2026 State of Mobile is Live!

Mobile App Insights · Stephanie Chan · June 2022

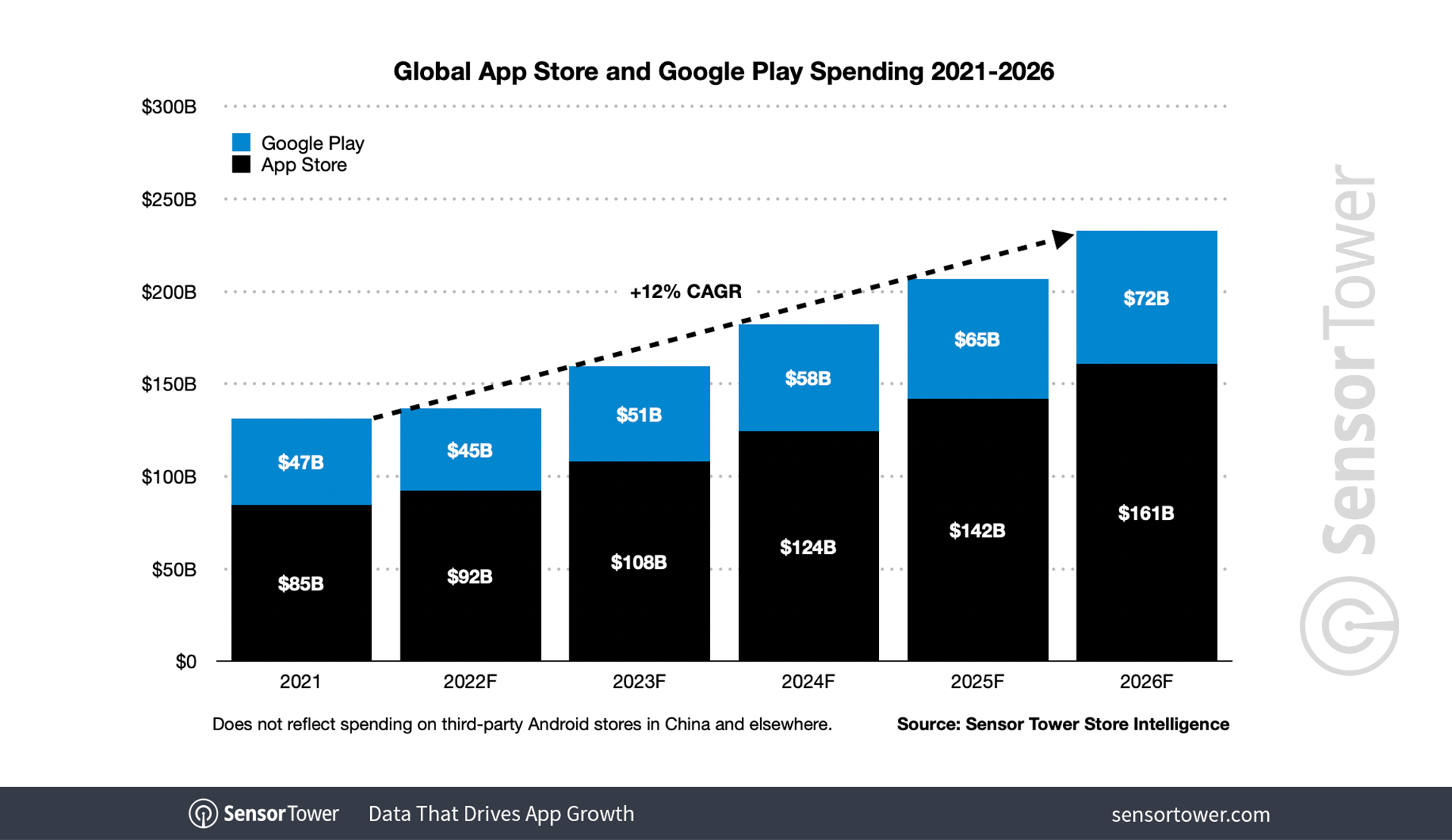

5-Year Market Forecast: App Spending Will Reach $233 Billion by 2026

Sensor Tower projects that global in-app spending will climb with a 12 percent compound annual growth rate over the next five years.

