2026 State of Mobile is Live!

Mobile App Insights · Stephanie Chan · October 2020

U.S. Buy Now, Pay Later App Usage Climbed 186% Year-Over-Year in September

The top BNPL apps in the U.S. saw their monthly active users grow by 186 percent year-over-year in September, Sensor Tower data shows.

Mobile apps that enable consumers to purchase goods on payment plans have seen their monthly installs climb steadily in the United States since COVID-19's economic impact began to be felt broadly in March of this year. In an analysis of top U.S. apps in this category, Sensor Tower Store Intelligence data reveals that their adoption by first-time users collectively grew 115 percent year-over-year in September while monthly active users climbed by 186 percent.

Installs on the Rise

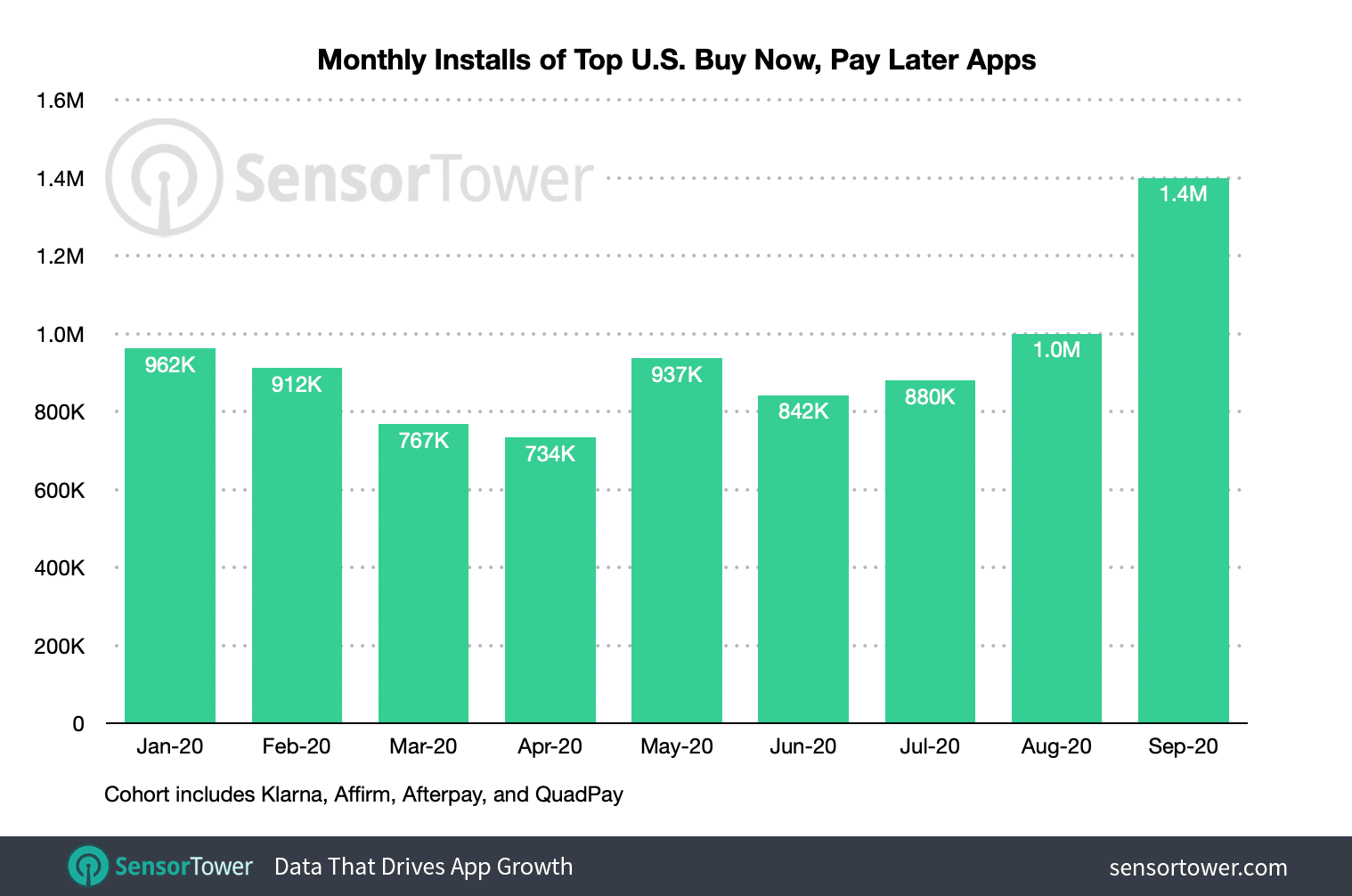

Sensor Tower examined a cohort comprised of the top four buy now, pay later (BNPL) apps in the U.S., including Klarna, Affirm, Afterpay, and QuadPay. To date, the four have collectively generated close to 18 million lifetime installs from across the U.S. App Store and Google Play. The cohort's downloads began to climb throughout 2019, eventually hitting 1.4 million last December, the most it had seen in a single month.

After declining month-over-month between March and April of this year, U.S. installs for the top BNPL apps surged in May, growing 28 percent M/M. Installs for the cohort declined in June, but have continued to climb since July, increasing 40 percent M/M in September to 1.4 million, their previous record.

