2026 State of Mobile is Live!

Mobile App Insights · Craig Chapple · January 2021

European Mobile App Consumer Spending Grew 31% in 2020 to Nearly $15 Billion

European app spending accounted for 13 percent of global app revenue in 2020, Sensor Tower data shows.

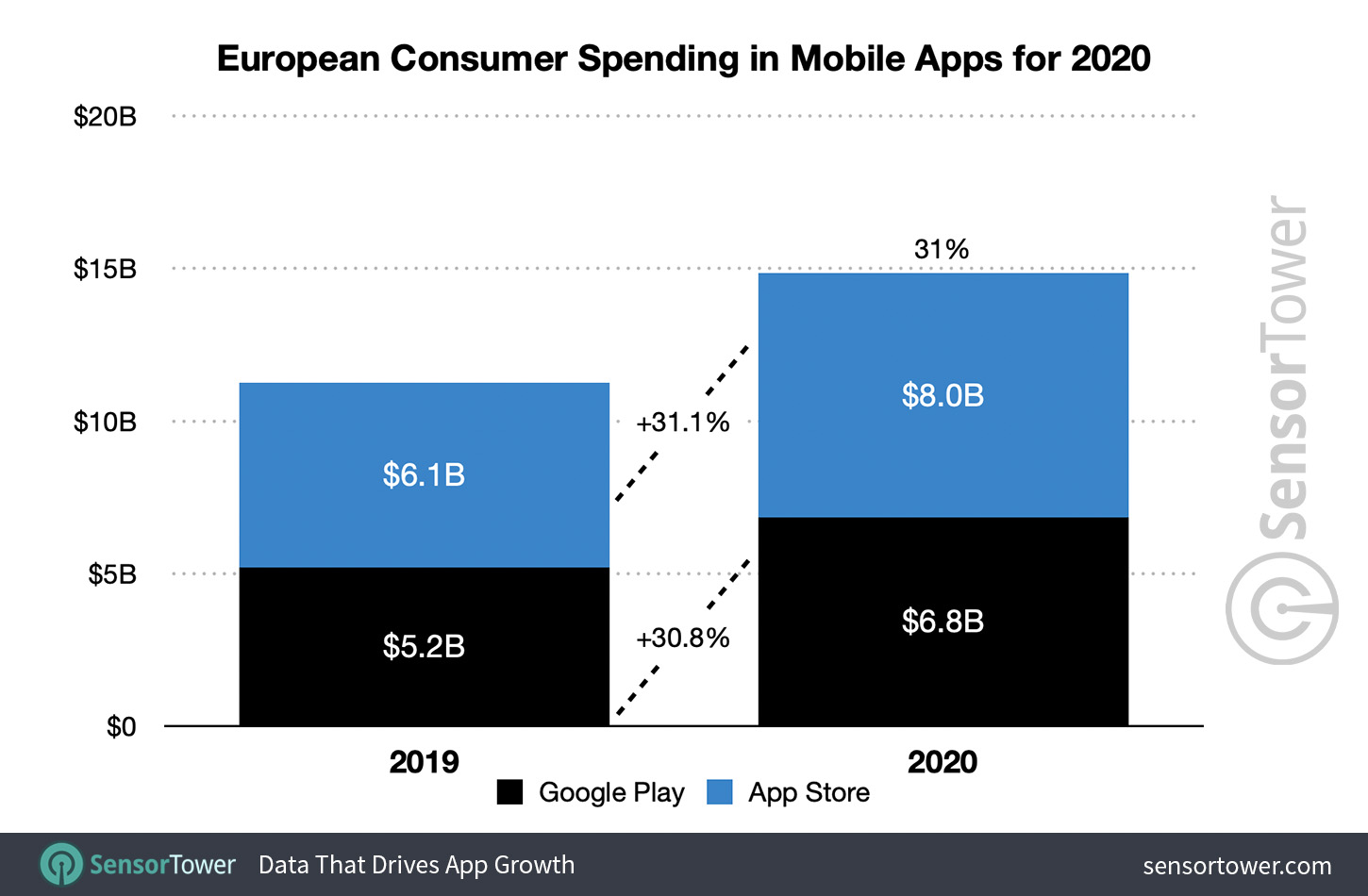

European mobile consumers spent an estimated $14.8 billion across the App Store and Google Play during 2020, Sensor Tower Store Intelligence data shows.

