2026 State of Mobile is Live!

Mobile App Insights · Marco Scacchi · February 2023

Health and Fitness Apps Need $4.3 Million in Monthly Revenue to Rank at No. 1 in Europe

Our Health and Fitness Apps report reveals that these apps have reached more than 200 million installs in Europe in 2022.

In the new year, Health and Fitness app downloads tend to rise as consumers are inspired to get into shape. Our latest Health and Fitness Apps in Europe report confirms this trend as Q1 installs from 2019 through 2022 show an increase in downloads, followed by a gradual slump from Q2 through Q4. Despite the slowdown in growth rates, apps falling into the Women’s Health and Running, Cycling, and Hiking subcategories have been able to buck the trend.

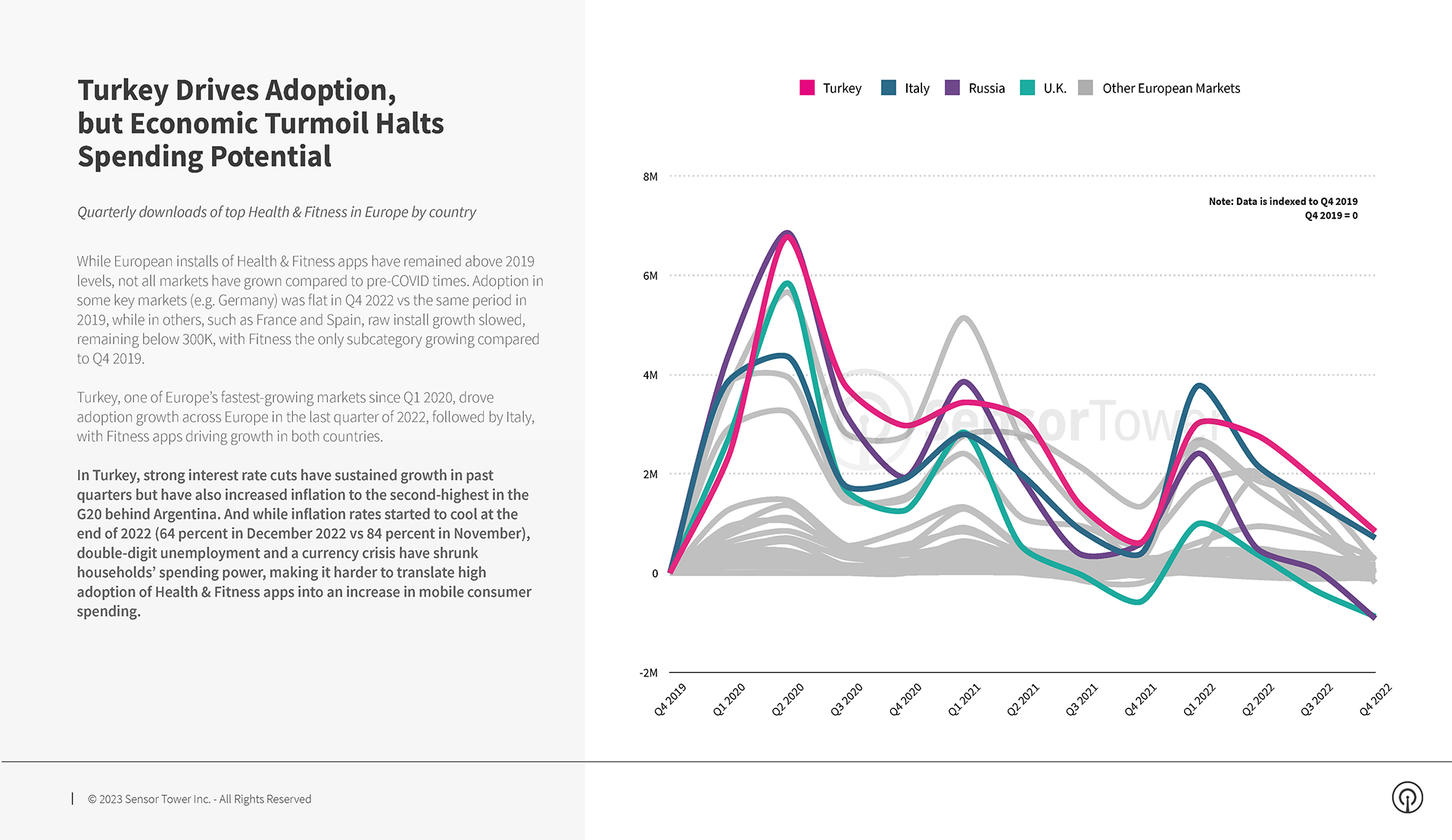

Turkey Drove Adoption

In 2022, Health and Fitness apps in Europe reached 232 million installs, up 16 percent from 2019. Quarterly downloads of the top Health and Fitness apps skyrocketed in 2020 during the peak of the pandemic. Turkey, one of Europe’s fastest-growing markets since Q1 2020, drove adoption growth across Europe in Q4 2022, followed by Italy.

