2 Billion Hole in the Market

Fortnite generated $1.2 billion from the App Store and Google Play before it was removed on August 13, 2020, Sensor Tower data shows.

Fortnite from Epic Games was removed from the App Store and Google Play on August 13, 2020, leaving a $1.2 billion hole in the battle royale market for shooters on mobile. We've looked at the current state of the genre using Sensor Tower Store Intelligence data.

According to our estimates, Fortnite accumulated the vast majority of its revenue from the App Store, where it picked up slightly more than $1.2 billion in player spending since launching in March 2018. By comparison, Google Play accounted for $9.7 million following its release on the storefront in April 2020. When it comes to downloads, the hit battle royale title picked up close to 144 million installs, with approximately 133 million of those racked up on the App Store and 11 million on Google Play.

In 2020, Fortnite generated $293 million in player spending with close to $283 million spent on the App Store alone. It also accumulated about 31 million downloads, with approximately 20 million from Apple’s marketplace.

Revenue Royale

Epic Games implemented its own proprietary payment system in Fortnite on August 13, circumventing both Apple and Google’s own systems and their 30 percent revenue cut. The title was summarily removed across both marketplaces. Fortnite’s ejection on mobile leaves a significant hole in the battle royale and shooter market—although users who already own the game can still play it. They can’t, however, access its latest season of Battle Pass content. Whether competitors can fill the gap left by what is a unique success story remains to be seen.

Globally, the biggest player in the mobile battle royale space is PUBG Mobile from Tencent, which, as of August 13, 2020, has generated close to $3.5 billion in player spending. Knives Out from NetEase ranks No. 2, followed by Fortnite at No. 3, Garena Free Fire from Garena at No. 4, and Call of Duty: Mobile from Activision at No. 5. While the latter, developed by Tencent studio Timi, isn’t strictly a battle royale title, it does include such a gameplay mode.

The battle royale market for shooters did not exist prior to September 2017 and, even then, not all games monetized from the start—Knives Out was the first to do this in December 2017. Since then, the global top five battle royale shooters, analyzed here, have generated 1.9 billion downloads between them and seen an estimated $7.5 billion in player spending across the App Store and Google Play.

Winner Winner

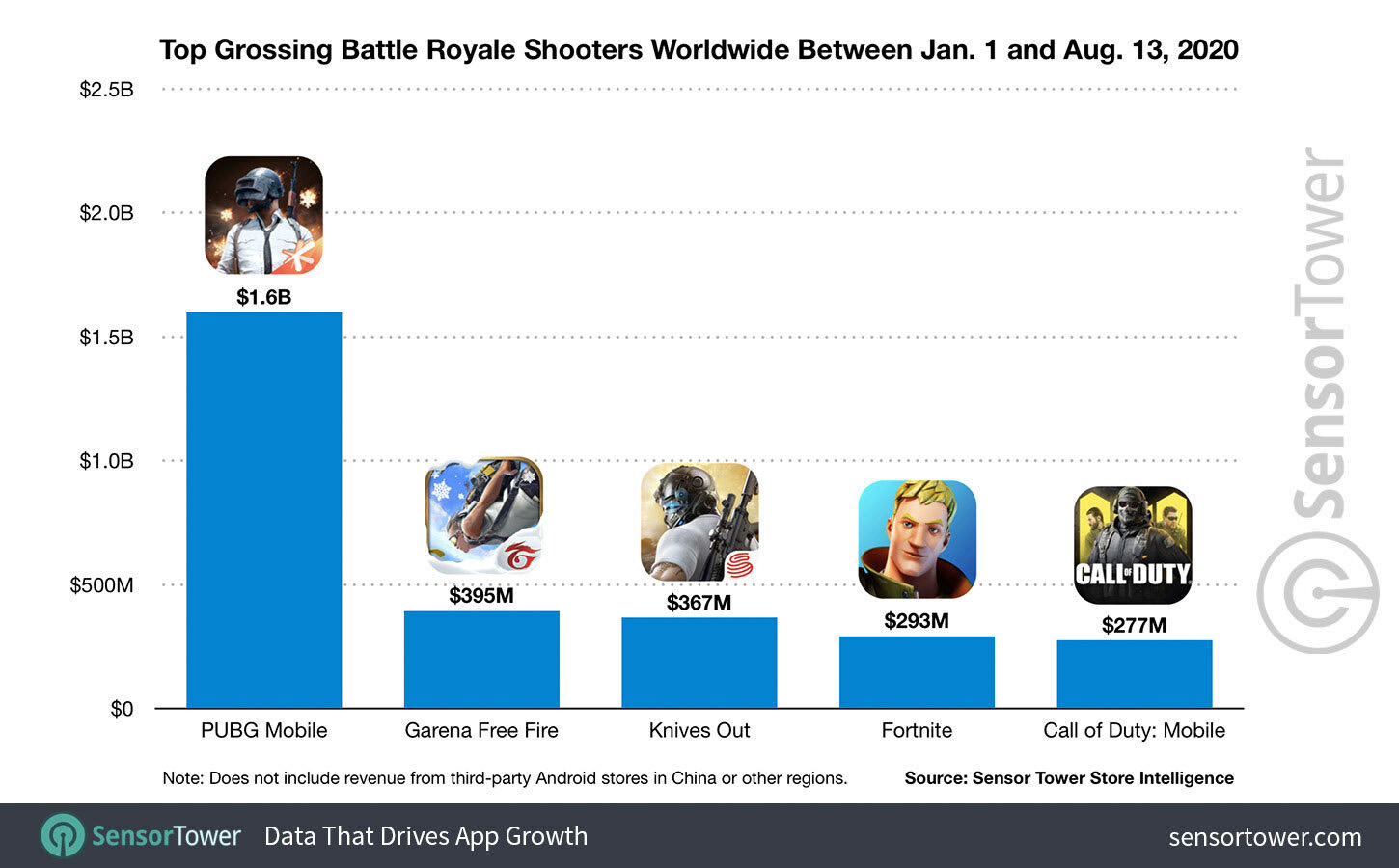

From January 1, 2020 to August 13, 2020—the day Fortnite was removed from the App Store and Google Play—Epic’s battle royale game ranked No. 4 for revenue among these titles globally, generating close to $293 million. Looking just at App Store sales, Fortnite ranked No. 3 with close to $283 million, behind PUBG Mobile and Knives Out.