This represented a 31 percent year-over-year increase in gross revenue from 2019, based on user spending for in-app purchases, subscriptions, and premium apps. Such large growth was accelerated by the COVID-19 pandemic and lockdowns, as Europe became an epicentre for the outbreak. European spending accounted for 13.3 percent of global mobile app revenue in 2020, which reached $111 billion.

In this report, we delve deeper into mobile non-gaming and gaming app revenue and download figures, and identify which countries are driving the region’s markets forward.

European Mobile App Revenue and Downloads

The App Store drove the majority of user spending in Europe, generating $8 billion in gross revenue in 2020, a Y/Y increase of more than 31 percent. Google Play revenue, meanwhile, grew 30.8 percent Y/Y to $6.8 billion.

Overall, the App Store accounted for 54 percent of user spending in Europe during 2020, with Google Play making up the remaining 46 percent.

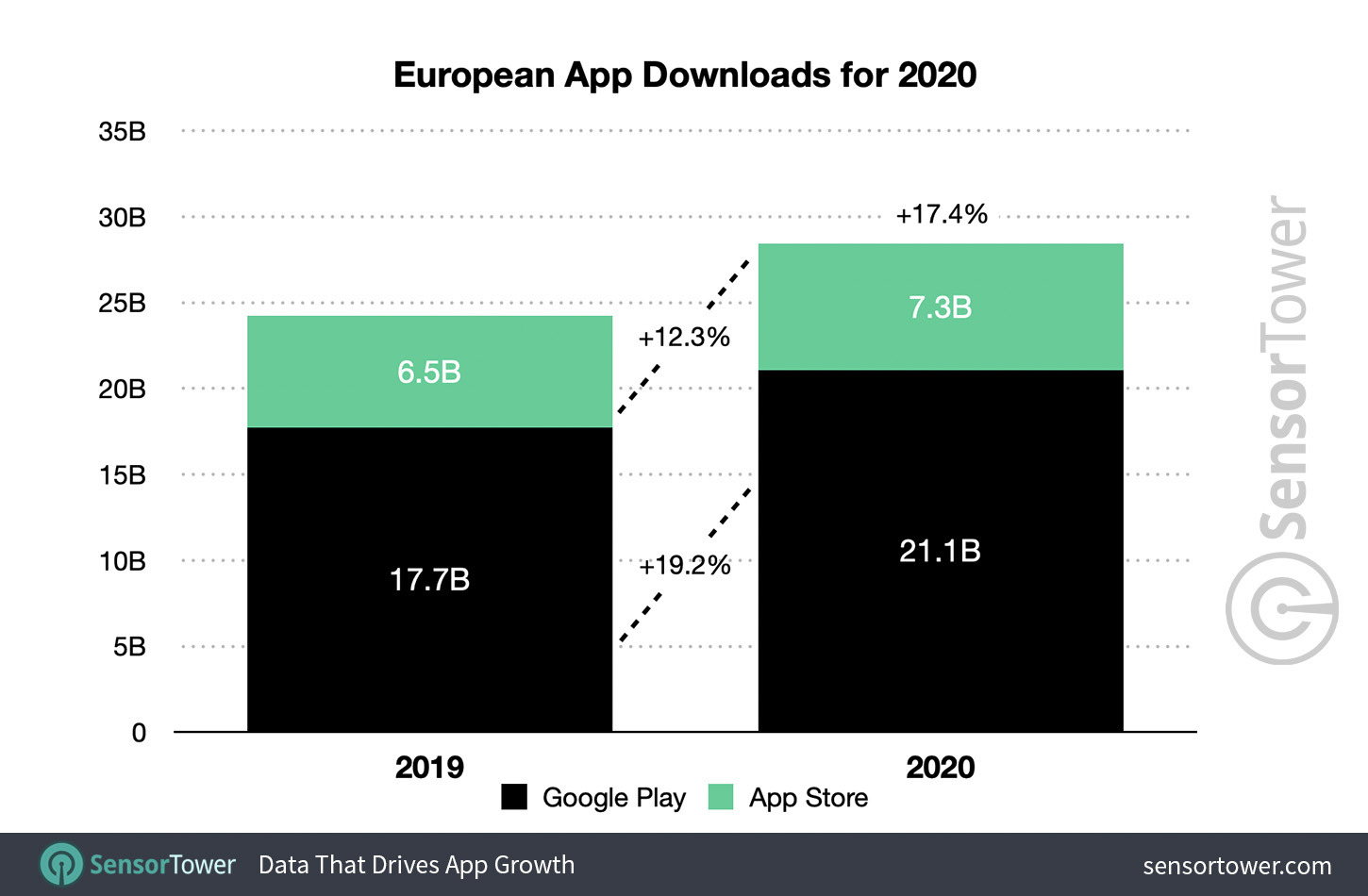

When it comes to downloads, the App Store and Google Play accumulated a combined 28.4 billion unique installs in 2020, up 17.4 percent Y/Y.

As is typically the case globally, Google Play drove a greater number of downloads than the App Store, amassing more than 21 billion installs in Europe in 2020, an increase of 19.2 percent Y/Y. The App Store generated 7.3 billion downloads, growing 12.3 percent Y/Y.

Google Play accounted for 74 percent of all downloads, while the App Store made up 26 percent.