While we have seen installs of Health and Fitness apps remain above 2019 levels, not all markets have been able to grow. Economic headwinds such as inflation and unemployment have made it difficult to translate high adoption rates of Health and Fitness into an increase in mobile spending.

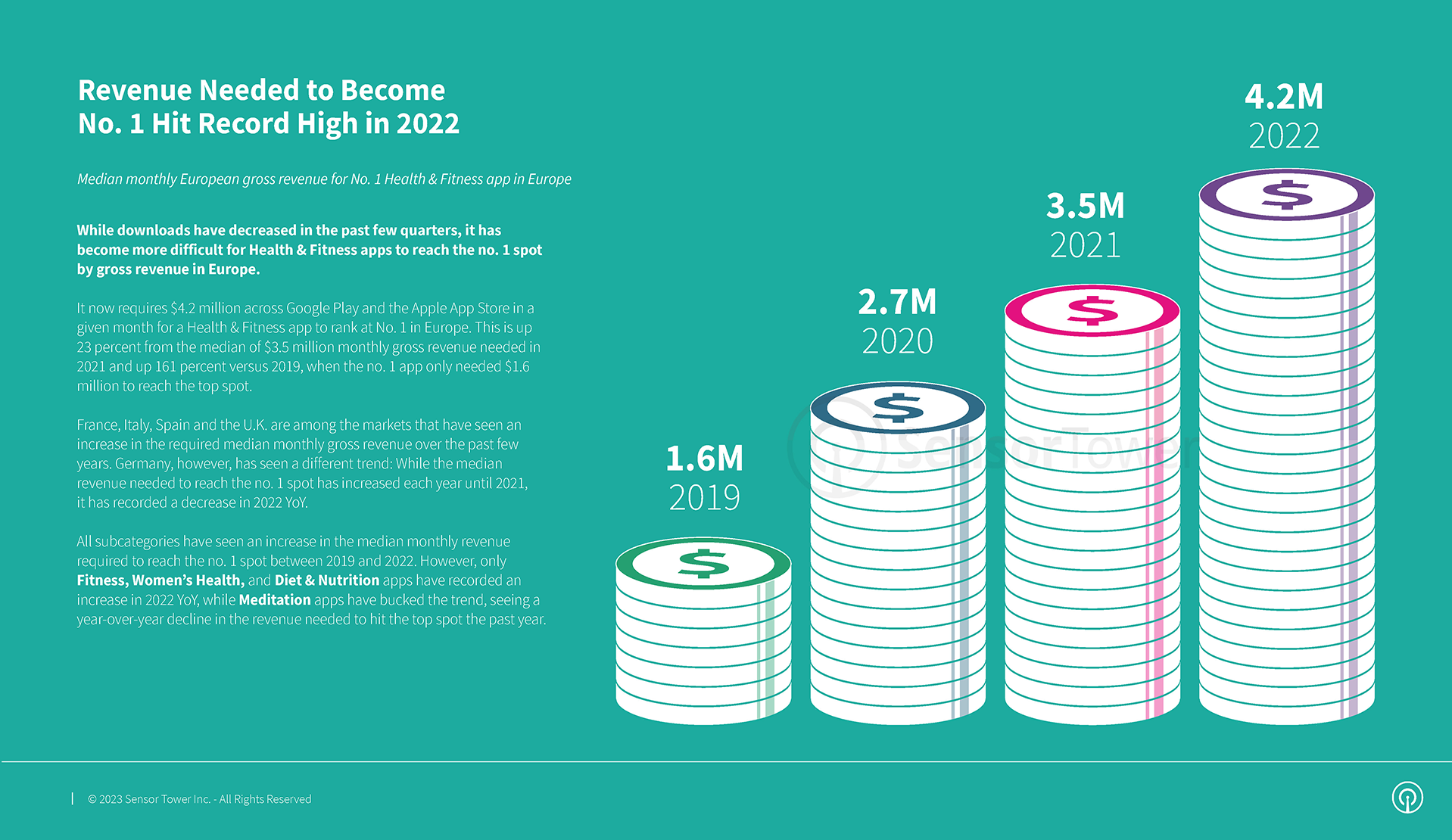

Subcategories See An Increase In Median Monthly Revenue Needed To Reach No. 1

To become the No. 1 ranking Health and Fitness app, it now requires nearly $4 million in gross revenue in a given month across the App Store and Google Play. This is a 23 percent increase from the $3.5 million monthly gross revenue needed in 2021.

