2026 State of Mobile is Live!

Trusted by leaders in mobile

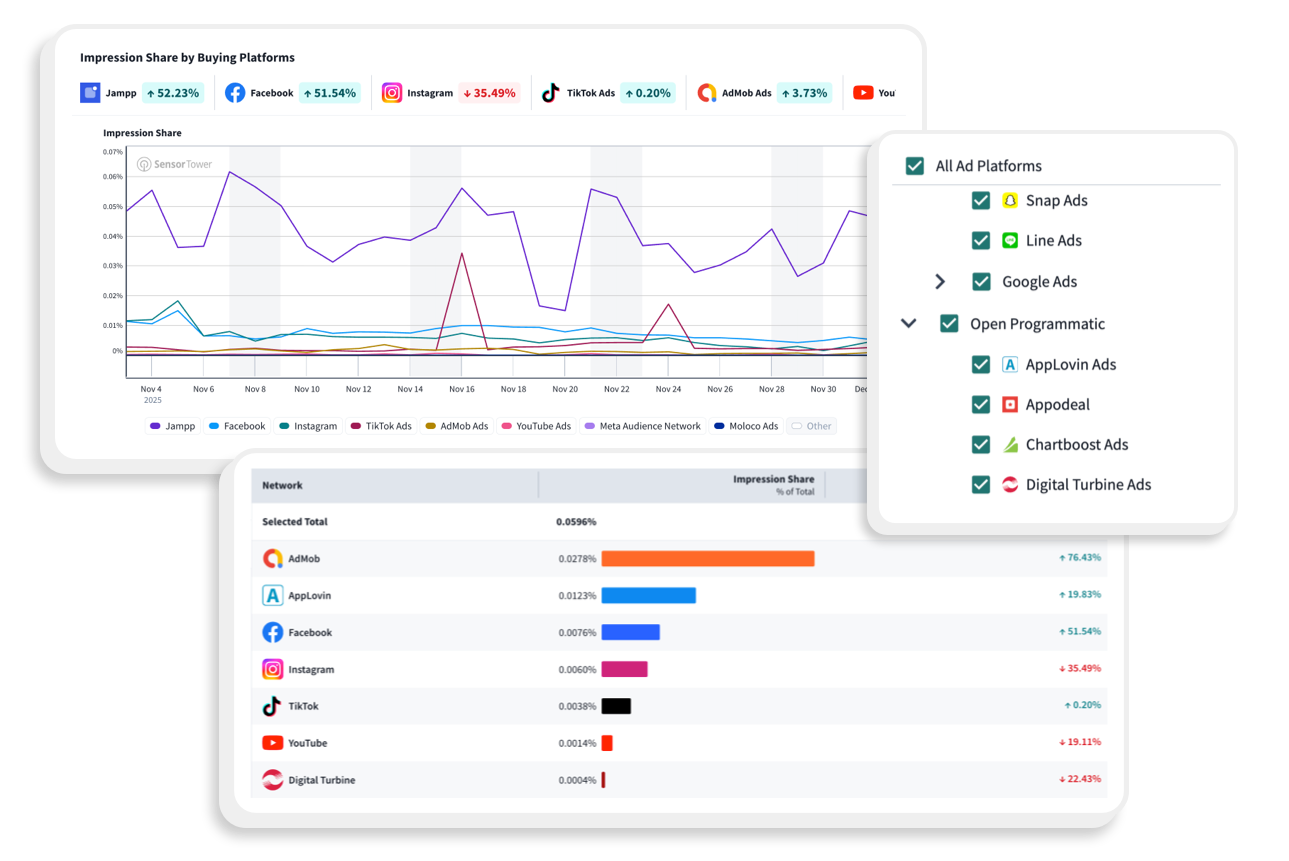

See exactly where competitors put their ad budgets

Understand how top apps direct their advertising budgets across different media buying channels - including demand-side platforms - and where their campaigns actually run. Instantly see whether changes in impressions come from increased investment or a shift in where budgets are allocated, helping you interpret competitor moves with confidence.

See how top apps split their spend and where their ads run

Use real-time market signals to refine creatives and boost performance

Spot the creative ideas and messages driving the most engagement

See where advertising presence is growing or slowing down

Track shifts in ad activity through Share of Voice, impression trends, and side-by-side comparisons with downloads and revenue to reveal real ad impact and capture the white space.