Europe’s Top Countries

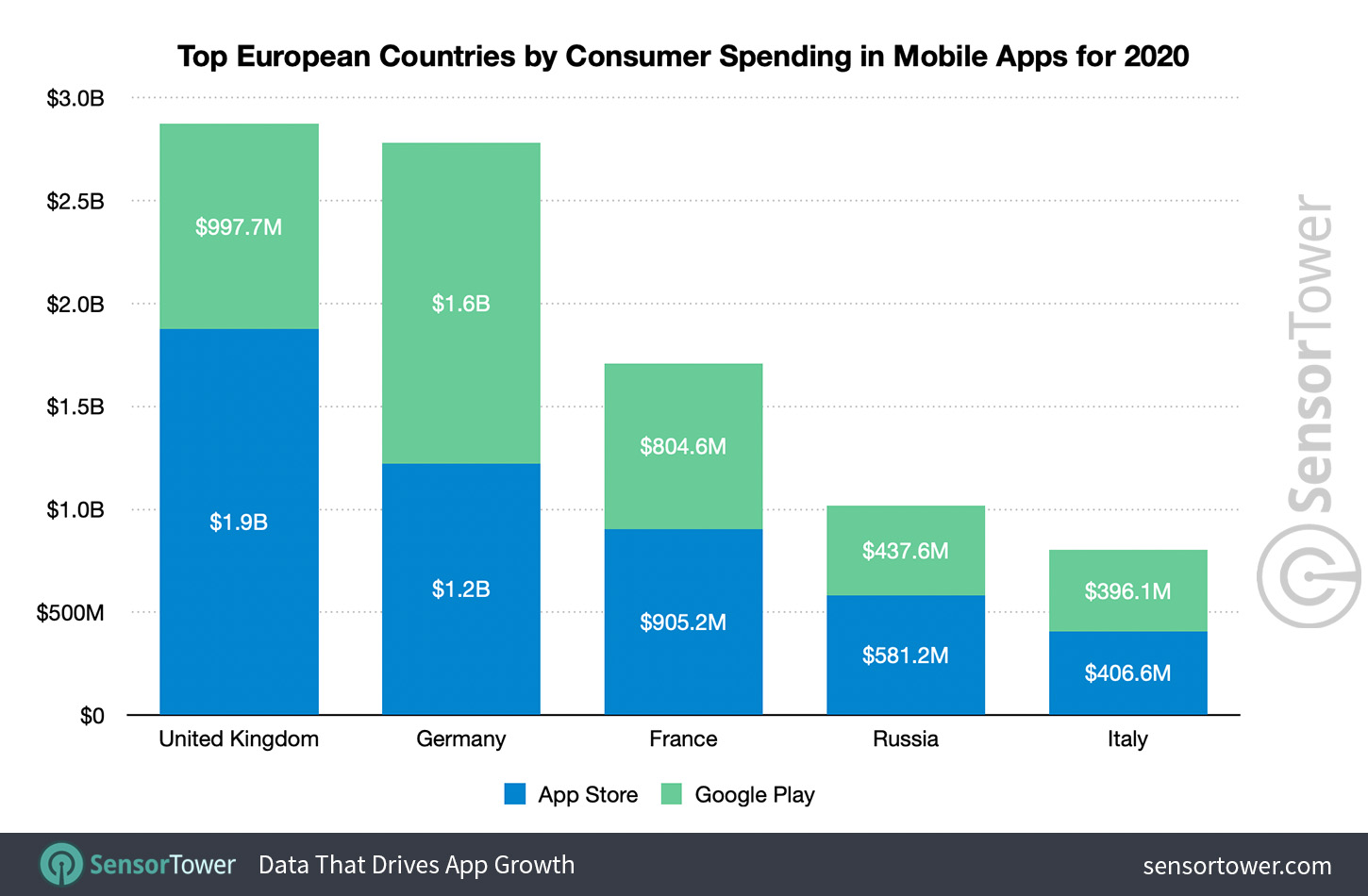

The European country that drove the most revenue in 2020 was the United Kingdom, generating $2.9 billion in user spending across the App Store and Google Play, up 33 percent Y/Y. Germany was close behind with $2.8 billion, an increase of 33.3 percent, while France ranked No. 3, having accrued $1.7 billion, up 25.8 percent.

The U.K. represented the largest share of App Store revenue in Europe with $1.9 billion, or 23.4 percent of all user spending on the store. Germany, meanwhile, ranked No. 1 for Google Play revenue, generating $1.6 billion, or 22.7 percent of the total.

The biggest generator of downloads was Russia with 6 billion installs in 2020, up 12.8 percent Y/Y. For comparison, Turkey ranked No. 2 for downloads with 3.9 billion installs for the year.

Most of Russia’s downloads came from Google Play, where it accrued close to 4.9 billion installs, or 23.4 percent of all downloads on the store in Europe. The U.K., meanwhile, led the way on the App Store with 1.4 billion downloads, or 18.5 percent of the total.

Europe’s Top Mobile Apps

As in 2019, dating platform Tinder was the top grossing non-gaming app in Europe in 2020, generating $329.5 million in user spending, significantly ahead of the No. 2 app Netflix. It should be noted, however, that Netflix redirects App Store users to its website for new sign-ups, which Sensor Tower does not track.

