We’ve acquired Playliner!

Store Intelligence · Stephanie Chan · February 2021

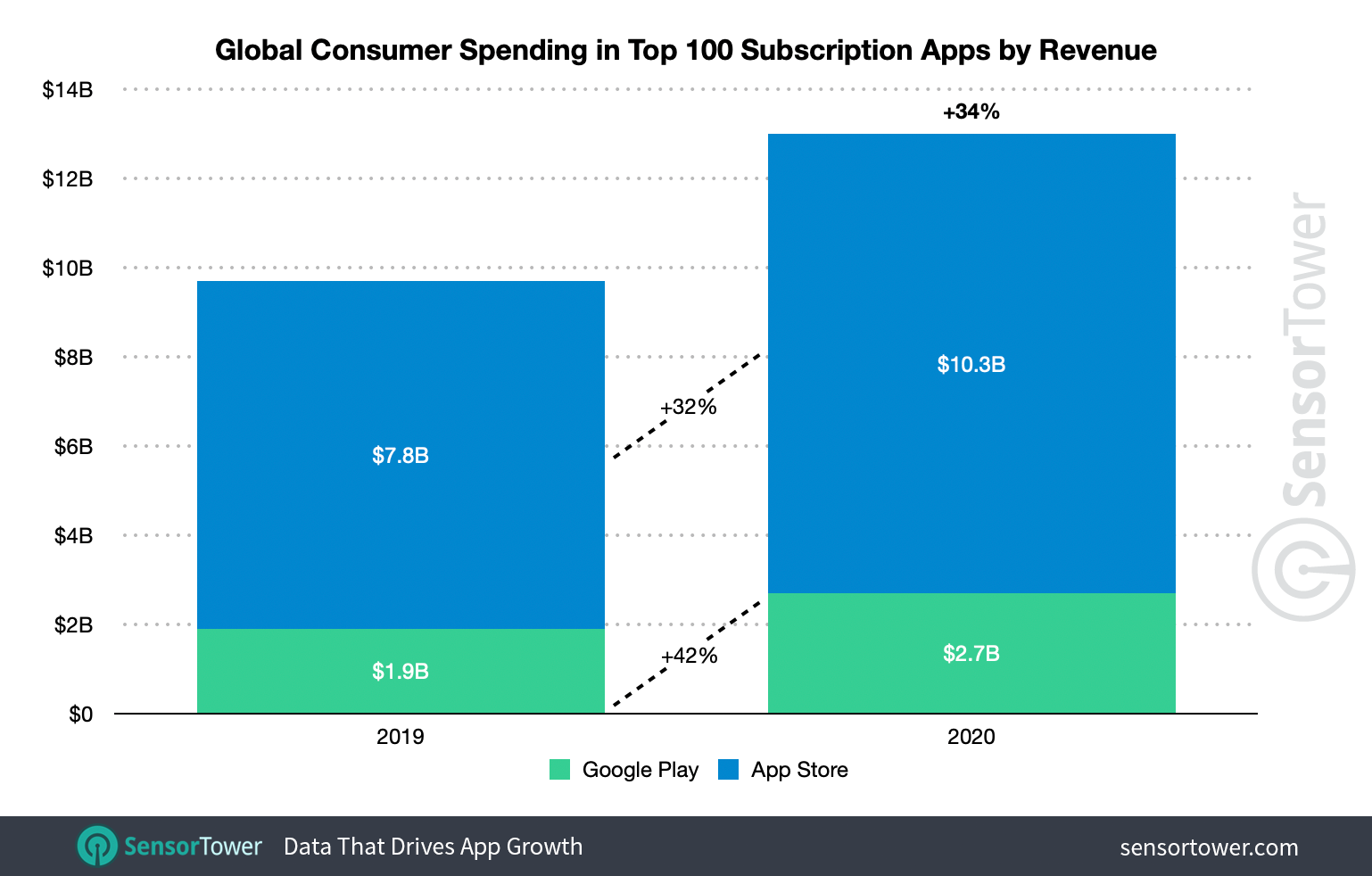

Consumer Spending in Top 100 Subscription Apps Climbed 34% to $13 Billion in 2020

The top 100 subscription apps earned $13 billion globally in revenue, according to Sensor Tower data.

Consumer spending in mobile apps reached new heights in 2020, as did revenue generated from in-app subscriptions. According to Sensor Tower Store Intelligence data, worldwide consumer spending in the top 100 non-game subscription-based apps grew 34 percent year-over-year from $9.7 billion in 2019 to $13 billion.

Revenue from the top 100 earning non-game subscription apps represented about 11.7 percent of the $111 billion that consumers spent on in-app purchases last year, the same share as in 2019. In Q4 2020, 86 of the top 100 earning non-game apps worldwide offered subscriptions, down slightly from 89 in Q4 2019.