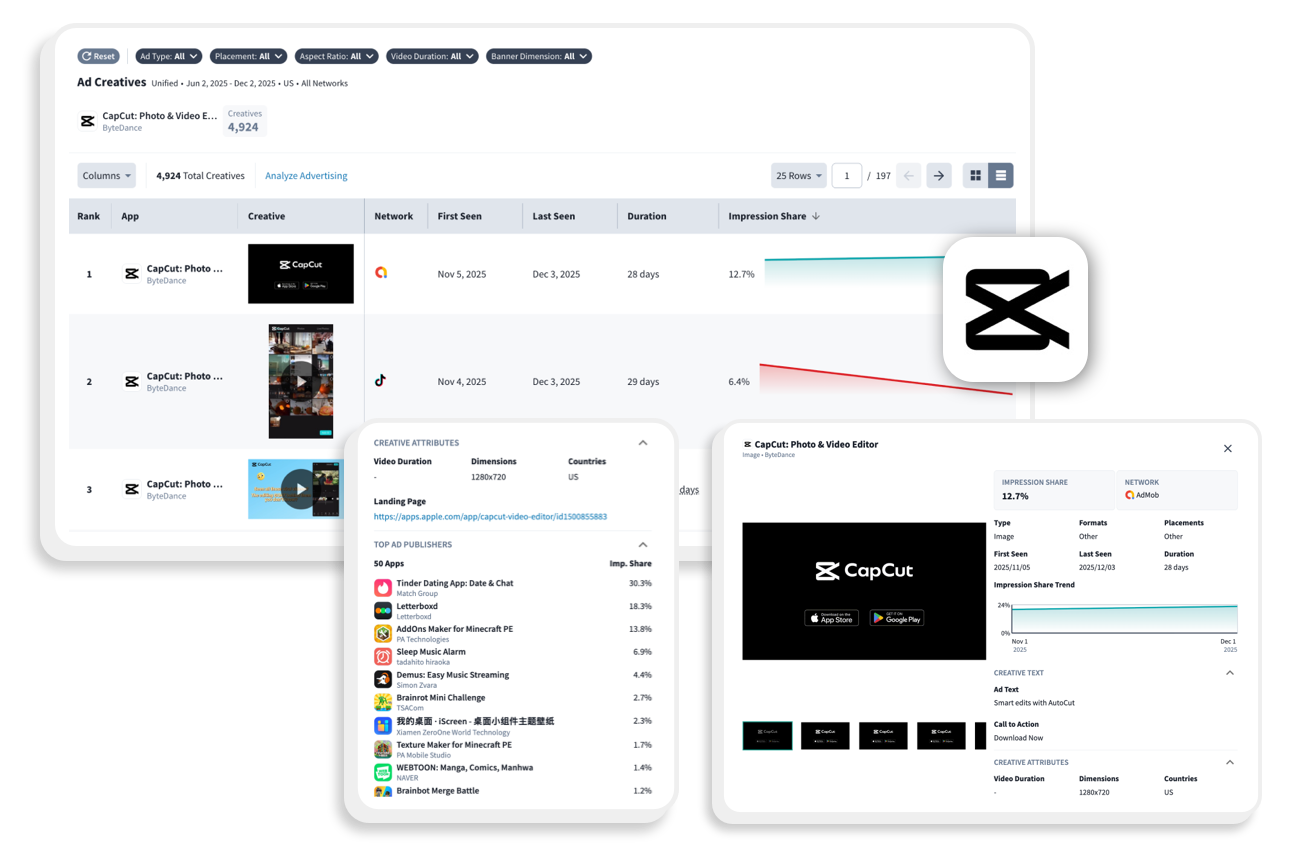

Optimize creatives with real market signals

See which creative formats and messages are gaining traction across the market in our Creative Gallery. Track what creative themes top advertisers amplify, where they push volume, and which creative approaches help them scale, and then use these insights to refine your own campaigns in real time.

Frequently Asked Questions

1. What is App Advertising Insights by Sensor Tower?

App Advertising Insights is a mobile advertising analytics solution that helps marketers, product teams, and growth leaders understand how top mobile apps plan, execute, and optimize paid user acquisition campaigns across major ad networks and channels.

2. What advertising data can I track with this tool?

You can see where competitors are allocating advertising budgets, how much share of voice they’re gaining, which ad networks are serving impressions, and creative performance insights — including formats, messaging, and trends — so you can improve your campaigns and media strategies.

3. How does App Advertising Insights help with competitor benchmarking?

The platform shows where your competitors are spending on ads, which channels they use most, and how their impression trends shift over time. This lets you compare competitor investment strategies and adapt your media buys based on real market data.

4. Can this tool optimize ad creatives and messaging?

Yes. The creative gallery and creative performance insights help you identify top-performing messages and formats in the market, giving you ideas to refine your own ad creative and messaging strategy based on proven engagement signals.

5. How does it help improve paid user acquisition performance?

By tracking share of voice, impression trends, and creative patterns across channels and regions, App Advertising Insights helps you:

reduce cost of acquisition (CAC)

identify which audiences and ad formats work best

spot growth opportunities and media inefficiencies in real time

6. Is the data global and localized for specific markets?

Yes — the solution provides market-specific insight so you can analyze advertising trends by country, region, or network, helping you tailor your paid strategies for different global audiences.

7. Who benefits most from using App Advertising Insights?

App Advertising Insights is ideal for:

UA and growth marketers refining acquisition strategy

Media planners optimizing ad spend across networks

Product leaders benchmarking against competitors

Creative teams seeking evidence-backed messaging and format ideas

Sensor Tower Blog

Gaming Insights • February 2026

State of Gaming 2026: Mobile, PC, & Console Trends

State of Gaming 2026 take a cross-platform view of the industry before diving into mobile game performance, marketing, and Live Ops trends. We’ll then explore the ins and outs of PC/Console dynamics, closing with a deep-dive case study on the Shooters genre.

Digital Advertising Insights • February 2026

Q4 Digital Market Index: App, Ads & Web Data

Our quarterly post-mortem on the digital economy is here — and there's a lot to say about Q4 2025. From AI's industry-spanning takeover to Europe's status as a growth leader, we're diving into the mobile, app, ad and web data that you need to understand a rapidly-evolving landscape.