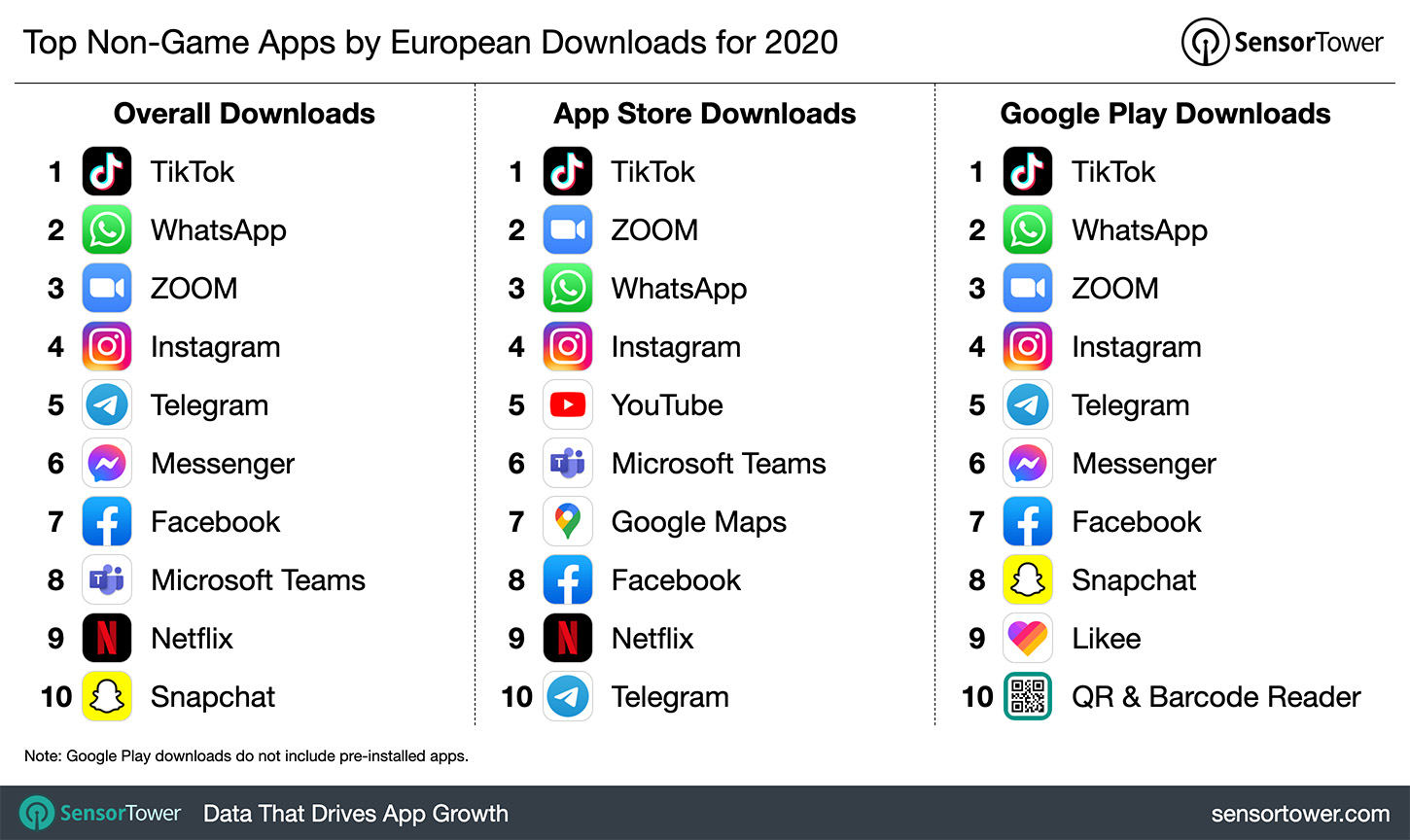

TikTok rose to the No. 1 spot for downloads in 2020, generating close to 163 million installs in Europe, up approximately 78 percent Y/Y. It was followed by messaging platform WhatsApp at No. 2, and video conferencing tool Zoom at No. 3. The latter garnered 124.7 million downloads in the region in 2020 as Europeans searched for ways to communicate and work from home during the COVID-19 pandemic and lockdowns.