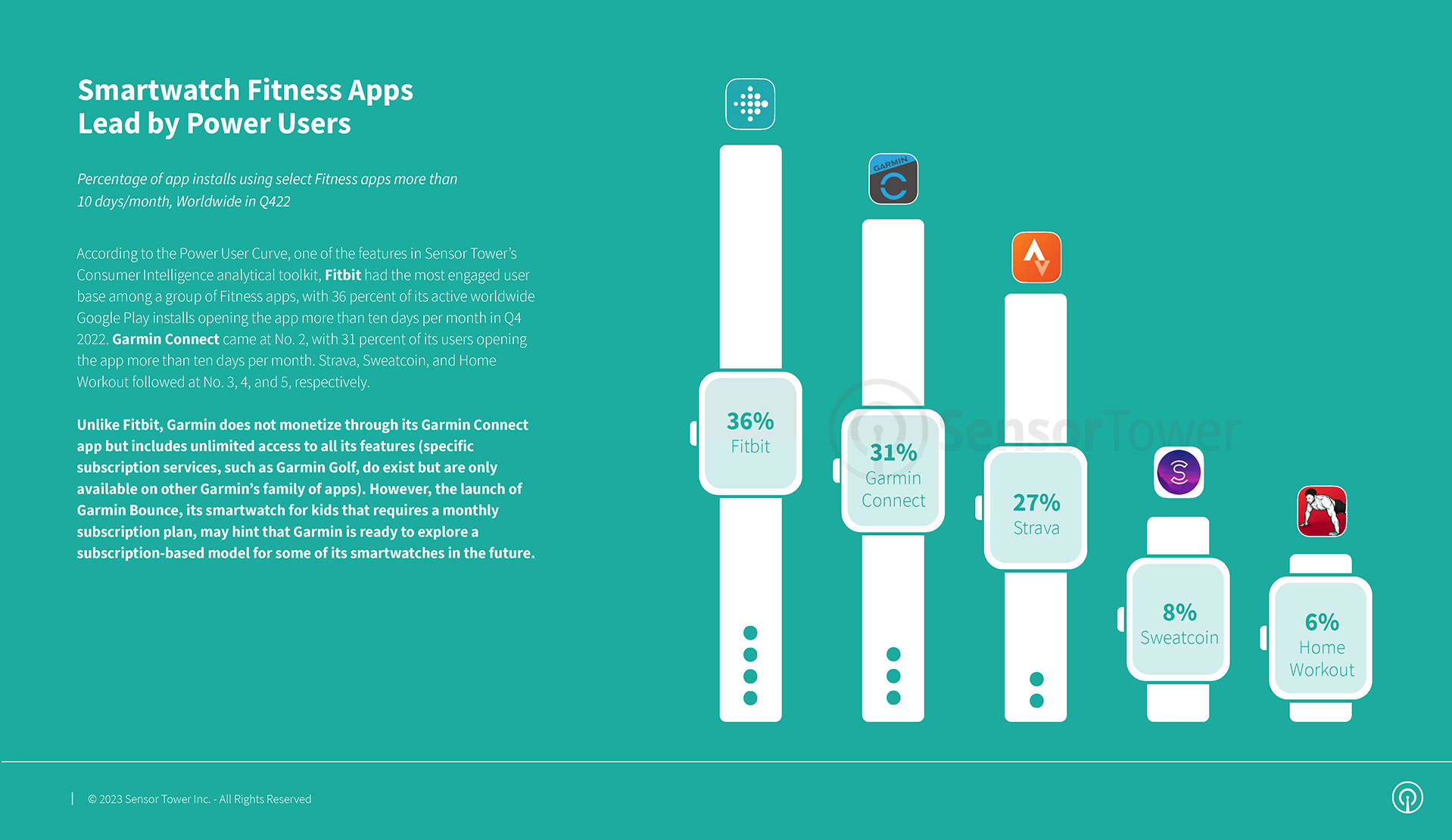

FitBit Has The Most Engaged User Base

Consumers gained a head start to their fitness goals at the end of 2022. According to our Power User Curve tool, Fitbit had the most engaged user base among a group of Fitness apps. Roughly 36 percent of its active worldwide Google Play installs opened the app more than ten days per month in Q4 2022. Other apps such as Garmin Connect, Strava, and Sweatcoin followed at 31 percent, 27 percent, and 8 percent, respectively.

COVID-19 lockdowns have accelerated growth for Health and Fitness apps as consumers were finding ways to stay active while staying home. As restrictions have been lifted, Health and Fitness apps have continued to find ways to grow with new features and targeted campaigns.

Sensor Tower empowers brands with accurate, actionable, and innovative intelligence to succeed in the rapidly evolving digital economy. Download the complete State of Health and Fitness Apps report below for more insights on apps like Flo, Calm, and MyFitnessPal.