By 2026, global consumer spending on premium apps, in-app purchases, and subscriptions will reach $233 billion across Apple’s App Store and Google Play. This is 77 percent higher than the $132 billion consumers spent in 2021. Our latest market forecast using Sensor Tower Store Intelligence data, available now, analyzes the long-term effects of current market trends as well as how consumer habits will evolve over the next five years.

In-App Spending Will Grow at 12 Percent CAGR

Although consumer spending habits have normalized since the initial spike during the pandemic, gross revenue on both app stores will continue to climb each year with a 12 percent compound annual growth rate (CAGR), reaching $233 billion in 2026.

Sensor Tower forecasts that the App Store will see a CAGR of 13.7 percent through 2026 to reach $161 billion annually. On Google’s platform, consumer spending is projected to grow at a CAGR of 8.9 percent, reaching $72 billion within the next five years.

The United States will outpace the global trend across the board, with consumer spending projected to reach $86 billion in 2026 at a CAGR of 16.5 percent. Apple’s App Store is forecasted to experience a CAGR of 18.8 percent, reaching $59.5 billion, while Google Play will climb to $27.4 billion at a CAGR of 12.3 percent.

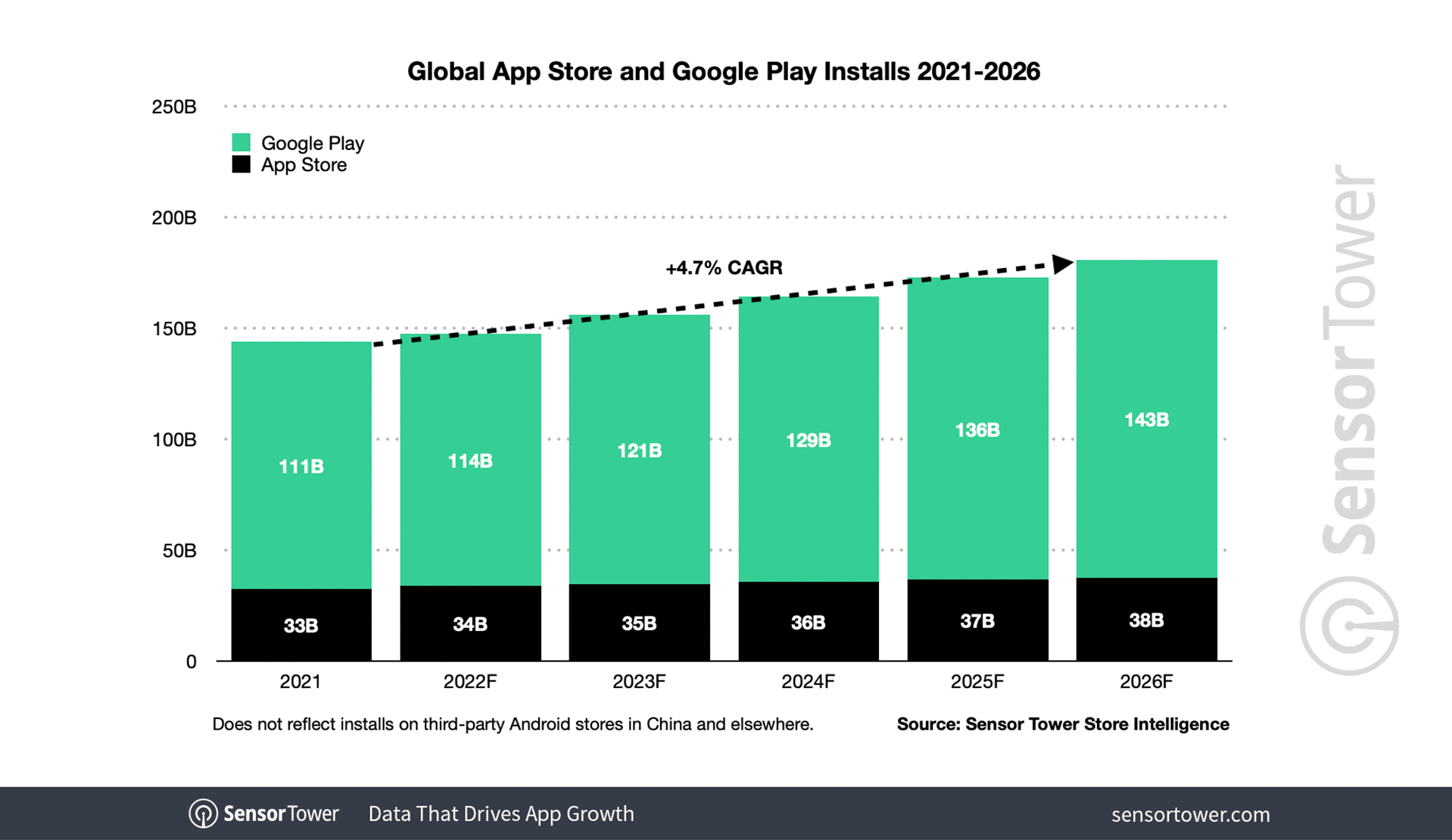

First-Time Downloads Continue Consistent Climb

Despite slowing since the surge in 2020, first-time downloads will continue to set new records in the next five years, climbing at a rate of 4.7 percent CAGR to 181 billion in 2026. The growth of app adoption on the App Store will experience 2.9 percent CAGR, reaching 37.8 billion within the next five years, while Google Play will surpass the combined CAGR by climbing 5.2 percent to 143.1 billion.

The velocity of first-time download growth in the U.S. lags behind global trends, with combined installs across the App Store and Google Play slated to climb to 13.4 billion in 2026 at a rate of 0.5 percent CAGR. Most of the growth is driven by the App Store, which will experience a 1.4 percent CAGR to reach 8.2 billion; Google Play will conversely see a decline of 1.2 percent CAGR to 5.2 billion downloads in 2026.

