2026 State of Mobile is Live!

Mobile App Insights · Stephanie Chan · August 2020

U.S. TikTok Alternatives Grow 361% As Government Ban Looms

Sensor Tower data shows that installs of alternative video-sharing apps grew 361% after the U.S. government threatened to ban TikTok.

While ByteDance maneuvers to avoid a ban from the United States government, consumers have turned their attention to alternative video-sharing apps in case TikTok is forced to shutter in its third largest market. As talk of a ban ramped up from mere conjecture during the week of July 27, four of the largest challengers contending to be the top social video-sharing app in the U.S. saw their installs collectively grow 361 percent compared to the week before, Sensor Tower Store Intelligence estimates show.

The State of TikTok

To date, TikTok has generated more than 2.3 billion installs globally from the App Store and Google Play, including Douyin for iOS in China but excluding installs from third-party Android marketplaces. It started the year strong with the best quarter ever for any app in Q1 2020, but its monthly downloads declined in June and July following a ban in its largest market, India, and the threat of a similar fate in its third largest market, the United States.

In July, the app saw 65.3 million installs worldwide from the App Store and Google Play. This was down 25 percent from nearly 87 million in June, a figure which, in turn, was down 20 percent from 108.7 million downloads in May.

Downloads in the U.S. have also trended downwards in the last three months, with TikTok hitting 6.3 million installs in July. This was down 16 percent from 7.5 million in June, which had dipped 8.5 percent from 8.2 million installs in May. To date, TikTok has generated slightly more than 190 million downloads across the U.S. App Store and Google Play, or about 8 percent of the app's lifetime installs globally, not counting its Android version in China.