European Mobile Game Revenue and Downloads

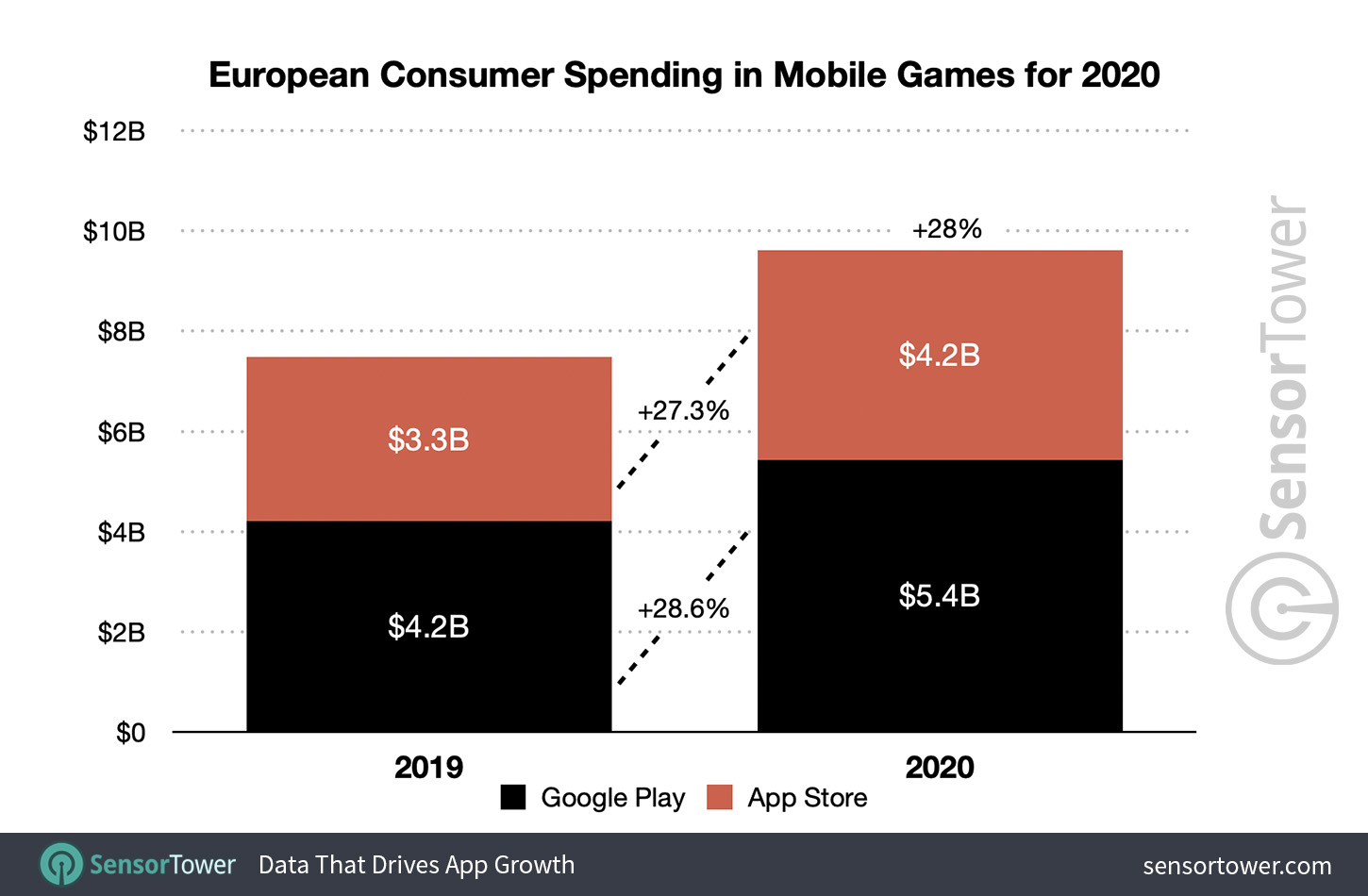

Mobile games generated $9.6 billion in Europe in 2020, an increase of 28 percent Y/Y. In total, gaming accounted for 64.8 percent of all mobile app revenue in Europe based on user spending. That’s down from a 66.4 percent market share in 2019, with categories such as Entertainment and Social Networking growing faster when it comes to revenue. Globally, European player spending in games accounted for approximately 12 percent of the global mobile games market.

While on a global level the App Store generated more game revenue than Google Play, in Europe the opposite was true. Google Play users spent $5.4 billion in the region last year, up 28.6 percent Y/Y, while the App Store generated close to $4.2 billion from user spending, an increase of 27.3 percent.

Overall, Google Play represented 56.3 percent of total gaming revenue in Europe, while the App Store accounted for 43.7 percent.

Germany was a key driver for Google Play games revenue, with user spending on the storefront representing $1.3 billion, or 64.2 percent of all mobile game revenue in the country.