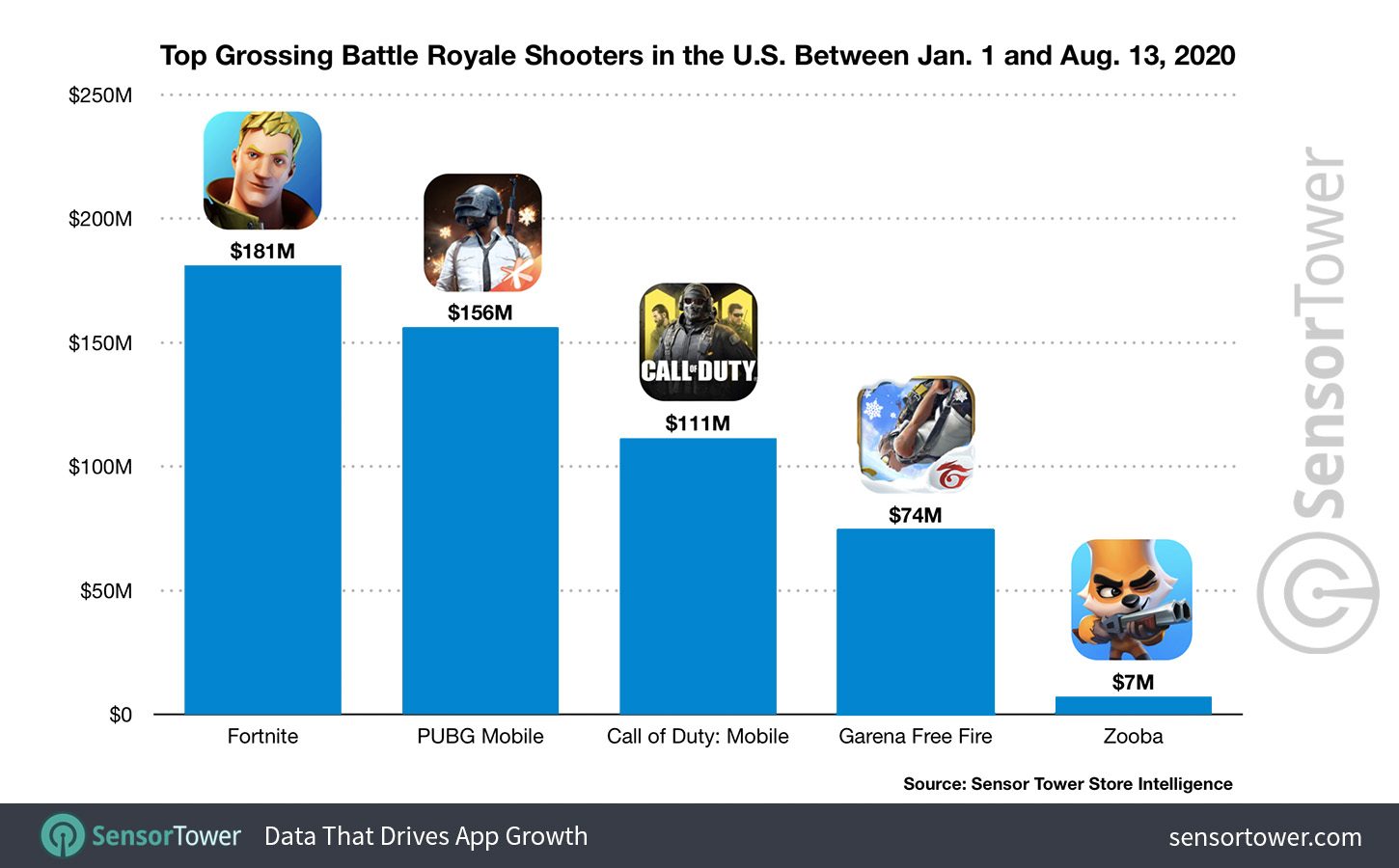

Taking a closer look at Fortnite’s top market, the United States, Epic’s hit title ranked No. 1 so far this year, picking up nearly $181 million across both the App Store and Google Play, about 34 percent of the close to $529 million total grossed by the top five battle royale shooters. PUBG Mobile followed in No. 2 with 29 of player spending, while Call of Duty rounded out the top three with 21 percent. Zooba from Wildlife Studios ranked No. 5 for revenue in the subgenre in the U.S. to date this year, ahead of Knives Out.

On The App Store alone, player spending in Fortnite during the same period hit $177 million, 45 percent of the close to $390 million generated by these five games.

Steamy Stacks (of Cash)

The shooter category and battle royale subgenre has risen rapidly over just the last several years, with some key top titles dominating not just the genre, but becoming some of the world’s top grossing mobile games. It’s too early to tell whether Fortnite’s players will gradually move to other titles in the genre, though, as while Call of Duty: Mobile revenue rose 69 percent in the U.S. week-on-week in the seven days following Fortnite’s removal, it’s not clear yet whether such a rise will be sustainable, or how much of that growth is related. No other title on the market replicates Fortnite or its cultural status, but can a rival fill the current large gap in the mobile games market left by its departure? Only time, and the data, will tell—and we’ll be watching the latter.