Combined installs of the top apps last month were up 115 percent Y/Y from approximately 650,000 in September 2019. Compared to January of this year, the cohort of top BNPL apps has grown monthly installs by 46 percent.

A Growing User Base

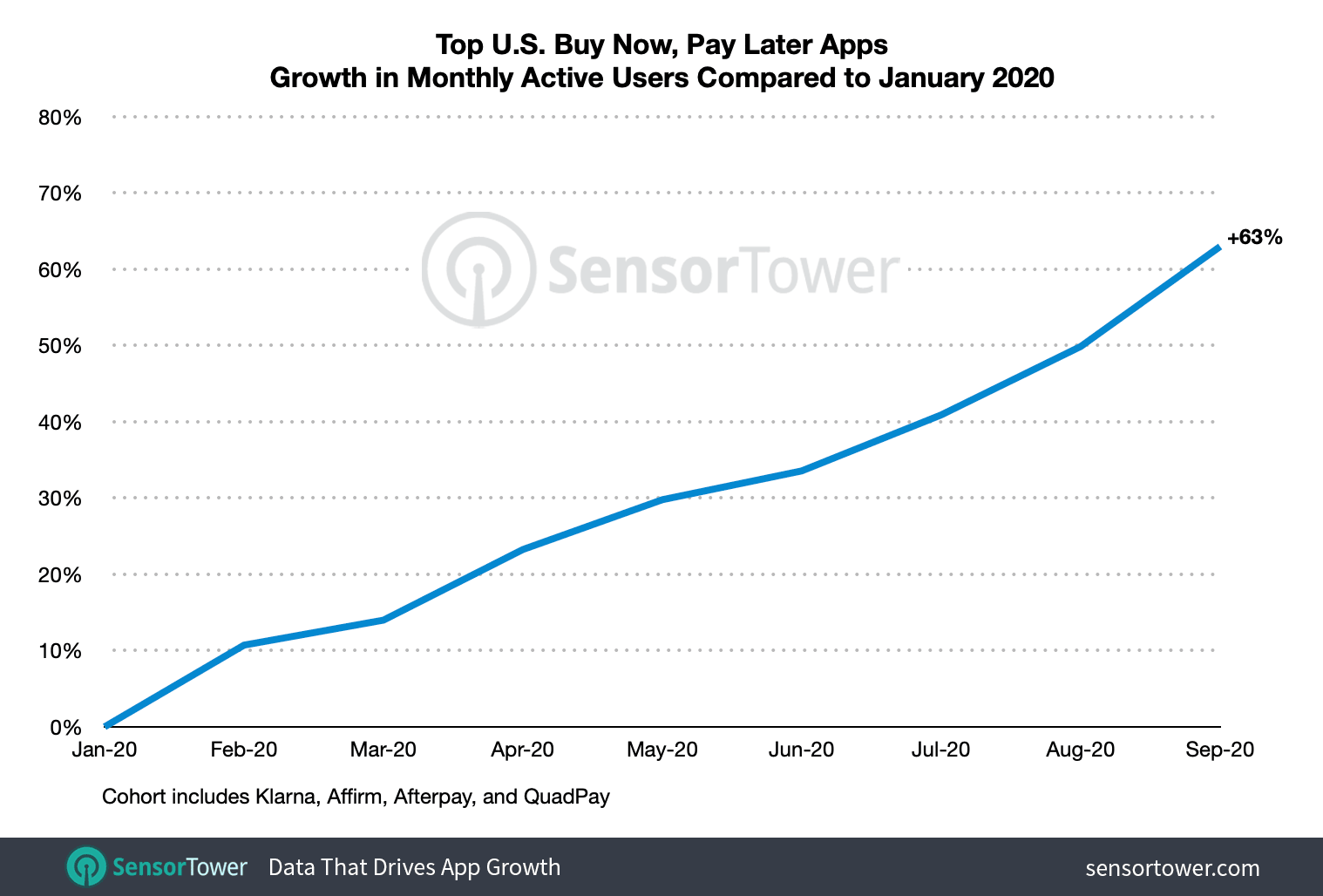

Although the top BNPL apps collectively saw the same number of installs last month as they did in December 2019, the cohort's combined monthly active user growth told a different story. More consumers than ever were using these apps in September, up 74 percent when compared to December. The cohort's monthly active users in September saw even greater Y/Y growth, climbing 186 percent compared to the previous year.

The cohort's monthly active users have continued to climb each month so far in 2020. February saw the highest M/M growth of 11 percent. Should this trend continue, it's possible these apps will see considerably more usage this holiday season than in 2019.

New Consumer Behaviors This Holiday Season

The COVID-19 pandemic has already forced U.S. businesses and app makers to adapt. From March to September, the Food & Drink and Shopping categories saw 50 percent more new app launches than during the same period in 2019, the majority of them featuring delivery options, contact-free payment, and discounts or deals on apparel and other goods. As the recession deepens in the U.S. and consumers seek more budget-friendly options, it's likely that interest in BNPL apps will continue to surge.

Standalone apps such as Klarna face competition from major mobile payment platforms such as PayPal and Square, both of which offer financing options with PayPal Credit and Square Installments, respectively. Other platforms such as Shopify offer a similar feature called Shop Pay Installments to merchants, although it is currently only available to U.S. businesses. However, the surge in adoption and growing monthly active users for standalone options both point to intensifying consumer interest in them—especially as we enter the holiday season.