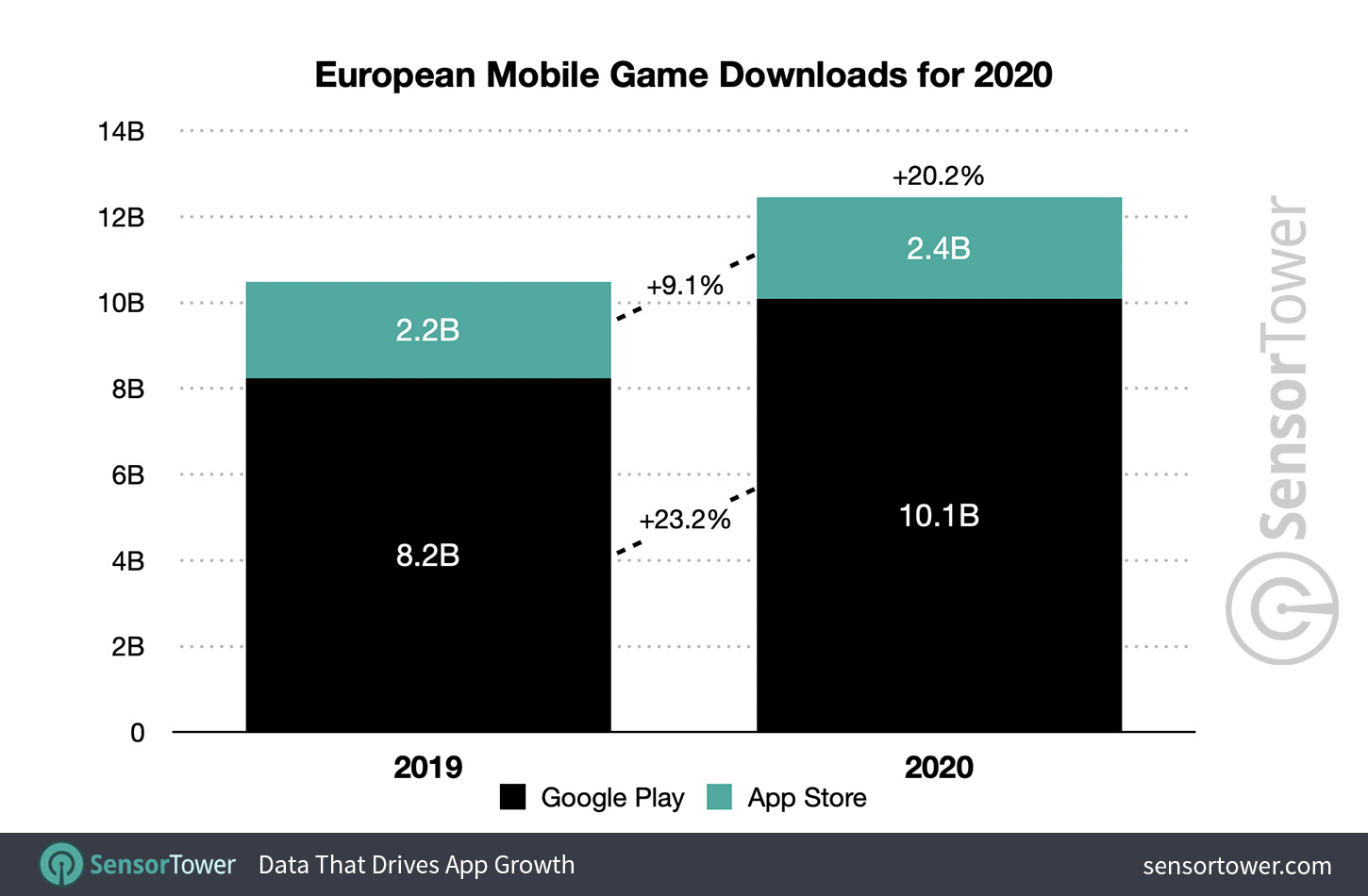

Combined gaming downloads across Europe increased by 20.2 percent Y/Y from 10.4 billion in 2019 to 12.5 billion in 2020. Unique installs for Google Play increased 23.2 percent to more than 10 billion, while App Store downloads grew by more than 9 percent to 2.4 billion. Overall, Google Play accounted for approximately 81 percent of total game downloads in Europe last year, while the App Store made up 19 percent.

Coin Master from Moon Active continued its meteoric rise in 2020, working its way to the top of the pile in Europe as the top revenue-generating mobile game with $398.2 million. That was higher than Brawl Stars from Supercell, which accumulated close to $259 million, and PUBG Mobile from Tencent, which grossed $253.5 million.

The fastest growing title in Europe’s top 10 grossing rankings was State of Survival from FunPlus, which saw revenue grow nearly 23 times Y/Y to $165 million. It was followed by Roblox from Roblox Corporation, which saw a 128 percent increase in player spending on mobile Y/Y, and PUBG Mobile, which saw 119.5 percent revenue growth.