A Shifting Landscape

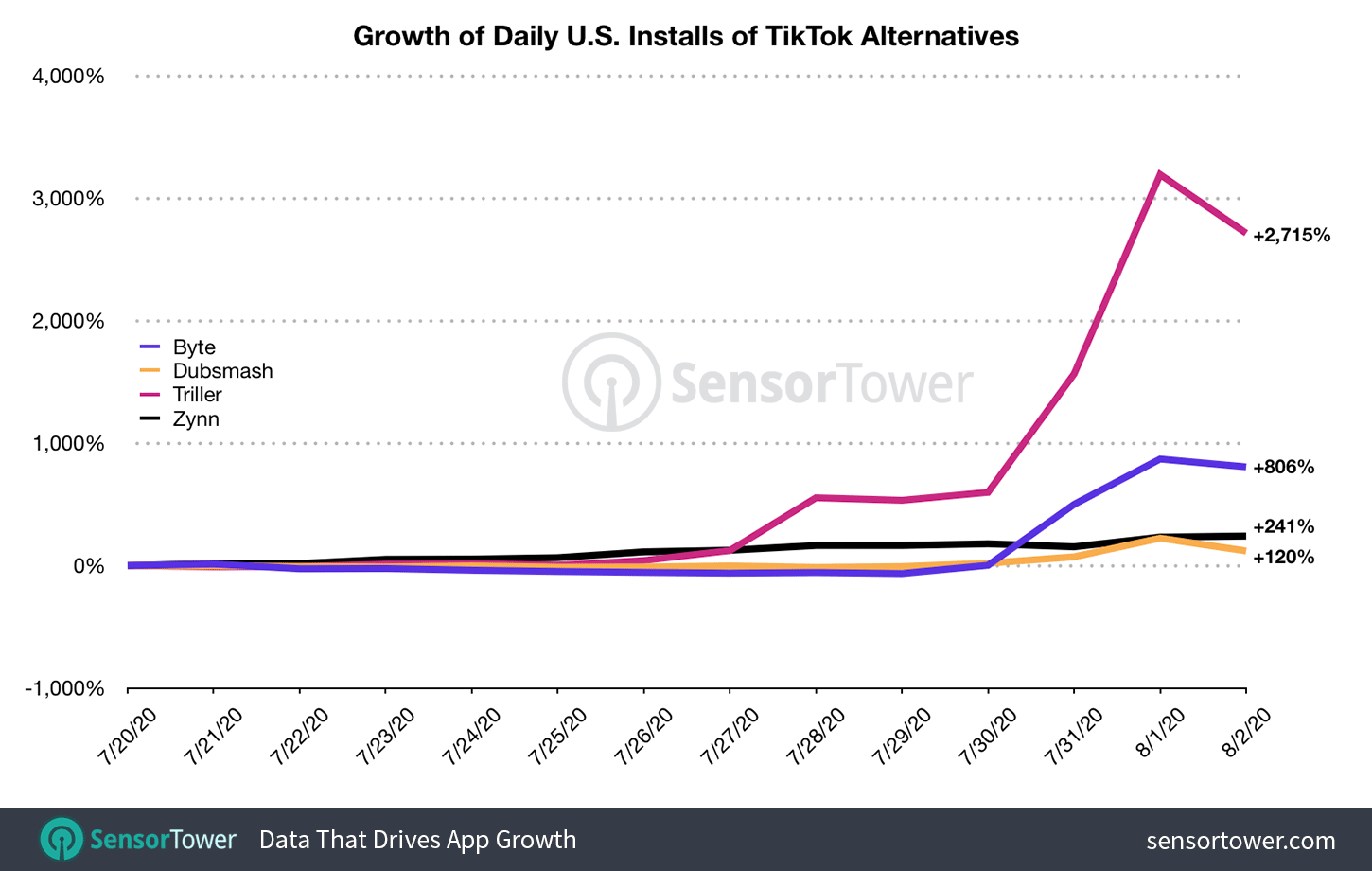

ByteDance's competitors have benefitted from the uncertainty around TikTok's future, and the largest alternative video-sharing apps to emerge are Triller, Zynn, Dubsmash, and Byte. These collectively saw nearly 1.5 million installs during the week of July 27 after the White House threatened to remove TikTok from U.S. marketplaces. This figure represents growth of 361 percent from the week of July 20, when those four apps saw an aggregate of 316,000 installs.

Triller and Byte saw the most substantial week-over-week growth, climbing 1,227 percent and 418 percent, respectively. During this time, Triller reached No. 1 among the top free iPhone apps in 50 markets including the U.S. on August 1. Previously, Byte had seen a spike in downloads during the week of July 6 when the U.S. government initially hinted at an impending TikTok ban. During that period, its installs increased by 275 times the week of June 29.

Zynn had been removed from the U.S. App Store and Google Play in June, but returned on July 21 just in time to capitalize on the challenges facing TikTok. Its installs grew 93 percent W/W during the week of July 27.

Dubsmash saw a smaller boost of 69 percent during that time period, though it has the highest lifetime downloads out of the cohort of TikTok rivals in the U.S. To date, it has accumulated an estimated 41.6 million installs.

Other apps have only recently joined the fray of competition: Clash launched in beta on July 24, and Tsu is available on an invite-only basis to early adopters. It's too early to tell how much of TikTok's massive user-base these newcomers will be able to attract, and they'll have more established video-sharing apps such as Triller and Dubsmash to compete with.