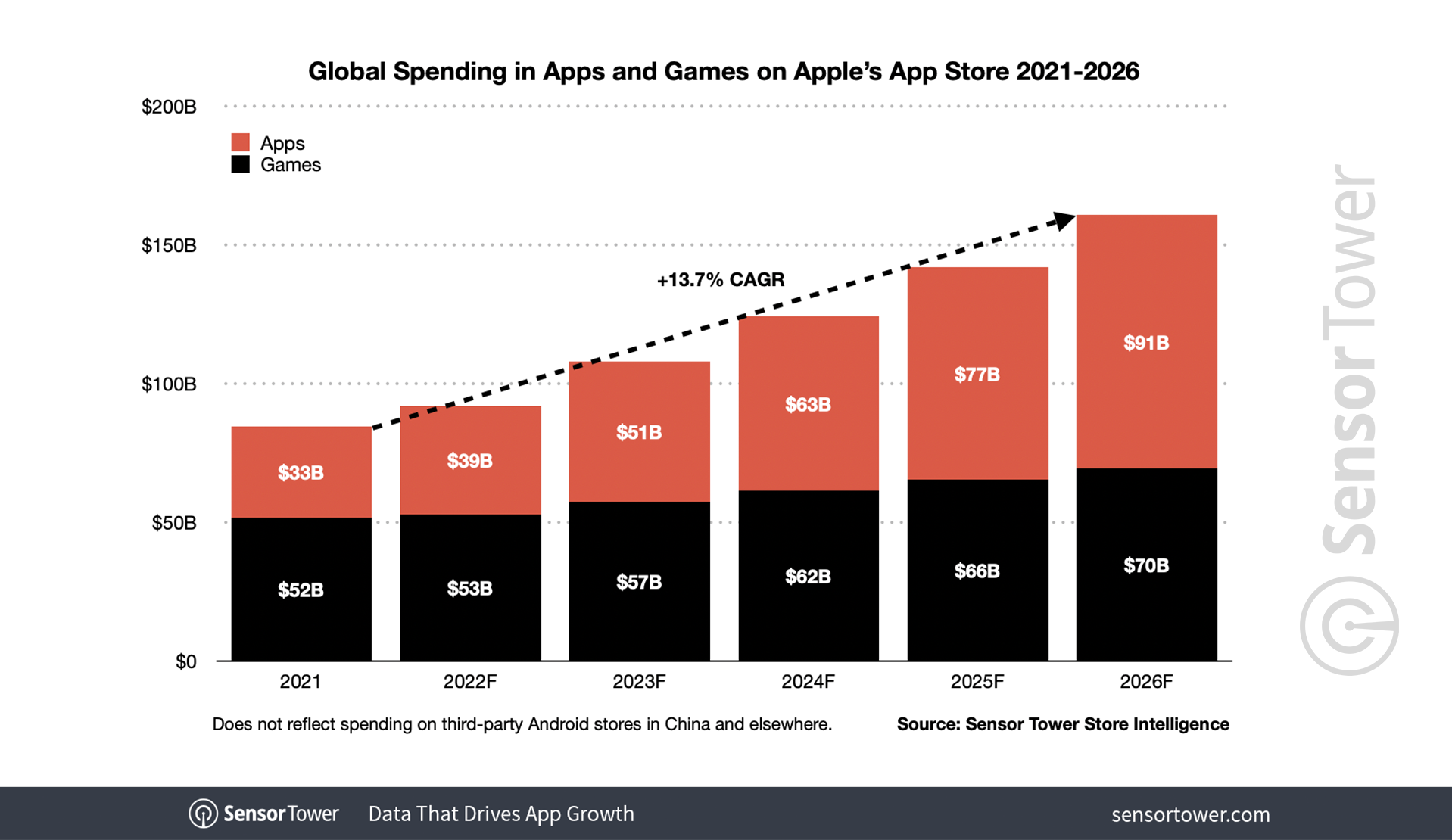

Non-Game Apps Will Represent the Majority of iOS Spending by 2026

Although mobile games will continue to reign as the single highest grossing category, non-game apps will collectively outpace its revenue share by 2026—at least on Apple’s App Store. By 2026, mobile games will represent 43 percent of revenue share on that marketplace, down 23 points from 2020. On Google Play, mobile games will also see a downward trend over the next five years; however, it will maintain its majority revenue share with 65 percent in 2026, down 18 points from 2020.

Among non-game apps, Entertainment is the leading category on iOS, with its revenue share climbing 5 points over the next five years to 13 percent. Social, Entertainment, and Productivity are the largest non-game apps by revenue share on Google Play, with Social and Entertainment tying at 6 percent revenue share in 2026.