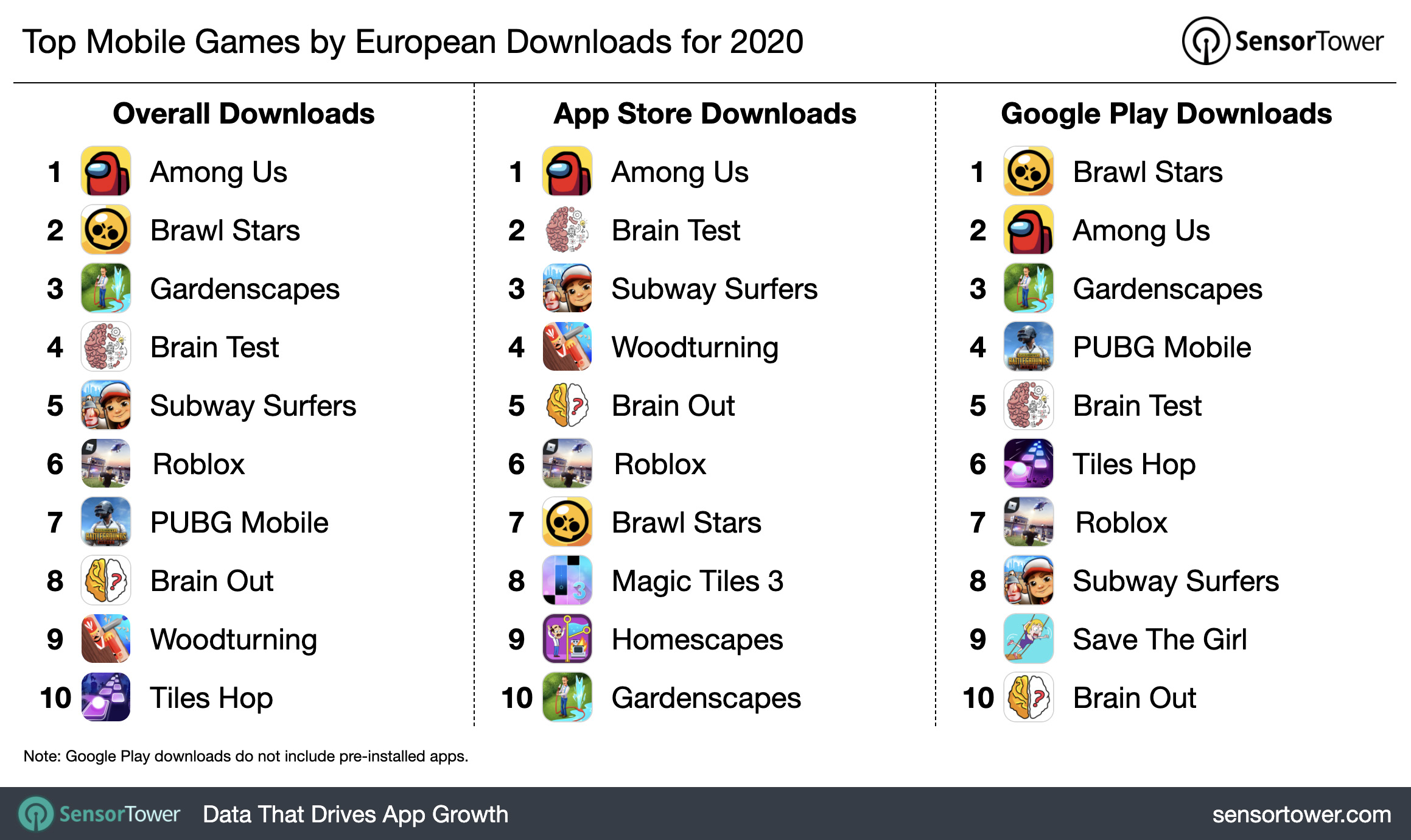

The year’s biggest surprise hit, the social deduction game Among Us from InnerSloth, topped the European game downloads chart with 64.7 million downloads in 2020, a 50-times increase Y/Y. Of the top 10 most downloaded games, only two were hyper-casual titles.

Central Role

Early in 2020, Europe rapidly became a hotspot for the COVID-19 pandemic, resulting in a series of country-wide lockdowns across the region. As people sheltered at home to keep safe, they turned to their mobile phones for entertainment and necessities. App spending increased by 31 percent, faster Y/Y than the global increase of 30.2 percent. Perhaps unsurprisingly, and aided by the rollout of Disney+ across Europe in 2020, the Entertainment category was a fast riser, overtaking segments such as Social Networking and Lifestyle. Player spending in games also exploded, increasing by 28 percent Y/Y, more than the 26 percent growth the global mobile games market saw.

It’s unlikely Europe will see such significant growth in revenue and downloads in 2021, though social restrictions continue to be enacted in various countries. What seems certain, however, is that consumers have formed new habits that have seen their mobile phones play an increasingly central role in their lives, whether that’s for playing games, streaming films, or shopping for groceries.

Note: The revenue estimates contained in this report are not inclusive of local taxes, in-app advertising, or in-app user spending on mobile commerce, e.g., purchases via the Amazon app, rides via the Lyft app, or food deliveries via the DoorDash app. Refunds are also not reflected in the provided figures.