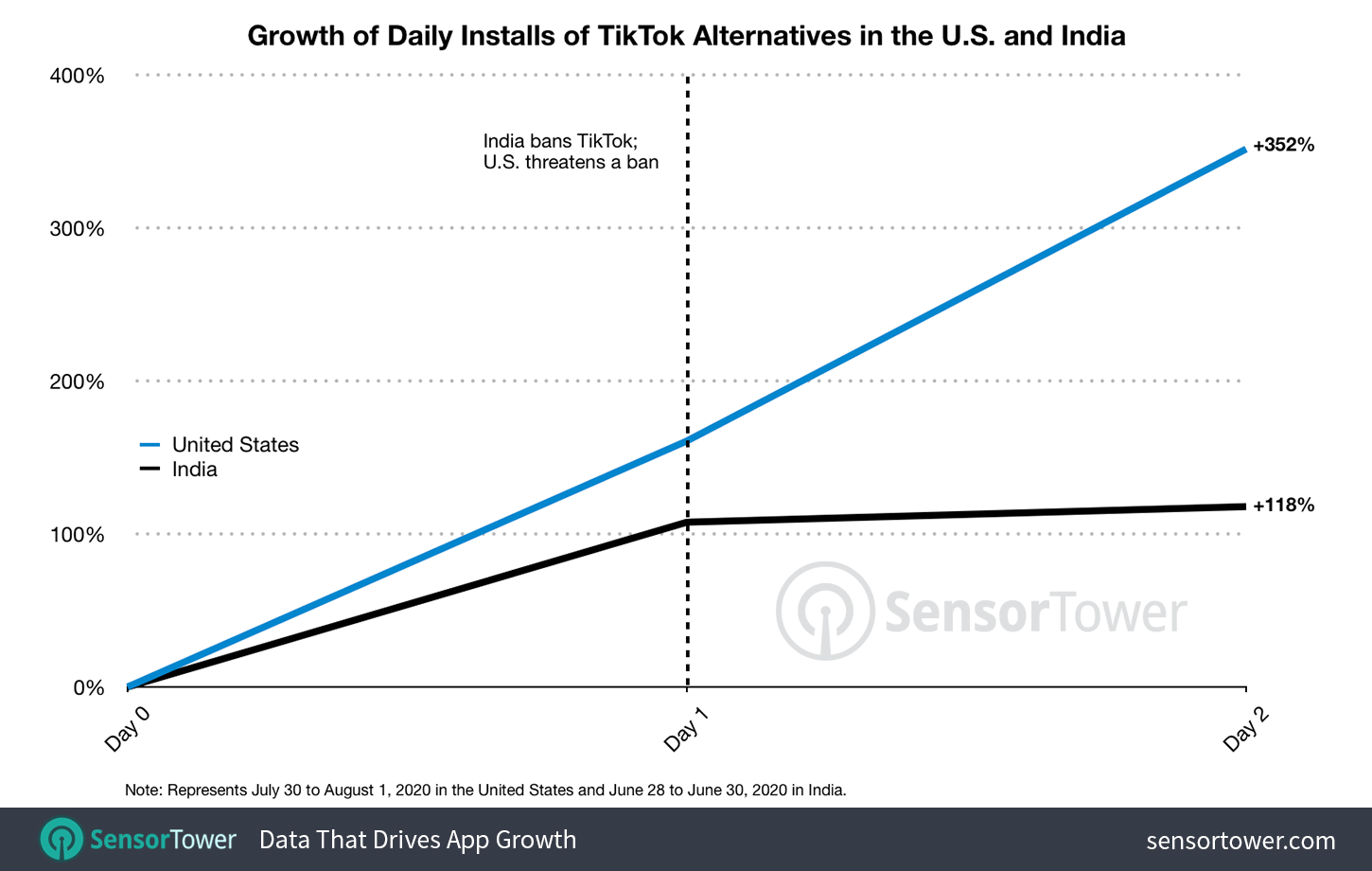

More Opportunities for Competitors

Although TikTok has yet to see an outright ban in the U.S., its situation has parallels to what happened after it was removed from India's App Store and Google Play on June 29. During that week, competitors Roposo, Zili, and Dubsmash collectively saw a 106 percent W/W boost in downloads. In the three weeks following the ban, the three saw a 155 percent increase when compared to the three weeks before.

Since ByteDance lost access to its largest market, alternative video-sharing apps Snack Video and Likee have climbed the charts there. In July, both ranked in the top 10 most downloaded non-game apps in the world at No. 8 and No. 9, respectively. This was likely due in part to their popularity in India, where Snack Video hit 22.4 million installs and Likee saw about 10 million that month.

As ByteDance works to resolve its current situation in the U.S., its competitors now have even more opportunities to grow their own audiences. However, as the playing field grows crowded with so many choices, developers will have to continually hone their user acquisition and app store optimization strategies as they vie for consumers' attention.