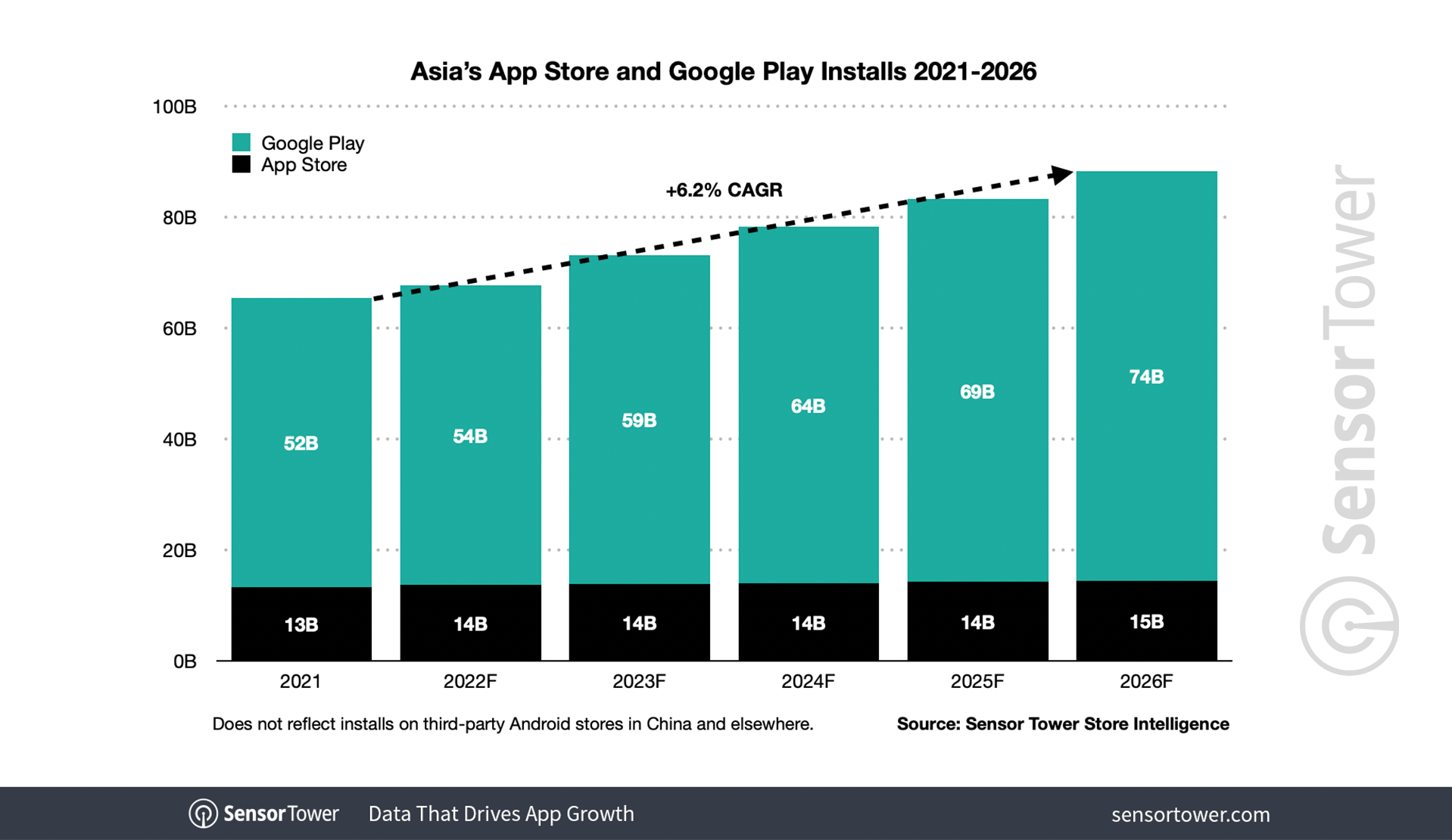

Asia Leads in App Adoption Over the Next Five Years

While North America will lead in consumer spending growth over the next five years, with revenue growing 113 percent in that region, Asia will see the most growth in app adoption. The region will experience a 6.2 percent CAGR and reach 88.3 billion first-time downloads by 2026, driven primarily by Google Play. Apple’s marketplace will see a CAGR of 1.7 percent over the next five years, reaching 14.5 billion, whereas Google Play will outpace the combined CAGR with 7.2 percent and reach 73.8 billion in 2026.

India will lead the region, reaching 40.2 billion new downloads in 2026, up 44 percent compared to 27.8 billion in 2021.

Opportunities Flourish Outside of Gaming

As the market continues to normalize after outsized spending and adoption during the onset of the pandemic, some new consumer habits have proven to be tenacious. Apps in the Business and Medical categories, for instance, are still seeing an increased velocity in adoption, far above what was expected before 2020. And consumers have shown a continued willingness to spend on non-game apps.

For more analysis, including key insights on specific markets and categories, download the complete report in PDF form below: