2026 State of Mobile is Live!

Mobile App Insights · Digital Advertising Insights · Marco Scacchi · August 2022

Retail Brand Apps in Europe: Supermarket Apps Drove Adoption in H1 2022

Sensor Tower Store Intelligence data reveals that Retail Brand app installs totaled 150 million in Q2 2022, down 7 percent from Q2 2020.

The popularity of Retail Brand apps has shifted significantly in the past few years. The pandemic accelerated some trends, resulting in the Fashion and Supermarket subcategories’ growth in Europe. Sensor Tower Store Intelligence data, along with our other market intelligence products, shows that installs of Retail Brand apps have slowed down in recent quarters, totaling 150 million in Q2 2022, waning 7 percent versus Q2 2020. Sensor Tower’s State of Retail Brand apps report, available now as a free download, includes an analysis of download, usage, and digital ad spend data for Marketplace, Fashion, and Supermarket apps in Europe.

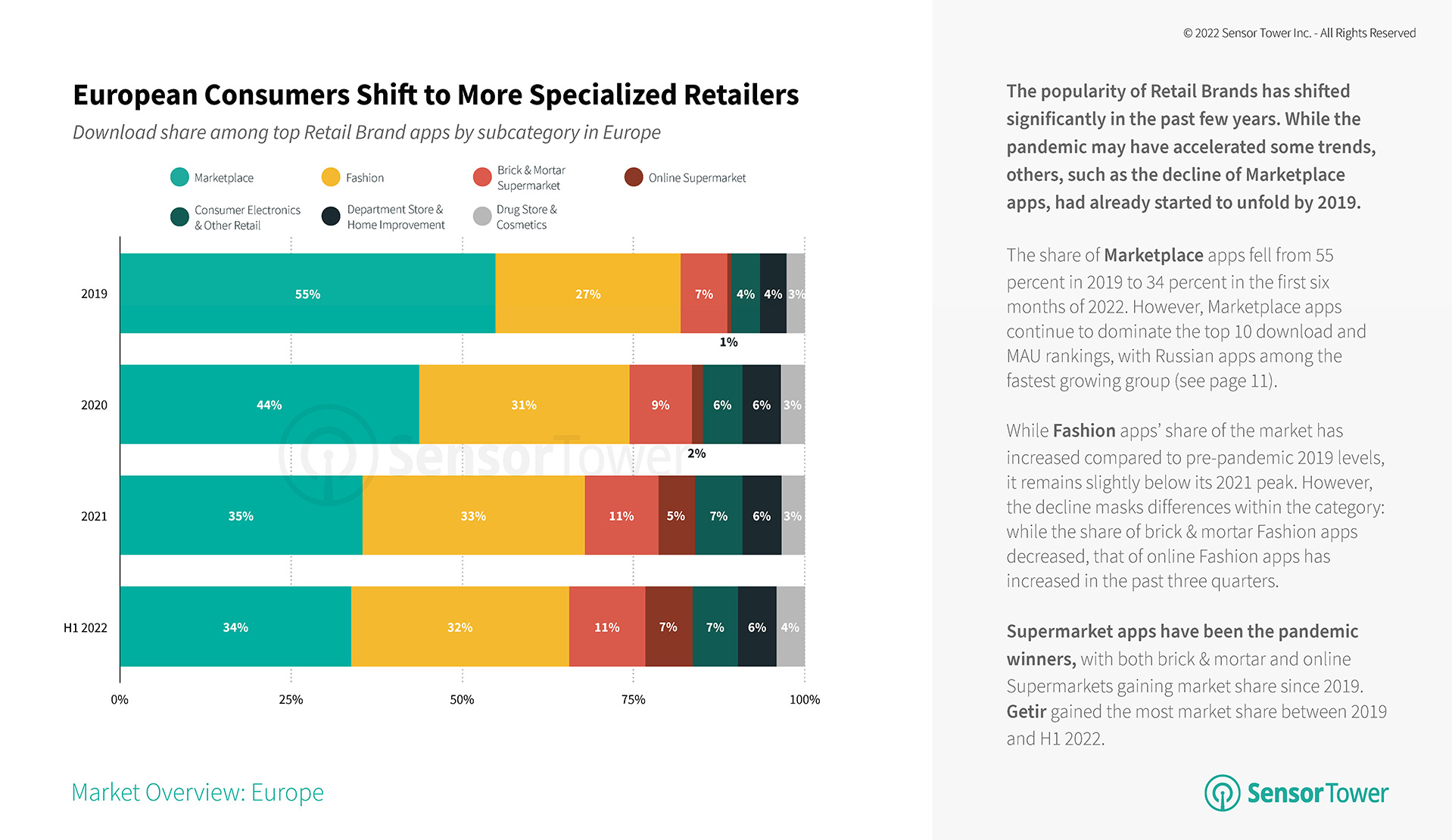

European Consumers Shift to More Specialized Retailers

The share of Marketplace apps, such as Amazon and AliExpress, declined from 55 percent in 2019 to 34 percent in the first six months of 2022. Fashion apps’ download share increased 5 percent in H1 2022 versus 2019, but it remains slightly below its 2021 peak. Brick & Mortar Supermarket apps have been the pandemic winners, slowly gaining market share since 2019. Getir, an on-demand grocery delivery service, gained the most market share between 2019 and 1H22.

Other subcategories such as Consumer Electronics and Drug Store & Cosmetics have also seen slight increases in download share in 1H22.

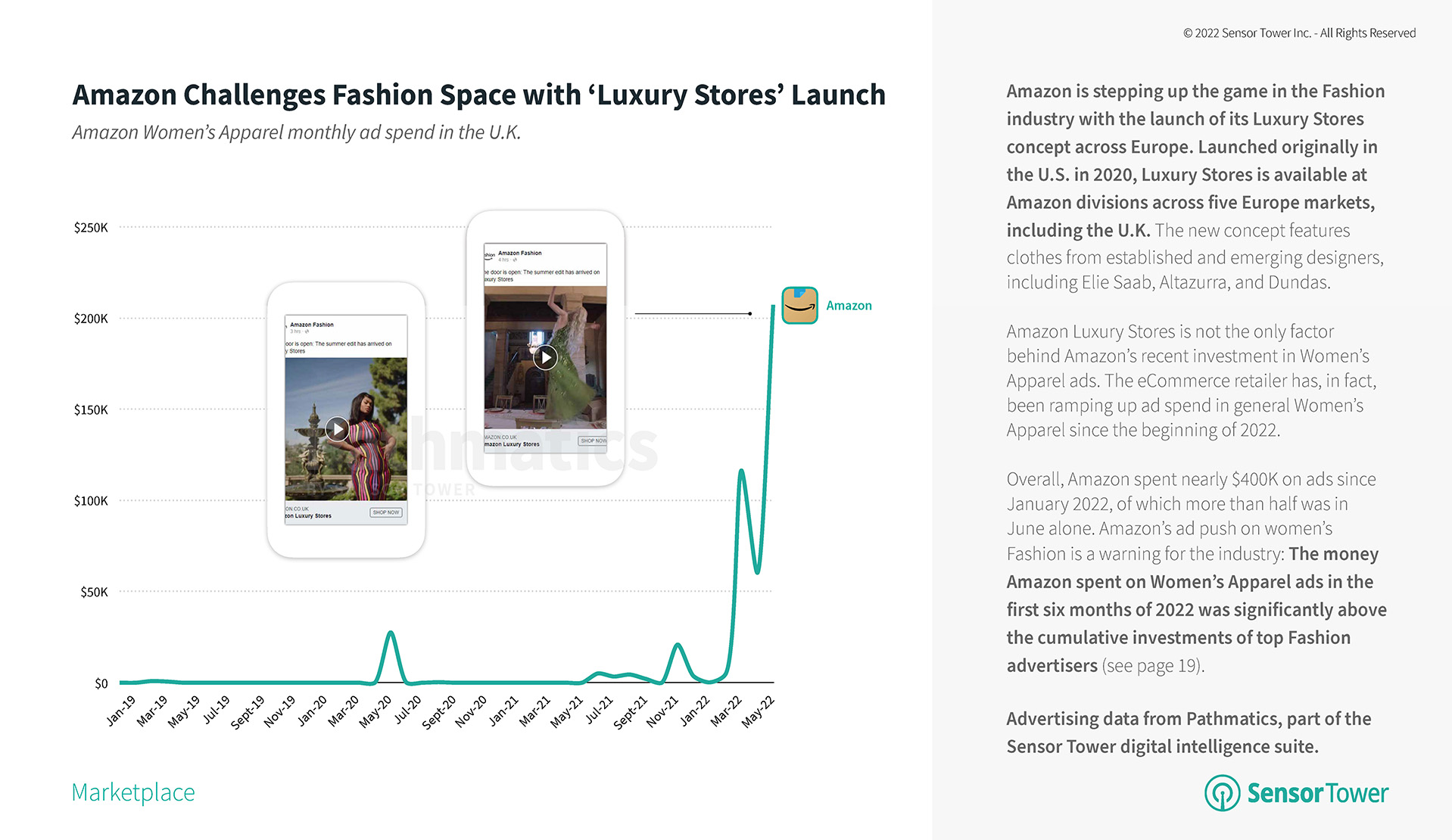

Amazon Monthly Digital Ad Spend Spikes As It Launches “Luxury Stores”

Earlier this Summer, Amazon announced the expansion of Luxury Stores to Europe, offering ready-to-wear collections from luxury fashion brands, including Elie Saab, Altazurra, and Dundas. The eCommerce retailer has been ramping up its ad spend in general Women’s Apparel since the beginning of 2022. Since January 2022, Amazon has spent nearly $400,000 on digital ads in the United Kingdom, of which more than half was in June alone, according to Pathmatics data.