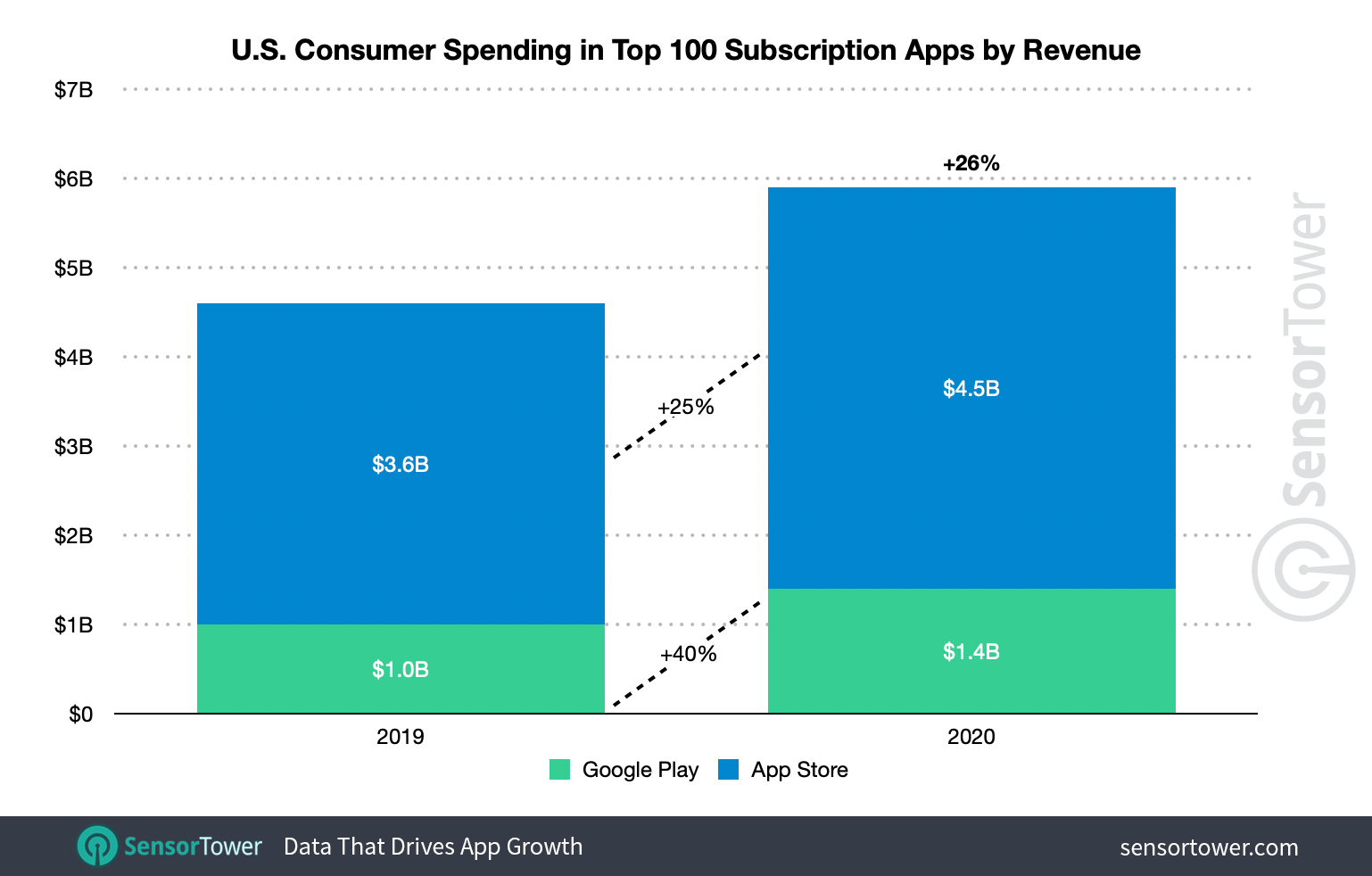

The growth of subscription app revenue in the United States trailed the global trend, but was still up from the previous year. U.S. consumers spent nearly $5.9 billion in the top 100 non-game mobile apps offering subscriptions during 2020, up 26 percent year-over-year from $4.6 billion in 2019. This is 5 percentage points greater than the Y/Y growth experienced by the top subscription apps in 2019.

Spending in the top 100 subscription apps represented about 17.6 percent of the $33 billion that U.S. consumers spent on in-app purchases in 2020, down 3.4 percentage points from the 21 percent revenue share they accounted for in 2019. Out of the top 100 earning apps in the U.S., 91 were subscription apps in Q4 2020, down slightly from 93 in Q4 2019.

Store Breakdown

Consumers have historically spent more on the App Store than on Google's marketplace, and the same holds true for subscription apps. Globally, the top 100 subscription apps on the App Store generated $10.3 billion in 2020, up 32 percent from $7.8 billion the previous year. The cohort of 100 top earners on Google Play saw $2.7 billion last year, up 42 percent Y/Y from $1.9 billion in 2019.

Looking at the U.S. App Store, consumers spent $4.5 billion in 2020 on the top 100 earning non-game apps offering subscriptions, up 25 percent from approximately $3.6 billion in 2019. While the top 100 earning subscription apps on Google Play did not generate as much revenue, they did see greater Y/Y growth. In 2020, the top Google Play subscription apps in the U.S. saw $1.4 billion spent, up 40 percent Y/Y from $1 billion.

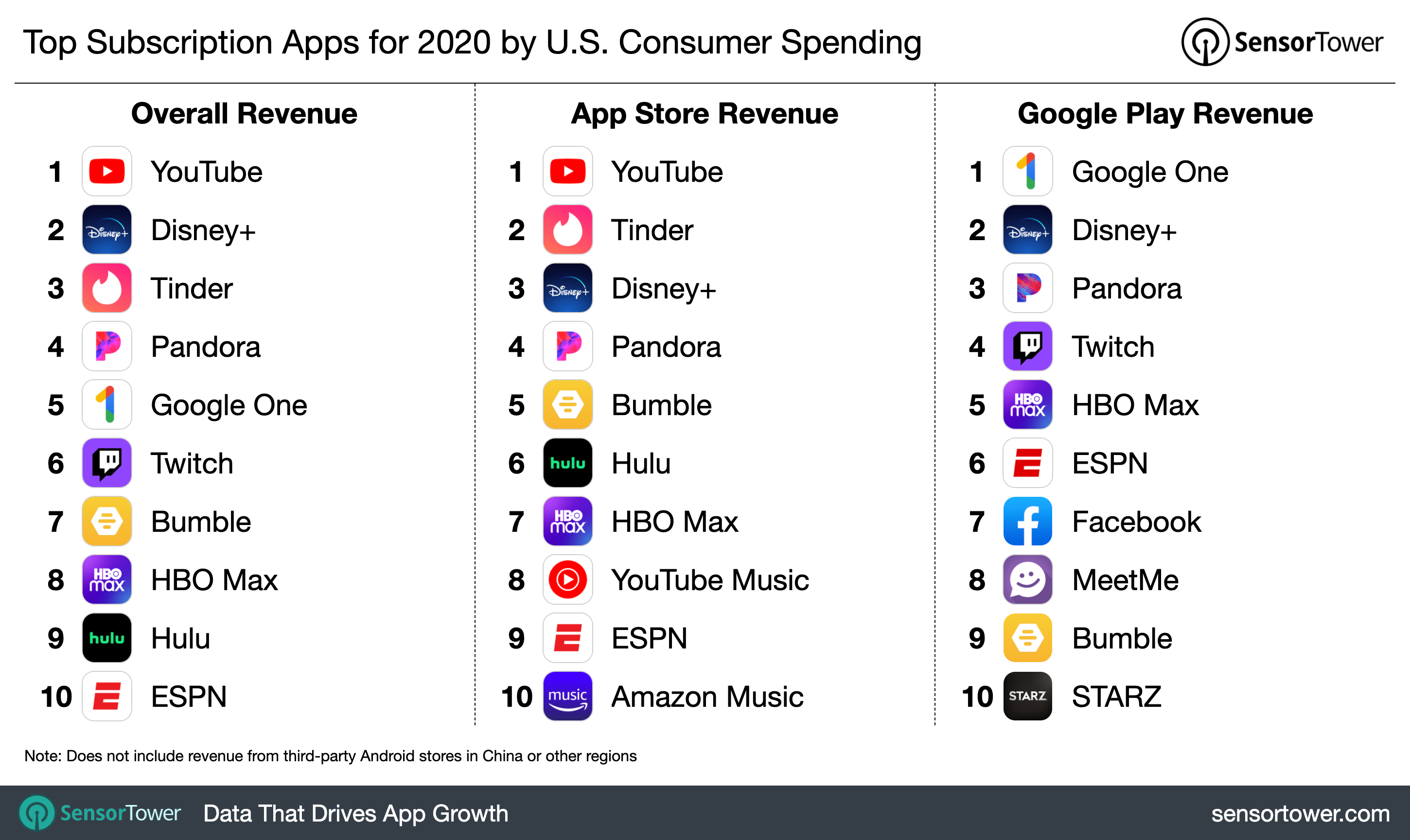

Alphabet came out on top this year in terms of subscription app spending, both globally and in the U.S. YouTube was the subscription app leader across both stores, earning $991.7 million in gross revenue globally and $562 million in the U.S. It was also the top earning subscription app on the App Store, whereas Google One was the top-grossing app on Google's marketplace with more than $445 million generated globally and $255.7 million in the U.S.

Subscribing to Success

Sensor Tower's 2021 Mobile App Industry Trends report found that mobile game publishers were adopting subscription models at an increased rate in 2020, with eight of the 15 top grossing titles offering recurring in-app payments. This shift in strategy follows consumer trends—even before the COVID-19 pandemic, consumers have been spending more on the top subscription apps than in the past.

From Q1 2019 to Q4 2020, U.S. consumers spent more in the top 100 subscription apps each successive quarter. This cohort of apps saw $1.7 billion in the final quarter of 2020, up 31 percent from $1.3 billion in the first quarter. Sequential growth like this, along with substantial gains by individual apps, are strong signals that we will see more publishers choose to adopt the subscription model in 2021 and beyond.