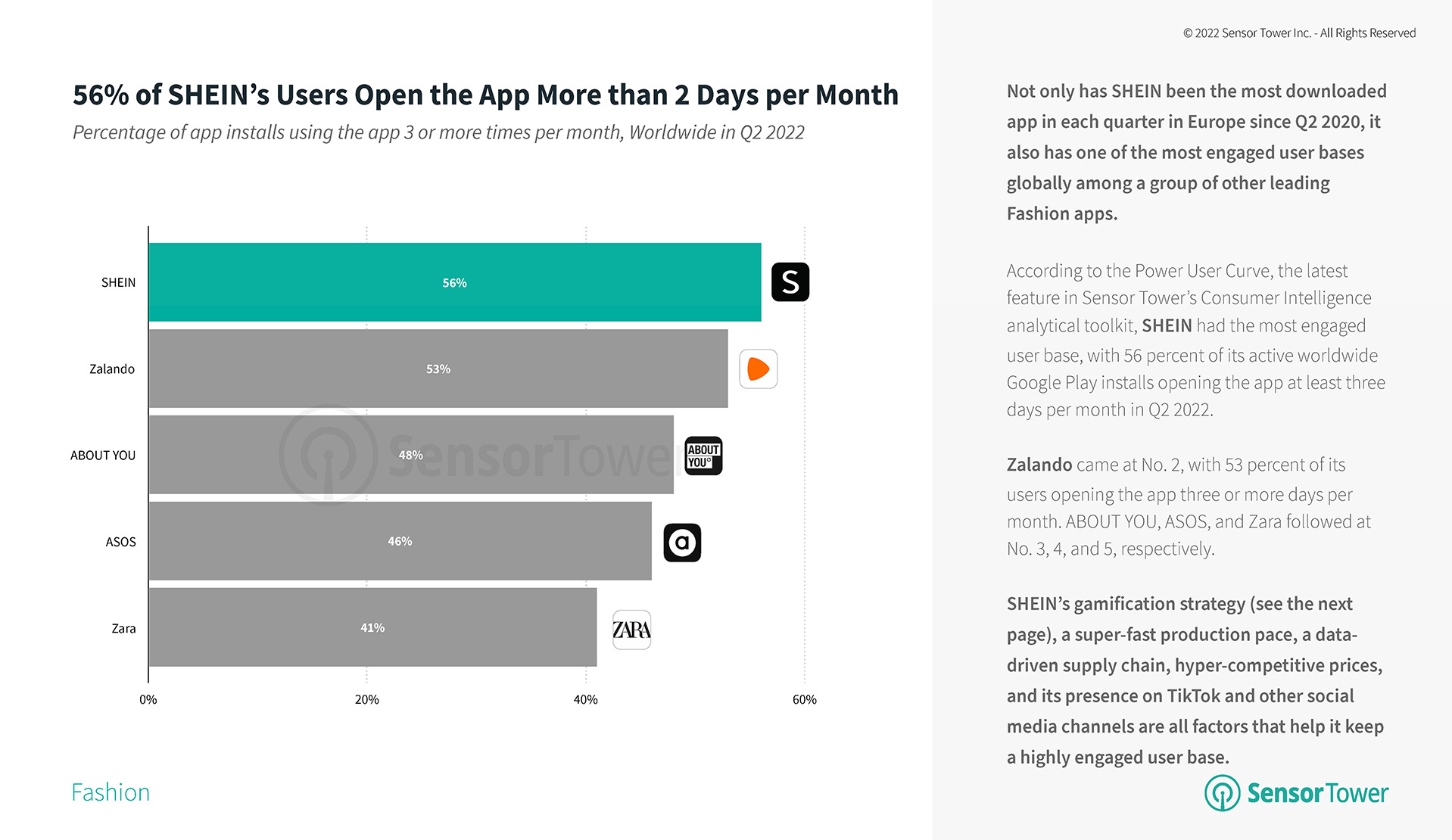

SHEIN Continues To Have The Most Engaged User Base Worldwide

SHEIN, an online fast fashion retailer, has been among the fastest growing Fashion apps in Europe compared to pre-COVID January 2019 levels. The app continues to outpace its rivals that are also among the top five Fashion apps by downloads in 1H22, including Vinted, Trendyol, Zalando, and H&M.

Not only has SHEIN been the most downloaded app each quarter in Europe since Q2 2020, it also has the most engaged user base, with 56 percent of its active worldwide Google Play installs opening the app at least three days per month in 2Q22. SHEIN’s hyper-competitive prices and its social media presence are some of the few factors that help it keep a highly engaged user base.

While installs of most mobile Retail Brand categories have slowed down versus their pandemic peak, many supermarkets and specialized retailers saw positive download growth in 2022.

For more analysis from the Sensor Tower Store Intelligence platform, including key insights on the performance of top retail brand apps in Europe, download the complete report in PDF form below: